Free stock promotions are one of the easiest ways to start investing without committing a large sum of money upfront. Brokerages use these offers to attract new customers, rewarding them with shares in publicly traded companies. These promotions are appealing because they can kickstart your investment portfolio at no cost. Whether you are new to investing or simply looking to expand your holdings, free stock bonuses can provide a valuable opportunity to participate in the market.

How Free Stock Offers Work

Free stock offers typically come in two forms: sign-up bonuses and referral rewards. In a sign-up promotion, new users receive stock after completing specific requirements like opening an account, linking a bank account, or making a qualifying deposit. Referral promotions reward existing users for bringing in new customers, often giving both parties a free share.

Some promotions offer tiered rewards based on deposit amounts, while others require no deposit at all. Stocks are often selected at random from a predetermined list, and the value can vary widely. Keep in mind that the value of your free stock can go up or down after you receive it. Most importantly, free stock bonuses are considered taxable income, so you will need to report them to the IRS.

Robinhood’s Free Stock Offer

Robinhood’s current promotion awards new users one free stock valued between $5 and $200 when they open an account and link their bank account. The stock is chosen randomly from a pool of well-known companies. Once awarded, the free stock is credited to your account and can be held or sold after any applicable holding period. This promotion is available to U.S. residents who meet Robinhood’s eligibility requirements.

Looking for a way to earn free crypto? Check out our guide to earning free Crypto through Coinbase here!

Current Promotion: Sign up and pick your Free Stock!

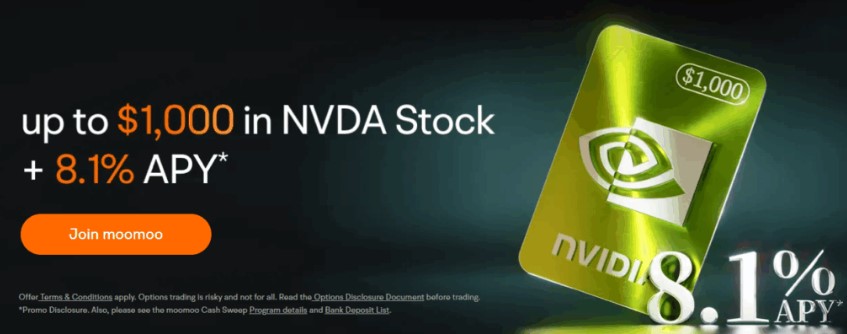

Moomoo’s Free Stock Offer

Moomoo’s current promotion gives new users free NVIDIA (NVDA) stock, with the amount based on the size of their initial deposit:

- Deposit $100 → Receive $20 in NVDA stock

- Deposit $2,000 → Receive $50 in NVDA stock

- Deposit $10,000 → Receive $300 in NVDA stock

- Deposit $50,000 → Receive $1,000 in NVDA stock

Current Promotion: Get up to $1000 in NVDA Stock Today!

Participants must maintain the qualifying average assets in their account for 60 days to unlock the shares. This tiered approach rewards larger deposits with more valuable stock awards.

Public.com’s Refer-a-Friend Free Stock Offer

Public.com’s referral program allows users to earn free stock by inviting friends to join the platform. When a new user signs up using your referral link and meets the promotion’s requirements, both you and your friend receive a free stock. The stock is typically awarded as fractional shares in popular companies. There may be annual limits on the number of referrals eligible for rewards.

Current Promotion: Refer a friend to Public and receive Free Stock Today!

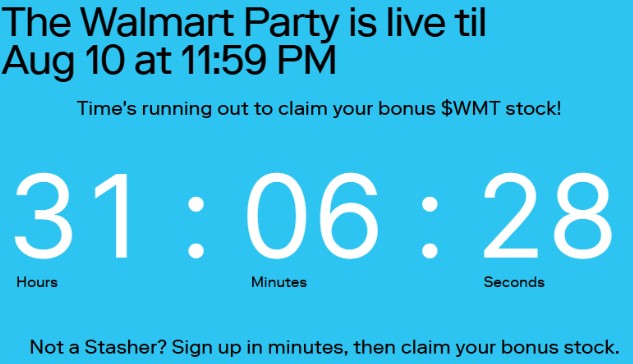

Stash’s “Stock Party” Offers

Stash runs recurring events called “Stock Parties” where users can join at a specific time to claim free stock. These events are open to both new and existing users. Participants receive fractional shares in featured companies, with the value determined by the size of the giveaway pool and the number of participants. Stock Parties provide a unique and engaging way for users to earn free stock without a deposit requirement.

Current Promotion: Join your first Stock Party today!

Leveraging Brokerage Accounts and Cash Bonuses

Opening a brokerage account is often the first step toward claiming a valuable stock reward. Many platforms pair their free stock promotions with bonus cash offers, giving you even more incentive to participate. These cash bonuses may come in the form of a set dollar amount or as cash value equivalent to your awarded stock.

Some brokers also provide bonus stock options, which can help diversify your starting portfolio. When comparing offers, review each platform’s terms to see if they require a minimum deposit or a linked checking account. In some cases, promotions also extend to retirement accounts like a Roth IRA, making it possible to start long-term investing with both bonus cash and free shares. By carefully selecting offers that align with your financial goals, you can make the most of these limited-time opportunities.

Expanding Opportunities with Investment Apps

Investment apps have made it easier than ever to buy stock, trade stocks, and even explore crypto trading—all while offering free stock rewards to attract new users. Some of America’s leading companies in the brokerage industry now offer commission free trading, which makes it simple for both active traders and new investors to manage their portfolios.

Certain platforms include recurring investments, allowing you to automatically grow your holdings over time. Others offer additional perks like debit cards that round up your spare change into investments. Many promotions require opening a new account and maintaining a minimum deposit, so be sure to track these requirements. The most robust apps offer powerful tools and educational content to help you learn, trade, and build wealth, turning your initial free stock into a substantial asset.

Comparing the Top Free Stock Promotions

| Platform | Potential Value Range | Deposit Required? | Key Details |

|---|---|---|---|

| Robinhood | $5–$200 | No | One free randomly selected stock when linking bank account |

| Moomoo | $20–$1,000 (NVDA) | Yes, tiered | Larger deposits yield more valuable stock |

| Public.com | Varies | No (referral) | Both referrer and new user receive free stock |

| Stash | Varies | No | Fractional shares via recurring Stock Parties |

Tips for Maximizing Free Stock Offers

- Sign up for multiple platforms to collect multiple bonuses.

- Refer friends and family to earn additional free shares.

- Track claim deadlines to ensure you do not miss out on rewards.

- Meet all deposit and holding requirements before withdrawing funds.

Maximizing Referrals and Special Promotions

Free stock promotions often extend beyond sign-up bonuses to include referral programs, seasonal events, and targeted offers. For example, platforms like Acorns and TradeStation regularly run promotions that allow you to earn free shares by referring friends or meeting specific activity milestones.

Referral bonuses may also include cash bonuses or other rewards like gift cards. Special promotions can occur around market events or during specific weeks of the year, so it is important to keep an eye on the platform’s page for the latest offers. These opportunities may involve ETFs, additional stock selections, or even crypto incentives.

To maximize your earnings, create a plan that includes multiple platforms, track each offer’s date and conditions, and ensure you meet the requirements. Over decades, small rewards can compound into significant value, especially when combined with good investing habits and careful reinvestment.

Common Mistakes to Avoid

- Forgetting to claim your stock within the required timeframe.

- Ignoring the tax implications of receiving free stock.

- Falling for fraudulent links that mimic official promotions.

How to Get Free Stock Without a Deposit

Some platforms offer promotions that require no deposit at all. These are ideal for beginners who want to test out a trading platform without committing funds. By completing simple tasks like signing up or linking a bank account, you can still receive valuable stock bonuses.

How to Get Free Stock and Keep It Growing

Once you have received free stock, you can hold it to benefit from potential long-term growth. Consider reinvesting any dividends you earn, or adding to your position over time. Treating your free stock as the start of a larger investment strategy can turn a small bonus into a meaningful portfolio component.

How to Get Free Stock as a Beginner Investor

If you are just starting out, free stock promotions can be an easy way to gain exposure to the market without risk. Begin with offers that do not require a deposit, then progress to platforms with higher-value rewards once you are comfortable navigating the app and understanding market basics.

Conclusion

Free stock promotions offer a low-risk way to begin investing or add to your portfolio. From Robinhood’s simple sign-up bonus to Moomoo’s tiered NVDA stock rewards, and from Public.com’s referral incentives to Stash’s interactive Stock Parties, there are options for every type of investor. By understanding how these offers work and following the requirements, you can take full advantage of these opportunities in 2026.

FAQs

Yes, but you may need to meet certain requirements like linking a bank account or making a deposit.

Yes, the value of the stock at the time you receive it is considered taxable income.

Some platforms require a holding period before you can sell. Check each offer’s terms.

While there is no upfront cost, stock values can go down, and you will still need to manage your investments wisely.

Yes, as long as you meet each platform’s eligibility rules.

Top U.S. Brokers Promotions for 2026

★ ★ ★ ★ ★

✅ Now 23 million users

✅ Cash mgt account and credit card

Free stock up to $200 with new account, plus up to $1,500 more in free stock from referrals; US residents only!

Get Free Stock

★ ★ ★ ★ ★

✅ Access to U.S. and Hong Kong markets

✅ Educational tools

Deposit $500 get $30 in NVDA stock; Deposit $2,000 get $100 in NVDA stock; Deposit $10,000 get $200 in NVDA stock; Deposit $50,000 get $400 in NVDA stock.

Get Free Shares

★ ★ ★ ★ ☆

✅ Trade U.S. stocks, ETFs, and crypto

✅ Trades with themed portfolios

★ ★ ★ ★ ☆

✅ Great charts and screeners

✅ Commission-free options trading

$10 and a 30-day complimentary subscription to Webull premium; $200-$30,0000 Tiered Sign up bonus

Learn more

★ ★ ★ ★ ☆

✅ IBKR Lite & Pro tiers for all

✅ SmartRouting™ and deep analytics