In the fast-paced world of online investing, choosing the right trading platform can be the difference between a smooth experience and constant frustration. Both moomoo and Robinhood have grown rapidly in a relatively short period, attracting beginner, intermediate, and advanced traders. Whether you want to trade equities, explore global markets, or test options trading strategies, understanding how each platform works is essential.

Both platforms are considered safe. Robinhood and moomoo users are protected by SIPC, while bank sweep cash on Robinhood is covered by the FDIC. Moomoo is regulated under FINRA, and both apps offer 2FA, end-to-end encryption, and private crime insurance to protect users if their security is breached.

Both Robinhood and moomoo are safe to use. Robinhood and moomoo users’ accounts are protected by the SIPC and Robinhood by the FDIC (moomoo by FINRA), and their website and mobile app have 2FA, end-to-end encryption, and the company has private crime insurance to protect users if their security is breached. This Moomoo vs Robinhood comparison will help you evaluate which app fits your trading style, goals, and level of experience.

Introduction to Trading Platforms

When selecting a trading app, your decision should align with how you start trading, your financial goals, and the assets you want exposure to. Investing involves risk, including market volatility, and you could lose principal during downturns.

Investors should also be aware that all market activity carries significant risk, especially during volatile periods.

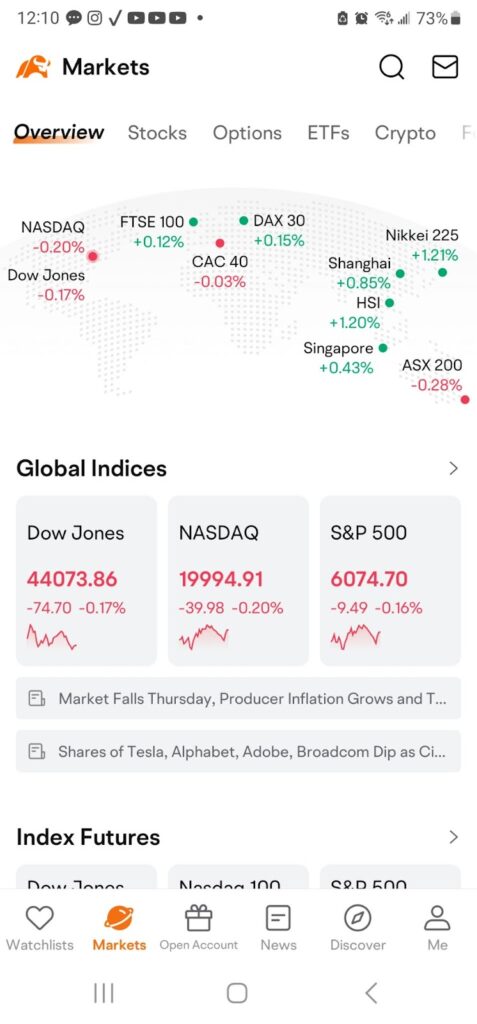

Both moomoo and Robinhood offer commission-free trading and easy onboarding, but they’re built for different types of investors. Robinhood focuses on simplicity, while moomoo emphasizes advanced trading tools, deeper analytics, and access to worldwide markets.

Evaluating each platform’s tools, features, and other fees will help you make better financial decisions for your entire investment strategy.

Features and Fees

Robinhood pioneered commission-free trading, making free trading the industry norm. Its simple interface makes investing accessible for beginners. The app is ideal for people learning to trade stocks or build their first portfolios without navigating complex menus.

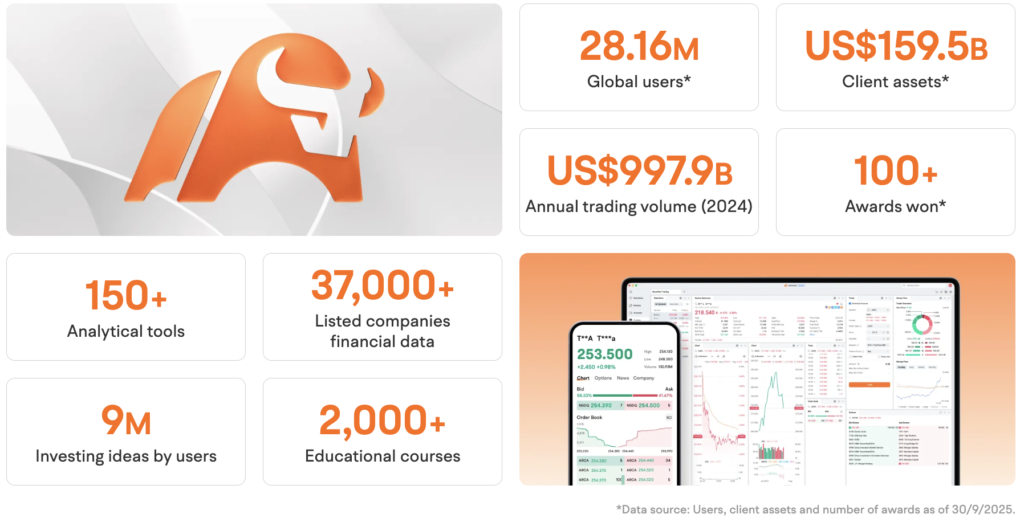

Moomoo, by contrast, is designed for intermediate traders, more advanced traders, and those who rely on analytics. It provides an advanced stock screener, technical indicators, and advanced tools that appeal to active traders researching new opportunities.

Both platforms, moomoo and Robinhood, offer stocks, ETFs, and options trading without commission fees, but moomoo stands out with access to Hong Kong stocks and extended hours.

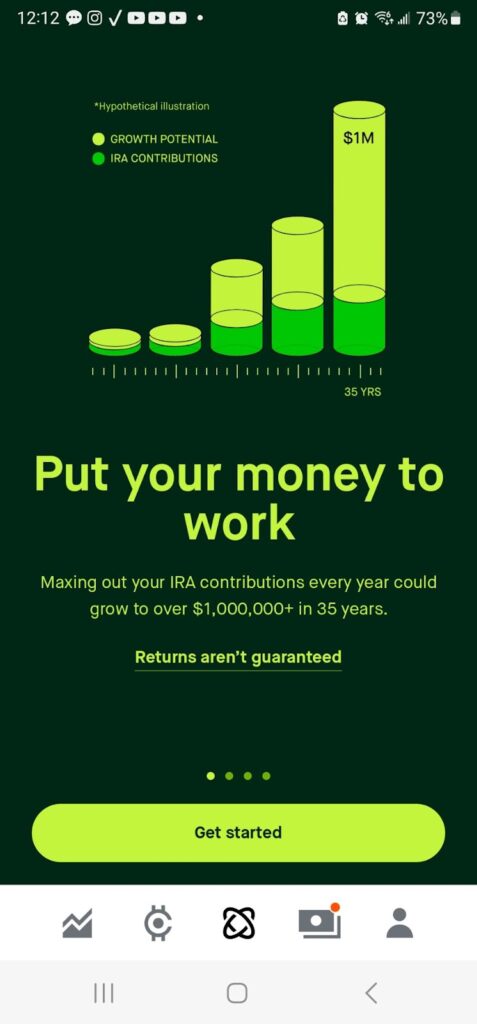

Fee-wise, both moomoo and Robinhood remain competitive. Robinhood Gold costs $5/month and includes margin access, 4% APY on uninvested cash, Level II data, a 3% IRA match, and more. Moomoo offers margin trading at 6.8% and includes Level II data and powerful tools without requiring a paid tier.

Investment Options

Robinhood supports stocks, ETFs, cryptocurrency trading, and retirement accounts such as IRAs. Investors can access Bitcoin, Ethereum, and more through crypto trades, although certain complex options strategies may require additional approvals.

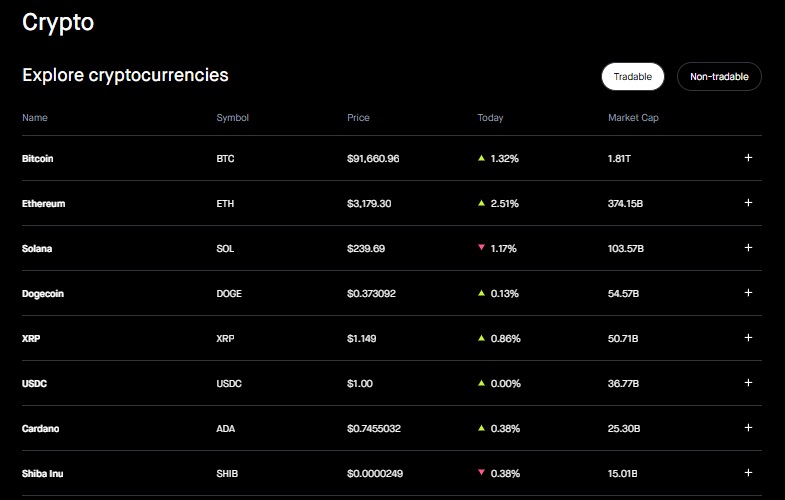

Moomoo focuses heavily on equities and global diversification. The platform provides access to the Hong Kong Stock Exchange, where trades include a 0.03% commission plus a platform fee. While moomoo does not support as many altcoins, its selection covers the essentials for users exploring digital assets.

Moomoo’s New Crypto Trading Features

Moomoo recently expanded into cryptocurrency trading, giving new users and experienced traders more flexibility. You can buy and sell Bitcoin, Ethereum, and a curated list of assets directly from the trading app. Real-time data, streamlined order entry, and basic charting tools make crypto easier to explore without leaving the moomoo ecosystem.

Moomoo is currently offering 8.1% APY!

With the WallStreetSurvivor Exclusive offer on this page, earn up to $1000 in NVDA stock with a qualified deposit.

Canada Residents: You can get up to $200 Cash when you visit this Canada Promo Page!

Trading Tools and Analytics

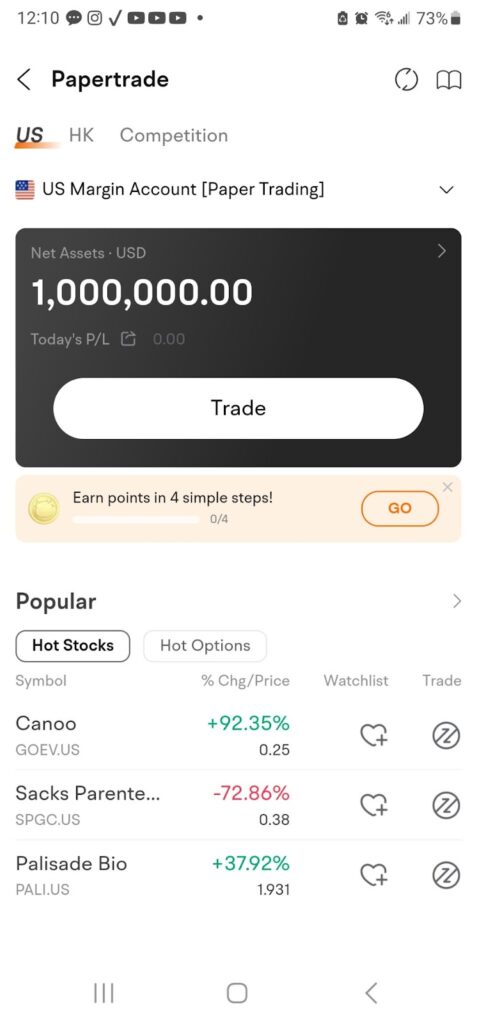

Moomoo is popular among investors who want control over their research. Features include:

- Real-time market information

- Custom alerts

- Advanced charting

- Stock screener and scanners

- Paper trading feature for strategy testing

- A synchronized desktop platform

These tools support deeper analysis, appealing to experienced investors exploring advanced strategies.

Robinhood offers streamlined tools with a clean layout. While it provides essential charting, real-time data, and simple order flows, the platform may feel limiting for traders who rely on multi-variable screeners or advanced trading tools.

Both trading platforms, moomoo vs robinhood, offer real-time data, but moomoo provides more robust customization.

Educational Resources

Moomoo places a strong emphasis on educational resources, offering tutorials, webinars, community discussions, and learning pathways for intermediate traders and beginners alike. This helps users understand options transactions, global diversification, and market structure.

Robinhood Learn provides beginner-friendly explainers and market definitions. While helpful, its resources are not as interactive or extensive as moomoo’s.

Moomoo is currently offering 8.1% APY!

With the WallStreetSurvivor Exclusive offer on this page, earn up to $1000 in NVDA stock with a qualified deposit.

Canada Residents: You can get up to $200 Cash when you visit this Canada Promo Page!

Moomoo vs Robinhood – Fees and Pricing Structure

The fee structures for each trading platform differ slightly:

| Feature | Moomoo | Robinhood |

|---|---|---|

| Margin Rate | 6.8% flat for U.S. margin accounts. | 5.75% standard rate; first $1,000 of margin is interest-free for Gold members. |

| HKEX Trading Fees | Commission: 0.03% (min HK$3); Platform Fee: HK$15; Stamp Duty: 0.1% of transaction amount. | Not available. |

| Crypto Trading | BTC, ETH, and more varying between the US and SG | Supports 19 cryptocurrencies, including BTC, ETH, DOGE, SOL, ADA, XRP, and PEPE. |

| Robinhood Gold Features | Not applicable. | $5/month; includes 4% APY on uninvested cash, 3% IRA match, 1% transfer match, access to Morningstar research, and Level II market data. |

Note: if you’re a Canada resident, you can visit the moomoo Canada website to see their fees, sign up for an account, and claim your commission rebate and stock cash coupon!

Premium Services

Robinhood Gold ($5/month) includes margin access, Level II data, Morningstar research, higher instant deposit limits, and boosted APY. It also includes its gold subscription benefits such as IRA match and transfer perks.

Moomoo, meanwhile, offers many premium-quality tools without charging a subscription. Users can also benefit from a cash sweep program with competitive APY boosts.

Unique Features

Here’s where the two platforms diverge:

- Moomoo gives users access to Hong Kong and other markets, extended trading hours, and analytics suited for advanced traders.

- Robinhood and moomoo both support crypto.

- Both trading platforms offer fractional shares, allowing investors to put money invested toward high-price stocks.

Moomoo focuses on tools; Robinhood focuses on ease of use and investing accessible design.

Investment Platform Comparison

A Moomoo vs Robinhood comparison often comes down to goals and experience:

- Moomoo: robust tools, advanced charting, global diversification.

- Robinhood: simplicity and a gentle learning curve.

If you’re transitioning from beginner to intermediate, moomoo may provide a better idea of how deeper analytics improve decision-making.

Moomoo vs Robinhood – Choosing the Right Platform

Evaluate your trading style, asset interests, and long-term goals. Are you investing mainly in U.S. assets? Do you want access to worldwide markets or extended hours?

Moomoo is currently offering 8.1% APY!

With the WallStreetSurvivor Exclusive offer on this page, earn up to $1000 in NVDA stock with a qualified deposit.

Canada Residents: You can get up to $200 Cash when you visit this Canada Promo Page!

Here is what to take into account when evaluating moomoo vs robinhood as trading platforms.

If simplicity matters most, Robinhood is ideal. If you require analytics, screening tools, and international exposure, moomoo aligns better with advanced traders and strategy-focused investors.

Hong Kong Trading

One of moomoo’s standout features is its access to the Hong Kong stock market and more. Investors can trade stocks, ETFs, and options on the Hong Kong stock exchange, gaining exposure to fast-growing sectors and emerging industries.

This global reach allows users to diversify beyond U.S. markets, but it also requires awareness of currency exchange, local regulations, and market hours. Moomoo supports users with translated data feeds, educational content, and compliance resources to help manage international trades effectively.

For those interested in investing in Asia or expanding their international exposure, moomoo is a rare tool that brings this level of access to retail traders.

Commission-Free Trades

Both moomoo and Robinhood offer commission-free trading on stocks, ETFsoptions. This makes both platforms highly competitive and appealing for cost-conscious investors.

Where they differ is in scope. Moomoo offers commission-free trading on Hong Kong stocks as well, making it a global contender. Robinhood, on the other hand, restricts commission-free trading to U.S. securities and does not offer access to foreign markets.

Additionally, neither platform charges for basic account usage or imposes account minimums, further lowering the barrier to entry.

Beginner Trading

For those new to trading, Robinhood is often the first stop. Its clean interface, intuitive layout, and quick sign-up process are ideal for those unfamiliar with investing. The Robinhood app simplifies concepts and limits options to reduce confusion.

Moomoo, while more robust, can initially feel overwhelming for new users. However, its educational resources, paper trading, and customer support make it a viable choice for beginner traders willing to invest time in learning.

Beginners should consider their risk tolerance and desired level of involvement. Robinhood is great for learning the basics and building comfort, while moomoo better supports those looking to grow into more active and advanced traders.

Advanced Trading

Advanced traders will appreciate moomoo’s platform versatility, including its detailed charting tools, global reach, and access to institutional-grade analytics. The desktop platform supports multi-monitor setups, technical overlays, and real-time scanners.

Robinhood’s advanced offerings come through Robinhood Gold, but these tools are more limited. While useful for casual options trading and research, they do not match the depth provided by moomoo’s native tools.

Users with defined strategies, time to research, and international interests will likely gravitate toward moomoo for its precision and scale, as well as its technical indicators.

Moomoo vs Robinhood – Conclusion

Both trading platforms, moomoo vs Robinhood, serve different needs.

Robinhood offers easy, commission-free access, while moomoo provides a deeper toolkit for strategy-driven traders. Both moomoo and Robinhood offer crypto, evolving tools, and features designed for long-term growth.

Still curious to learn more about moomoo, read our full Moomoo Review!

FAQs

Moomoo offers more advanced trading tools and access to international markets. Robinhood offers crypto, retirement accounts, and a simpler user experience.

No, Robinhood is not currently offering paper investing. If you’re willing to spend a little money, you can start building a portfolio with fractional shares. As you get accustomed to how the trading process works, you can buy additional shares.

Yes, both Robinhood and moomoo are safe to use. Robinhood users’ accounts are protected by the SIPC and FDIC, and their website and mobile app have 2FA, end-to-end encryption, and the company has private crime insurance to protect users if their security is breached.

Moomoo is protected by the SIPC up to $500,000 per investment account. They also offer 2FA and encryption.

Both platforms, moomoo vs Robinhood, offer commission-free trading on U.S. stocks, ETFs, and options. Robinhood Gold is a paid subscription for extra features. Moomoo provides advanced tools at no additional cost.

Yes, Moomoo now offers BTC, ETH, and more in the US and Singapore

Top U.S. Brokers Promotions for 2026

★ ★ ★ ★ ★

✅ Now 23 million users

✅ Cash mgt account and credit card

Free stock up to $200 with new account, plus up to $1,500 more in free stock from referrals; US residents only!

Get Free Stock

★ ★ ★ ★ ★

✅ Access to U.S. and Hong Kong markets

✅ Educational tools

Deposit $500 get $30 in NVDA stock; Deposit $2,000 get $100 in NVDA stock; Deposit $10,000 get $200 in NVDA stock; Deposit $50,000 get $400 in NVDA stock.

Get Free Shares

★ ★ ★ ★ ☆

✅ Trade U.S. stocks, ETFs, and crypto

✅ Trades with themed portfolios

★ ★ ★ ★ ☆

✅ Great charts and screeners

✅ Commission-free options trading

$10 and a 30-day complimentary subscription to Webull premium; $200-$30,0000 Tiered Sign up bonus

Learn more

★ ★ ★ ★ ☆

✅ IBKR Lite & Pro tiers for all

✅ SmartRouting™ and deep analytics

The Best Canadian Brokerages as of February 1, 2026

Ranking of Top Canadian Stock Brokerages Based on Fees, Features, and Sign-Up Bonuses

We are experienced users of dozens of Canadian stock trading platforms. We stay up to date on these platforms' service offerings, subscription fees, trade commissions, and welcome bonuses. The brokerages listed below are for Canada-based investors, and are ranked in order of overall value received after taking advantage of their sign-up and/or referral offers.

✅ Dual-currency accounts without conversion fees

✅ Advanced trading with multi-leg options support

✅ Tiered interest on idle cash balances over $10,000 CAD

✅ Supports portfolio margin and direct market routing

✅ Access to Canadian Markets

✅ RRSP and TFSA Accounts

Deposit $100, get $20 in NVDA stock; Deposit $2,000, get $50 in NVDA stock; Deposit $10,000, get $300 in NVDA stock; Deposit $50,000, get $1,000 in NVDA stock

Learn more✅ In-kind transfers & dividend reinvestment plans for CA stocks

✅ RESP and FHSA accounts with self-directed tools

✅ 24/5 U.S. market access with fractional share support

✅ No FX fees on U.S. trades if subscribed to USD feature

Fees, features, sign-up bonuses, and referral bonuses are accurate as of June 30, 2025. All information listed above is subject to change.