Editor’s Note: As of February 2023, Personal Capital is known as Empower. This review will be updated to reflect this change.

Empower is a nationally recognized platform that offers free tools for personal finance, budgeting, and portfolio analysis, as well as a cash management program and wealth management services.

In our Empower review, we’re going to be discussing:

- The banking analysis and budgeting tools offered on the platform

- The Empower Personal Cash program that allows you to earn interest on your uninvested cash

- The investment analysis features and allocation graphics that show you how your portfolio is performing

- The financial planning tools that help you save for retirement safely and build an emergency fund

- How you can get access to Empower’s free financial management tools

- The wealth management services that connect you to a dedicated advisor for investment management and advice

Overview

Let’s start this Empower review with a general overview of the pros and cons of Empower. We’ll dive into these points later in the review.

Pros

- Easily link all of your bank, investment, cash, and loan accounts as well as your home value for an all-in-one view.

- The Net Worth tool is a simple snapshot of your assets and liabilities that does the work for you.

- Customize your Budgeting tool to see how much you’re spending and on what.

- See a simple graph of your portfolio versus a benchmark to know whether or not you’re beating the market.

- Know exactly how much you need to save for retirement every year with the financial Planning tools.

- Know if you’re dangerously undiversified with the Investment Checkup.

- Access your own, dedicated advisor and a customized ETF portfolio with the Empower Advisor program.

Cons

- No way to link your subscriptions in the Bills section.

- Only electronic transfers to and from the Empower Personal Cash account – no cash transactions or debit card.

- Minimum of $100,000 invested for the Advisor program.

- Higher-than-average management fees for Advisor, Empower’s wealth management program.

Okay, now let’s dive into the details!

Dashboard

The Dashboard view from Empower is your snapshot of your financial life.

On this page, you can see your net worth, budget, cash flow, portfolio balance, retirement savings, and emergency fund.

You can see your linked financial accounts on the left-hand side along with their individual balances so you know how much you have saved, how much you have invested, and how much you owe.

There are also special, customized cards that pop up on your dashboard to give you financial advice and direct you to other parts of the platform that can analyze different aspects of your finances.

From the Dashboard, you can link to pretty much every tool and report that Empower has to offer.

Let’s talk about the different sections you can access from the dashboard.

Net Worth

The Net Worth section gives you a timeline view of your net worth over time.

If you recall from our article on the Top 1% at Every Age, net worth is calculated by subtracting your liabilities from your assets.

Empower does this work for you by adding up what you have in your checking accounts, savings accounts, brokerage accounts, and equity in other assets, and subtracting out your credit card debt, mortgage, and other loans.

You can customize your Net Worth view by specifying a date range and choosing which accounts, assets, and loans you want to see.

Transactions

The Transactions section acts as your own, personal general ledger.

You can use this view to see a list of transactions you’ve made from your credit cards, debit cards, direct deposits, and just about everything else. You can also filter this view by date range and account type.

Banking

Empower offers analysis on your cash flows, budget, and bills, as well as a dedicated cash management program.

Cash Flow

The Cash Flow page gives you a month-over-month view of your cash flows.

This page is similar to the Transactions section, except non-cash transactions are filtered out.

For example, if you transferred an investment account from one brokerage to another or rolled an IRA over, Empower will exclude these transfers since you didn’t actually make or spend any money.

You can break down the Cash Flow view by “Income” and “Expense”, which allows you to see your positive and negative cash flows separately.

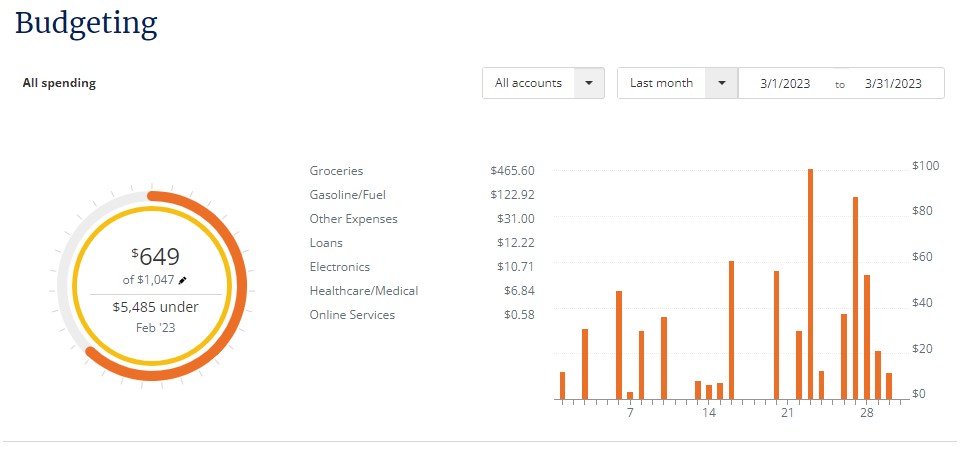

Budgeting

Empower’s budgeting tool is slept on.

While the platform is known for its stellar cash management and wealth management services (which we’ll get to later), the free budgeting tool is also top-notch.

The tool analyzes every transaction you make from your linked accounts and gives you a bar chart of your expenses broken down by day.

You can break the view down by spending category so you can pinpoint which types of expenses you need to focus on.

You can also manually edit any transaction to change its name or category, as well as add tags and pictures of receipts.

If you want to do your own budget analysis, Empower lets you export a list of your transactions as a .csv file (which you can then read into Excel)!

If you’re looking for ways to save tax money and expand your budget, check out our Lively HSA Review.

Bills

The Bills section gives you a quick overview of the bills you have coming up.

If you have unpaid bills, Empower will conveniently link you to your financial institution’s website where you can take care of the payment.

Note: Empower will only show you bills from linked financial accounts that are specifically recognized as debts, such as credit cards and mortgages.

If you have bills to pay for subscriptions like music services and shopping platforms, you won’t find them in the Bills section.

Customer Service:

Phone at (855)855-8005 M-F 8:00:6:00 PST

Email at support@personalcapital.com

EMPOWER SUMMARY

What You Get:

- Free Net Worth, Budgeting, and Portfolio Analysis Tools

- Cash Management Program

- Financial Advising Program

Set Your Portfolio Up for Success:

- Portfolio Checkup with Suggested Asset Allocations

- Retirement Planning Tools for Long-Term Investors

Empower Pricing:

- Personal Finance Tools Are Completely FREE

- Wealth Management Program Is 0.49% – 0.89% of AUM

Empower Personal Cash

Empower Personal Cash is Empower’s own banking program.

Like other cash management accounts from other brokerages, Empower’s cash management program takes your cash and deposits it in partner banks, which are FDIC insured.

The program does not require a minimum balance and does not charge any fees. You can make unlimited transactions to and from the account and even open joint accounts. Empower offers a 4.25% APY for the Cash program.

The downside to the Cash program is that you can only perform electronic transfers. You cannot deposit or withdraw cash, nor do you receive a debit card to use for everyday transactions.

Investing

Empower offers some simple but very effective tools to help you evaluate the quality of your portfolio in the Investing section.

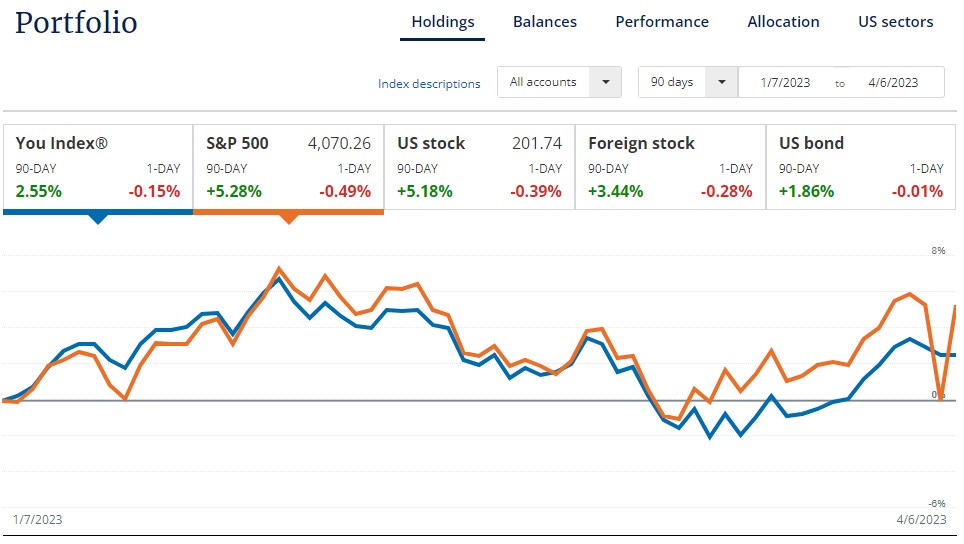

Holdings

The Holdings tab of the Investing section shows you a line graph of the You Index versus one of several possible benchmarks (the default is the S&P 500).

The You Index is a special index from Empower that shows the portfolio of all your current holdings (stocks, bonds, ETFs, mutual funds, etc.) extrapolated backwards in time.

Below the line graph, you see a list of all of your individual holdings.

You can select a holding and add it to the graph, allowing you to compare it to the You Index and your chosen benchmark.

This is a great way to see if your portfolio or one of your specific investments is beating the market!

Balances

The Balances tab is a quick way to see the total value of all of your different investment accounts over time.

You can filter out specific accounts, view only taxable or tax-advantaged accounts, and specify a date range.

Performance

Unlike the Holdings tab, the Performance tab tracks your actual portfolio’s performance against a benchmark instead of the retroactive performance of your current holdings.

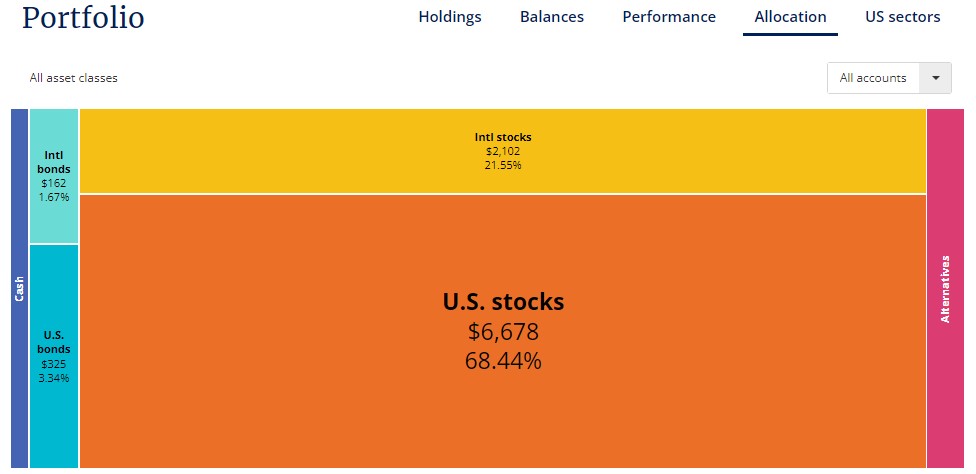

Allocation

The Allocation tab shows you a cool view of your current asset allocation.

You can click on any asset class to see a breakdown of its subclasses, and then click on a subclass to see your specific holdings in that subclass.

For example, you might click on “U.S. Stocks”, then “Large Cap Growth” to see what investments you have in domestic large-cap growth stocks.

US Sectors

The US Sectors tab is yet another way that Empower breaks down your portfolio so you can view it a certain way.

This tab gives you a bar graph of each sector you’re invested in.

When you click on a sector, you’ll see a graphic similar to the one from the Allocation tab that shows you which specific investments you have in each sector.

Planning

If you’re looking to plan for retirement, build an emergency fund, or make sure that your portfolio has the right level of risk for your situation, Empower has some great tools for you.

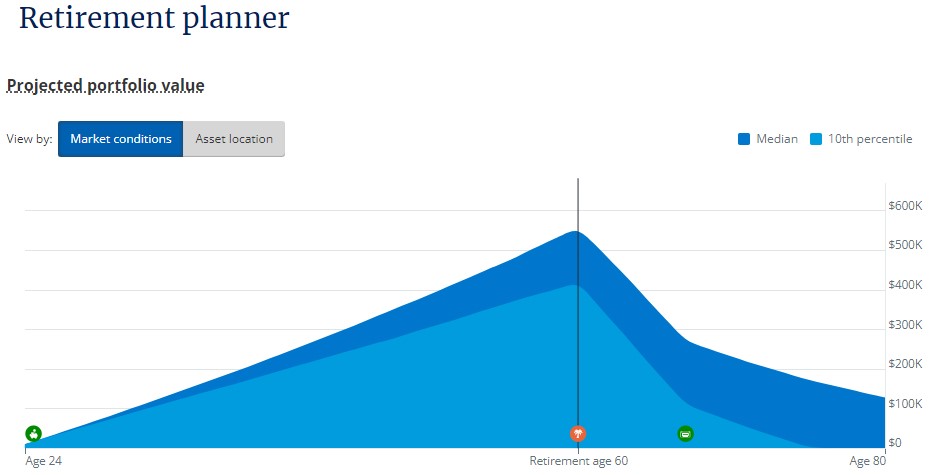

Retirement Planner

The Retirement Planner tool gives you a personalized projection of your retirement portfolio and estimates its degree of success in supporting you through retirement.

You provide Empower with inputs such as your income, how much you’re putting aside for retirement, and how much you want to spend in retirement.

The Retirement Planner tool uses estimated factors such as management fees and inflation to give you an approximate view of how much your portfolio will be worth at the time of retirement and for how long it will support you.

You can use the Retirement Planner tool to create different scenarios and compare them in order to plan for your perfect retirement.

Savings Planner

The Savings Planner tool tells you exactly how much money you should be saving every year to achieve your goals.

You can see how much you should be saving in order to have a good chance at achieving your desired retirement, how much you should be putting into your emergency fund, and how much you should be putting towards your loan payments.

Retirement Fee Analyzer

Empower offers a great tool for getting a realistic idea of how much your 401(k) will be worth at the time of your retirement, known as the Retirement Fee Analyzer.

You can input your annual contributions, how much your employer matches, and how much you expect to earn on your investments.

The Retirement Fee Analyzer tool then estimates how much of your retirement fund you’ll lose overtime to management fees.

Investment Checkup

The Investment Checkup is an extremely useful tool that shows you how your portfolio looks versus how it should look.

Empower uses the information you’ve provided to make a “profile” for you and recommend a specific asset allocation.

For example, if you are 22 years old with no debt and an estimated retirement age of 65, Empower will recommend an aggressive asset allocation for you.

If you’re closer to retirement and are supporting your family members, Empower will recommend a more conservative asset allocation.

The Investment Checkup compares your current allocation to your target allocation and suggests how much money you should take out of certain asset classes and put into others in order to reach your target asset allocation.

Empower will also give you a warning if you are dangerously overweight in a certain sector or stock.

Wealth Management

If you’re looking to take your investing game to the next level, Empower has a special wealth management program as well as research and a blog.

Advisor

Advisor is Empower’s paid wealth management program.

When you sign up for an Advisor account, you get access to an Advisory team of financial advisors that will create and manage a portfolio of ETFs for you and give you investing advice for your other investment accounts.

Your dedicated financial advisors will also help with retirement planning and help you reign in your spending.

Unfortunately, you can only join the Empower Advisor program if you have at least $100,000 to invest.

If you invest between $100,000 and $1 million, the management fee is 0.89%.

The management fee for the higher tiers for Empower Advisory clients ranges from 0.79% to 0.49%.

Many U.S. investors won’t be able to access the Empower Advisor program due to the high minimum investment requirement.

If you do qualify for the program, you should be aware that the Empower fees are higher than those of other investment platforms.

Many robo-advisors with no minimum investment requirement charge fees of less than 0.40%.

Empower’s high management fee, though, can be justified by the fact that it is a more holistic wealth management platform equipped with financial advisors that can handle almost any aspect of your financial life.

Research

The Wealth Management section of the platform gives you access to some of Empower‘s market research and insights as well as a blog called The Currency.

So, Is Empower Right for Me?

Now that you’ve read our Empower review and know about all the features and free financial tools offered by Empower, let’s take a look at whether or not it’s the right platform for you.

Empower is for:

People who want to see all of their financial data in one place. This is one of the best parts of a platform like Empower. Instead of having to open separate apps for each of your bank accounts, investment accounts, and budgeting tools, you can do it all from one dashboard.

Investors who want free portfolio analysis. While you won’t get the same level of personalized advice you would get from the paid wealth management program that offers a dedicated financial advisor, it’s pretty cool to get a quick analysis that will tell you if you need to diversify more.

Investors who want to start planning for retirement. It’s great to have a retirement planning tool that can tell you what portion of your income you should be putting away every month to stay on track for retirement. You can also get access to wealth management service and a team of financial advisors for a fee.

Empower is not for:

People who want a true checking account. Since the Empower Personal Cash account doesn’t offer physical checks or a debit card, you shouldn’t expect to use it like a real checking account. It’s a great way to keep your money all in one place for easy transfers into and out of your investment accounts, but you can’t use it for your everyday purchases.

Investors who want investment advice for smaller portfolios. Unfortunately, you do have to have at least $100,000 invested with Empower in order to be eligible for the Advisor program. If you want professional financial advice but your portfolio is on the smaller side, you might have to check out a different platform without a dedicated financial advisor.

Investors looking for low-cost wealth management. Empower’s fees for the Advisor program are higher than many other platforms. If you want something that costs less and you don’t need the holistic financial advice in every aspect of your financial life, you should look into signing up for a robo-advisor instead of a platform that connects you to a team of financial advisors.

Final Thoughts

While Empower‘s wealth management service might not be a realistic choice for every investor, the platform’s free budgeting, investing, and financial planning tools are simply some of the best in the business.

Who doesn’t want an easy way to track their spending and evaluate the quality of their portfolio, especially when it’s free?

This Empower Review 2023 has been updated to include the platform’s current features, interest rates, and fees in 2023. Did we miss anything in this review? Let us know in the comments below!

If you’re tightening up your personal finances and you want a simple way to pay your friends, invest your money, and bank all in the same place, Cash App might be a good app for you. Read our Cash App review for more information.

If you’d like to continue your journey and look at more personal finance and budgeting tools, read our Quicken review or Simplifi review.

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.