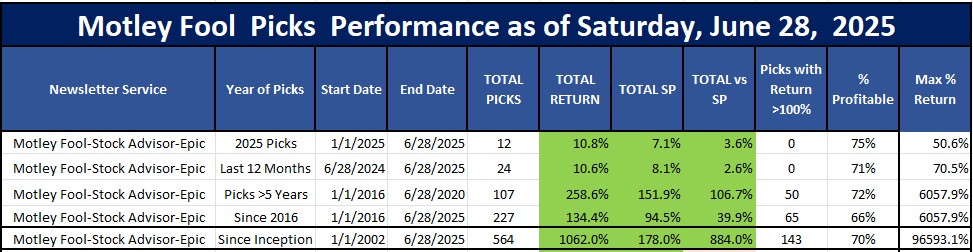

This Motley Fool Review updated June 29, 2025: The S&P500 and Nasdaq set new highs this past week and, true to form, the Motley Fool Stock Advisor’s stock picks have also SET ANOTHER RECORD HIGH in terms of performance .

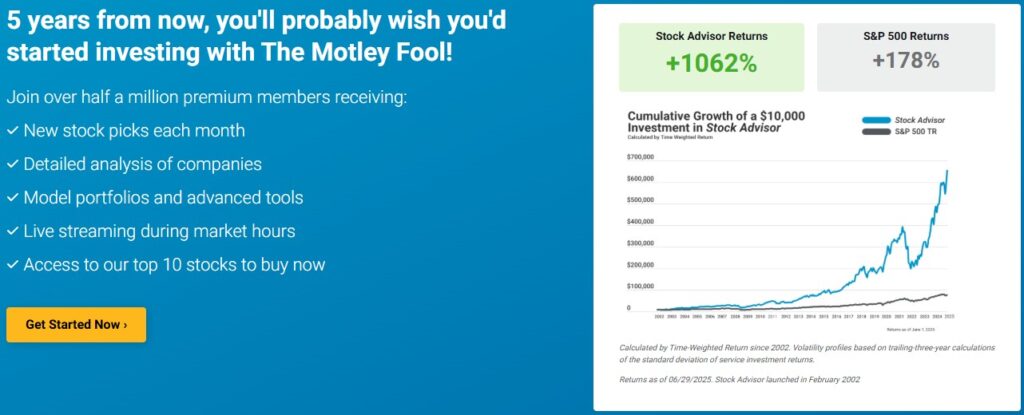

Stock Advisor currently has an average return since inception of 1,062% vs. the S&P500’s 178%. That means that over the last 23 years, their 500+ stock picks have averaged a 10-fold return and are beating the market by an average of 884%. How is that possible? Read on to see my analysis of all their picks and my experience buying their stock picks.

The Motley Fool reminds us that the best time to buy is often when everyone else is selling. Over the last few months they have said “Don’t think that stocks are down–think they are just on sale!”—As long as you buy the right stocks. And they were RIGHT.

This Motley Fool Stock Advisor Review is based on my personal experience of being a subscriber to the Motley Fool Stock Advisor service AND buying about $1,500 of each of their stock picks since 2016 in my ETrade account. Yes, that’s 200+ trades over the last 8 years. And I have sold the 30% that they recommended selling.

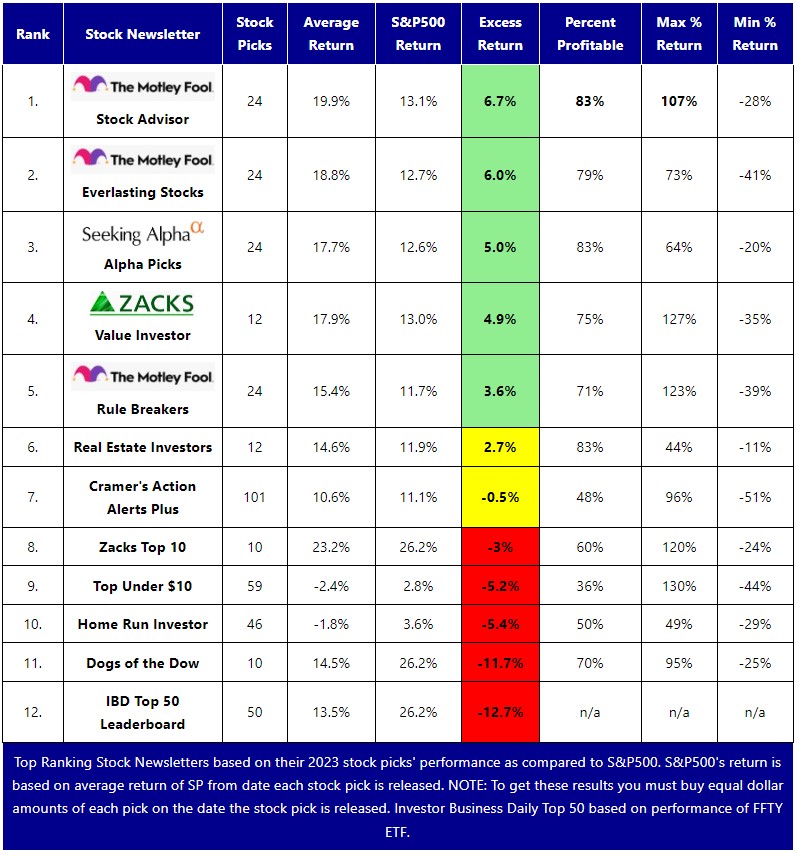

I also subscribe to a dozen other stock newsletters (Zacks, Seeking Alpha, IBD, Benzinga, Cramer, Morningstar, Moby, CNBC, etc.) so I can constantly compare all of their performances, as you will see below.

Hint: The Motley Fool Stock Advisor service has the best returns of all of the stock newsletters I have ever tested. Their investing philosophy is that you should buy at least 25 of their stock picks and hold them for at least a few years. Therefore, it is not a service for day traders; it is not a service for those wanting to get rich quick. It is for the intelligent investor who wants to get rich over time by buying solid stock with high growth potential like NVDA, NFLX, AMZN, and SHOP early and holding for a few years.

A quick comment about all the Motley Fool naysayers out there. The Fool recommends stock that you should plan on holding for 5 years or more. They say that up front. Every pick does not go up. But over time they do pick many stocks that double or triple or 10x as you will see below. Those winners more than offset the losers. Their returns speak for themselves.

I try to update this Motley Fool review every month so you can see how the Motley Fool stock picks have performed since 2016 when I started buying them, and since inception–so please bookmark this page and keep coming back.

Overall Performance of The Motley Fool Stock Picks

First, you need to know that these ads that you see for the Motley Fool returns are definitely true. The average of all 552 of their stock picks since 2002 is 1,062% as of June 29, 2025 compared to the market’s 178%. That means if you had invested just $100 in each of their 2 picks a month for 23 years, your $55,200 (24 picks a year for 23 years is 552) would now be worth over $650,000. If you had invested that same amount in the S&P 500 you would have only $150,000.

Likewise, if you had invested $1,000 in each of their picks your $552,000 would now be worth over $6,400,000! That is an amazing difference and that is the reason over 500,000 investors are subscribers to the Motley Fool. With that many subscribers, you really need to buy their picks as soon as they are released as their picks frequently pop in price the day they come out.

The best advice we can give you is save $100 on now and try it for a year for just $99, get their picks in real-time, buy equal dollar amounts of each on the day they are released, and sell when they say sell. Then just sit back, relax, and watch your portfolio grow and, if the past is any indication, you should enjoy beating the market.

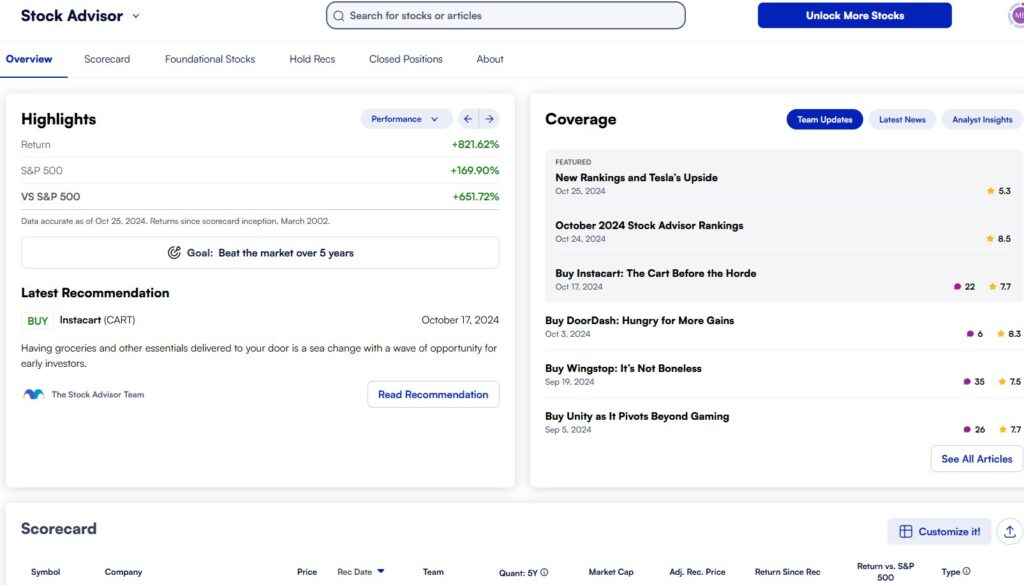

Look at this recent image from their site. Their stock picks took a hit during Covid but have since fully recovered and zoomed higher. This chart is quite remarkable as no other stock service comes close to these consistent returns.

But those returns are not available now to you since you missed out on the 10,000% returns on stocks like AMZN, DIS, NFLX and NVDA.

Instead, you should be asking how are their recent stock picks doing?

My Experience with the Motley Fool Stock Advisor Picks Since I Subscribed in 2016.

Here’s a summary of the performance of Stock Advisor since I subscribed in January 2016. I was so impressed with their performance that I started buying $1,000 to $2,000 in my Etrade account. And I am really glad I did.

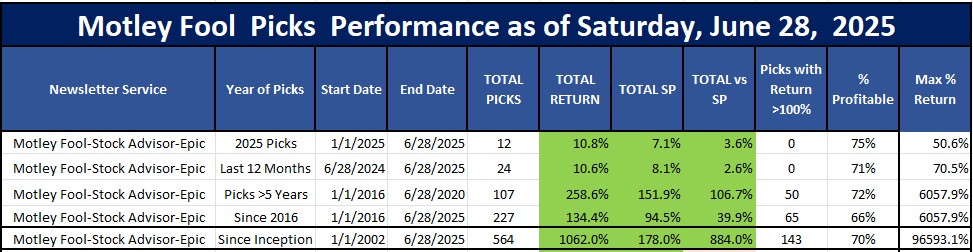

As you can see from the chart below, their 227 stock picks since January, 2016 are up an average of 134% and are beating the market by 40%.

But what you should focus on is their 107 stocks that are at least 5 years old are up an average of 258% and are beating the market by 106%. And 50 of those have at least doubled; one is up 60x; and they did sell 26 of them. That is how they get these remarkable returns over the years.

As you can see, Stock Advisor’s picks are easily beating the S&P for these last 8 years for me–and the longer you hold them the better they do.

Most importantly, their picks since I started subscribing in 2016 that are at least 5 years old are beating the market by 106%. Also note that 72% of these Stock Advisor’s picks are profitable. And 143 of those 564 have doubled or more.

To get these great returns you need to plan on buying equal dollar amounts of each of their stock picks on the day they are released. Their picks tend to spike 2-5% on the day of release so that is why you should subscribe to get their picks in real-time and maximize your returns.

Don’t be a FOOL & pay full price for the Motley Fool.

Summary of Motley Fool's July, 2025 Best Discounts & Promotions

| Motley Fool Stock Advisor | Motley Fool Epic | |

|---|---|---|

| Overall Rating: | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Service Type: | 2 stock picks and 2 "Five Best Stocks to Buy Lists" per month. That's 1 email per week on Thursday. Next pick comes out July 17th. | 5 stock picks per month from Stock Advisor (2 picks), plus 1 pick from Rule Breakers, 1 from Hidden Gems and 1 from Dividend Investor. Next pick comes out July 17th. |

| Strengths: | Original and best performing stock newsletter since its launch 23 years ago. Average pick is up 1,062% vs market's 178%; 70% profitable. | Well diversified, lower risk, high percentage of accuracy with 75% of picks being profitable. |

| Best for: | Beginning & intermediate investors that want to invest each month and plan on staying invested for at least 5 years. | Intermediate to experienced investor looking for better diversification, less risk, & some dividend yield. |

| Retail Cost: | $199 a year | $499 a year |

| Links to Best Promotion and Discount Pages: | Best Stock Advisor July, 2025 Promotions/Discounts: All promotions have a 30 day money back guarantee: Best money saving deal--Get 2 years for only $179 and save $229 on THIS promo page with code 'WSS179' if prompted. --Get 1 year for only $99, save $100 AND get their just released AI Supercycle: An Investor’s Guide to the Artificial Intelligence Boom ($49 Value) on THIS promo page with code 'WSS99' if prompted. --Save $100 and get 1 year for only $99 AND get Fool's top 3 "Double Down" Picks on THIS promo page with code 'WSS99dd' if prompted. |

Best EPIC July, 2025 Promotions/Discounts: All promotions have a 30 day money back guarantee: --Save $200 if you use EPICSALE on THIS promo page; includes 30 day money back guarantee. --Use this link to compare Stock Advisor ($100 off) and Epic ($200 off). |

Overview of the Motley Fool Stock Advisor

The Motley Fool was founded by David Gardner and Tom Gardner in 1993. Tom and David Gardner’s most popular stock recommendation service is called “Stock Advisor” and was launched in 2002. This review is just on their Stock Advisor service. To learn more about their other top performing service that gives you more variety of picks each month see our Motley Fool Epic Review.

The Fool’s Stock Advisor service has only one purpose – to help investors like YOU invest better.

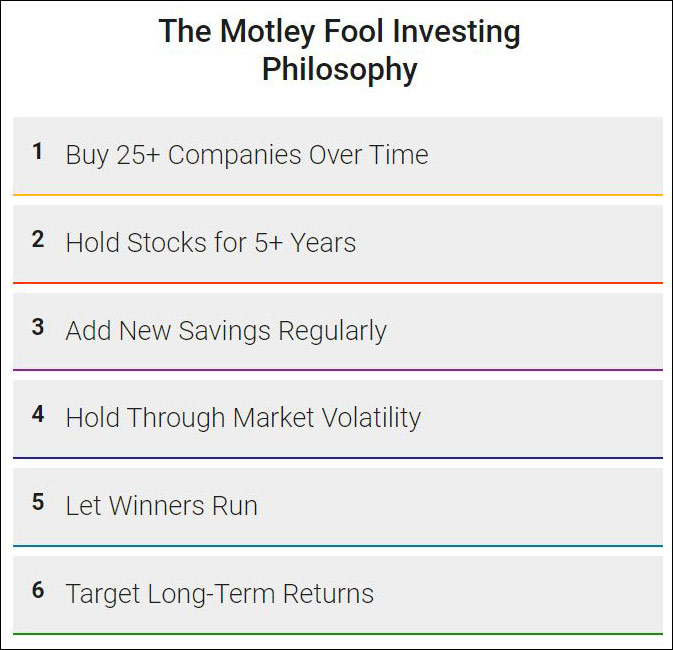

It is important to note that the Motley Fool Stock Advisor stock picks are NOT about day trading or dividends stocks or penny stocks. They are stock picks for investors that plan on staying invested for at least 5 years, as you can see from this summary:

Every month, the Motley Fool release 2 U.S. stock recommendations, typically on the first and third Thursdays of each month. On the second and fourth Thursday of each month they release other lists of BEST STOCKS TO BUY which are updates of previous picks and suggestions about whether to increase or reduce your holdings in those stocks.

What You Get: Motley Fool Stock Advisor Summary

Here’s what you get when you get when you subscribe:

- Two brand new stock recommendations and analysis per month delivered in real-time to your email.

- Access to all of the Motley Fool’s Stock Advisor historical recommendations.

- The Motley Fool’s Top 10 Best Stock to Buy RIGHT Now report features some of their recent picks that still offer the best potential return.

- The Motley Fool’s Top 5 Starter Stocks report features the ideal stocks that should be the foundation of new investors’ portfolios.

- 24/7 Monitoring: They will let you know when they believe it’s time to sell any of their stock picks.

- Toll-free customer service. Yes, real people answer the phone.

- You also get:

- A clear explanation of WHY they recommended each stock and the factors considered

- A Risk Profile that explains the upside and downside of every stock pick

- Starter Stocks: If you are just starting a portfolio, they will tell you their 10 rock-solid stocks that should be the foundation of your portfolio

- Fool Knowledge Base: 24/7 access to their full library of reports and research to help you get their opinion on other stocks that you might own or be considering buying

When you are a subscriber and you visit your Stock Advisor main page, it will show recent stock recommendations and further research and commentary on their various picks:

The Motley Fool Investing Philosophy

But before I dive into more details of this service and their performance of their stock picks, you need to understand the Motley Fool Stock Advisor philosophy.

The Motley Fool Stock Advisor is not about day trading or making a quick buck in the market.

Instead of a “get rich quick” approach, The Motley Fool promotes what I call a “get rich slowly” approach that requires consistent investing every month and staying invested. What I have learned is this is how real wealth is created.

As you saw from the graphic above, The Motley Fool Stock Advisor is about strategic, long term investing (holding stocks 5 years or more).

Here are some other points you need to understand about Stock Advisor. Since inception in 2002, regarding those 500+ picks over the last 20+ years:

- the AVERAGE return is up 1,062% vs average S&P return of 178% (calculated June 29, 2025)

- about 70% are profitable

- they have sold 242 or almost half of their picks

- current portfolio is

- 36% Information Technology

- 21% Consumer Discretionary

- 12% Communication Services

- 8% Industrials

- 9% Health Care

- 5% Financials

- 2% Consumer Staples

- 2% Materials

- 2% Energy

- Tom Gardner is still running the company

So how does The Motley Fool get these market-beating results?

They are very good at picking a few stocks each year that experience significant growth. Those big winners more than offset the few losers each year.

Introductory Offer: New members can get the next 12 months for only $99.

Remember, they have a 30 day money back guarantee.

They release new picks each Thursday so the next one comes out this Thursday, July 17th.

Motley Fool Performance Overview for Short-Term and Long-Term

Now that we are clear on the Motley Fool’s investing philosophy, let’s see how their stock picks have done over the short and long term.

In terms of their long term performance, we all have seen their ads like the one below promoting these fantastic returns of 1,000+% vs 170+% for the S&P 500 since inception in 2002.

You are probably asking how is that even possible. The answer is they got these big returns by being early to recommend stocks like Amazon, Nvidia, Netflix, and Disney as you can see below.

Another lesser know fact about this service is the founders of the company, Tom and David Gardner, are still involved with the company, and Tom in particular is still involved in the Stock Advisor recommendations.

But the real question is how are they doing recently and what can YOU expect in the future.

Recent Performance Overview

In terms of their recent performance, you need to know that their 2025 picks are beathing the market with one up 50% already.

But you also need to know that their picks do take some time to appreciate, as per their 5 year holding period strategy.

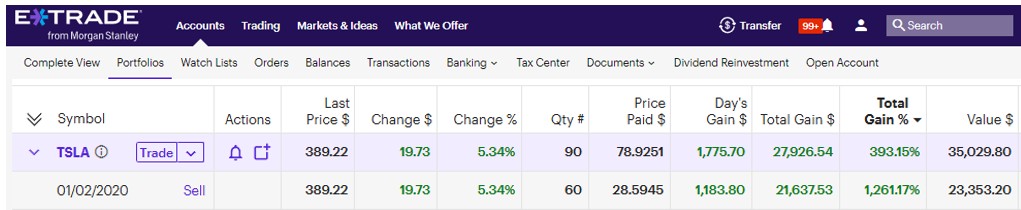

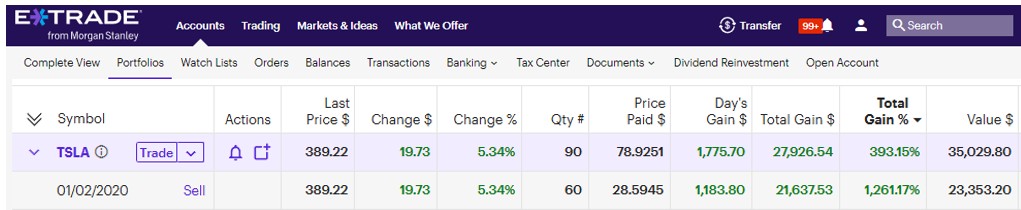

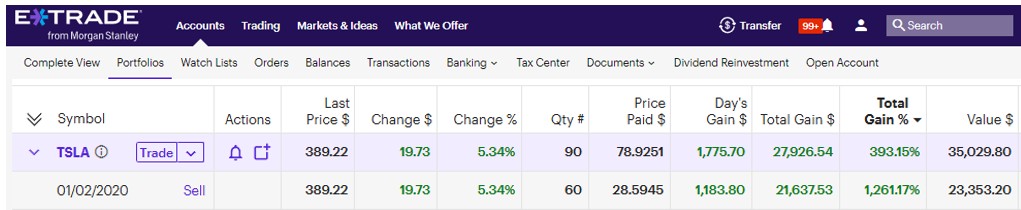

To give you an example of my “get-rich-slowly” point, here is a screen shot from my ETrade account dated December 7, 2024 that shows one of their top performing recommendations in the last 4 years. Tesla (TSLA) was the Motley Fool’s recommendation on January 2, 2020 and I bought 60 shares at $28.59 (split adjusted) for about $1,700 and it is now worth $23,353 for a profit of $21,637 and a 1,261% return in just 5 years. (I did buy another 30 shares later when it was re-recommended to give me a total of 90 shares.)

This Tesla pick was one their best picks (their best was NVDA in 2017 and now it is up 60x since then) of the last 5 years but it is just one of many with great returns I have had since subscribing. Their top pick in 2023 (ticker: NOW) is already up 207%; top pick from 2022 (TTD) is up 175%; and their top pick from 2020 (TSLA) is up 1,261%. In 2019 they picked TTD and it is up 621%; in 2018 they picked FICO and it is now up 1,324%, in 2017 they picked NVDA and it is now up 5,549% and their 2016 pick of Shopify is up 3,562%.

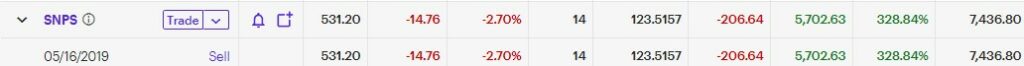

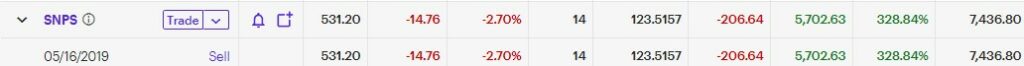

And here is their May, 2019 pick of SNPS that is up 328% for a $5,702 profit on my initial $1,700 investment.

In fact, since I subscribed in January, 2016, out of their 192 recommendations 46 stocks have more than doubled and 28 have more than tripled and 15 have more than quadrupled. The average stock pick from 2016-2022 is up 145% crushing the market by more than 45%. But more importantly, the Stock Advisor stock picks that are at least 5 years (2016, 2017 and 2018 stock picks) are up HUGE (145%) vs the S&P 500. So that 5 year holding period is key.

I have even reviewed all of the Motley Fool trades going back to inception in 2002 and as of the date above 143 out of their 500+picks have doubled or more and 81 have tripled or more.

Long-Term Performance (8 Years 2016-2024)

Also note the performance of the 2016-2018 stocks. The stock picks that are at least 5 years old have absolutely crushed the S&P 500. And this is exactly what you would expect as the Fool says you should plan on holding their stocks for at least 5 years.

Overall, the 227 Motley Fool stock picks from 2016 thru 2025 have an average return of 134% and those stocks alone are beating the market by 40%. That means that for the last 8 years across all of their picks they have, on average, more than doubled.

That number is more impressive than it sounds. What it means is that across all 200+of their stock picks for 8 years running, their average stock performance is beating the market by double digits.

As I mentioned above, they recommend you hold their stocks for at least 5 years. They claim the longer you hold the stocks the better they perform. And that is absolutely true as you can see below:

How do they get these great results that have consistently beat the S&P 500 over time?

The Motley Fool is very good at finding a few stocks that double or triple each year. While about 66% of their picks have been profitable, the most successful stocks more than offset the less successful ones. Remember, the most you can lose on a stock is 100%, but the most you can gain is infinite. So by picking a few stocks that are up double, triple and even go up 6,000% like in my chart is the key to beating the market over the long term.

So is The Motley Fool worth it? It has definitely been worth it over the last eight years.

If you are asking ‘How are these results possible when most Wall Street money managers struggle to beat the S&P 500 Index?’, the answer is now clear to me. It is because over these last 8+ years The Motley Fool has consistently picked many stocks each year that double, triple, and even quadruple in price – and hold onto them through thick and thin. Over the last 8 years:

- 65 of their 227 stocks have at least doubled

- 39 have at least tripled, and

- 24 have at least quadrupled

Overall Performance Since Inception

And here are a few of their all-time best stock picks as of June 29, 2025. Just take a look at some of these returns. They picked Nvidia back in 2005 and that stock is now up over 90,000%. They also picked Netflix early and it is now up 70,000%:

Again, going back to their objectives of staying invested for 5 years or more, I have found no better service than the Motley Fool Stock Advisor.

How To Maximize Your Returns with the Motley Fool Stock Advisor

In fact, when doing a deep-dive on the Motley Fool stock picks, I found some research on their stock picks that show that if you had purchased any 30 of their stock picks over the last 23 years, you would have a 98.7% chance of a positive return and the expected average return is 88.6%.

Obviously, as you can see, the more stocks you hold the greater the probability of a positive return.

Key Points for Success With The Motley Fool

The key points I am making is to get these results you need to do exactly what I do:

- BUY EQUAL DOLLAR AMOUNTS OF ALL OF THEIR PICKS EACH YEAR. It doesn’t matter if you are buying $500 or $5,000 of each of their picks, you would have the same percentage returns. But remember, you need to buy each pick because you never know which one will be the top performer for that year.

- SELL WHEN THEY SAY SELL: It doesn’t happen often (18 times in 8 years). But sometimes stocks are acquired, or get overpriced, or just never move and they will tell you when to sell them.

- PLAN ON INVESTING FOR AT LEAST 5 YEARS. As you can see The Motley Fool stock picks for the last 5 years have absolutely crushed the market’s return. Furthermore, the longer you hold them, the better they perform. That is why they recommend you hold their stocks for at least 5 years, as I have done.

- DON’T PAY FULL PRICE FOR THIS SERVICE. Finally, this service retails for $199 a year but they frequently run discounts. The current promotion is $99* for the first year for new subscribers. At that price, it is absolutely the BEST VALUE around for investors of all levels. It will probably be the best investment you ever make.

So if you have at least a few hundred dollars to invest each month, and you plan to invest for at least 5 years, then subscribing to the Motley Fool is a no-brainer.

Exit Strategy Guidance

The Motley Fool returns would actually be higher had they used trailing stops on their positions.

I backtested their picks from 2016 and found that a 20% trailing stop actually would have improved their results over the last 8 years by exiting some of their stocks before they plummeted, while maintaining some positions in their correction period.

As I said previously, the Motley Fool has recommended selling almost 1/2 of their position over their history. These have been due mostly to what I call fatigue. Stocks that have just languished and not moved one way or the other. Many have also been sold due to acquisitions.

Is the Motley Fool Worth the Money?

Based on my experience over the last 8 years of buying every one of their two new stock picks each month, my analysis of The Stock Advisor performance concludes absolutely YES!

As I mentioned above, just buying $1,700 shares of TESLA on January 2, 2020 has given me $21,637 in profits.

Just to be clear: NOT every one of The Motley Fool stock picks goes up, but they do pick a lot of stocks that have historically DOUBLED or TRIPLED in value. So, on average, their stocks have beaten the market by over 1,000%.

To properly answer the question ‘is it worth the money’ you need to understand how much it costs. The list price of Stock Advisor is $199 a year. Even at that price it is very inexpensive compared to other services. But new customers can subscribe now for just $99 a year on this Motley Fool NEW SUBSCRIBER DISCOUNT link. At $99 for the first year, with a 30 day membership-fee back guarantee, and based on both their recent and historical performance, Motley Fool Stock Advisor is absolutely worth it.

You should absolutely consider subscribing and get the Motley Fool’s next 24 stock recommendations, plus access to all their recent picks, and try it out. Every stock probably won’t go up, but 73% of their picks over the years were profitable for me and the average has crushed the S&P500. You have very little to lose and lots to gain.

So, assuming you have some cash to invest each month, and you can let the money stay invested for a few years, it certainly seems like a very safe bet.

Cost Breakdown & Subscription Options

The Motley Fool has recently consolidated its offerings.

Whereas they used to have 20+ newsletters, they now have 2 affordable services.

Their most popular service, and best performing service, remains their Stock Advisor service that was launched in 2002 that has an 900+% return. It’s current retail price is $199 but can often be purchased by new subscribers for $99 for the first year. It then renews at their current rate.

Their second most popular services was their Rule Breakers, but this is now consolidated into the Motley Fool Epic service. It is priced at $499 per year (read our Epic Review to find the latest discounts available) and now includes Rule Breakers, Stock Advisor, Dividend and their Epic picks.

Is The Motley Fool a Scam? Is The Motley Fool Legit?

The Motley Fool is DEFINITELY NOT a scam. My results with the Fool picks over the last 8 years have been phenomenal, as you have seen. Of course it’s not perfect and every stock tip is not a winner. But, they definitely are a legit company and for the last 8 years their stocks have easily beat the market so the Motley Fool is worth it; and more specifically, the Motley Fool Stock Advisor is worth it.

The fact is, The Motley Fool stock picks have beaten the market since 2016. My results shown above prove it. That is the most important thing you need to know. Also, the Motley Fool has been in business since 1993 and employ 250+ people. And, according to The Motley Fool website, they have 500,000+ subscribers to their Stock Advisor. 500,000 people can’t be wrong!

But, for the benefit of people reading The Motley Fool review, here are the FACTS:

- There’s no question, the answer to ‘is The Motley Fool a legitimate company?’ is YES. It is well-known among stock market investors. In fact, they now say they have over 500,000 subscribers.

- I subscribed in 2016 and my results are listed above.

- They even have their own stock market mutual fund, which is the “Motley Fool Global Opportunities Fund Investor Shares (FOOLX)”.

- Also, the Fool brothers, Tom and David Gardner, don’t hide from their customers. For example, they often have interesting ideas on their certified Twitter page.

Here is an interesting piece on their ups and downs with Amazon.com (they first purchased it in September 1997!)

Here another testimonial from a customer given on Stackexchange, proving even more how it’s not a scam.

“I’ve had a MF Stock Advisor for 7 or 8 years now, and I’ve belonged to Supernova for a couple of years. I also have money in one of their mutual funds. “The Fool” has a lot of very good educational information available, especially for people who are new to investing. Read full testimonial“

Now that we’ve beaten that myth to death, let me answer a few other questions…

Comparisons Against Other Stock Newsletters?

Those are all great returns but, unfortunately, that is just water under the bridge since you already missed out on those picks.

You should be asking how have their 2024 picks done? And how have other stock newsletters done over the same time period? Well trust me, I monitor other stock newsletters too. Take a look at the performance of these other popular stock advisory services 2024 stock picks as of December 31, 2024:

So as you can see from my analysis, the Motley Fool Stock Advisor’s 2024 picks are the top performing picks for 2024. Also of note is their profitability rate of 83%.

What this means is that if you had subscribed on January 1, 2024 and bought only $250 of each of those 24 picks, you would have invested $6,000 and had a profit of $1,194 as of December 31, 2024. And if you would have invested that same amount in an S&P 500 mutual fund or ETF you would have a profit of only $762. So the Motley Fool would have given you an extra $432 on just $250 on each pick. So it was definitely been worth it 2024. Likewise, if you had invested $1,000 in each of their 24 picks you would have a profit of $2,388 at December 31, 2024.

As you can see from my results, if you have some cash to invest now and you can add cash each month, then the Motley Fool Stock Advisor is definitely worth the $199 per year fee. And since it’s on sale on this promotion page for only 99, it is even a better deal. FYI–if you go to buy it off the Motley Fool’s sales page you will pay $199 so make sure you use this the link above.

MY SUMMARY AS OF June 29, 2025:

The average return of all 500+ Motley Fool Stock Advisor recommendations since the launch of this service in 2002 is 1,064% vs the S&P 500’s 178%. That means they are now beating the market by 5X since inception.

They have a win rate of 70% profitable stock picks.

189 of their 532 picks have at least doubled and 130 have at least tripled.

They have sold 233 of their picks or about half of all of their picks.

More importantly, the stocks that I have purchased since 2016 that are at least 5 years old have an average of 244%. (remember The Motley Fool says you should plan on holding their stocks for at least 5 years). Look at this chart below…

My Experience with the Motley Fool Stock Advisor Picks Since I Subscribed in 2016.

Here's a summary of the performance of Stock Advisor since I subscribed in January 2016. I was so impressed with their performance that I started buying $1,000 to $2,000 in my Etrade account. I quickly learned to put a 30% stop loss on these picks in case they do pick a big loser. You can see how their picks have performed for the 2025, the last 12 months, and the last 8 years. Notice those picks that are older than 5 years since I subscribed are up 258% and are beating the market by an average of 107%.

See what you missed out on by not signing up a few years ago when I did? You would be up 134%, beating the market by 40% and you would have bought NVDA in 2017!.That means if you had just bought $100 of each of their 227 stocks your $22,700 would have a profit of $30,418. Seems to justify the $99-199 per year price, right? Seems like a no brainer based on this track record.

It clearly shows that since I have been buying their stocks beginning in January of 2016, the Motley Fool stock picks that are at least 5 years old are really crushing the market by 100+%.

Will it Help you Make More Money?

The short answer is YES. While past performance is no guarantee of future results, as I mentioned above in this review, since 2016 their stock picks have an average return of 131%. That means that had you bought these picks your portfolio would have doubled while the market was only up 87% on average. I subscribed in 2016 and my results speak for themselves.

Motley Fool’s Stock Advisor- Additional Insights

- It is true that there are many stock advisor services to explore, but after testing a bunch of them, the Motley Fool provided the best returns and the best bang for the buck.

- The Stock Advisor is usually $199 a year, but if you are a new subscriber visit this new subscriber page to see their latest offers like 40% off with a 30-day 100% membership refund period. It is an investment, but you should get a great return on that investment.

- There is definitely a “Fool Effect.” With 500,000 subscribers, you must understand that their stock recommendations go up about $2 – $5 within hours of the release of their recommendations. So be ready on Thursday to buy as soon as you get the email.

- Like with any other stock picking service, it’s true that their investment strategies are not 100% guaranteed. From what I have experienced in the last 8 years, they do seem to pick one stock a year that goes down 20-30%. They will, however, let you know when they want you to sell it. My recommendation would be to place a stop loss order at 32% of your purchase price.

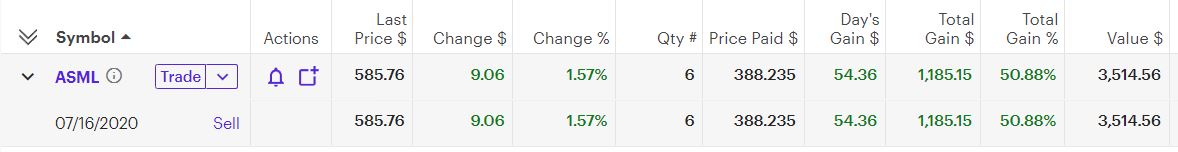

- After paper trading their stock picks for 6 months, I eventually had the confidence to start buying all of the Motley Fool stocks in my Etrade account. Here are a few screenshots of my account that show the date I bought them and the returns. These shots of my Motley Fool portfolio are from December 1, 2023.

I also feel that the Motley Fool service is very cheap compared to other alternatives that don’t perform as consistently. (Zack’s Investor service is 3x the price)

How to Use The Motley Fool

Now before I get started with my detailed review of the Motley Fool and showing you screen shots of my ETrade account, I want to make sure you understand their investing philosophy so you can decide if it is right for you. From the Motley Fool’s web page, they describe their investing philosophy as follows:

-

- You should plan on buying at least 25 stocks over time

-

- You should expect to hold them at least 5 years

-

- You should add cash to your account regularly, and

-

- You should let winners run and hold through market volatility.

In other words, the Motley Fool is NOT for day traders. It is NOT for dividend investors. And it is NOT a get-rich-quick scheme.

It is, however, a “get-rich-slowly” strategy for beginning and advanced investors who can abide by that philosophy and want to take the stress out of picking stocks. The Fool makes investing in stocks easy as they tell you what to buy, when to buy it, and when to sell it. Over the last 8 years for me, and going back 23 years since they started this service, it has worked extremely well and they have easily beaten the S&P 500 as you will see.

If you are reading negative review about the Motley Fool, those people simply are NOT following these rules. My results prove it.

This “get-rich-slowly” strategy is the strategy that most successful investors rely upon and it is how most millionaires become millionaires. Finance guru Dave Ramsey’s 2023 study that found that 75% of millionaires said “regular, consistent investing over a long period of time is the reason for their success.” And CNBC just ran a story that said the best way to grow your wealth is to start investing automatically and increase the amount invested every year. That CNBC story said to try to match the S&P’s 10% return, but there are some stock services that are able to easily beat that return over time. And, as you will see, the Motley Fool has almost quadrupled the market’s return over the last 23 years. With the current AI Boom the Motely Fool just released 5 of it’s market beating AI picks to buy now. Check out our review of their picks Motley Fool AI picks here!

From my personal experience over the last 8 years, they continue to deliver similar results. Most importantly, their picks easily BEAT the S&P 500 over time. Take a look at this screenshot from my ETrade account where I bought about $1,700 of Tesla based on their January 2, 2020 recommendation. That stock pick alone has given me a profit of $21,000+ or 1,261% as of December 7, 2024.

So, as you can see from my results, if you are looking for excellent stock picks, and willing to invest a little money each month and stay invested for 5 years, the Motley Fool Stock Advisor is a great choice. It is especially a good value right now given new subscribers can try it for just $99 for the next 12 months.

Ok, back to my review…

I have found over the last 8 years that the longer you hold their stock picks the better they perform. But most importantly, the longer you hold them the more likely they are to beat the S&P 500, which is exactly what you want.

Motley Fool’s Recent Performance

Their recent stocks continue to drastically outperform the market:

-

- Their last 3 picks are up 15%, 28% and 27%

- Their January, 2025 pick of HWM is already up 51%

- Oct 2024 pick of DoorDash is already up 71%

- Sept 2024 pick of U is up 52%

- June pick of SHOP is up 85%

- April pick of PAC is up 212%

- November 2023 pick of DASH is up 176% and RBLX is up 176%

- October 2023 picks (CRWD) is already up 202%

The 5 Steps to Being Successful with the Motley Fool

- You should buy equal amounts of ALL of the Fool stock recommendations as they come out. So if you are saving $1,000 a month, then you should plan on buying $500 of each of their 2 monthly stock picks.

- Be watching your email every Thursday and buy their stocks as soon as they come out because the stocks tend to go up 5% within the first few days after they are released.

- You should plan on holding the stocks for at least 5 years. The Motley Fool is about long-term investing.

- Plan on selling the few stocks that they tell members to sell.

- Never pay full price for anything: New subscribers should visit their special offer page and get their next 12 months of stock picks for just $99*.

MOTLEY FOOL STOCK ADVISOR TIP: As you can see, they have done a fantastic job over the last 8 years for me. That period covers the 2016 election, the Trump presidency, COVID, the Biden election/presidency, rising inflation and interest rates, and wars in Ukraine and Gaza. Now they are focusing their picks on the post-Covid world, the next election, AI and the expected economic boom as the pandemic ends.

Their next stock recommendation is scheduled to be released Thursday, July 17th. But most importantly, as soon as you subscribe you can immediately access ALL of their most recent picks so you can start adding to your portfolio.

With over 500,000 subscribers their stock picks tend to pop 2%-5% within 72 hours of their announcement. So, to maximize your returns, you need to buy the stock as soon as their recommendation comes out.

Their Best Stock Pick of 2020

On January 2, 2020 The Motley Fool issued a BUY recommendation for TESLA when the stock was trading around $28 a share (split adjusted). Here is a picture of the Motley Fool email I got recommending “BUY TESLA”:

You can see in the image below of my ETrade portfolio that I bought 60 shares of TESLA on January 2, 2020. I got filled at $28.59 (split adjusted) per share, for a total cost of about $1,715. And as of December 31, 2024, the stock was at $389 per share for a profit of $21,000+ on my $1,715 investment in just 5 years. That is a 1,261% gain for me:

While I am at it, here’s another screenshot from my ETrade account–one of The Motley Fool’s December 2019 stock picks that is up 328% in 18 months. On December 5, 2019, the Motley Fool recommended HUBS and I bought 10 shares at $153.65 a share. And as of February 3, 2024 it was around $601 for a gain of $4,473 or 291%.

These are just 2 examples of the Motley Fool’s stocks that have done well.

The obvious conclusion here is the longer you hold the Motley Fool’s picks, the better they get.

If you came here just to get that Quick Summary of the recent Motley Fool’s performance, there you go.

MY MOTLEY FOOL CONCLUSION – Given that, through November 30, 2024 their last 198 stock picks (that’s 24 stock picks a year over the last 8 years) are up an average of 140%, The Motley Fool Stock Advisor Service is absolutely worth it. If you have at least $200 to invest each month it clearly pays for itself many times over.

The list price of the service is $199 a year. But if you are a new subscriber you can claim a $100 discount on the link below. They also offer a 30-day membership-fee guarantee so you can try it and get a full month of all of their picks and decide if it is worth it.

How To Become a Subscriber At the Best Price Available

New subscribers can get a full year of Motley Fool Stock Advisor for just $99. Normally The Motley Fool service is $199 per year. I have bookmarked this New Subscriber page that has their lowest price ever for NEW SUBSCRIBERS ONLY so you can try it for just at this special rate and get the next 12 months of stock picks if you click this link.

Now if they maintain their excellent track record as they have had for the last 8 years, it just might be the best $99 investment you ever make.

In fact, over the last 8 years the average Motley Fool stock pick has just about doubled, being up 99.7%! This time period covers the 2016 election, the Trump administration, the China trade negotiation, COVID, the election, rising inflation, 2 wars and now the recent stock surge. Don’t miss out on the Motley Fool’s picks as we head into an election year and the Artificial Intelligence surge. Here is their schedule for the next few weeks:

Here is their release schedule of their upcoming stock picks:

- July 3, 2025 - New Stock Recommendation

- July 10, 2025 - List of 5 Best Stocks to Buy Now List

- July 17, 2025 - New Stock Recommendation

- July 24, 2025 - List of 5 Best Stocks to Buy Now

So, if you have a few hundred dollars to invest each month and plan on staying invested for at least 5 years, we haven't found any better source of stock picks.

The Details About The Motley Fool Stock Advisor Program

In the rest of this article, I will also show you:

- Exactly what you get when you subscribe to the Motley Fool

- When the Motley Fool will release their next new stock picks

- The percentage of the Motley Fool picks that were profitable each year

- The OVERALL results of their picks year after year,

I will also tell you 2 important trading tips about the Motley Fool services that I have learned. Two little facts that you must understand about their services in order to maximize your profits.

Why Did I Write This?

I will try not to bore you, but I think it’s important to tell you a bit about myself and why I felt the need to write this Motley Fool Stock Advisor review.

My story is probably not too different from yours. I watched my parents work their a** off (excuse my French). They each worked 50+ hours a week to give our family the best lifestyle they could. Unfortunately, my father passed away six years ago just after his 65th birthday. He worked hard his whole life and planned to enjoy his retirement, but he died within months of retiring. My dad’s death taught me a valuable lesson–I need to start building my personal wealth NOW so I can retire early and ENJOY my retirement.

Does Motley Fool Tell You When to Sell?

Yes, The Motley Fool will tell you when to sell a stock. Over these 8 years they have issued 18 sell recommendations. Four of these sell orders have been because the companies were being acquired and they recommended selling to get the cash out.

How Much Does It Cost?

The normal price is $199 a year. No commitment. Cancel any time with a 30 day membership-fee back guarantee. However, the Motley Fool constantly runs frequent pricing promotions for new customers like. Here is their current offer:

Stock Advisor is Normally $199, but Here is Their Latest Offer:

SAVE $100 AND get the next 12 months access for just $99*

The Motley Fool is a stock picking service whose stated goal is to help investors like you learn how to “invest better.” And based on my experience that is exactly what they do. They take the stress out of picking stocks.

Here’s something else you MUST KNOW–Tom Gardner is still running the company and provides some of these stock recommendations! If you look at other newsletters, you can’t compare one year to the next because they have so much changeover and you never know whose guidance you are following. This is a STRONG POINT for The Motley Fool service!

If you are curious about what the Motley Fool’s top ten recommended stocks are today, check out our new article detailing the Fool’s best stock tips.

User Reviews

You’ve heard what we think of The Motley Fool, but it’s always smart to consider multiple perspectives and responses. Here’s a summary of what users online are saying about Stock Advisor.

What Do Users Think About the Motley Fool Stock Advisor?

Let’s start with the reviews on Trustpilot. In total, there are over 9,000 reviews and the average rating is 3.4 out of 5 stars. Here are some of the things users have praised:

- The performance of its picks. One reviewer said she and her husband first subscribed in the 90s and followed the Fool’s recommendations. The result was a portfolio that has allowed them to retire comfortably.

- The Fool’s educational resources. Many users say these helped them learn about the stock market and other investment topics.

- The improved interface. Some of the reviews specifically called out improvements to the interface, making it more user-friendly and intuitive.

Of course, there are negative reviews, too. Here are some of the most frequent complaints.

- The performance of its picks. Yup, this one was the subject of both praise and disappointment. Some people feel the service recommends overpriced stocks, while others say that the picks have lost money. One mitigating factor here is that some of the reviewers haven’t owned these stocks long enough or don’t understand the buy-and-hold strategy.

- Slow customer service. Another complaint is from users who haven’t been happy with the Fool’s customer service. (There’s some praise for their service, too, but it showed up more frequently in the negative reviews.) On a related note, some users also noted that they had difficulty canceling the service, which requires a phone call and can’t be done directly from the website or app.

- Promotions and upselling. Several reviewers mentioned that they wish Motley Fool sent fewer promotional emails and had fewer ads in their articles.

Reddit users give Motley Fool Stock Advisor mixed reviews. Some have had great experiences and built thriving portfolios. They’re long-term subscribers and very happy with the service.

Others have expressed disappointment in the performance of recent picks, while others echoed what Trustpilot reviewers said about the service recommending stocks at their highest price, with key examples being Lemonade (LMND) and Fiverr (FVRR).

There are also plenty of reviews by investment websites such as Business Insider that give the service high ratings, usually 4 stars or more.

Overall User Rating: Is It Worth the Hype?

After reading the above, it’s clear that users are divided in their opinions of Motley Fool Stock Advisor. Many are happy with the service, while some are disappointed.

Recent picks have not performed as well as earlier picks, but some users specifically said they dumped a stock after just a few months. That’s contrary to the recommended buy-and-hold strategy.

From the personal experience we’ve shared here, we do think that Motley Fool Stock Advisor is worth the hype if you use it properly. For that to happen, you’ll need to commit to buying equal amounts of all their recommendations and hold them for at least 5 years unless they issue a specific recommendation to sell.

FAQS

Why Should You Care About The Motley Fool?

You should care for several reasons. First, it makes investing in the stock so much easier and less stressful. Second, as you have seen in great detail above, they really do pick a few stocks each year that, historically, doubled or tripled in value. Third, if you are just getting started, it’s a great place to start and learn about the stock market.

Personally, I just read their recommendations every Thursday and buy what they recommend. I just buy the 2 NEW picks each month as the “5 Best Stocks Now” are usually re-recommendations of previous stocks. Any of their stocks that go down 32% I just sell off to cut my losses. This helps to keep some cash in the account.

Financial advisers agree on few things, but they ALL AGREE that the sooner you start investing in the stock market the better off you will be in the future.

None of us have the time nor the skills to analyze thousands of stocks and then decide which ones are the best ones. The Stock Advisor subscription is tailored to the Individual Investor to do exactly that. For more information on the Fool’s Rule Breakers which is now part of their Epic service. Still can’t decide between Stock Advisor and Epic? Then you can get them both at a massive discount with their Epic review.

How Reliable is The Motley Fool?

Overall, since inception in 2002 The Motley Fool Stock Advisor picks have had an average return of over 800% compared to the market’s 170%. About 67% of the picks have been profitable, and they have sold 44% of their picks. They achieve these fantastic returns by picking a few stock each year that double or triple year after year.

Is Joining Motley Fool Worth It?

With an average return of over 900% since inception, subscribing to The Motley Fool is absolutely worth it if you plan on staying invested for at least 5 years To get these fantastic returns, you need to try to buy equal dollar amounts of each stock pick as they are released.

Has Motley Fool Beaten the Market?

The Motley Fool Stock Advisor has beaten the market by over 800% over the last 23 years. They average stock return is over 900% compared to an average return of the market over that period of 170%. No other newsletter comes close to this.

Can Motley Fool Be Trusted?

The Motley Fool is trusted by over 500,000 stock investors who subscribe to one of their services. They have excellent customer service that can be reached by phone or messaging, and they offer a 30 day membership fee to their popular services.

Is Motley Fool a Pump and Dump?

Absolutely not. In fact, they are the opposite. The Motley Fool recommends you invest in at least 25 stocks and hold these stock picks for at least 5 years. Over the years, they have sold 44% of their positions, most of which they held for years.

How Much Does Stock Advisor Cost?

The Motley Fool Stock Advisor retails for $199 per year. For this fee, you get 2 new stock picks per month and their Top 5 Stocks to Buy Lists that are updated twice per month. They do run pricing promotions of 30-40% off from time to time. Currently they are running a special like $99 a year for new subscribers*. Either way, you can cancel and take advantage of their 30-day membership-fee back guarantee and get a full refund.

What Else Do You Get?

When you order a Stock Advisor subscription, in addition to the two new stock picks every month, you’ll have unlimited access to all of their current Rankings, Service Updates and historical stock recommendations.

You will also receive “Instant alerts”. They will send you an instant alert as soon as one of these events occurs to a stock in your list:

- New buy alerts

- When it is time to sell (this is huge)

- Large price changes

Does The Motley Fool Cover Penny Stocks?

No, the Motley Fool services focuses on blue chip stocks, which are large & well-established companies in their respective industry. They also look for companies that are dominating their industries and have high growth potential. They do NOT recommend penny stocks.

For penny stocks, I would suggest looking into Timothy Sykes, a penny stock trader who made $1.65 million by day trading as a university student.

He has a couple of teaching segments that you might interest you:

- Tim Sykes teaches Penny stocks

- Superman Trade alerts and premium research

- Guru – learn from proven profitable traders

- Analyze your trades

Is The Motley Fool Good for Technical Analysis?

No, definitely not. Technical analysis involves analyzing trade volume and prices and then trying to forecast the direction of stock prices. The Motley Fool is based on fundamental analysis and is for longer-term investing. Hence they focus on the company’s financial statements, their competitors, the overall health of the economy, etc.

Is it Good for Day Traders?

No. Day Trading involves buying and selling stocks on the same day. The Motley Fool recommends stocks they want you to hold for years, not minutes.

It is focused on buy & hold portfolios that seek capital growth. This involves a lot less stress and more growth for the long-term.

Motley Fool Review Conclusion

So… is the Motley Fool Stock Advisor worth the money?

The answer is a definite YES.

Of all the stock subscriptions I have tried over the years, Motley Fool’s Stock Advisor has been the most profitable for me. And it is probably one of the best investments I make each year. Just look at my TSLA trade above that they recommended where I now have a $21,000 profit on a $1,700 investment. The Motley Fool Stock Advisor is worth its $199 retail price, and is most definitely worth the $99 for the first 12 months for new subscribers.

The purpose of this Motley Fool Review was to show you my personal experience with the Stock Advisor service over the last 8 years. I’ve been a paying member of the Stock Advisor subscription since 2016. I buy $1,000-$2,000 worth of each of their 2 specific stock picks every month. I wrote this Motley Fool’s Stock Advisor Review so others can see how great the Fool’s Stock Advisor service picks have been for me over the years.

I simply have not found another stock advisor service that has such a strong historical performance and an excellent short term performance as well. As you can see from above; it is doing quite well in 2024 and in the last 8 years that I have been a subscriber.

As I stated at the beginning of this review, my portfolio has also easily outperformed the S&P 500 over the 8 years that I have been buying the Stock Advisor stocks. My Motley Fool picks that I have held at least 5 years are up almost 278% compared to the SP’s 138% return over the same time period.

The biggest negative experience is:

- With over 500,000 subscribers, there is definitely a “Fool Effect” on the stock prices. Within the first few hours of getting a recommendation, the price of the stock typically shoots up $2 or $3. This means you really have to paying attention to their Thursday emails and I have learned to get my order in quickly.

If you are in Canada and want both the Motley Fool’s U.S. and TSX picks, then you must read our Motley Fool Canada Review and learn how to save C$200 on this service.

* $99 promotional price for new members. $100 discount based on the current list price of Stock Advisor of $199/year. Membership will renew annually at the then current list price.