What’s the best stock trading platform to use?

Whether you’re a beginner or an experienced trader, it’s smart to compare your options and brokerage services to make sure you’re getting access to the assets you want to trade and features to help you with everything from choosing investments to rebalancing your portfolio.

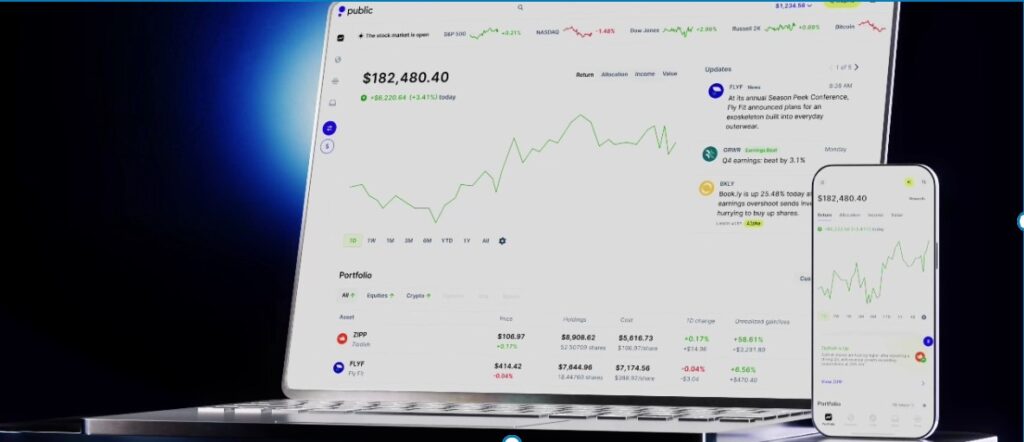

Public com has been around since 2019 and in many ways, it revolutionized the world of online trading.

You may be wondering about Public.com’s safety and asking: Is Public.com legit?

In this Public com review, we’ll tell you about the company’s history and mission, its safety features and the security measures that keep users safe, and how it compares to other online brokerages.

We’ll also talk about how Public.com allows users to trade stocks, bonds, mutual funds, ETFs, futures, options, crypto and offers a high yield cash account.

Keep reading to get all the information you need to decide whether Public.com is right for you!

Is Public.com Legit? Here’s What You Should Know

Public.com hasn’t been around as long as some of the better-known online brokerages, but that doesn’t mean it isn’t legit.

Company Background and Founding

Public.com was first founded in 2019 and became the first online trading platform to offer commission-free, fractional trading. Robinhood and other platforms quickly followed suit.

Their mission is to “give people every opportunity to grow their wealth.”

Said another way, Public.com wants to make investing easy and does so by providing a user-friendly interface and affordable fees, so that anybody who wants to can jump in and start building a portfolio.

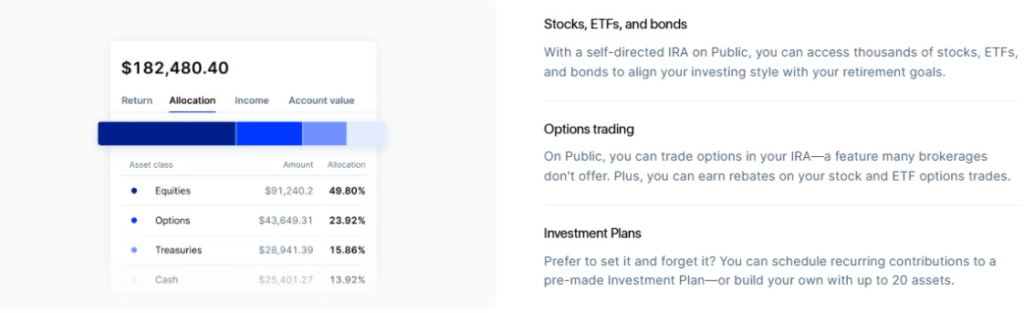

Since the company’s inception, it has added features and assets that allow for portfolio diversification and management. You can buy and sell stocks, bonds, treasury bonds, mutual funds, ETFs, crypto, and other asset classes, in addition to a high yield cash account.

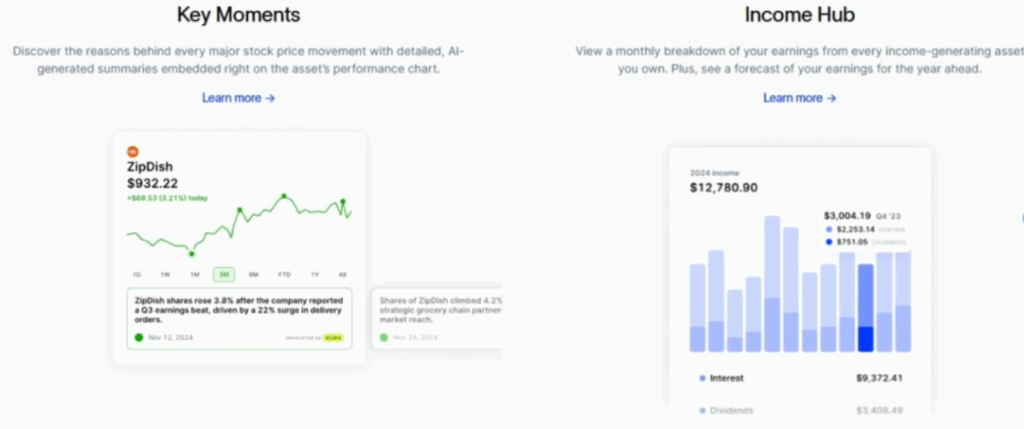

Public.com and public premium users get access to useful tools, data, and even AI-powered investment insights to help them manage their investments, make informed decisions, and increase their wealth.

Pro Tip:

Earn a 4.1% yield on your cash today with Public.com!

Ownership Structure and Funding

Over the years since its founding, Public.com has received funding from a variety of private investors. Some of the names that have provided capital include Lakestar, Tiger Global, actress Zoe Saldana, and skateboarding superstar Tony Hawk.

One of the things we like about Public.com is the company’s commitment to transparency. Here are a few highlights.

- Public.com brokerage accounts are held with Open to the Public Investing, Inc, a registered broker-dealer with FINRA.

- Users’ shares are held in street name at Apex Clearing Corporation, Public Investing’s clearing and custody firm.

- Both Public Investing and Apex are members of SIPC and FINRA.

- SIPC insurance coverage protects user assets up to $500,000.

This transparent approach is something that should set investors’ minds at ease. If you use Public.com, you won’t need to worry about a company failure putting your assets or your high yield cash account at risk.

Safety Features That Protect Your Investments

Safety has to be a major concern whenever you’re considering an investment platform. Nobody wants to take unnecessary risks with their money, after all.

THe good news is that Public.com takes user safety extremely seriously. Here are some of the safety features that answer the question: Is Public.com safe?

256-bit encryption

Like many other digital brokerages, Public.com uses 256-bit bank-level encryption to protect users’ accounts and investments.

Encryption protects your stored assets and also offers end-to-end security during transactions.

Two-factor authentication

Two-factor authentication, or 2FA, is a security measure that you can enable that requires you to use a secondary log-in method to access your account.

It’s something we always recommend on any website or app where you’re sharing financial information or have a funded account.

Why? Because it should never be easy for someone unauthorized to access your accounts, investments, or cash deposits.

Public.com doesn’t require 2FA, which means you’ll need to go into the menu, choose Account Settings, and then enable it.

Biometric login options

Public.com refers to 2FA as Biometric Authentication, and there are three ways you can use it.

- Fingerprint scan

- Facial recognition

- PIN

A PIN isn’t biometric, so we’d say it’s the least secure of these three options. If someone has your phone, they could potentially see the authentication code, especially if you have it set up to preview texts when your phone is locked.

Pro Tip:

Earn up to a $10,000 cash bonus when you transfer your existing account to Public.com today!

How Public.com Makes Money While Keeping You Safe

No Public app investing review would be complete without an explanation of how Public.com makes money while still keeping you safe.

We’ve already told you that they don’t charge commission on standard trades, but they make money in other ways.

The no-PFOF (optional tipping) model for stocks and ETFs

Public.com (and a lot of other trading platforms) used to charge a payment for order flow (PFOF) which usually amounted to only a few pennies per trade.

The amount charged varied based on the type of trade, with higher-risk trades garnering the highest fees.

In 2021, Public.com got rid of the PFOF model and replaced it with a no-PFOF model that allows for optional tipping.

One very important note about tipping: the Public.com interface DEFAULTS to tipping, so you’ll need to uncheck the box if you don’t want to leave a tip (this can make a big difference if you have high monthly trading volume).

Premium subscription review

Signing up for a basic Public.com self directed brokerage account is free, which makes it an affordable option for beginner investors who want to start building a portfolio.

There’s also a premium option, and Public.com earns some of its money through subscriptions, which cost $8 per month for public premium members.

One cool thing about Public Premium is that even the $8 per month charge goes away if you have a total portfolio balance of $50,000 or more.

Premium subscribers get access to enhanced data, including earnings call transcripts, custom price alerts, and VIP customer support.

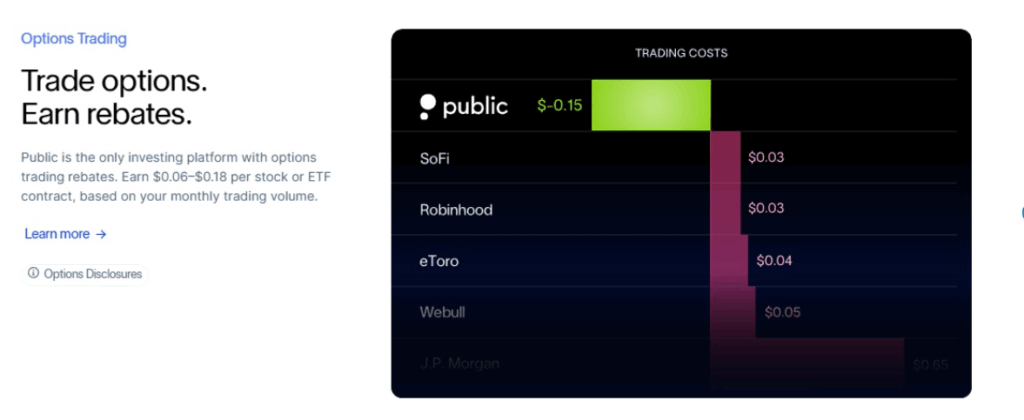

Options rebate program transparency

Options trading always comes with a fee. On Public.com the fees range from $0.35 to $0.50 per contract, prices that align with industry standards.

Public.com encourages options trading by including a transparent rebate program. It gives traders a rebate between $0.06 and $0.18 per options trade based on trade volume.

Of course, more options trades mean more money for Public.com, but the rebate translates to lower-than-average prices, thus encouraging traders to participate.

How Does Public.com Stack Up Against Traditional Brokers?

It’s not uncommon for digital brokerages to be compared to traditional brokerages. Here’s our take on how Public.com stacks up.

Public.com vs. established brokerages

Public.com established itself as a digital brokerage, which means it was always designed to be a mobile app and/or online platform.

That differentiates it from traditional brokerages, many of which started as analog services where brokerage clients met in person or talked to their brokers on the phone.

These traditional brokerages had to adapt to create online platforms. Some have created platforms that prioritize the user experience, while others have struggled to do so.

Public.com had a user-friendly interface and high levels of digital security from the outset. As a mobile-first platform, safety precautions such as 2FA, biometrics, and encryption were built in and have always been there to protect users.

Pro Tip:

Lock in a 7.3% Bond Account yield with Public.com today!

Mobile-first security considerations

Because Public.com started out as a mobile trading app, mobile-first security on their app is thorough and impressive. A few examples include:

- Device lock for phones and tablets

- Biometric authentication

- OS-level encryption

THese things have also become standard on apps created by traditional brokerages.

Regulatory compliance comparison

Public.com is regulated by the SEC, a member of FINRA, and users’ deposits are insured in a bank account by the SIPC.

Any licensed broker-dealer must register with the SEC and join FINRA, so this is an area where Public.com comes out even with traditional brokers, who offer the same protections.

Common Security Concerns—and How Public.com Handles Them

Public.com is fully prepared to address any security concerns as they arise.

Platform reliability during market volatility

One of the times when investors are at their most vulnerable is during market volatility.

When the market is experiencing turbulence, trading platforms such as Public.com experience higher-than-normal traffic and that may mean that there are security risks, including the risk of the platform crashing.

There are no news reports of Public.com experiencing any outages when there’s high traffic, so that’s a good sign for users.

WIthdrawal process security

Withdrawals from your Public.com account are easy to make within the app or web interface.

As we mentioned before, all transactions, including withdrawals, are protected by end-to-end, 256-bit encryption, which is the same level of encryption that banks use for account security.

Customer service response to security issues

Public.com makes it easy to contact customer service and report security issues.

Routine customer service requests should be submitted through live chat in the app or via email.

There’s a dedicated email (security@public.com) for reporting security issues. You should limit such issues to those that:

- Could result in a financial loss for Public.com or its members

- Could impact the confidentiality or integrity of members information or Public.com systems

- Have the potential to impact a large number of people

Account recovery procedures

If you need to recover your account, you can contact Public.com for assistance or use the live chat feature.

You can reduce the risk of losing access to your account by enabling 2FA, using device lock, and not sharing your account information or bank details with anyone.

Is Public.com Right for You?

Is Public.com safe? Is it right for you? Here’s how we see it.

Beginners, mobile-first users, and those interested in ESG (environmental, social, and governance) investing are likely to love Public.com. (Public.com offers ESG scores for all stocks.)

It’s less likely to appeal to active investors who want tools to manage their own portfolios, advanced analysts, and people who want a large selection of cryptocurrencies or multi asset investing..

Here’s our take on the pros and cons.

| Pros | Cons |

|---|---|

| Mobile-first platform | Limited analysis features |

| Offers bonds for trading | Has only 18 crypto coins available |

| Offers options rebates | Overall fees may be higher than other platforms |

| Affordable premium option | Must pay for premium to get price alerts |

Conclusion

Now that you’ve read our Public.com review, you may be looking for an overview. Here’s our take on Public free, their high yield cash account, and their premium membership.

Is Public.com one of the best investment apps?

Public.com offers users full transparency about fees, state-of-the-art bank grade security, and a simple, user-friendly interface that’s ideal for beginners, looking to build a diversified portfolio with high interest on cash balances (uninvested cash) and high yield bonds.

The company is legitimate and regulated, and there’s insurance in place to protect users’ accounts and holdings.

All in all, Public.com compares favorably to other digital platforms and traditional brokerages for beginner investors (especially with public premium account features and a high yield cash account), although it lacks extensive asset classes, alternative investments, and investment analysis.

If you are curious to how a Public investing brokerage account compares to Robinhood specifically, check out our Public.com vs Robinhood full review!

FAQs

Yes, Public.com has a user-friendly, mobile-first interface that makes it easy for beginners to start their investing journey with state-of-the-art security.

Yes, Public uses the same 256-bit encryption used by banks and credit unions.

If you opt for the premium option, which gives you access to custom alerts and more data than the free version, you’ll pay just $8 per month. If your overall balance is more than $50,000, the premium service is free.

Top U.S. Brokers Promotions for 2026

★ ★ ★ ★ ★

✅ Now 23 million users

✅ Cash mgt account and credit card

Free stock up to $200 with new account, plus up to $1,500 more in free stock from referrals; US residents only!

Get Free Stock

★ ★ ★ ★ ★

✅ Access to U.S. and Hong Kong markets

✅ Educational tools

Deposit $500 get $30 in NVDA stock; Deposit $2,000 get $100 in NVDA stock; Deposit $10,000 get $200 in NVDA stock; Deposit $50,000 get $400 in NVDA stock.

Get Free Shares

★ ★ ★ ★ ☆

✅ Trade U.S. stocks, ETFs, and crypto

✅ Trades with themed portfolios

★ ★ ★ ★ ☆

✅ Great charts and screeners

✅ Commission-free options trading

$10 and a 30-day complimentary subscription to Webull premium; $200-$30,0000 Tiered Sign up bonus

Learn more

★ ★ ★ ★ ☆

✅ IBKR Lite & Pro tiers for all

✅ SmartRouting™ and deep analytics