Welcome to

Wall Street Survivor!

We’ve just created your account and loaded it with $100,000 in virtual cash. You can use this risk-free money to practice trading:

- U.S. Stocks & ETFs

- Stock Options

- Cryptocurrencies

Table of Contents

How Would You Like to Get Started?

I’m New to Investing

I want to learn the ropes before I risk my virtual cash.

I’m an Experienced Investor

I’m ready to build my portfolio now.

5 Helpful Hints to Get Started

HINT #1

Don’t Know What You’re Doing? Start Here.

Go through 10 easy-to-follow chapters covering everything from market fundamentals to building your own strategy. Best of all, you get to apply every lesson in real-time with your $100,000 practice portfolio.

HINT #2

Learn How and Where to Buy Your First Few Stocks

Here is a list of popular courses to help you make the most of your money:

- 10 Steps to Start Investing the Right Way

- How to Pick Winning Stocks

- Growing Your Portfolio on Falling Prices (Short Selling)

Discover the investing strategies that have worked for veterans like Warren Buffett and Peter Lynch.

HINT #3

Practice Trading Mechanics (Risk-Free)

Don’t let a confusing order form cost you money. Watch our short videos to learn the basics—like the difference between a Market Order and a Limit Order—so you can build your trading muscle memory before you risk a dime.

💡 Pro Tip: Treat your virtual cash exactly like real money. If you wouldn’t buy it in real life, don’t buy it here.

💡 Pro Tip: Check the “My Portfolio” widget on your dashboard or visit the Trading Ideas page to see what’s moving the market today.

HINT #4

Stop Guessing, Start Researching

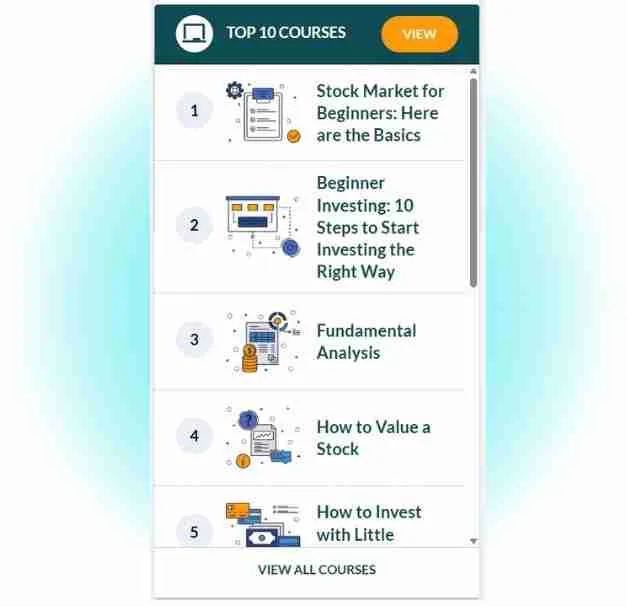

Ignore the “hot tips” you hear online. We give you a professional-grade Research Center packed with stock screeners, interactive charts, and analyst ratings so you can make decisions based on data, not rumors.

HINT #5

Your Cheat Sheet for the First Trade

1. The Strategy

Go to “Stock Game” > “Stocks.”

Aim to buy 5 different companies across 5 different industries (e.g., one Tech, one Retail, one Healthcare).

💡 Pro Tip: Start with SPY (S&P 500 ETF)—it tracks the top 500 companies, so it’s a safe, reliable first choice.

2. The Research

Don’t just guess. Use our stock quoting tools to find and compare US and Canadian stocks, explore different sectors and market movers.

This helps you pick the best companies to build a truly diversified portfolio.

3. The Math

Let’s say you want to spend $20,000 of your initial cash.

Allocate $4,000 to each stock. To find your share count, divide your budget by the stock price.

Example: $4,000 budget ÷ $90 share price = 44 shares.

4. The Execution

Enter the symbol, type in your quantity (whole numbers only!), and hit Confirm.

Congratulations—you’re officially an investor!

Ready to Start Trading?

Go to DashboardWhat Else Can You Do on Wall Street Survivor?

There’s no limit to how many contests or how many people you can invite to join.

Invite Friends to Private Contests

It’s free to set up a contest for you and your friends to test out different trading ideas. All while using virtual money. Customize your rules and see who comes out on top!

Win Real Prizes

Put your skills to the test! In our semi-monthly contests, you can compete against other investors from across the community for real prizes. It’s a fun way to sharpen your strategy without any of the risk.

Ready to Start Trading?

You’ve learned the basics. Now it’s time to put theory into practice with your $100,000 virtual portfolio.

Go to Dashboard

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks as of December 27, 2025

We are paid subscribers to dozens of stock and option newsletters. We actively track every recommendation from all of these services, calculate performance, and share our results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Return vs S&P500" which is their return above that of the S&P500. So, based on December 27, 2025 prices:

Best Stock Newsletters Last 3 Years' Performance

| Rank | Stock Newsletter | Picks Return | Return vs S&P500 | Picks w Profit | Max % Return | Current Promotion |

|---|---|---|---|---|---|---|

| 1. |  Alpha Picks | 82% | 56% | 76% | 1,583% | VALENTINE'S SALE: SAVE $75 NOW |

| Summary: 2 picks per month based on Seeking Alpha's Quant Rating; consistently beating the market every year since launch; tells you when to sell and they have sold almost half. See complete details in our full Alpha Picks review. Or get their Premium service to get their QUANT RATINGS on your stocks to better manage your current portfolio--read our Is Seeking Alpha Worth It? article to learn more about their Quant Ratings. | ||||||

| 2. |  Zacks Value Investor | 60% | 40% | 54% | 692% | February Promotion: $1, then $495/yr |

| Summary: 10 stock picks per year on January 1st based on Zacks' Quant Rating; Retail Price is $495/yr and includes 6 different services including those below. Read our Zacks Review. | ||||||

| 3. |  Moby.co | 50% | 16% | 74% | 2,569% | February Promotion: Next pick free! |

| Summary: 60-150 stock picks per year, segmented by industry; consistently beating the market every year; retail price is $199/yr. Read our full Moby Review. | ||||||

| 4. |  Zacks Top 10 | 36% | 15% | 71% | 170% | February Promotion: $1, then $495/yr |

| Summary: 10 stock picks per year on January 1st based on Zacks' Quant Rating; Retail Price is $495/yr and includes 6 different services. Read our Zacks Review. | ||||||

| 5. |  TipRanks SmartInvestor | 20% | 9% | 62% | 464% | Current Promotion: Save $180 |

| Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. | ||||||

| 6. |  Action Alerts Plus | 27% | 5% | 66% | 208% | Current Promotion: None |

| Summary: 100-150 trades per year, lots of buying and selling and short-term trades. Read our Jim Cramer Review. | ||||||

| 7. |  Zacks Home Run Investor | 5% | -0.4% | 45% | 241% | February Promotion: $1, then $495/yr |

| Summary: 40-50 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. | ||||||

| 8. | Dogs of the Dow Strategy | 16% | -1.8% | 43% | 44% | Current Promotion: None |

| Summary: Buy the 10 highest yielding dividends stocks in the Dow Jones Industrial Average on January 1st and sell on Dec 31st each year. | ||||||

| 9. | IBD Leaderboard ETF | 11.4% | -1.8% | n/a | n/a | February Promotion: NONE |

| Summary: Maintains top 50 stocks to invest in based on IBD algorithm; Retail Price is $495/yr. Read our Investors Business Daily Review. | ||||||

| 10. |  Stock Advisor | 34% | -3.9% | 75% | 289% | February Promotion: Get $100 Off |

| Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr. Read our Motley Fool Review. | ||||||

| 11. |  Zacks Under $10 | -0.2% | -4% | -4.3 | 263% | February Promotion: $1, then $495/yr |

| Summary: 40-50 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. | ||||||

| 12. |  Rule Breakers | 34% | -5.1% | 69% | 320% | Current Promotion: Save $200 |

| Summary: Rule Breakers is included with the Fool's Epic Service. Get 5 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. | ||||||

| Top Ranking Stock Newsletters based on their last 3 years of stock picks covering 2025, 2024, and 2023 performance as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF. Performance as of December 27, 2025. | ||||||