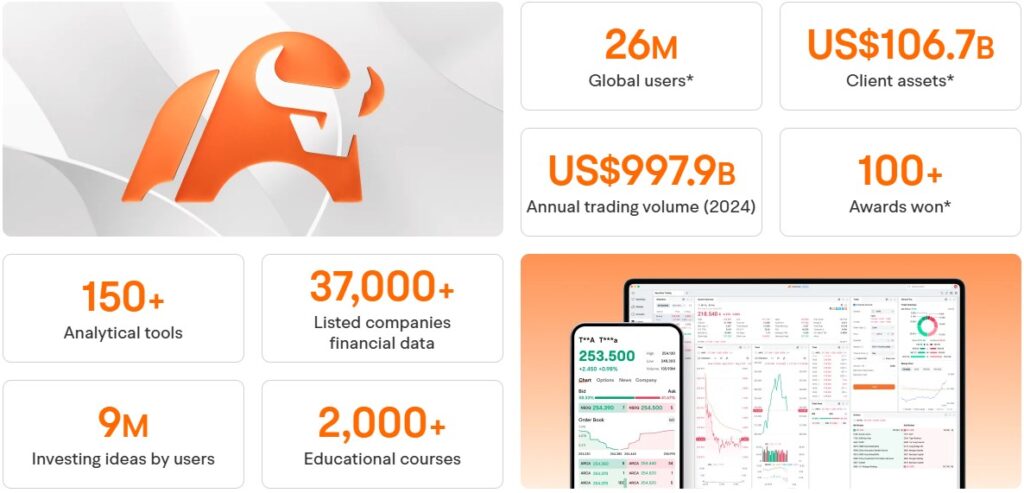

With more online brokers entering the market each year, it’s natural for potential users to ask, is moomoo legit? As of 2025, moomoo continues to rise in popularity among retail investors, active traders, and those seeking access to both U.S. and global markets.

But legitimacy isn’t just about popularity—it’s about transparency, regulation, technology, and service. This review examines whether moomoo is a trustworthy trading platform by looking at its background, safety practices, features, and more.

Introduction to Moomoo

Moomoo is a tech-forward trading platform offering access to a broad range of investment products, including stocks, ETFs, mutual funds, options, and fixed income securities. The platform operates with a strong emphasis on accessibility, combining professional-grade tools with an interface suitable for new users and seasoned investors alike.

Available via desktop and on the moomoo app (downloadable on Google Play and iOS), the platform is known for real-time financial news, competitive fees, and powerful analytics. Whether you want to trade stocks, monitor market trends, or explore new investment strategies, moomoo provides a well-rounded trading experience.

Company Overview and Regulation

Moomoo is operated by moomoo Financial Inc., which is owned by Futu Holdings, a publicly traded company listed on the NASDAQ. This backing ensures a high degree of transparency and investor trust. Futu’s listing subjects it to financial disclosures, shareholder scrutiny, and regulatory oversight, which contributes to moomoo’s credibility.

Moomoo holds a trading license from the U.S. Securities and Exchange Commission (SEC) and is regulated by both the SEC and the Financial Industry Regulatory Authority (FINRA). These two agencies are the primary regulators for brokerage firms in the U.S., and moomoo’s compliance with their requirements demonstrates that the company meets strict operational and ethical standards.

Moomoo is currently offering 8.1% APY!

With the WallStreetSurvivor Exclusive offer on this page, earn up to $1000 in NVDA Stock with a qualified deposit.

Canada Residents: You can get up to $200 Cash when you visit this Canada Promo Page!

As an added layer of protection, moomoo is a member of the Securities Investor Protection Corporation (SIPC). This means that moomoo accounts are insured for up to $500,000, including up to $250,000 for uninvested cash. SIPC coverage does not protect against market losses, but it does protect against the unlikely event of broker failure.

Safety and Security Measures

Is moomoo safe for trading and storing your assets? The platform uses bank-level encryption to protect all user information, including login credentials, personal identification, and transaction history. All sensitive data is stored securely, and users’ funds are held in segregated accounts to ensure financial integrity.

Additional safety features include two-factor authentication, which adds a critical layer of protection against unauthorized account access. moomoo also actively monitors for suspicious activity, prompting users to verify transactions and login attempts when necessary.

Cash holdings are supported by moomoo’s cash management system. Through its cash sweep program, eligible uninvested cash can earn interest at a competitive 4.1% APY. This feature turns idle funds into an interest-generating asset while ensuring liquidity when trading opportunities arise. Rates are subject to change and depend on eligibility and partner banks.

Trading Platforms and Investment Options

The moomoo trading platform is robust, offering real-time quotes, interactive charting tools, customizable alerts, and access to U.S. and international markets. Investors can trade stocks, ETFs, options, and index options. Fixed-income assets like bonds and other securities are also available for those seeking portfolio stability.

Moomoo is currently offering 8.1% APY!

With the WallStreetSurvivor Exclusive offer on this page, earn up to $1000 in NVDA Stock with a qualified deposit.

Canada Residents: You can get up to $200 Cash when you visit this Canada Promo Page!

The integration with TradingView allows for enhanced charting features and direct trading within the interface. Users can easily switch between the desktop platform and moomoo app for a seamless experience.

Whether you’re building a diversified portfolio, exploring portfolio diversification, or looking to make high-frequency trades, moomoo offers tools and features to meet different trading needs.

Moomoo’s New Crypto Trading Features

Moomoo recently expanded into cryptocurrency trading, giving users the ability to diversify their portfolios beyond traditional stocks and ETFs. Through its new crypto trading interface, investors can now buy and sell a curated list of digital assets, including Bitcoin, Ethereum, and a handful of other top-tier coins.

While the selection is currently limited compared to larger crypto exchanges, the rollout prioritizes compliance and ease of use—ideal for traders who want to explore crypto without leaving the Moomoo ecosystem. You’ll get real-time price updates, basic charting tools, and competitive spreads, all within the same app you already use for equities and options. This move puts Moomoo on the radar for crypto-curious investors looking for a secure, all-in-one platform.

Account Management and Setup

Opening a moomoo account is a straightforward process that involves filling out a digital application, verifying identity, and linking a bank account. Most accounts are approved within 24 to 48 hours.

There is no initial deposit required to open an account, although funding is necessary to begin trading and qualify for promotions. Users can transfer money via ACH or wire and can transfer assets from another brokerage using ACAT (Automated Customer Account Transfer). Account types include individual, joint, and retirement accounts, giving flexibility for various investors.

Users can manage their portfolio and cash settings easily through both the app and web portal. These tools include balance summaries, real-time portfolio updates, historical data tracking, and integrated reporting for fees, performance, and cash movements.

Note: If you’re a Canada resident, you can click here to open a moomoo account and receive your welcome bonus!

Fees and Charges

Moomoo’s fees are among the lowest in the industry. Users enjoy commission-free stock and ETF trading in the U.S. Options trading is also commission-free for equity options, with no platform or per-contract fees. For index options, moomoo charges a low $0.50 per contract. Regulatory and exchange fees may still apply where relevant.

| Moomoo | Fraudulent Brokers | |

| Fee transparency | Yes | No |

| Regulation | Yes | No |

| Clear ownership | Yes | No |

| Easy withdrawals | Yes | No |

| Real user reviews | Yes | No |

There are no annual fees, inactivity fees, or fees for ACH deposits and withdrawals. The only standard charges are for outgoing wire transfers and ACAT out transfers. These are clearly listed on the site, ensuring a transparent fee structure with no hidden costs.

Research and Data Tools

Moomoo users gain access to comprehensive research tools supported by partnerships with third-party sources like Morningstar and Bloomberg. This includes real-time market data, analyst ratings, price targets, financial reports, and economic calendars.

The platform supports technical analysis with a suite of indicators and drawing tools. Whether you are a swing trader, day trader, or long-term investor, these features help in making more informed decisions.

Customer Support and Service

Customer support is a critical factor when evaluating whether a trading platform is trustworthy. Moomoo offers 24/7 online support via inquiry forms and live chat. Phone support is available Monday through Friday from 8:30 a.m. to 4:30 p.m. Eastern Time. The support team is responsive and knowledgeable, ensuring that users get answers quickly.

A detailed FAQ section on the moomoo website covers everything from account setup and withdrawal times to how to resolve technical issues. While some users have said they called customer service with long wait times during peak hours, the overall feedback is positive.

Cash Management and Interest Earnings

In addition to trading, moomoo supports cash management through its cash sweep feature. This allows uninvested cash to be automatically transferred into an interest-bearing account. The interest rate is competitive with traditional banks and online money market accounts.

Moomoo is currently offering 8.1% APY!

With the WallStreetSurvivor Exclusive offer on this page, earn up to $1000 in NVDA Stock with a qualified deposit.

Canada Residents: You can get up to $200 Cash when you visit this Canada Promo Page!

The platform’s cash tools help investors allocate funds efficiently between securities and interest-generating accounts, offering both growth and liquidity. Users can view earned interest, set allocation preferences, and ensure cash is available when needed.

Execution Quality and Market Access

One of the most important considerations for active traders is execution speed. Moomoo delivers fast order routing and optimal execution pricing, backed by regular performance audits.

Moomoo offers access to a broad range of markets, including U.S., Hong Kong, Australian, and Chinese mainland stocks. This global access makes the platform attractive to investors seeking to diversify their assets or trade during non-U.S. market hours.

Education and Learning Resources

For new users, moomoo provides one of the most comprehensive learning environments available. Its education center includes video tutorials, live webinars, interactive guides, and a moo community forum where users exchange tips and ask questions.

Topics cover everything from beginner trading to advanced charting techniques, and new content is added regularly. The platform’s goal is to support smarter, more informed investing.

Risks and Transparency

Trading with any broker carries inherent risk, and moomoo is no exception. Investors should be aware of risks such as market volatility, interest rate exposure, and trading leverage. The platform makes an effort to inform users of these risks by providing disclosure statements and risk reminders before high-risk trades.

Users are encouraged to invest responsibly, and the platform provides risk management tools such as stop-loss orders, alerts, and watchlists to minimize downside exposure.

Final Verdict: Is Moomoo Legit?

Given its regulatory standing, professional-grade tools, responsive support, and transparent pricing, moomoo is legit. It is well-suited for active traders, long-term investors, and anyone seeking a reliable and regulated trading platform.

With backing from Futu Holdings, registration with the SEC and FINRA, and SIPC insurance, moomoo provides the safety and infrastructure required for serious investing. Add in commission-free stock trades, low-cost options, and strong data tools, and the platform stands out among its peers.

For users still comparing their choices, moomoo offers an impressive balance of cost, features, and accessibility. It’s not only legitimate—it’s one of the best platforms available for those who want to trade smart and stay informed.

If you decide moomoo is right for you, check out our article on Free Moomoo Stock Rewards to maximize your account bonuses.

FAQs

Yes, moomoo is a legitimate trading platform regulated by the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). It offers commission-free stock and ETF trading for U.S. residents and provides robust research tools and market access.

Yes, moomoo Financial Inc. is a registered broker-dealer regulated by the SEC and FINRA. It is also a member of the Securities Investor Protection Corporation (SIPC), which provides insurance coverage up to $500,000 for customer accounts, including $250,000 for uninvested cash.

No. moomoo’s fee structure is transparent. There are no commissions for trading U.S. stocks and ETFs, and no annual or inactivity fees. Fees may apply for services like outgoing wire transfers, ACAT transfers, and certain index options contracts.

Yes. Moomoo uses bank-level encryption and two-factor authentication to secure user accounts. In addition, SIPC membership helps protect your cash and securities in case the broker fails, though it does not protect against losses from market activity.

Moomoo offers a cash management feature that automatically moves eligible uninvested cash into an interest-bearing account. As of May 2025, qualified users can earn up to 4.1% APY, depending on account type and promotion eligibility.

Yes. Moomoo supports trading in mutual funds, fixed income securities, stocks, ETFs, and options. This wide range of investment products supports portfolio diversification across different asset classes.

Opening a moomoo account is simple. You’ll need to complete a digital application, verify your identity, and link a bank account. There is no minimum initial deposit required to open the account, though you must fund it to start trading.

Yes. The moomoo app, available on Google Play and the App Store, is secure and offers the same level of encryption and account protection as the desktop platform. It is regularly updated and offers real-time market data, trading tools, and account monitoring.

Top U.S. Brokers Promotions for 2026

★ ★ ★ ★ ★

✅ Now 23 million users

✅ Cash mgt account and credit card

Free stock up to $200 with new account, plus up to $1,500 more in free stock from referrals; US residents only!

Get Free Stock

★ ★ ★ ★ ★

✅ Access to U.S. and Hong Kong markets

✅ Educational tools

Deposit $500 get $30 in NVDA stock; Deposit $2,000 get $100 in NVDA stock; Deposit $10,000 get $200 in NVDA stock; Deposit $50,000 get $400 in NVDA stock.

Get Free Shares

★ ★ ★ ★ ☆

✅ Trade U.S. stocks, ETFs, and crypto

✅ Trades with themed portfolios

★ ★ ★ ★ ☆

✅ Great charts and screeners

✅ Commission-free options trading

$10 and a 30-day complimentary subscription to Webull premium; $200-$30,0000 Tiered Sign up bonus

Learn more

★ ★ ★ ★ ☆

✅ IBKR Lite & Pro tiers for all

✅ SmartRouting™ and deep analytics

The Best Canadian Brokerages as of February 1, 2026

Ranking of Top Canadian Stock Brokerages Based on Fees, Features, and Sign-Up Bonuses

We are experienced users of dozens of Canadian stock trading platforms. We stay up to date on these platforms' service offerings, subscription fees, trade commissions, and welcome bonuses. The brokerages listed below are for Canada-based investors, and are ranked in order of overall value received after taking advantage of their sign-up and/or referral offers.

✅ Dual-currency accounts without conversion fees

✅ Advanced trading with multi-leg options support

✅ Tiered interest on idle cash balances over $10,000 CAD

✅ Supports portfolio margin and direct market routing

✅ Access to Canadian Markets

✅ RRSP and TFSA Accounts

Deposit $100, get $20 in NVDA stock; Deposit $2,000, get $50 in NVDA stock; Deposit $10,000, get $300 in NVDA stock; Deposit $50,000, get $1,000 in NVDA stock

Learn more✅ In-kind transfers & dividend reinvestment plans for CA stocks

✅ RESP and FHSA accounts with self-directed tools

✅ 24/5 U.S. market access with fractional share support

✅ No FX fees on U.S. trades if subscribed to USD feature

Fees, features, sign-up bonuses, and referral bonuses are accurate as of June 30, 2025. All information listed above is subject to change.