Do you have any idea where all of your money goes? No? Well, trust me, I have been there before.

No matter what you do, you cannot seem to get ahead with your finances.

If you are in this boat, like many of us, you likely do not have a budget (or one that works for you).

To get your finances together, you will need to get an idea about your overall financial health.

So, what should you do?

Hint: BUDGET YOUR MONEY!!

Financial experts and money advisors have given this advice for decades.

We cannot stress the importance of having, and sticking to, a budget enough. Otherwise, you will have no clue where your money is going.

Still not convinced that you need a budget?

Keep reading, and you will change your mind on this topic very quickly.

Why do I need a budget, anyway?

So, if you still do not think you need a budget…

…here are 5 reasons why you need a budget.

Track your goals

A budget helps you decide what your long-term goals are and how to work toward them. If you wander through life aimlessly, spending money on things you don’t need (or want), you will never save up for significant, major purchases (i.e., car, house in the Caymans, etc.).

You see, a budget forces you to create a roadmap to save money, track progress, and most importantly, achieve your goals.

Avoid overspending

Overspending is a HUGE problem – mainly because credit cards have become so common. Often, people do not even realize that they are overspending until they are up to their eyeballs in debt!

If you create and stick to a budget, you will never need to worry about this happening to you. Why? Because you will know exactly how much you earn and how much you can afford to spend each month.

Retire on time

It is imperative to spend wisely today, but equally important to save for tomorrow. In fact, you should consider adding retirement contributions in your budget to begin building your nest egg.

You can contribute to an IRA, 401(k), or any other type of retirement vehicle. The sacrifice today will be well worth it tomorrow. Start now – you will not regret it!

Be prepared for the unexpected

You should prepare for the unexpected surprised that life throws at you. Whether it be job loss, illness, injury, or anything else – you could find yourself in severe financial turmoil. This uncertainty means you need to budget to save money (preferably an emergency fund) to avoid serious financial hardship.

This extra cash will ensure that you do not spiral into debt during, or after, a life crisis. Even saving $10, $20, or $30 per week will get you well on your way.

Uncover bad spending habits

Your budget forces you to review where your money is going. Do you purchase a $5 coffee every day? Well, you may be surprised that those “little” purchases can add up to over $100 per month!

Budgeting allows you to re-think and adjust your spending to better align with your financial goals.

And these few reasons are just the tip of the iceberg. There are many advantages to budgeting.

Now that you can see the importance of budgeting…

…you need some help.

The days of tracking your spending on pencil and paper are long gone (c’mon, who has time for that?).

It is 2019, and you need to have the ability to manage your personal finances anywhere and anytime.

But there are so many different personal finance and budgeting software options.

As such, each option comes with different functionalities and features. Which one is best?

Great question!

We realized this problem and set out to find the best personal finance and budgeting software for you.

And today, we have a great one to review.

The company is called CountAbout, and they are changing the budget game for many of folks just like yourself.

Are you ready? Let’s GO!

CountAbout Overview

Keeping track of finances can be a confusing and daunting task for anyone…

…thankfully, CountAbout has got you covered.

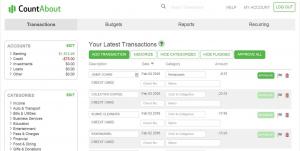

CountAbout is a highly functional, easy-to-use online personal finance application.

The application requires no software to install so you can use it anywhere you have an Internet connection.

And what else is so great about CountAbout?

Well, a few things, because the app is:

- Customizable;

- Easy-to-use (have we already mentioned that?); and

- About half the price of other personal finance applications

These are all the right reasons to make the switch to CountAbout today.

To give you a better idea of this brand and its product…

…we have gone through the entire software from sign-up to implantation.

The best part about CountAbout is the simplicity of the product.

But what makes the app so simple?

You do not need to worry about the hassle of downloading, installing, connecting, or configuring anything.

You can use CountAbout just about anywhere there is an internet connection.

And the connection is 100% secure and private.

Also, you can sign-up in less than one minute…

…and get access to all of the CountAbout features.

Okay, okay – enough talk about how easy it is to get started with CountAbout.

What exactly does the company do?

To put it simply, the software gives you the ability to import files from your bank…

…so you can create a budget for your personal and business use.

It does not matter whether you are running a business or learning to save money – CountAbout can benefit you.

The app connects to most financial institutions (over 12,500!) to keep all of your financial records in-sync.

And by “financial institutions,” we are talking:

- Banks;

- Credit cards;

- Brokerages;

- Accounting software (i.e., Mint, Quicken, etc.); and

- Much more!

Additionally, since the app is web-based, you can forget about pesky outages, information loss, or a host of other issues that come with downloadable software.

CountAbout Features and Services

Now that you are familiar with the basics…

…let us see how to use the software.

This section will cover all of the details and features that you need to know.

Customization

One of my favorite features about CountAbout is that it is a genuinely personalized experience.

You can customize nearly every:

- Field;

- Function; and

- Report

Additionally, you can customize every income and spend tag or category.

You can also add, delete, or rename tags based on your preferences.

Import accounting software

You can also import data from common accounting software like Quicken or Mint.

So, if you use another accounting software, you can skip the tedious work of transferring that data.

Automated transactions

The app will automatically sync all of your transactions.

By syncing your transactions, you can save hours of data entry.

This feature is available on the Premium plan only (more on that later).

Scheduling

You can schedule your payments and work them into your budget.

For example, if you have a monthly phone bill that comes out, you can account for that.

This way, you can track:

- Recurring payments;

- Remaining budget; and

- Track ongoing payments

You can also generate a copy of your budget for the coming months.

If you can see what you are spending the future, you can make better financial decisions.

Reporting

Another useful feature is ‘Reporting’ which allows you to look at accurate and detailed reports of all of your account activity.

You can access tons of different reporting options, which includes reporting for:

- Account balances;

- Category activity;

- Compounds;

- Tag activities; and

- More!

All of these options are customizable, which means you can select which fields you want in your reports.

You also have the option to create reports based on specified dates for even more specific information tracking.

And lastly, you can export your reports and share them with others.

These features are coming soon!

On top of all of those features, there are a couple of other add-ons that are coming this September.

You will be able to access:

- Attachments add-on. This feature gives you the ability to attach an image to your transactions, which makes them easier to identify, label, and find.

- Invoicing add-on. This feature is excellent for small businesses. You can create, send, and track invoices for $60 extra per year.

Depending on your needs, these add-ons could provide significant value to you personally and professionally.

CountAbout Plans and Pricing

Okay, so we have gone over everything important about CountAbout, and now we arrive at one of the most critical questions…

…”How much is this going to cost me?!”

We can break “Plans and Pricing” down into three options:

- Basic plan

- Premium plan

- Free trial

The basic plan is $9.99 per year and comes with all the features mentioned above.

The premium plan is $39.99 per year and comes with all features mentioned above plus automatic data syncing.

If you do some digging, you will find that CountAbout’s Basic plan is usually cheaper than competitor pricing.

However, you may still consider the Premium plan because it offers great convenience by automatically updating your accounts.

And, if you do not want to make a financial commitment upfront…

…CountAbout offers a 15-day free trial.

This offer is relatively standard with competitors, but this company does not require any personal details to access the trial.

No personal details means that you can sign up for the Premium plan for 15 days at no charge.

At the end of your free trial, you can subscribe to the Premium or Basic plan. From there, you will need to provide credit card information and submit an application form.

CountAbout Security

Security is an important topic when it comes to your finances. You do not want your information to fall into the wrong hands, right?

CountAbout utilizes highly respected third-party security services called MX. MX connects subscribers to their financial institutions.

Additionally, CountAbout does not store usernames, passwords, account numbers, phone numbers, or addresses. CountAbout uses two-factor authentication to access your account, which further secures your important information.

CountAbout iOS and Android Apps

You can use CountAbout on any web browser but also have the option to download the app on your phone.

The mobile-friendly app is usable on either iOS or Android compatible devices…

…so no matter what smartphone you use, CountAbout has you covered.

However, the app’s functionality is limited. For example, you cannot set up recurring transactions or create reports.

But you can perform many other functions like approving, adding, or categorizing transactions.

You can perform all other functions via your mobile web browser.

CountAbout Customer Service

CountAbout has excellent customer service.

Simply fill out the request form under ‘Contact’ on the website, and the company will reply with an e-mail.

Once you reach out via e-mail, you can connect with a customer services representative by telephone.

In my experience, the support staff was fast, helpful, and friendly.

There is also a FAQ section that answered most of the questions that I had.

Here you can get answers to questions like:

- Can CountAbout link to my bank? (with Financial Institution Lookup)

- Will you sell my data?

- What if I decide to quit using CountAbout?

- Will you be adding more features?

If the answers to these questions are satisfactory…

…you can sign-up for your 15-day free trial on the FAQ page.

Sign Up for CountAbout

So, you know everything that you need to know about CountAbout.

If you need to know more, continue reading for:

- What we love about CountAbout

- What we don’t love about CountAbout

- Who CountAbout is right for

- Summary and Pros/Cons

But if you are prepared to sign-up already – we will not stop you!

Signing up for CountAbout is very easy. Simply enter your e-mail and choose your password to get started.

You will be signed up for a free 15-day trial (no payment information required).

Once the trial is up, that is when you decide if this is a service worth paying for.

Are you ready to get started? Sign-up here.

What we love about CountAbout

Simple user interface. The user experience with CountAbout is nice and straightforward. This simple interface means you will not be overwhelmed with crazy graphics and ads while trying to budget. Overall, we found the platform to be simple and streamlined.

Automated transactions. Manually entering transactions on your personal finance software is very time-consuming. This feature will save you a ton of time and hassle when it comes to your budget.

Customization. You can customize your user interface, budgeting categories, and much more. This customizability means you can use this software precisely as you desire.

Ease of use. If you are not the most tech-savvy user (or don’t have tons of time), CountAbout is very easy to figure out. You do not need to jump through hoops to get started.

Transferability. CountAbout is the only service we have encountered that allows you to import historical data from Quicken or Mint. This feature makes the transition to your new personal finance app much easier, especially if you are importing several years of data.

Budgeting and reporting. Reporting is straightforward and comprehensive. Users can also create forward-looking reports which can be very helpful. Lastly, you can export reports and share them with others (i.e., your significant other) on specific areas of spending.

What we don’t love about CountAbout

Accounting. At times, this app felt more geared toward business-oriented users. If you are looking for an app that merely tracks your spending, there could be better options out there.

Annual Fee. The yearly subscription cost is reasonable, but there are free personal finance options available that offer similar features (but you will have to deal with ads).

Financial Planning. CountAbout is primarily a budgeting app, which means it does not help with your investments.

Is CountAbout right for you?

CountAbout is an excellent personal finance app that caters to many different types of users.

The cost of $39.99/year for Premium or $9.99/year of Basic is definitely not cost prohibitive for personal users.

Additionally, business users can benefit from this app, as well.

So, who is it really for?

Individuals and businesses who are detail-oriented and wants a better way to track their finances.

Summary

So, you have decided that you need a budget.

Congratulations!

You are half way there – but you need help starting and sticking to your budget.

This step is where personal finance and budgeting software comes into play.

But let’s face it – there are tons of personal finance apps that you can choose.

We had a GREAT experience using CountAbout.

If you are looking for personal finance software you can use to set up and track your budget…

…CountAbout definitely fits this criteria.

From start to finish, the app provided quick, easy, and useful functionality.

If you already use a personal finance app…

…you can import your categories and transactions from Quicken or Mint accounts.

Additionally, you will enjoy a fully customizable, ad-free user experience.

And here are a few more key points:

- All features and functions are easy to understand at a glance

- The software is available instantly

- You can easily create, edit, and generate reports

What is your favorite personal finance software? Will you be trying CountAbout?

Let us know if with a comment below!

We are experienced users of dozens of stock trading platforms. We stay up to date on these platforms' service offerings, subscription fees, trade commissions, and welcome bonuses. The brokerages listed below are for U.S.-based investors, and are ranked in order of overall value received after taking advantage of their sign-up and/or referral offers. ✅ U.S. stocks, ETFs, options, and cryptos $3 monthly sub 10k in assets Growth $3; + $9 Month Bronze $3; Silver $6; Gold $12 a monthThe Best U.S. Brokerages as of June 30, 2025

Ranking of Top U.S. Stock Brokerages Based on Fees, Features, and Sign-Up Bonuses

Rank

Brokerage

Fees

Features

Sign-Up Bonus

Read Our Review

1.

$0

✅ Now 23,000,000 users

✅ Cash management account and credit cardFree stock up to $200 with new account, plus up to $1,500 more in free stock from referrals

Robinhood Review

2.

Moomoo

$0

✅ Free Level 2 Nasdaq quotes for advanced traders

✅ Access to U.S. and Hong Kong markets

✅ Learning tools built in60 free stocks with $5k deposit; or 25 free stocks with $2k deposit

Moomoo Review

3.

Interactive Brokers

$0

✅ Access 150+ global stock exchanges

✅ IBKR Lite & Pro tiers for different experience levels

✅ SmartRouting™ and deep analytics for executionRefer a Friend and Get $200

Interactive Brokers Review

4.

M1 Finance

✅ Automated investing “Pies” with fractional shares

✅ Integrated banking & low-interest borrowing

✅ No trading fees with scheduled trades$75-$500 Tiered Sign-up bonus

M1 Finance Review

5.

Webull

$0

✅ Extended-hours trading premarket and after-hours

✅ Built-in technical charts, screeners, and indicators

✅ Commission-free options trading$10 and a 30-day complimentary subscription to Webull premium;

$200-$30,0000 Tiered Sign up bonusWebull Review

6.

Public

$0

✅ Fractional shares of U.S. stocks and ETFs

✅ No payment for order flow (PFOF) model

✅ “Alpha” tool with earnings calls and sentiment data$100-$10,000 Tiered Cash Account Transfer Bonus

Public Review

7.

Composer

$32 a month

✅ Invest in fully automated stock strategies

✅ Build custom strategies with our no-code builder

✅ IRAs$49 per successful referral with no limit on the number of referrals

Composer Review

8.

Stash

✅ Stock-Back® debit card rewards in fractional shares

✅ Auto-invest and budgeting tools for beginners

✅ Curated theme portfolios for retail investors$5 when you invest $5

Stash Review

9.

Acorns

✅ Automated investing portfolios

✅ ESG curated portfolios

✅ Retirement Accounts

✅ Acorns Early Invest for Kids' AccountsGet a $20 bonus when you start saving & investing

Acorns Review

10.

Etoro

$0

✅ CopyTrading™ feature to follow top traders

✅ Trade U.S. stocks, ETFs, and crypto in one app

✅ Commission-free trades with themed portfolios$10 Crypto Sign-Up Bonus

Etoro Review

11.

Robinhood Gold

$5

✅ 4% APY on cash

✅ 3% IRA match

✅ Level II data; Morningstar

✅ No interest on first $1,000 of margin Save with Annual Fee

Robinhood Gold Review

12.

Cash App

$0

✅ U.S. stocks and bitcoin; $1 minimum

✅ Peer-to-peer payments

✅ Beginner-friendly financial ecosystemUp to $200 in free overdraft coverage and earn 4% on cash

Cash App Review

Fees, features, sign-up bonuses, and referral bonuses are accurate as of May 31, 2025. All information listed above is subject to change.