Zacks vs. Motley Fool: Which is Better for 2025?

The fact that you landed on this page indicates you are already a pretty knowledgeable investor.

You might have noticed ads and articles from Motley Fool and Zacks Investment Research boasting about their great profits.

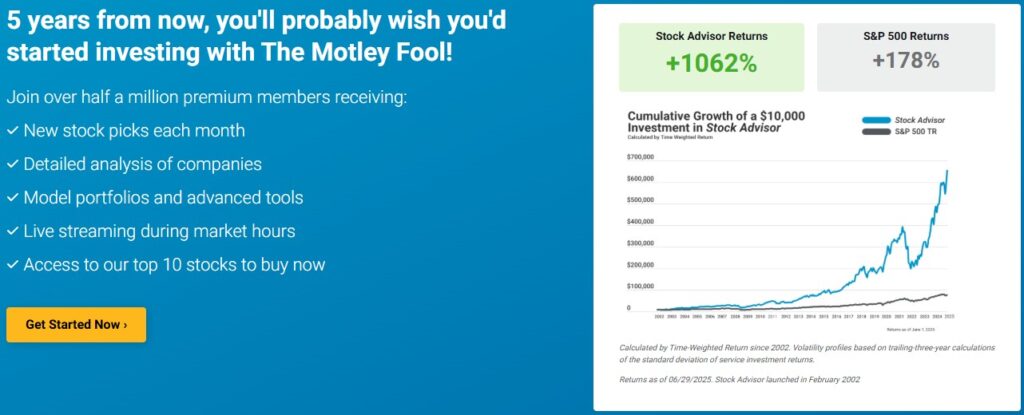

The Motley Fool boasts incredible returns like this…

And Zacks lures you in with offers like this before trying to upsell you to their subscription services…

So you may be wondering: Which is the better platform for stock picks?

Today we will be comparing Zacks vs Motley Fool Stock Advisor.

These are both two proven investment services and stock picking services with remarkably different benefits and features. Each has their own unique perspective on which stocks to invest in for short term trades or longer term value investing.

This has led to HUGE DIFFERENCE in gains made from the stock suggestions offered from each platform…

Let’s get straight to it and determine the ideal platform for you. But first here is a quick comparison of the services. Zacks is better known as much more of a do-it-yourself stock research platform that also offers stock picking newsletters, whereas the Motley Fool is better know for its stock newsletters and some educational features that also offers some research and news.

At-a-Glance Comparison: Zacks vs. Motley Fool

| Zacks Investment Research | Motley Fool | |

| Overall Rating: | ⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Recommended service: | Zacks Premium | Stock Advisor |

| Service type: | Premium investment research platform | Stock-picking newsletter with excellent track record over 22 years with average stock return of 979% vs market’s 171%. |

| Best for: | Do-it-yourself investors | Investors who just want 2 stock picks a month and take the stress out of investing |

| Retail Price: | $249/year | $199/year |

| Best Current Promotion: | None for its subscription services; but you can get their list of 5 Stocks Set to Double for free. | Save $100 on THIS promo page and try it for just $99 for first year. Also includes immediate access to recent picks. |

Here is a quick summary of how these two services’ 2024 stock picks have performed versus other well known services in the same price range as of December 31, 2024:

Our Best-of-the-Best Awards for 2024

Ranking of Top Stock Newsletters Based on 2024 Picks, Dec. 31, 2024

We are paid subscribers to dozens of stock and option newsletters. We actively track every recommendation from all of these services, calculate performance, and share our results of the top performing stock newsletters for under $500 below. The main metric to look for is EXCESS RETURN--that means they are beating the market!

| Rank | Stock Newsletter | Stock Picks | Average Return | S&P500 Return | Excess Return | Percent Profitable | Max % Return | Min % Return |

|---|---|---|---|---|---|---|---|---|

| 1. | Stock Advisor | 24 | 19.9% | 13.1% | 6.7% | 83% | 107% | -28% |

| 2. | Hidden Gems | 24 | 18.8% | 12.7% | 6.0% | 79% | 73% | -41% |

| 3. | Alpha Picks | 24 | 17.7% | 12.6% | 5.0% | 83% | 64% | -20% |

| 4. | Value Investor | 12 | 17.9% | 13.0% | 4.9% | 75% | 127% | -35% |

| 5. | Rule Breakers | 24 | 15.4% | 11.7% | 3.6% | 71% | 123% | -39% |

| 6. | Real Estate Investors | 12 | 14.6% | 11.9% | 2.7% | 83% | 44% | -11% |

| 7. | Cramer's Action Alerts Plus | 101 | 10.6% | 11.1% | -0.5% | 48% | 96% | -51% |

| 8. | Zacks Top 10 | 10 | 23.2% | 26.2% | -3% | 60% | 120% | -24% |

| 9. | Top Under $10 | 59 | -2.4% | 2.8% | -5.2% | 36% | 130% | -44% |

| 10. | Home Run Investor | 46 | -1.8% | 3.6% | -5.4% | 50% | 49% | -29% |

| 11. | Dogs of the Dow | 10 | 14.5% | 26.2% | -11.7% | 70% | 95% | -25% |

| 12. | IBD Top 50 Leaderboard | 50 | 13.5% | 26.2% | -12.7% | n/a | n/a | n/a |

| Top Ranking Stock Newsletters based on their 2024 stock picks' performance as compared to S&P500. S&P500's return is based on average return of SP from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF. | ||||||||

In this chart you will see the Motley Fool services, then 4 of Zacks most popular services, and then Investors Business Daily, Cramer’s Action Alerts Plus and then the simple Dogs of the Dow strategy.

As you can see, the Motley Fool services outperformed the Zack’s services for 2024.

Zack’s different services are generally beating the market by just a few percentage points. That indicates to me that there model/stock ranking is valid to evaluate your own portfolio, but if you want specific picks Stock Advisor and Rule Breakers seem to offer a high return if you have money to invest monthly and plan to stay invested for 5+ years.

The rest of the review will cover how I arrived at these ratings, more about each service, and why I prefer Motley Fool over Zacks.

About Zacks Investment Research

Len Zacks founded Zacks Investment Research in 1978.

Zacks Premium offers independent research for insights into a company’s future expected and overall performance. Ultimately, Zack’s wants to equip you with a trading advantage. Industry experts mostly manage Zack’s and prioritize quantitatively analyzing instead of fundamental (value investing) for the company’s market outlook.

They have a reputation for analyzing equities, mutual funds, and ETFs.

Zacks Research Features

Unlike The Motley Fool, they don’t tell you what to buy, but they show you ratings on stocks you might consider buying. This helps with your own research and decision making.

Zacks functions as more of a “do-it-yourself” research tool.

Specifically, Zacks Investment Research follows:

- Brokerage & Analysts Ratings

- Earnings per share forecasts (EPS)

- Earnings per share (EPS) Revisions measure the expected change in earnings per share over time.

Their research found that stocks consistently rated as “strong buys” and with increased earnings per share (EPS) outperform the market.

One of the most compelling insights for Zack’s research:

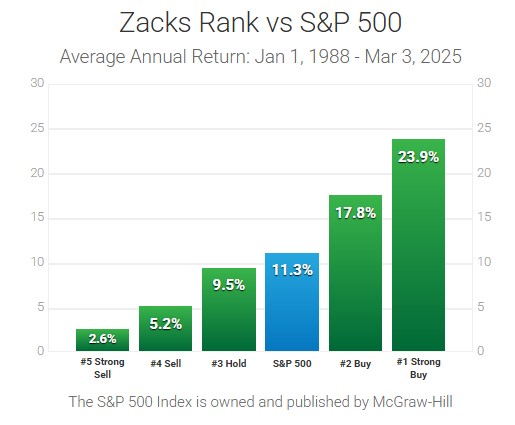

According to the chart from March, 2025, stocks rated as #1 Strong Buy have outperformed the market. They have had an average yearly return of 23.9% compared to the market’s average of 11.3% over the past 36 years.

Equally crucial, stocks they rank as #5 Strong Sell notably lag behind the market. Indeed, the graph’s incline is what you’d anticipate, as it improves quite nicely from #5 (Strong Sell) to #1 (Strong Buy).

Do Zacks Stock Rankings Truly Work?

How reliable is the Zacks Rank at predicting future stock performance?

Zacks rates over 19,000 mutual funds on a scale from one to five. Zack’s rates stocks in U.S. funds to find the best ones and ranks mutual funds based on those top holdings.

What do these ratings mean?

- A rating of ONE (1) signals a “Strong Buy” recommendation.

- A rating of FIVE (5) signals a “Strong Sell” recommendation.

Additionally, you can access articles featuring Zacks top stocks, ETFs, and mutual fund picks. They send the newsletter by email every weekday morning. It gives a summary of the market, its impact on investors, and recent changes in stock ratings.

Over the past 36 years, stocks with a Zacks Rank #1 Stocks had an average return of 23.9% per year! In comparison, the S&P 500 had a return of 11.3%.

Conversely, stocks with a Zacks Rank #5 had a significantly lower average return of 2.6% as you saw above.

So yes, Zacks Rank is an excellent indicator of future performance.

Zacks Premium

Zacks Premium gives you exclusive access to powerful research and tools and their Zacks Rank for more than 10,000 stocks.

Access to these features will give you an edge in improving the performance of your investments. The Zacks Premium homepage gives you access to everything included in your membership. To get there:

- Log on to Zacks.com.

- Hover over the “Services” tab (top of the page)

- Select “Zacks Premium”

Pro tip: Bookmark this Zacks page to help you get there faster each day!

The Premium Tools & Resources include:

- Zacks #1 Rank List: The top 5% of stocks with the most potential, from Value to Growth, Moment and Income, and more!

- Industry Rank List: Sorts over 250 industry groups.

- Earnings ESP Filter: Stocks with the highest % upside of surprising for profitable earnings.

- Premium Screens: Access a list of the best stocks, including value, growth, momentum, income, and more!

- Focus List: A collection of 50 stocks chosen by Zacks’ Research Director, Sherax Miam, based on earnings momentum.

- Research Reports: Each report covers over 1,000 popular stocks and includes independently analyzed by Zacks. It provides detailed insights on a company’s fundamentals and growth potential.

Other Zacks Offerings

If you like Zacks system for determining winning stocks but don’t want to do the research yourself, you may be interested in Zacks Home Run Investor. It’s a done-for-you investing newsletter (like Motley Fool Stock Advisor) based on the underlying investment approach taken at Zacks.

New subscribers can join Home Run Investor for just $149 $99 for the first 12 months.

In addition to Zacks Premium and Home Run Investor, Zacks offers:

- Zacks Investor Collection. This membership comes with everything in Premium, plus real-time buy and sell signals and the Stocks Under $10.

- Zacks Ultimate. This membership is the most inclusive package, including everything mentioned above and access to every recommendation the firm offers.

About The Motley Fool

Tom and David Gardner founded The Motley Fool in 1993.

Since then, the company has helped hundreds of thousands of investors make better investment decisions through their investing newsletter services, educational content, and other resources.

Instead of providing quantitative research like Zacks, The Motley Fool’s premium services provide 2 stock recommendations to buy each month.

Motley Fool Research Features

The Motley Fool is best known for the incredible results its services have generated over the last 22 years (more on this below).

While the investment team’s exact process for picking stocks is proprietary, they do provide stock reports to accompany each new recommendation.

The Motley Fool also offers investing resources, a community of like-minded investors, money-back guarantees, and more.

“Best Practices” recommended by The Motley Fool:

- Having a portfolio of at least 25 stocks

- Invest regularly and be prepared to withstand market declines

- Suggested to hold onto the stocks for a minimum of 5 years

Motley Fool Stock Advisor

The Motley Fool Stock Advisor is the company’s flagship newsletter service. Users get access to the company’s top investors and two new stock recommendations each month. Every recommendation includes a detailed explanation analyzing why you should consider their specific stock picks.

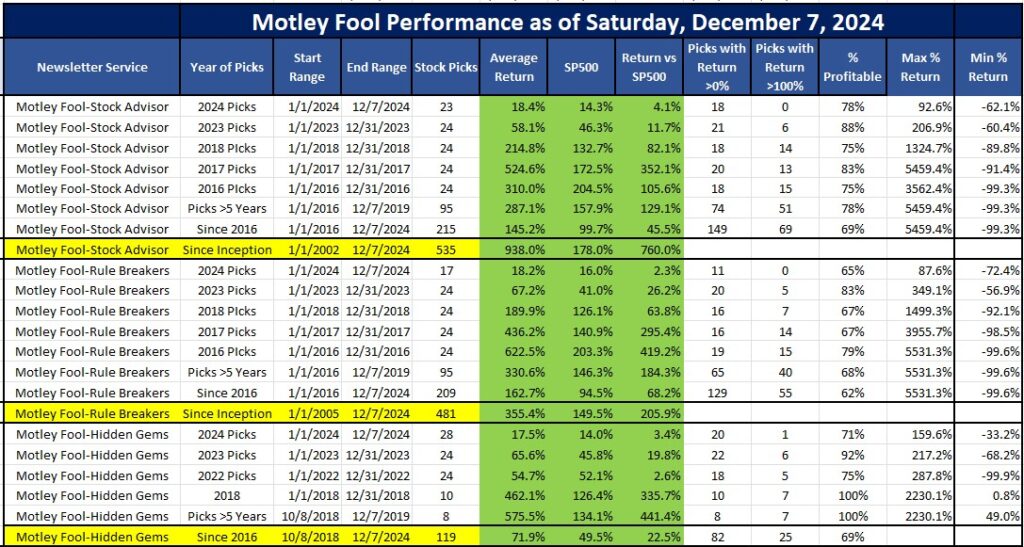

Here’s how the Motley Fool’s picks have done the last few years. It’s impressive that they have beat the market easily the last 2 years and over the last 8 years that I have been a subscriber and following their picks:

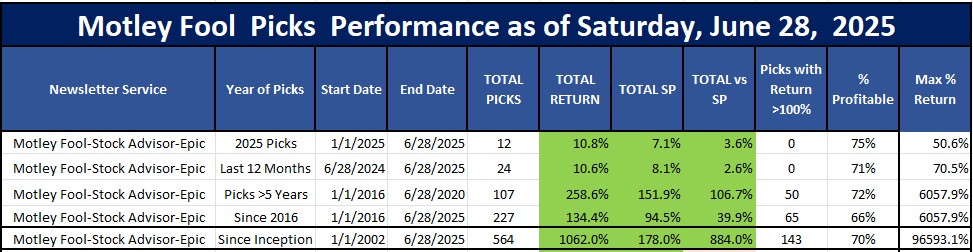

And Stock Advisor continues to outperform in 2025. You can see below that their last 12 months, their 2024 and their 2023 picks have all beat the market. And if you look at their performance of their stocks that are at least 5 years old since I became a subscriber in 2016, you will see they have DOUBLED THE MARKET.

My Experience with the Motley Fool Stock Advisor Picks Since I Subscribed in 2016.

Here's a summary of the performance of Stock Advisor since I subscribed in January 2016. I was so impressed with their performance that I started buying $1,000 to $2,000 in my Etrade account. I quickly learned to put a 30% stop loss on these picks in case they do pick a big loser. You can see how their picks have performed for the 2025, the last 12 months, and the last 8 years. Notice those picks that are older than 5 years since I subscribed are up 258% and are beating the market by an average of 107%.

See what you missed out on by not signing up a few years ago when I did? You would be up 134%, beating the market by 40% and you would have bought NVDA in 2017!.That means if you had just bought $100 of each of their 227 stocks your $22,700 would have a profit of $30,418. Seems to justify the $99-199 per year price, right? Seems like a no brainer based on this track record.

Here is what you get with Motley Fool Stock Advisor:

- Ten Starter Stocks: The first recommendation for all new members is to consider the Stock Advisor’s “starter stocks.” If you are a new investor, these stocks can help you build a well diversified portfolio of high growth stocks.

- They are typically re-recommendations of previous picks.

- 10 Best Stocks to Buy Right Now: The 2 teams pick five “best buys now” each month (a total of ten picks). Each stock’s underlying businesses look to be much stronger than the current price warrants.

- They look for companies that have hit a minor setback, or companies that have just reported great news. Best buys come with a short write-up detailing why the stock is a good investment at that time.

- 2 New Stock Picks Each Month: The Motley Fool is highly “competitive,” and the Stock Advisor team is no exception. David and Tom Gardner, the Fool’s Founders, lead two teams of Stock Advisors.

- They each choose one stock every month that they believe is a good investment for members. The teams compete to provide the best stocks and track the performance of each pick.

This intra-company competition is working exceptionally well. Here is how those stock picks have performed since 2002:

That charts says it all. They have absolutely crushed the S&P500 over these 22 years.

With each recommendation, you get a thorough write-up about the investment thesis behind each team’s choice, as well as potential risks. From these 2 new picks a month, the Motley Fool advertises these fantastic returns since inception in 2002.

Summary of Motley Fool's July, 2025 Best Discounts & Promotions

| Motley Fool Stock Advisor | Motley Fool Epic | |

|---|---|---|

| Overall Rating: | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Service Type: | 2 stock picks and 2 "Five Best Stocks to Buy Lists" per month. That's 1 email per week on Thursday. Next pick comes out July 17th. | 5 stock picks per month from Stock Advisor (2 picks), plus 1 pick from Rule Breakers, 1 from Hidden Gems and 1 from Dividend Investor. Next pick comes out July 17th. |

| Strengths: | Original and best performing stock newsletter since its launch 23 years ago. Average pick is up 1,062% vs market's 178%; 70% profitable. | Well diversified, lower risk, high percentage of accuracy with 75% of picks being profitable. |

| Best for: | Beginning & intermediate investors that want to invest each month and plan on staying invested for at least 5 years. | Intermediate to experienced investor looking for better diversification, less risk, & some dividend yield. |

| Retail Cost: | $199 a year | $499 a year |

| Links to Best Promotion and Discount Pages: | Best Stock Advisor July, 2025 Promotions/Discounts: All promotions have a 30 day money back guarantee: Best money saving deal--Get 2 years for only $179 and save $229 on THIS promo page with code 'WSS179' if prompted. --Get 1 year for only $99, save $100 AND get their just released AI Supercycle: An Investor’s Guide to the Artificial Intelligence Boom ($49 Value) on THIS promo page with code 'WSS99' if prompted. --Save $100 and get 1 year for only $99 AND get Fool's top 3 "Double Down" Picks on THIS promo page with code 'WSS99dd' if prompted. |

Best EPIC July, 2025 Promotions/Discounts: All promotions have a 30 day money back guarantee: --Save $200 if you use EPICSALE on THIS promo page; includes 30 day money back guarantee. --Use this link to compare Stock Advisor ($100 off) and Epic ($200 off). |

My Experience with Motley Fool Stock Advisor

Since January 2016, my portfolio has grown well and I’ve received reliable stock picks from Motley Fool’s Stock Advisor.

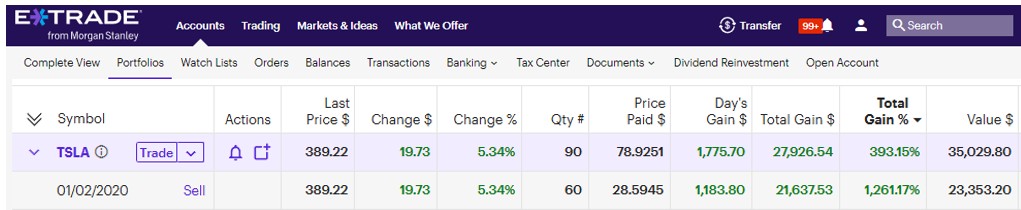

Here’s a quick peek at my ETrade account and their best pick of 2020 (as of December 31, 2024).

- I always buy about $1,500 of each of their 2 stock picks each month in my ETrade account.

- I bought 60 shares of TESLA at (split adjusted) $28.59, as recommended by Motley Fool Stock Advisor on January 2, 2020.

On that $1,700 trade I now have a 1,261% return and a $21,000+ profit in 4 years!

Here is another one of their top performers that I bought. HUBS was recommended on December 5, 2019 and I bought 10 shares at $153. In January, 2024 it hit $601 giving me a $4,473 profit:

At I showed at the top of this analysis, the Motley Fool Stock Advisor has been performing better than Zacks and other competition for the last12 months. This calculation relies on returns, percentage of winners, and the highest and lowest percentages.

The Motley Fool recommends you hold stocks at least 5 years. Take a look at the charts above of how their picks that are at least 5 years old have done for me:

They are definitely doing something right as their picks that are at least 5 years old have averaged 227% and easily beat the SP by 94%.

I just like these ease and stress free way to invest with the Motley Fool.

Stock Advisor is their oldest and premier Motley Fool newsletter service with over 500,000 subscribers. The primary purpose of this service is to TELL investors what two stocks to buy each month. They also tell you when to sell and over the 22 years they have sold off about 33% of their picks.

Motley Fool Stock Advisor is my preferred platform for reliable stock picks that have consistently grown over time.

Get a special discount on Motley Fool Stock Advisor by signing up through Wall Street Survivor:

How They Work

While a casual glance at Zacks and Motley Fool Stock Advisor might lead you to believe they have a lot in common, there are some crucial differences in how they work.

How Zacks Investment Research Works

Zacks Investment Research conducts independent research and analysis to arrive at their Zacks ratings. They’re on a scale from 1 to 5, with 1 indicating a Strong Sell and 5 indicating a Strong Buy.

It all started with Zacks Founder and CEO, Len Zacks, having a revelation in 1978. His light-bulb moment was this:

Earnings estimate revisions are the most powerful force impacting stock prices.

From this insight, he developed the Zacks Rank, which harnesses earnings estimate data to provide a quantitative analysis of stocks.

The proof is in the pudding, as Zacks has more than doubled the S&P 500 with average gains of 24.10% per year since its inception.

Additional breakthroughs followed, including:

- The Price Response Indicator, which predicts what a stock price is likely to do after an earnings report is released.

- Earnings ESP (Expected Surprise Prediction), which predicts the likelihood of an earnings surprise before earnings are reported.

- Most Accurate Estimate, which provides (you guessed it) the most accurate earnings estimate available.

- Zacks Mutual Fund Rank and Zacks ETF rank, which use Zacks proprietary model to analyze history and predict future success.

To sum up, Zacks is a stock research and analysis platform. It may be suitable to a variety of investment styles since it doesn’t make specific stock recommendations the way Motley Fool does.

How Motley Fool Works

Motley Fool is primarily a stock-picking service, but it does give investors access to a significant library of research and analysis, plus market news.

The primary investment style encouraged by Motley Fool Stock Advisor is a “buy and hold” strategy. They suggest that subscribers buy equal amounts of every stock they recommend, and play to hold their stock for a minimum of five years.

There’s plenty of reason to trust Motley Fool’s predictions, since they have outperformed the S&P 500 significantly over time. In fact, someone who started with $10,000 at Motley Fool’s inception would have nearly $500,000 today!

Motley Fool assigns 5-year quant ratings that are designed to predict a stock’s ability to outperform the market over the next five years.

Because it makes specific stock recommendations, Motley Fool can be used without a major time investment. Investors who stick to a buy-and-hold strategy and buy every recommendation have historically done very well.

In addition to monthly stock picks, Motley Fool subscribers also get access to portfolio management tools, real-time market information, and much more.

The Better Stock Picking: Zacks or Motley Fool?

We realize both Zacks Premium and Motley Fool Stock Advisor are similar (but different) in many ways. Are you wondering if Zacks Premium is worth it or if Zacks is reliable? We will summarize how Zacks’ top rated stocks compare to Motley Fool Stock Advisor picks.

This comparison of these two services can help you decide which one ranks stocks in the most effective manner.

| Zacks | Motley Fool | |

| Year Founded: | 1978 | 1993 (Stock Advisor was launched in 2002) |

| Type of Service: | Stock analyzing tools help you evaluate stocks and research your own market ideas. Think of it as a do-it-yourself service for those of you that like to research your stocks. | Stock recommendation service that recommends 2 stocks each month and provides other “top stocks to buy” lists. They assist with monthly investments, making it simpler and less tense to build a portfolio over a year with market fluctuations. |

| Performance Statistics: | Their stocks rated a “Strong Buy” have an average annual return of 23.09% vs S&P’s 11.3% going back to 1988. | Stock Advisor stock picks are up 900+% vs the S&P’s 170+% going back to 2002. |

Type of Service:

- Zacks: Stock analyzing tools help you evaluate stocks and research your own market ideas. Think of it as a do-it-yourself service for those of you that like to research your stocks

- Motley Fool: Stock Recommendation service that recommends 2 stocks each month and provides other “top stocks to buy” lists. They assist with monthly investments, making it simpler and less tense to build a portfolio over a year with market fluctuations.

Years in Business:

- Zacks: Started in 1978

- Motley Fool: Launched first stock newsletter in 2002

Performance Statistics:

- Zacks: Their stocks rated a “Strong Buy” have an average annual return of 24.2% vs S&P’s 10.7% going back to 1988.

- Motley Fool: Stock Advisor stock picks are up 900+% vs the S&P’s 175% going back to 2002.

While they both always boast about their long-term performance, I like to start by looking at their recent performance. Here is a quick snapshot of the performance of various newsletters’ 2023 picks (including Zacks & Motley Fool) and their last 12 months of picks:

As you can see, the Motley Fool Stock Advisor picks are consistently the strongest.

To more easily compare the Motley Fool’s 900+% total return since 2002 versus Zacks’ 24.2% average annual return, here are how Stock Advisor’s picks have performed on an annual basis.

- Their 2016 picks are up 230% which over 6 years is an average annual rate of return of 32%

- Their 2017 picks are up 363% which is an average annual rate of return of 60%

- Their 2018 picks are up 141% which is an average annual rate of return of 28%

Pros and Cons

Pros and Cons of Zacks vs. Motley Fool

Both Zacks and Motley Fool Stock Advisor have their advantages and drawbacks. Here’s our take.

Pros and Cons of Zacks Investment Research

| Pros | Cons |

| Plenty of research for investors to use | Some analysts believe that the market has already adjusted for earnings estimate revisions, making Zacks ratings less important than they once were. |

| Ratings are accessible without a subscription. | The user interface is cluttered and not very easy to navigate. |

| Zacks users can make investments within the platform. | Zacks pays a low interest rate on uninvested holdings and charges a percentage for trades. |

| Access to international exchanges. |

Pros and Cons of Motley Fool

| Pros | Cons |

| Motley Fool picks have consistently outperformed the market. | There’s no option to link your brokerage account. |

| New subscribers get access to Motley Fool’s top 10 stock picks. | Some of Motley Fool’s fees are higher than those of their competitors. |

| Investment research and investor guides are available. | Must pay to get access to most advanced features. |

| Beginner-friendly service. | Not suitable for day traders or short-term investors. |

Summary of the Key Differences: Zacks Premium vs. Motley Fool Stock Advisor

Zacks Premium gives users access to a variety of different stock analyzing tools and ratings. They rank their stock lists based on many different metrics (i.e., earnings).

The information provided by Zacks is an excellent source to base your investment research on going forward. Zacks Investing Research is helpful for selecting stocks, and can be more beneficial if you have some knowledge about investing.

Knowing how to use the data they give you is important, so be familiar with investing tools and metrics.

Motley Fool Stock Advisor, on the other hand, offers specific beginning and monthly stock recommendations. If you are a newer investor, Stock Advisor is an excellent way to get your portfolio up-and-running. If you are an experienced investor, Stock Advisor stock picks are an excellent basis for your research. You can also gain insight into future trends and investments that you may have never considered.

The Motley Fool Stock Advisor can be better for casual investors that could use additional guidance with their investments.

What are the Main Differences?

- Zacks offers detailed analyzing on stocks to help you choose strong ones for your portfolio, providing the necessary tools.

- Motley Fool’s Stock Advisor examines stocks and suggests monthly picks based on a fundamental approach.

Each service differs to the point where both services can add value to your portfolio. However, there is enough overlap where you could get away with choosing one source of information.

Both services are excellent and accomplish the overall mission, which is to…

…make YOU a better investor!

So, Zacks Premium or Motley Fool Stock Advisor – which will you choose?

My preferred choice is with Motley Fool’s Stock Advisor because I don’t have the time to do research. I have been buying their picks since 2016 and they have done great for me! If that’s fit for you, gain access to an exclusive discount only available to Wall Street Survivor below:

Get Stock Advisor for justFAQs

What types of investment strategies do Motley Fool and Zacks promote?

Motley Fool is built around a buy and hold strategy, which means when you buy one of their recommendations, you should plan to hold it in your portfolio for a minimum of five years. Zacks doesn’t promote any one investment strategy. Instead, they use their proprietary algorithm to determine which stocks have the best chance of earnings surprises to benefit investors.

How frequently do they release new stock recommendations?

Motley Fool Stock Advisor releases two new stock recommendations every month. If you upgrade to Epic, you’ll get five new picks each month, and Epic Plus comes with nine recommendations per month. Zacks doesn’t make direct recommendations, but they do update their ratings all the time. Anything with a Buy or Strong Buy rating is something you might want to consider buying.

Can I trust the investment advice from Motley Fool and Zacks?

Only you can choose whether to trust investment advice. That said, Motley Fool’s picks have an excellent track record and so do Zacks “strong buy” rated stocks. Past performance is not a predictor of future success, but we think that these are both good services if you want information to help you make investment decisions.

What types of investors are best suited for each service?

Motley Fool is best suited for long-term investors who are comfortable with buying and holding stocks. It works best if subscribers buy equal amounts of every stock recommendation. Zacks doesn’t have a clearly-defined target investor, so we would say it’s more suitable for people who want to do their own research, as well as those who want to actively trade.

Which service is better for long-term vs short-term investing?

Motley Fool’s commitment to the buy and hold strategy makes it the best option for long-term investing. It’s not really suited for day traders or short-term investors, so those people should stick with Zacks.

Pricing, Subscription Options, and Value Analysis

| Motley Fool Stock Advisor | Motley Fool Epic Review | Zacks Premium | Zacks Investor Collection | |

| Value Estimate | Stock Advisor is ideal and valuable for beginner investors and those who want done-for-you stock picks. | Epic is worth the spend for more experienced investors and those who want access to additional stock picks and more in-depth research. | Zacks provides a lot of information for free, so casual investors can view 5Y ratings without subscribing. May be worth the money for some investors. | Zacks Investor Collection offers a lot more value for investors who can afford the price. |

| Key Features | 2 stock picks per month; portfolio management; access to screeners and real-time market data | 5 stock picks per month; portfolio management; Fool IQ; 5Y quant ratings; investment strategies; access to picks from Motley Fool Rule Breakers | Daily updates of Zacks Rank; Zacks #1 Rank List; equity research reports; focus list; premium screeners | Everything in Zacks Premium plus: buy and sell signals; Stocks under $10; full access to premium research tools; access to ETF Investor, Home Run investor, and Zacks Top 10 Stock Picks |

| Pricing | $199/year. Get Stock Advisor for just | $499/year. See Best Epic Discount Promo | $249/year | $495/year |

| Free Trial? | 30-day cancellation period | 30-day cancellation period | Yes, 30 days | 30 days for $1 |

Final Verdict: Motley Fool vs Zacks: Which Is Better?

While both Zacks and Motley Fool have their fans, our winner in this Motley Fool vs Zacks review is… Motley Fool! We think that in return for the price, Motley Fool Stock Advisor offers the most value for investors, particularly those who don’t have the time or inclination to do a lot of research on their own.

Motley Fool’s picks have an impressive track record. That said, investors should know going in that past performance isn’t a guarantee of future success. That said, if you stick to Motley Fool’s “buy and hold” strategy and buy every stock they recommend, your chances of success are higher than they would be if you tried to go it on your own.

Boost Your Portfolio With Motley Fool – Sign Up Today on THIS Fool Promo Page.

If you prefer to do your own research and want to get comfort on your stock picks, then Zacks is the better choice for you so you can see the Zack’s Quant Rating on your stocks. To get started with Zacks for free, Sign up HERE to get their list of 5 stocks likely to double this year.

Save $100 and try it for a year for only $99!

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.