*** UPDATED WITH STOCK PRICES AND PERCENTAGE RETURNS AS OF June 27, 2020 ***

The key to “winning” as an investor is to uncover high-performing stocks before the rest of the market does.

David Gardner and his brother Tom started the Motley Fool in the 1990s to help investors do exactly that–pick solid stocks and learn how to invest better.

The Motley Fool’s most popular stock picking newsletter service is called the ‘Stock Advisor’ and has over 600,000 subscribers. It claims to have outperformed the market by 429% to the market’s 86% since inception-returns as of June 27, 2020. (See our review of the Motley Fool Stock Advisor service here.)

But HERE is the Little Known Secret…

David Gardner’s stock picks for the Stock Advisor have outperformed his brother’s picks by a wide margin. For example, in their Stock Advisor service, David ‘s stock picks are up 626%, Tom’s are up 184% and the S&P500 is up 86% over the same time period (percentages as of June 27, 2020).

Yes, that is correct. David Gardner’s picks in the Stock Advisor service are up 626% compared to the market’s 86%.

Not to say anything negative about Tom’s picks given they are up 184%, but David’s stocks were amazing!

How did he do it?

We purchased a subscription to the Stock Advisor 4.5 years ago to find out. What we learned was that he picked stocks like AMZN, NFLX, DIS, BKNG, and SHOP just to name a few and these picks are all up over 1,000% since he picked them. It seems that he has knack of picking at least one stock a year that doubles or triples. And he has continued to do so.

Subscribers to the Motley Fool Stock Advisor service, like me, know that David’s stocks have historically outperformed Tom’s picks.

So what did the Motley Fool do? They created another newsletter just for David Gardner and his team of analysts. This newsletter is called “The Motley Fool Rule Breakers.”

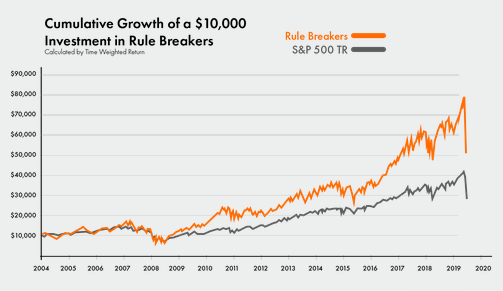

So how have David Gardner’s stock picks in the Fool’s Rule Breaker service performed? Since it was launched, it is up 215% compared to the market’s 74%. Another amazingly successful stock picking newsletter.

Recent David Gardner’s Stock Picks Performance

We bought a subscription to this Rule Breakers service 3 years ago and have some valuable incite to share with you.

Over the last 4+ years, going back to January 2016 when we got a subscription to both, Rule Breakers has outperformed Stock Advisor!

So why does the Fool promote Stock Advisor so much? Because their marketing works to get you in the door on Stock Advisor, and then they try to get you to subscribe to Rule Breakers because from 2016 to 2020 it has OUTPERFORMED Stock Advisor.

Here are some examples of David Gardner’s recent stock picks in his Rule Breakers service (percentages as of June 27, 2020):

- January 2016 pick of PLNT is up 416%

- February 2016 pick of SHOP is up 4,229%

- March 2016 pick of SHOP again is up 3,373%

- Sept 2016 pick of TEAM is up 503%

- October 2016 pick of RMD is up 224%

- Nov 2016 pick of ETSY is up 681%

- Nov 16 pick of UI is up 207%

- January 2017 pick of TWLO is up 661%

- Feb 2017 pick of TREX is up 286%

- Feb 2017 pick of TTD is up 690%

- March 2017 pick of VEEV is up 379%

- May 2017 pick of TTD again is up another 690%

- November 2017 pick of TDOC is up 468%

- January 2018 pick of AYX is up 483%

- July 2018 pick of MDB is 287%

- Nov 2018 pick of GH is up 117%

- January 2019 pick of NEE is up 35%

- Feb 2019 pick of GH is up 65%

- March 2019 pick of ROKU is up 98%

- June 2019 pick of RGEN is up 28%

- August 2019 FSLY is up 252%

- Sept 2019 pick of TDOC again is up 180%

- Nov 2019 pick of ETSY is up 145%

- Feb 2020 pick SE is up 133 already

- March 2020 pick of QDEL is up 148% already

- and the April picks are up 95 and 42%

Pretty impressive right?

TRUE, I just picked the stocks that are up over big in the last few years and gave you the good ones for 2019 and 2020. Remember, these % are all AFTER the market has tanked 30% because of COVID.

But overall, for the last 4 years here is what you really need to know:

- The 2016 picks are up 427% vs 55% for the SP500

- The 2017 picks are up 185% vs 28%

- The 2018 picks are up 95% vs 14%

- And the 2019 picks are up 49% vs 5%

- And after just 6 months the 2020 picks are up 39% vs 2%

But here is a another little know secret… David releases a new stock pick every over Thursday around noon ET. And when the email alert comes out, the recommended stock usually pops up $2 or $3 in the first few hours. So if you want to maximize your profits on David’s picks, you need to get his alerts in real-time.

And here is another tip from my analysis: There worst pick from 2016 is down 77%; the worst pick from 2017 is down 90%; the worst pick from 2018 is down 84%. So you MUST UNDERSTAND, that this service is trying to pick true rule breakers and innovators so not every stock pick is profitable. But since several stocks each year have been up over 200% it more than makes up for the losers.

So how much is a subscription to the Fool’s Rule Breaker service?

The Rule Breaker service is usually $299 a year, but there is a special sales page for new subscribers. They frequently run special promotions like “50% OFF” and “TRY IT FOR JUST $19.”

So if you are a new subscriber, click THIS LINK and you can try it for just $19 and see their latest sales promotion.

And, there is a 30 day cancellation period for a full refund.

David’s next stock picks will be released the first Thursday and the third Thursday of this month!

CLICK HERE to Get David Gardner’s Current Stock PicksThere is Even a Rule Breaker Podcast

Did you know that Motley Fool co-founder, David Gardner, recommends sets of stocks on the Rule Breaker Investing podcast?

For every five-stock set, at every annual review, Gardner has beaten the S&P 500’s performance over the same period.

And today, we are here to put that claim to the test.

We have selected one of David Gardner’s five-stock sets from about a year ago to analyze.

We will take a look at:

- Why David Gardner chose the stock

- How the stock has performed

- Where the stock is today

So, how did these stocks perform?

You are about to find out!

5 Stocks That David Said Could Double Your Money in 2018

1- Activision Blizzard (ATVI)

David Gardner Analysis

Gardner acknowledges that Activision is not as prominent as other large Chinese companies, like NetEase, for example. Gardner praises the future of interactive entertainment, particularly the digital card game Hearthstone and Overwatch. These games have proved to be hits and moneymakers for the company.

Cities in the United States and abroad are paying millions to have rights to have a team competing in Overwatch. Thus, e-sports is a major component of Activision Blizzard. These games also include Starcraft and World of Warcraft. Bottom line – this company has plenty to offer gaming enthusiasts.

Oh, and Gardner loves Activision CEO Bobby Kotick. Gardner’s ringing endorsement of the CEO included calling him a “brilliant asset allocator.”

Stock Price (as of 4/23/2018): 66.23

Where is Activision today?

It appears that David Gardner was off on his initial predication.

The first major speed bump came when shares of Activision Blizzard sunk 28% in November 2018 following a weak outlook for the holiday quarter. The company reported revenue of $1.51 billion, down from $1.62 billion year over year.

The stock was loved in 2017, but not-so-much in 2018. However, you may not need to continue looking in the rear-view mirror for this stock. Shares have been trading sideways for the past six months. This trend could be a result of the lingering negative sentiment surrounding the stock.

But there is one thing you can’t deny – people around the world love video games. Activision is one of the largest companies in this space and is in virtually every corner of the world.

So, let’s just say that David Gardner is wrong…for now.

Stock Price (as of 5/8/2020): $74

The verdict: UP 12%

2- Google (GOOG)

David Gardner Analysis

Alphabet is the parent company of Google.

When you think of Google you likely think ‘Search engine’ to start out. After all, Google is the company that answers all of the important questions in the world like ‘Who would win in a fight between superman and batman.’

However, Gardner suggests that, in 20 years, we will remember Google for Artificial Intelligence (AI). That’s right – we will remember Google as the AI, the artificial intelligence company as artificial intelligence.

Gardner goes on to suggest that AI will be as vital to day-to-day life as Wi-Fi. If he is right, Google certainly would not be a bad bet, right?

Stock Price (as of 4/23/2018): 1,073.81

Where is Google Stock today?

Google stock dropped as low as $984.67 around Christmas 2018.

But hopefully you held the stock rather than sold it whilst cursing out Gardner and cutting your losses. Google still maintains its giant presence as a search engine and has powerful tailwinds in digital advertising, cloud, and computing platforms.

Not only does the company dominate the search game, it also has investments in a variety of other businesses. These investments may not be fully built into the stock price which is why the stock continues to rise and may not be done. Oh, and don’t forget these guys own YouTube, as well.

Gardner got this one correct – but is it possible to go wrong with Google?

Stock Price (as of 5/8/2020): $1385

The verdict: up 29%, so it beat the market

Get David Gardner’s Current Stock Picks; Next Recommendations Will Be Released May 14, 21 and 28!

3- Intuitive Surgical

David Gardner Analysis

Intuitive Surgical was a winner in 2017 and perhaps there is more to come in 2018.

David Gardner has held Intuitive Surgical for 15 years. During that time, the company has split a few times (including a three to one stock split in 2017) but that has not deterred Gardner from the stock.

The company spends around $250 million a year on R&D investing in the future. Other upstart companies would kill for having that as their revenues or profits. So, think about that – Intuitive Surgical is spending that much on R&D.

Was David Gardner right on this one?

Stock Price (as of 4/23/2018): $447.84

Where they are today?

Intuitive Surgical is up more than 1,600% over the last ten years.

The market for robotic surgical systems should continue to grow in the future. Think about it – baby boomers are going to require more healthcare services, including surgery. Additionally, many of these surgeries are going to be candidates for Intuitive’ s da Vinci system.

Furthermore, millennials are getting older, too! In 10 years, many of this group will be in their 40s which is the prime age for hysterectomies. And guess what? Hysterectomies are one of the most frequently performed surgeries for da Vinci.

Perhaps there is a reason Gardner picked this winner.

Stock Price (as of 5/8/2020): $537

The verdict: up 20%, so YES it beat the market

4- Zillow

David Gardner Analysis

Zillow has about 150 million people who visit on a monthly basis.

These people are looking at listings of their house, of other houses, or places they would like to move. Or maybe people just enjoy looking at houses. However, these reasons make Zillow the go-to home-search site and the friend of realtors everywhere.

Stock Price (as of 4/23/2018): $47.69

Where is Zillow today?

Zillow stock declined around 17% in March 2019.

Zillow’s shares have rebounded slightly in April, up 7%. The Federal Reserve recently announced that it would back away from its plan to raise rates later in 2019. This is good news for Zillow and investors seem to be pricing in the potential for lower mortgage rates to increase home sales and refinancing activity.

New home sales are at an 11-month high and refinancing applications are up, as well. The housing market appears to be getting strong which bodes very well for this stock.

Gardner was right as of today – the stock has recovered nicely from a tough March but is recently performed well.

Stock Price (as of 5/8/2020): $53

The verdict: RIGHT…

5- Match Group

David Gardner Analysis

Gardner has found memories of growing with Match.com. Gardner goes on to describe Match.com as the “LinkedIn of dating” for the sites professional look.

But do not forget that Match Group owns Tinder and Match.com. In addition to those offerings, Match Group has 30 to 40 other sites appealing to people of all different, um, tastes?

So, let’s face it – meeting other people online and forming life-long relationships is how people nowadays.

Stock Price (as of 4/23/2018): $46.41

Where they are today?

Match Group continues with its strong push and should not be overlooked by investors.

The company runs leading online dating sites like Match, Tinder, PlentyofFish, OkCupid, Pairs, Twoo, OurTime, and many more.

And Tinder is poised to continue to be a leader in the global app market. The company gets around 1.6 billion swipes per day and about 1 million dates per week. This makes Tinder (and the other sites) excellent targets for online advertisers.

Furthermore, Match Group’s products are available in 42 languages in over 190 countries.

Hopefully you swiped right last year when Gardner made the pick.

Stock Price (as of 5/8/2020): $80

The verdict: CORRECT!

David Gardner Stock Pick Summary

As you can see, no one can predict the market with 100% accuracy. Even the greatest investors in the world like David Gardner make mistakes some times.

BUT I like to look at his performance with a baseball analogy… He got 4 out of 5 right; that’s a .800 batting average! I want him on my TEAM!

Here are the final results (on a per company basis) on the David Gardner stock picks that we sampled:

Activision Blizzard: Wrong

Google: Correct!

Intuitive Surgical: Correct!

Zillow: Correct!

Match Group: Correct!

MOST IMPORTANTLY, HIS STOCK PICKS HAVE BEAT THE FOOL’S OTHER NEWSLETTER EACH OF THE LAST 4 YEARS AND THEY HAVE BEAT THE SP500 BY OVER 44% EACH OF THE LAST 4 YEARS.

* This is a no-risk offer with a 30-day money back guaranty. For a limited time only, Get Rule Breakers for $19 a month or $99/year.

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.