If you’re new to investing, chances are you’ve learned a few lessons.

And maybe you learned some of those lessons the hard way…which is no fun.

But we’re here today to talk about some of the biggest mistakes rookie traders make so that you can learn about them the easy way!

#1: Not Diversifying

It’s okay to take risks when you’re investing, especially if you’re far from retirement and don’t have a lot of financial responsibilities.

But a lack of diversification in your portfolio can lead to a lot of volatility and make for a very stressful time.

Ideally, you should build a portfolio of more than 20 securities that are uncorrelated.

This way, the poor performance of one stock won’t bring down your entire portfolio.

If you need help diversifying your portfolio without doing all the work yourself, check out a robo-advisor like Acorns. Acorns will give you a short questionnaire to assess your financial situation and risk tolerance and assign you a well-diversified portfolio of ETFs based on your investing profile. Acorns also uses its unique roundups system, which takes your everyday purchases, rounds them up to the nearest dollar, and invests the spare change for you.

#2: Trading Emotionally

The consequences of trading emotionally can be tough, and it’s a lesson that a lot of new investors learn the hard way.

The stock market can be emotional and irrational. It’s important to keep your cool during periods of market volatility so that you don’t let yourself make a decision that loses you money unnecessarily.

If you’ve done your research on the stocks in your portfolio, you should know when it’s time to buy more, hold, or sell.

The swings of the market shouldn’t be making this decision for you, because you know what your stock is worth.

Unless there is a change in the fundamental qualities of your stock, you should have no reason to make a change.

Some of the most common emotional trading mistakes include:

- Panic-selling when your stock’s price is dropping or the market as a whole is taking a dip

- Selling a winning stock too early instead of letting it run

- Holding onto a losing stock, or even buying more in the hopes of “getting even,” or recovering your losses

#3: Not Using a Stock Picking List

If you don’t have several hours a day to spend researching the market and deciding what your next investing moves will be, you can always take advantage of a stock picker to help you decide what to buy and sell.

A good stock picking list will make daily updates to their recommendations and alert you immediately when a stock changes from a buy to a sell rating or vice versa.

There are some stock pickers out there who make false claims about their abilities. They’ll say that they can make you rich, that they only pick winning stocks, or that they know how to time the market.

It’s important to be able to differentiate between these stock pickers that just want to take your money and real stock pickers who really know what they’re doing.

A reliable stock picker is honest about their abilities. They’ll recognize that they can’t time the market and that they won’t outperform the market every year. They’ll acknowledge that they don’t have some sort of secret that the rest of the investing world doesn’t have; they are simply offering to do the research for you so that you don’t have to spend the time doing it yourself. And most importantly, a good stock picker will have a solid performance history.

Here are some of our favorite stock pickers:

The Motley Fool Stock Advisor is a list from the Motley Fool that aims to give its users long-term success through buy-and-hold investing. The Fool adds two new stocks to the list every month, and it has beaten the S&P 500 by over 900% since its inception in 2002.

Zacks #1 Strong Buy is a list from Zacks Investment Research that uses the Zacks Rank system. Zacks evaluates stocks and assigns them a rank between 5 (strong sell) and 1 (strong buy). You can use Zacks’ advanced research and screening tools to see what your favorite stocks are ranked, or you can just buy from the list of stocks that are ranked as #1 strong buy. The #1 Strong Buy list has beaten the market in 26 out of the last 31 years it has been used.

#4: Not Using Tax-Advantaged Accounts

If you think the only way to get access to the stock market is to open a run-of-the-mill brokerage account with no income tax advantages and no shelter from capital gains tax, you would be incorrect.

Depending on your situation, there are plenty of options for investment accounts that will leave you with a lower tax burden compared to a regular brokerage account.

For example, the Roth IRA is a retirement account that lets you make your contributions with after-tax dollars and allows you to withdraw your money and gains tax-free in retirement.

The traditional IRA lets you deduct your contributions from your taxable income.

There is also a Roth variation of your typical 401(k), which is even better if your employer offers contribution matching!

There are also tax-advantaged investment accounts for self-employed individuals, those who want to invest in real estate, and children. The possibilities are endless!

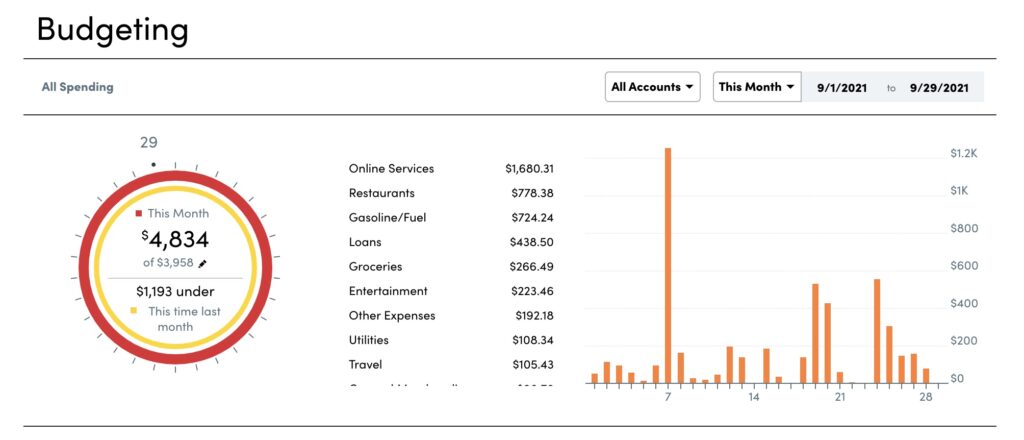

#5: Not Using a Budgeting App

How are you supposed to be a successful investor if you don’t know how much money you have available to invest?

There are plenty of platforms out there that let you sync your bank accounts, credit and debit cards, and even your loans so that you have a snapshot of your financial life all in one place.

These platforms will keep track of your income, spending, saving, upcoming bills, and sometimes even your credit score.

Our favorite budgeting tool comes from Personal Capital. Personal Capital (now known as Empower) is a holistic personal finance platform that offers cash management, portfolio analysis, retirement planning, and wealth management services. Their budgeting tool analyzes your purchases and automatically categorizes them, allowing you to manually edit categories, upload receipts, and download your transaction ledger as a .csv file. And the best part: it’s completely free!

#6: Investing in Securities They Don’t Understand

If you don’t understand something, you shouldn’t put money in it. Plain and simple.

Of course, it can be tempting jump on the train when you see people making millions of dollars off of options, cryptocurrency, and NFTs, but keep this in mind: for every story of someone making a ton of money off of some new investing craze, there are plenty of stories of people losing everything trying to invest in the same thing because they didn’t understand it.

We’re not saying that you shouldn’t keep up with the times and try out new types of investments, but just make sure you do your research and understand how it works before you dump a bunch of money into it.

#7: Not Learning

If you want to set yourself up to meet your financial goals through investing, you have to commit to being a lifelong learner.

As Charlie Munger once said, “those who keep learning will keep rising in life.”

The world of investing is constantly changing, as are the strategies used to navigate it.

New information comes out every day as companies make new decisions. The economy fluctuates with time and with policy.

If you want to make the most informed investing decisions possible, you have to stay up-to-date with the news and be dedicated to learning as much as possible.

If you’re not sure where to start learning or you need some help finding a large amount of stock research in one place, we have some recommendations for you.

Zacks Investment Research is a great platform to help you keep up with the news and find out if anything important about a stock has changed. They offer screening tools, professional stock analysis, and their own Zacks Rank system that makes stock evaluation easy.

Stock Rover simply has some of the most advanced research tools available. In addition to their charting and screening capabilities, they offer portfolio management and in-depth research reports with commentary from skilled analysts.

Final Thoughts

Hopefully these investing lessons have given you some ideas and put you in a position to avoid making some of these painful mistakes.

What are some of the investing lessons you’ve learned that weren’t mentioned here? Let us know in the comments below!