BlockFi is one of the coolest new players on the block in the investing world.

Their aim is to join crypto and traditional finance, and they’ve been doing quite a job so far!

In this BlockFi Review, you’ll find out:

- What BlockFi is

- The services BlockFi offers

- BlockFi’s values

- Whether or not BlockFi is for you

Let’s get started!

What is BlockFi?

BlockFi is a crypto-lending and cryptocurrency exchange institution that allows users to earn interest on deposited cryptocurrency as well as use cryptocurrency as collateral for loans.

The company was founded in 2017 in New York City by Zac Prince and Lori Marquez.

BlockFi Features

So, what can you do when you sign up for BlockFi?

Trading Account

First off, you can invest in cryptocurrency!

Once you fund your BlockFi account, you can use the trading feature to buy, sell, and exchange crypto, commission-free.

The best part about trading with BlockFi is that you can immediately start earning interest on your investments; once you purchase a cryptocurrency, it goes straight into your BlockFi Interest account, discussed below.

You can also set up automatic trades in order to buy or sell cryptos on a regular basis!

BlockFi does not offer joint or custodial investment accounts.

BlockFi Interest Account

One of BlockFi’s main features is its BlockFi Interest Account, or BIA.

We think the BIA is one of the coolest interest accounts out there, and here’s why.

With the BlockFi Interest Account, you can deposit your cryptocurrency and earn interest on it.

With the Interest Payment Flex option, you can choose which cryptocurrency your interest is paid in.

How does this whole interest payment thing work?

Well, when you deposit some of your crypto into your BIA, BlockFi then lends that crypto out to borrowers, who pay BlockFi interest.

Some of that interest is then passed on to you, the client!

Interest is compounded daily and deposited to your account monthly, and there are no account maintenance fees or required account minimums.

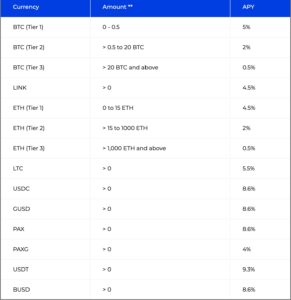

Here are BlockFi’s currently accepted cryptocurrencies and the current APYs on the BlockFi Interest Account.

Crypto-Backed Loans

BlockFi also offers loans where you put your cryptocurrency up as collateral.

You can secure a loan using Bitcoin, Ether, or Litecoin.

In exchange for this collateral, BlockFi will lend you U.S. dollars, GUSD, or USDC.

In order to take out a crypto-backed loan, you will need to post a loan-to-value (LTV) ratio of 50%.

In other words, you can take out a loan that is no more than half the size of your current portfolio.

If your crypto goes down and value and raises the LTV ratio of your loan, you will need to post more collateral in order to get the ratio back down.

The origination rate for a crypto-backed loan is 2%, and the interest rate varies depending on how low your loan-to-value ratio is. (A lower LTV ratio is better.)

Here are the current interest rates for crypto-backed loans:

BlockFi Rewards Credit Card

BlockFi will be releasing the first-ever credit card to offer cash-back rewards in the form of Bitcoin.

The BlockFi Rewards Visa Signature Credit Card, which will be released in the spring of 2021, will grant cardholders 1.5% back on every purchase, paid out as Bitcoin.

The Bitcoin earned on purchases will be transferred to your BIA and start earning interest immediately.

The annual fee for the card will be $200. You can join the waitlist for the BlockFi Rewards Credit Card on the BlockFi website!

Who is BlockFi For?

BlockFi is great for cryptocurrency investors who want to earn a profit from their crypto assets without selling.

Why wouldn’t you want to sell your crypto if it’s gone up?

Because selling an asset that has increased in value creates a capital gain, which will be subject to capital gains tax.

When you use your cryptocurrency to secure a loan instead of selling it, you avoid creating a taxable event while giving yourself the opportunity to make even more gains with the extra money you’ve been loaned.

The interest you pay on your crypto-backed loan can even be used as a tax deduction in order to reduce your taxable income for the year!

Want to get started investing in cryptocurrency but not sure where to start? Check out our guide to getting started with Bitcoin!

How does BlockFi Make Money?

BlockFi makes money in several different ways.

One of these ways is withdrawal fees on BIAs. When you have a BIA, you are allowed to make one cryptocurrency withdrawal and one stablecoin withdrawal per month for free.

But when you want to withdraw more than that, the following fees are applied:

Why BlockFi?

So, are there any other reasons to sign up for BlockFi besides a great return on your crypto holdings?

Absolutely!

BlockFi’s corporate vision and values are a great testament to their commitment to progress and to their clients.

The BlockFi Vision

BlockFi’s vision of uniting traditional finance and blockchain is pretty spot on.

They’ve taken your ordinary financial tools like checking accounts, loans, and credit cards, and infused them with cryptocurrency!

So we’d say they’re doing a pretty good job.

BlockFi’s Values

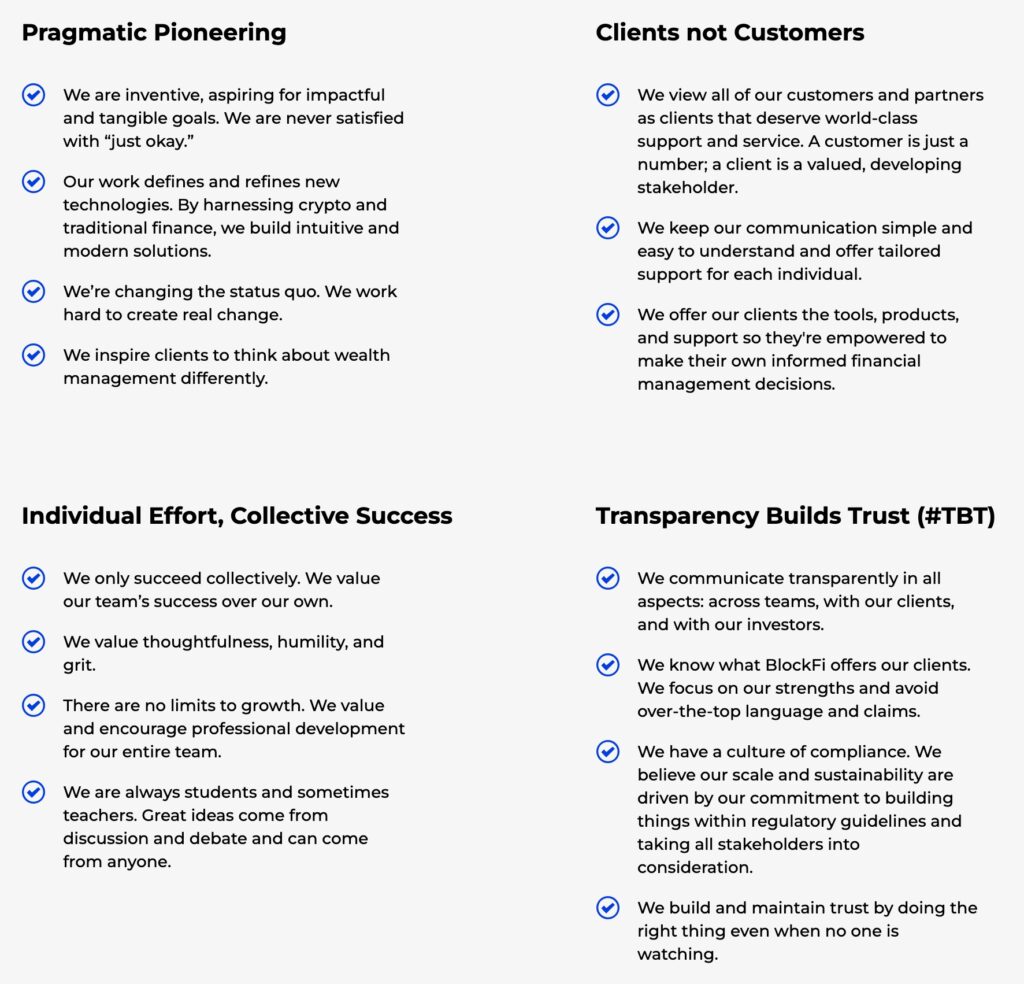

BlockFi’s values encompass their views on why what they’re doing matters and how they view their clients.

Their goal is to “change the status quo” and to grow without limits, something they’ve been doing pretty well with so far!

They view their clients as valued individuals with a stake in the company and make sure to give them real, meaningful support when needed.

Lastly, BlockFi aims to be transparent and to operate within regulatory boundaries.

Before You Buy

While BlockFi has taken many steps to ensure its customers safety and protect them from losing their cryptocurrency, it is important to understand the risks that are inherent with the type of business model the platform is running.

BlockFi is based in the U.S., which means it is subject to U.S. regulations.

This should come as a relief to many investors who are worried about the looser regulations that apply to other cryptocurrency exchanges, many of which are based internationally.

In addition to the regulations BlockFi has to adhere to, the company also chooses its borrowers carefully.

When BlockFi takes the cryptocurrency in your BIA and lends it out, it chooses reputable borrowers and requires a high LTV ratio from them in order to execute the loan.

This means that BlockFi takes extra steps to protect you in the event that one of their borrowers is unable to repay the loan provided to them with the cryptocurrency from your BIA.

While the U.S. regulations and reliable borrowers associated with BlockFi are a good step towards protecting customers, the biggest risk associated with putting money into a BlockFi account is the fact that it is uninsured.

With most regular brokerages, your investments and uninvested cash are insured by the Securities Investment Protection Corporation (SIPC).

This means that your investments and cash are protected in the event that your brokerage goes out of business. (It does not, however, mean that you are insured if your investments simply go down in value.)

With most bank accounts, your deposits are insured by the Federal Deposit Insurance Corporation (FDIC). This means that your deposits are covered in the event that there is a bank run and your bank does not have the cash to pay out your withdrawals.

While BlockFi acts as both a brokerage and an interest-bearing bank account for cryptocurrency, its accounts are not insured by the SIPC or the FDIC.

This means that, in the event that the company goes out of business, you could be at risk of losing the cryptocurrency and cash in your BIA and your investment account.

This risk should not be taken lightly and should be considered heavily before putting your cryptocurrency into a BlockFi account.

It is also important to keep in mind that cryptocurrency is an asset whose value can fluctuate constantly, which is risky when using it as collateral for a loan.

While the current value of your cryptocurrencies may be enough to secure a loan with a LTV ratio of 50% or less, your crypto can always go down in value and reduce that ratio.

A heightened LTV ratio will lead to a demand for more collateral, which can be a dangerous situation if you don’t have more money to deposit into your account.

Final Thoughts

BlockFi is an extremely innovative cryptocurrency institution that is expanding into spaces that have never before been explored.

As long as you can look past the risk that comes along with putting your crypto into an interest account and an investment account that are uninsured, BlockFi can be a great way for you to grow your money.

If this BlockFi review helped you make a decision, leave a comment below to tell us what you think!

Oh, and don’t forget to join the waitlist for the BlockFi Rewards Credit Card!

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks as of December 27, 2025

We are paid subscribers to dozens of stock and option newsletters. We actively track every recommendation from all of these services, calculate performance, and share our results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Return vs S&P500" which is their return above that of the S&P500. So, based on December 27, 2025 prices:

Best Stock Newsletters Last 3 Years' Performance

| Rank | Stock Newsletter | Picks Return | Return vs S&P500 | Picks w Profit | Max % Return | Current Promotion |

|---|---|---|---|---|---|---|

| 1. |  Alpha Picks | 82% | 56% | 76% | 1,583% | VALENTINE'S SALE: SAVE $75 NOW |

| Summary: 2 picks per month based on Seeking Alpha's Quant Rating; consistently beating the market every year since launch; tells you when to sell and they have sold almost half. See complete details in our full Alpha Picks review. Or get their Premium service to get their QUANT RATINGS on your stocks to better manage your current portfolio--read our Is Seeking Alpha Worth It? article to learn more about their Quant Ratings. | ||||||

| 2. |  Zacks Value Investor | 60% | 40% | 54% | 692% | February Promotion: $1, then $495/yr |

| Summary: 10 stock picks per year on January 1st based on Zacks' Quant Rating; Retail Price is $495/yr and includes 6 different services including those below. Read our Zacks Review. | ||||||

| 3. |  Moby.co | 50% | 16% | 74% | 2,569% | February Promotion: Next pick free! |

| Summary: 60-150 stock picks per year, segmented by industry; consistently beating the market every year; retail price is $199/yr. Read our full Moby Review. | ||||||

| 4. |  Zacks Top 10 | 36% | 15% | 71% | 170% | February Promotion: $1, then $495/yr |

| Summary: 10 stock picks per year on January 1st based on Zacks' Quant Rating; Retail Price is $495/yr and includes 6 different services. Read our Zacks Review. | ||||||

| 5. |  TipRanks SmartInvestor | 20% | 9% | 62% | 464% | Current Promotion: Save $180 |

| Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. | ||||||

| 6. |  Action Alerts Plus | 27% | 5% | 66% | 208% | Current Promotion: None |

| Summary: 100-150 trades per year, lots of buying and selling and short-term trades. Read our Jim Cramer Review. | ||||||

| 7. |  Zacks Home Run Investor | 5% | -0.4% | 45% | 241% | February Promotion: $1, then $495/yr |

| Summary: 40-50 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. | ||||||

| 8. | Dogs of the Dow Strategy | 16% | -1.8% | 43% | 44% | Current Promotion: None |

| Summary: Buy the 10 highest yielding dividends stocks in the Dow Jones Industrial Average on January 1st and sell on Dec 31st each year. | ||||||

| 9. | IBD Leaderboard ETF | 11.4% | -1.8% | n/a | n/a | February Promotion: NONE |

| Summary: Maintains top 50 stocks to invest in based on IBD algorithm; Retail Price is $495/yr. Read our Investors Business Daily Review. | ||||||

| 10. |  Stock Advisor | 34% | -3.9% | 75% | 289% | February Promotion: Get $100 Off |

| Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr. Read our Motley Fool Review. | ||||||

| 11. |  Zacks Under $10 | -0.2% | -4% | -4.3 | 263% | February Promotion: $1, then $495/yr |

| Summary: 40-50 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. | ||||||

| 12. |  Rule Breakers | 34% | -5.1% | 69% | 320% | Current Promotion: Save $200 |

| Summary: Rule Breakers is included with the Fool's Epic Service. Get 5 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. | ||||||

| Top Ranking Stock Newsletters based on their last 3 years of stock picks covering 2025, 2024, and 2023 performance as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF. Performance as of December 27, 2025. | ||||||