If you want your investing journey to be a successful one, choosing the right investment service is crucial.

Both Motley Fool Stock Advisor and The Street’s Action Alerts Plus are subscription-based investment services that offer insights and recommendations to investors.

The most important difference between these platforms is their approach to investing. Motley Fool focuses on long-term investing within a buy-and-hold strategy. The Street’s Action Alerts PLUS emphasizes real-time portfolio management, trading, and short- to medium-term investment strategies based on Jim Cramer’s approach.

One of the most important attributes of successful investors is knowing how to conduct in-depth research to understand the risks and rewards of any potential investment. In other words, knowing how to discern good stocks from bad stocks.

In this Motley Fool vs The Street review, we’ll look at what makes these services unique, including features, costs, and the quality of the research and analysis available on each. Which one should you choose? Let’s dive in and find out!

Discover which service is best for you!

What is The Street?

The Street is a finance and investing website founded in 1996 by Jim Cramer, who’s best known for his role on CNBC’s “Mad Money,” and Mark Peretz.

Cramer’s approach to investing, which is familiar to CNBC viewers, emphasizes access to timely news and quick reactions, and that philosophy is reflected in The Street.

On The Street’s homepage, which you can see above, you’ll find sections dedicated to a variety of financial topics, including investing, retirement, personal finance, and technology. You can get detailed information by viewing your portfolio.

Regular updates ensure that subscribers are aware of anything that might impact the stock market. The site reflects Jim Cramer’s unique perspectives and insights, combined with expert insights and analysis to keep subscribers in the know.

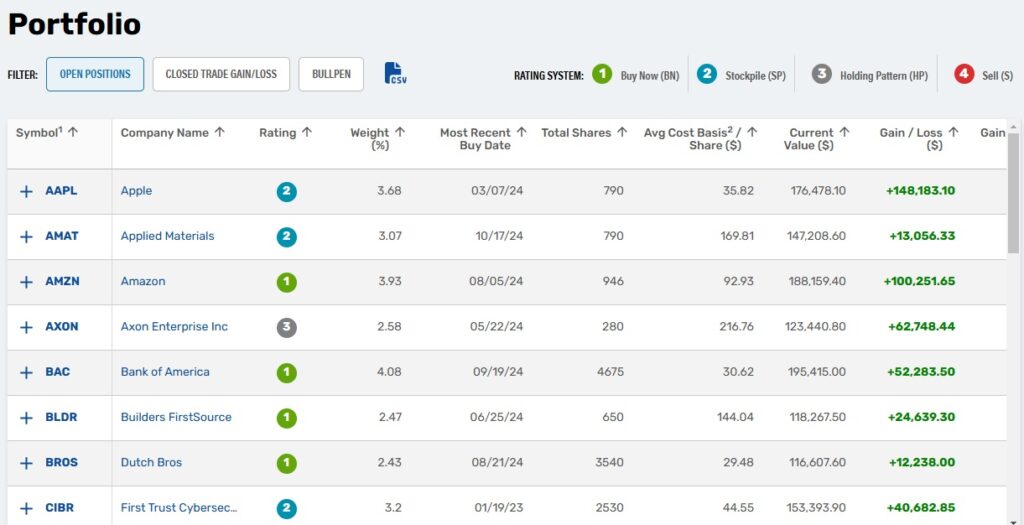

The Street’s Action Alerts PLUS is The Street’s subscription service, which offers resources for new investors. If you subscribe, you’ll also get a real-time view of Jim Cramer’s actively-managed portfolio.

Viewing the portfolio means you’ll get insights into how Jim makes investment decisions, plus access to historical performance data to see how his personal picks have done.

You’ll also get a roundup of major news and world events that have impacted the market. In other words, it’s a learn-by-observation platform where you can glean valuable information and learn how to make your own investment decisions.

What is Motley Fool?

Motley Fool was founded in 1993 by brothers Tom and David Gardner together with Todd Etter and Erik Rydholm. It’s a financial and investing advice company best known for its newsletter and stock picking service, Motley Fool Stock Advisor.

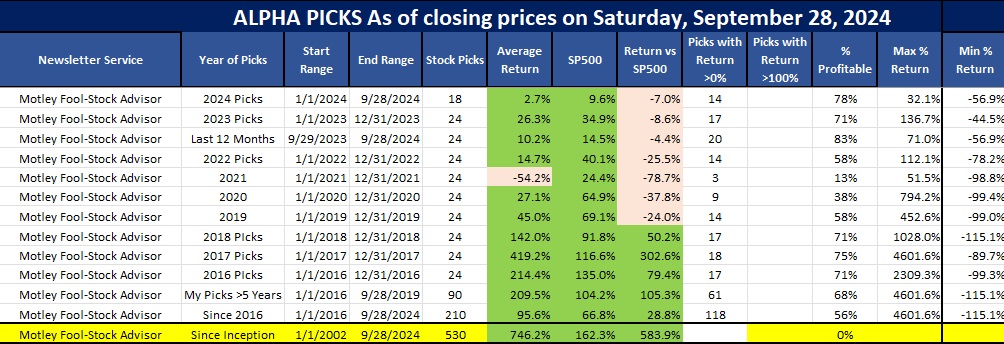

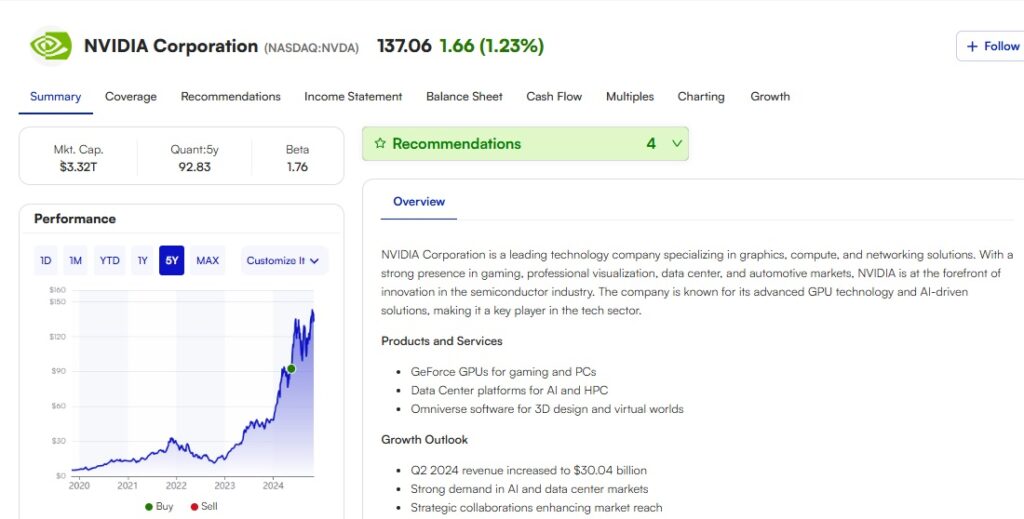

Stock Advisor has a sterling track record when it comes to picking stocks that outperform the S&P 500, as you can see on this chart.

The stock picks for Stock Advisor are all based on a buy-and-hold strategy, which is why it may take some time for picks to show positive returns.

In addition to offering stock picks, Motley Fool Stock Advisor subscribers also get access to:

- All Stock Advisor historical recommendations

- Comprehensive investment guides

- 5Y Quant ratings

- Top 10 Best Stocks to Buy RIGHT Now report

- Stop 5 Starter Stocks

- 24/7 monitoring

- Fool knowledge base

Beginners may opt for Stock Advisor because they can get vetted stock picks even if they’re not familiar with investment research.

Motley Fool and The Street: Research and Analysis Techniques

Both Motley Fool and The Street perform research and analysis on stocks, but their methods vary slightly and make each service appealing to a different set of investors.

Let’s start with Motley Fool, where the analysis is primarily focused on financial fundamentals, most specifically, the price-to-earnings ratio. Their main goal is to provide investors with stock picks with future growth potential and articles on the site have the same preference.

The Street sometimes takes the same approach as Motley Fool Stock Advisor, putting its attention on stocks with growth potential. The primary difference is that The Street incorporates technical analysis into its ratings. For example, articles on The Street incorporate charts detailing annotated support and resistance lines, and related analysis informs investors about potential entry (buy) and exit (sell) points based on the information in the charts.

Both services offer investors the option to do their own research or take a deep dive into the analysis. We would suggest that in any case, since you’re always going to be the best judge of how to spend your money.

Cost Comparison: Motley Fool vs. The Street

Now let’s get to the big question: how much does it cost to subscribe to Motley Fool or The Street? Each has several subscription tiers.

| Cost | Free Trial? | Best For | |

| Motley Fool Stock Advisor | $199 per year | No, but there’s a 30-day money-back guarantee | Beginner and intermediate long-term investors |

| Motley Fool Epic Bundle | $499 per year | No, but there’s a 30-day money-back guarantee | Intermediate and advanced long-term investors who want additional stock picks |

| Motley Fool Epic Plus Bundle | $2,400 per year | No, but there’s a 30-day money-back guarantee | Advanced investors with a large enough portfolio to justify the cost |

| The Street Action Alerts PLUS | $149 per year | 14-day free trial | Data-driven investors who don’t mind doing their own research |

| The Street Real Money | $249 per year | 14-day free trial | Intermediate and experienced investors who want access to professional analysis and daily picks |

| The Street Pro | $984 per year; $99/mo if billed monthly | 31-day trial for $5 | Experienced investors who want real-time market updates, trend analysis, market forecasts, and more. |

Most investors won’t need to shell out the money for either of the top-tier services. We believe beginners will benefit the most from Motley Fool Stock Advisor, which offers done-for-you picks plus a nice suite of portfolio and investment research tools.

Pros and Cons of Each Platform

Here are some pros and cons of both Motley Fool and The Street to consider before choosing a subscription to buy.

| Motley Fool Pros | Motley Fool Cons | The Street Pros | The Street Cons |

| Monthly stock picks | No linking to brokerage account | Lots of analysis for data-driven investors | The interface is a little overwhelming, especially for new investors |

| Strong history of outperforming the S&P 500 | Limited data provided for picks | Real-time market updates and news | While The Street is based on Jim Cramer’s philosophy, he no longer writes for the website |

| Access to historical picks | Trading fees are high compared to some other services | Ideal for daily traders and active investors | Cancellation requires a call to customer service |

| Affordable choice for beginners | No portfolio analysis is provided | The PLUS subscription offers options for both buy-and-hold investors and traders | The website says you can cancel at any time, but there’s no concrete information about refunds |

| Investment research guides | Picks sometimes impact the market | Email and SMS alerts (SMS for Pro subscribers only.) | |

| Email alerts |

Which Is Better: Motley Fool or The Street? The Final Verdict

Both Motley Fool and The Street have their advantages. The key difference is that Motley Fool focuses on done-for-you stock picks that are issued every month, while The Street is more of an investment research platform for investors who prefer to dig into the numbers before choosing investments.

Motley Fool Stock Advisor is our pick for beginner investors. It’s worthwhile if you have money to invest every month, since The Fool’s investing philosophy involves buying equal amounts of every one of their stock picks. It may also be useful for intermediate investors who want the convenience of getting those picks every month.

The Street is better suited to intermediate to advanced investors who want lots of data to evaluate potential investments. Subscribers at higher subscription tiers get stock recommendations, but the real benefit is getting access to all that juicy analysis. The interface may be too much for beginners and those who don’t like seeing pop-ups.

Our overall pick from this The Street vs Motley Fool review is Motley Fool Stock Advisor because of its historical success and its ease of use for beginners.

Ready to invest in your future? Try Motley Fool risk-free with their 30-day guarantee.

FAQs

How do Motley Fool and The Street perform in terms of investment returns?

The Street’s picks from Action Alerts Plus have slightly outperformed the S&P 500 (+0.9% since 2016). Motley Fool’s picks have done far better, outperforming the S&P 500 by more than 800% since the newsletter’s inception.

Are Motley Fool and The Street suitable for beginners?

We think the interface and the sheer volume of information on The Street makes it unsuitable for beginners. The Motley Fool’s clean interface and straightforward picks are ideal for those just starting their investment journey.

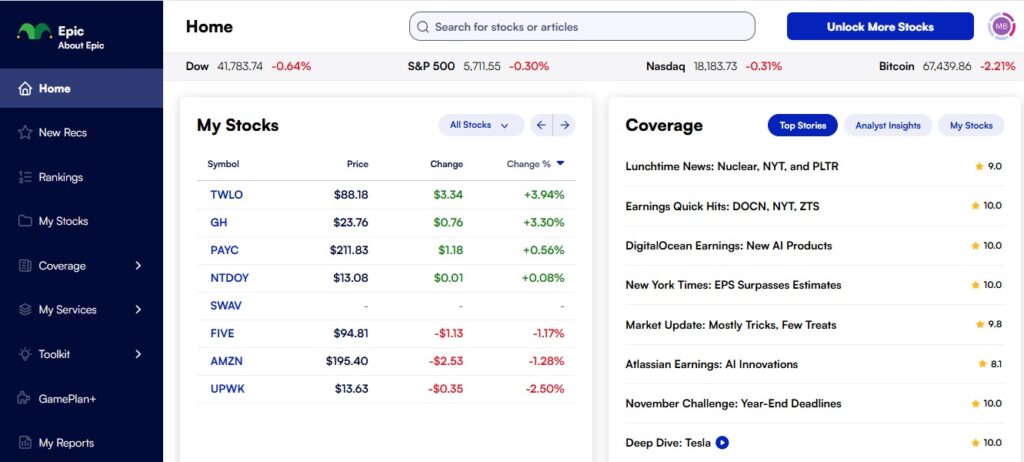

How user-friendly are the platforms of Motley Fool and The Street?

Motley Fool has a straightforward and user-friendly platform. Navigation is intuitive from the side menu and it’s easy to find whatever you need. By contrast, The Street offers a lot of information on the interface and it may be a little overwhelming and many of the important features are hidden at the end of the top menu.

Do Motley Fool and The Street offer personalized investment advice?

No, the advice provided by each of these services is generalized and based on predictions of how stocks are likely to perform.

Which service is better for long-term vs short-term investments?

Motley Fool’s buy-and-hold strategy is ideal for long-term investors, while The Street’s constant information updates make it most suited for those interested in trading and short-term investments.

*** Sunday, July 13, 2025 ALERT—Motley Fool Picks Still CRUSHING the SP500!****

The Motley Fool Stock Advisor’s stocks picks, even with this recession, inflation, and COVID recovery have been performing very well as of late.

I have been a subscriber since 2016 and their average pick of the last 8 years is easily beating the SP500. Keep in mind these FIVE very important tips regarding the Motley Fool Stock Picks.

Tip #1 is that you need to buy them as soon as you get the alert because the stocks typically rise 2-5% in the first 24 hours of the pick being released.

Tip #2 is that I buy about $2,000 of each pick and I immediately place a 20% stop loss order to control risk.

Tip #3 is that their next stock pick should come out Thursday, so make sure you have subscribe now so you are ready.

Tip #4 is to always read your emails from the Fool because they also tell you when to sell stocks.

Tip #5 is to save $100 and get a Full Year of Stock Picks for only $99 (new members only)