BlockFi is one of the coolest new players on the block in the investing world.

Their aim is to join crypto and traditional finance, and they’ve been doing quite a job so far!

In this BlockFi Review, you’ll find out:

- What BlockFi is

- The services BlockFi offers

- BlockFi’s values

- Whether or not BlockFi is for you

Let’s get started!

What is BlockFi?

BlockFi is a crypto-lending and cryptocurrency exchange institution that allows users to earn interest on deposited cryptocurrency as well as use cryptocurrency as collateral for loans.

The company was founded in 2017 in New York City by Zac Prince and Lori Marquez.

BlockFi Features

So, what can you do when you sign up for BlockFi?

Trading Account

First off, you can invest in cryptocurrency!

Once you fund your BlockFi account, you can use the trading feature to buy, sell, and exchange crypto, commission-free.

The best part about trading with BlockFi is that you can immediately start earning interest on your investments; once you purchase a cryptocurrency, it goes straight into your BlockFi Interest account, discussed below.

You can also set up automatic trades in order to buy or sell cryptos on a regular basis!

BlockFi does not offer joint or custodial investment accounts.

BlockFi Interest Account

One of BlockFi’s main features is its BlockFi Interest Account, or BIA.

We think the BIA is one of the coolest interest accounts out there, and here’s why.

With the BlockFi Interest Account, you can deposit your cryptocurrency and earn interest on it.

With the Interest Payment Flex option, you can choose which cryptocurrency your interest is paid in.

How does this whole interest payment thing work?

Well, when you deposit some of your crypto into your BIA, BlockFi then lends that crypto out to borrowers, who pay BlockFi interest.

Some of that interest is then passed on to you, the client!

Interest is compounded daily and deposited to your account monthly, and there are no account maintenance fees or required account minimums.

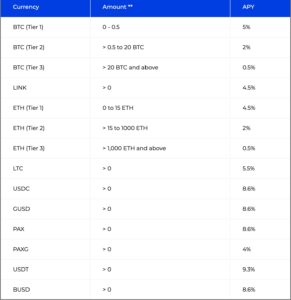

Here are BlockFi’s currently accepted cryptocurrencies and the current APYs on the BlockFi Interest Account.

Crypto-Backed Loans

BlockFi also offers loans where you put your cryptocurrency up as collateral.

You can secure a loan using Bitcoin, Ether, or Litecoin.

In exchange for this collateral, BlockFi will lend you U.S. dollars, GUSD, or USDC.

In order to take out a crypto-backed loan, you will need to post a loan-to-value (LTV) ratio of 50%.

In other words, you can take out a loan that is no more than half the size of your current portfolio.

If your crypto goes down and value and raises the LTV ratio of your loan, you will need to post more collateral in order to get the ratio back down.

The origination rate for a crypto-backed loan is 2%, and the interest rate varies depending on how low your loan-to-value ratio is. (A lower LTV ratio is better.)

Here are the current interest rates for crypto-backed loans:

BlockFi Rewards Credit Card

BlockFi will be releasing the first-ever credit card to offer cash-back rewards in the form of Bitcoin.

The BlockFi Rewards Visa Signature Credit Card, which will be released in the spring of 2021, will grant cardholders 1.5% back on every purchase, paid out as Bitcoin.

The Bitcoin earned on purchases will be transferred to your BIA and start earning interest immediately.

The annual fee for the card will be $200. You can join the waitlist for the BlockFi Rewards Credit Card on the BlockFi website!

Who is BlockFi For?

BlockFi is great for cryptocurrency investors who want to earn a profit from their crypto assets without selling.

Why wouldn’t you want to sell your crypto if it’s gone up?

Because selling an asset that has increased in value creates a capital gain, which will be subject to capital gains tax.

When you use your cryptocurrency to secure a loan instead of selling it, you avoid creating a taxable event while giving yourself the opportunity to make even more gains with the extra money you’ve been loaned.

The interest you pay on your crypto-backed loan can even be used as a tax deduction in order to reduce your taxable income for the year!

Want to get started investing in cryptocurrency but not sure where to start? Check out our guide to getting started with Bitcoin!

How does BlockFi Make Money?

BlockFi makes money in several different ways.

One of these ways is withdrawal fees on BIAs. When you have a BIA, you are allowed to make one cryptocurrency withdrawal and one stablecoin withdrawal per month for free.

But when you want to withdraw more than that, the following fees are applied:

Why BlockFi?

So, are there any other reasons to sign up for BlockFi besides a great return on your crypto holdings?

Absolutely!

BlockFi’s corporate vision and values are a great testament to their commitment to progress and to their clients.

The BlockFi Vision

BlockFi’s vision of uniting traditional finance and blockchain is pretty spot on.

They’ve taken your ordinary financial tools like checking accounts, loans, and credit cards, and infused them with cryptocurrency!

So we’d say they’re doing a pretty good job.

BlockFi’s Values

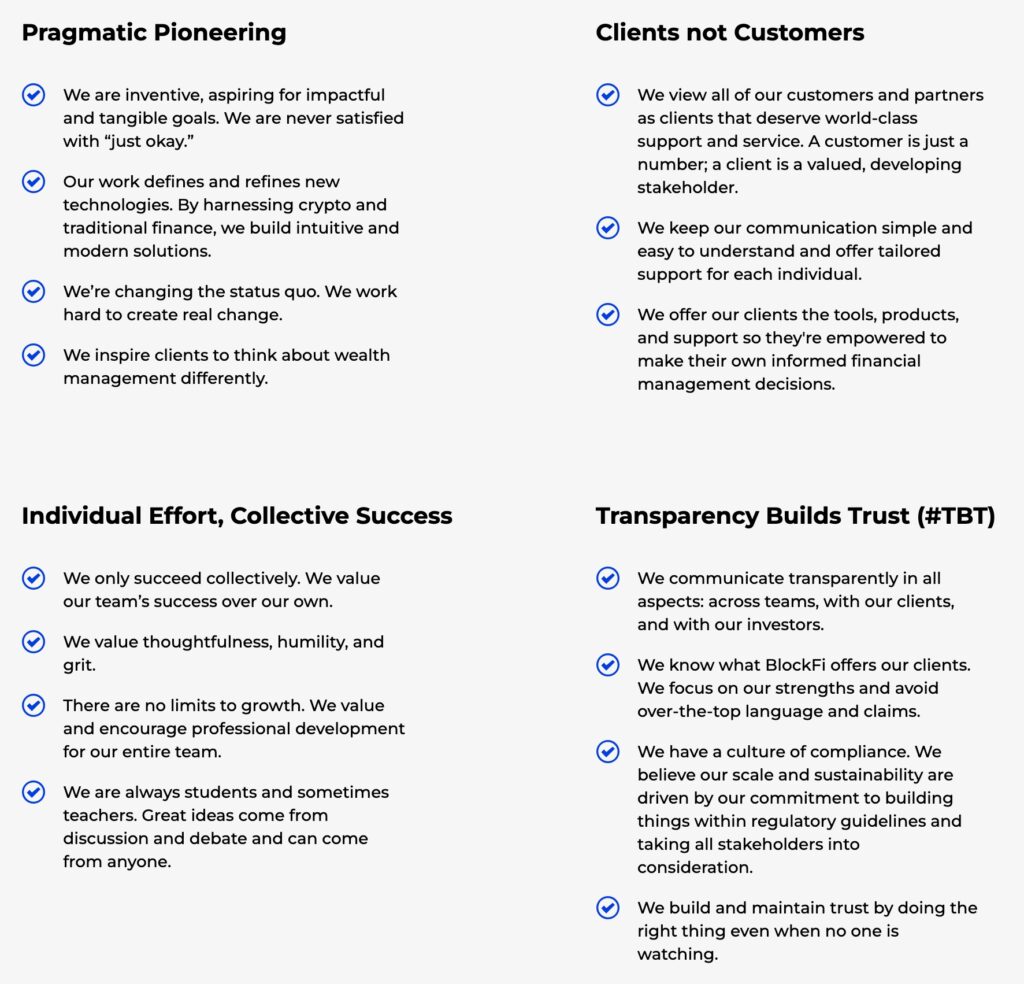

BlockFi’s values encompass their views on why what they’re doing matters and how they view their clients.

Their goal is to “change the status quo” and to grow without limits, something they’ve been doing pretty well with so far!

They view their clients as valued individuals with a stake in the company and make sure to give them real, meaningful support when needed.

Lastly, BlockFi aims to be transparent and to operate within regulatory boundaries.

Before You Buy

While BlockFi has taken many steps to ensure its customers safety and protect them from losing their cryptocurrency, it is important to understand the risks that are inherent with the type of business model the platform is running.

BlockFi is based in the U.S., which means it is subject to U.S. regulations.

This should come as a relief to many investors who are worried about the looser regulations that apply to other cryptocurrency exchanges, many of which are based internationally.

In addition to the regulations BlockFi has to adhere to, the company also chooses its borrowers carefully.

When BlockFi takes the cryptocurrency in your BIA and lends it out, it chooses reputable borrowers and requires a high LTV ratio from them in order to execute the loan.

This means that BlockFi takes extra steps to protect you in the event that one of their borrowers is unable to repay the loan provided to them with the cryptocurrency from your BIA.

While the U.S. regulations and reliable borrowers associated with BlockFi are a good step towards protecting customers, the biggest risk associated with putting money into a BlockFi account is the fact that it is uninsured.

With most regular brokerages, your investments and uninvested cash are insured by the Securities Investment Protection Corporation (SIPC).

This means that your investments and cash are protected in the event that your brokerage goes out of business. (It does not, however, mean that you are insured if your investments simply go down in value.)

With most bank accounts, your deposits are insured by the Federal Deposit Insurance Corporation (FDIC). This means that your deposits are covered in the event that there is a bank run and your bank does not have the cash to pay out your withdrawals.

While BlockFi acts as both a brokerage and an interest-bearing bank account for cryptocurrency, its accounts are not insured by the SIPC or the FDIC.

This means that, in the event that the company goes out of business, you could be at risk of losing the cryptocurrency and cash in your BIA and your investment account.

This risk should not be taken lightly and should be considered heavily before putting your cryptocurrency into a BlockFi account.

It is also important to keep in mind that cryptocurrency is an asset whose value can fluctuate constantly, which is risky when using it as collateral for a loan.

While the current value of your cryptocurrencies may be enough to secure a loan with a LTV ratio of 50% or less, your crypto can always go down in value and reduce that ratio.

A heightened LTV ratio will lead to a demand for more collateral, which can be a dangerous situation if you don’t have more money to deposit into your account.

Final Thoughts

BlockFi is an extremely innovative cryptocurrency institution that is expanding into spaces that have never before been explored.

As long as you can look past the risk that comes along with putting your crypto into an interest account and an investment account that are uninsured, BlockFi can be a great way for you to grow your money.

If this BlockFi review helped you make a decision, leave a comment below to tell us what you think!

Oh, and don’t forget to join the waitlist for the BlockFi Rewards Credit Card!

We are experienced users of dozens of stock trading platforms. We stay up to date on these platforms' service offerings, subscription fees, trade commissions, and welcome bonuses. The brokerages listed below are for U.S.-based investors, and are ranked in order of overall value received after taking advantage of their sign-up and/or referral offers. ✅ U.S. stocks, ETFs, options, and cryptos $3 monthly sub 10k in assets Growth $3; + $9 Month Bronze $3; Silver $6; Gold $12 a monthThe Best U.S. Brokerages as of June 30, 2025

Ranking of Top U.S. Stock Brokerages Based on Fees, Features, and Sign-Up Bonuses

Rank

Brokerage

Fees

Features

Sign-Up Bonus

Read Our Review

1.

$0

✅ Now 23,000,000 users

✅ Cash management account and credit cardFree stock up to $200 with new account, plus up to $1,500 more in free stock from referrals

Robinhood Review

2.

Moomoo

$0

✅ Free Level 2 Nasdaq quotes for advanced traders

✅ Access to U.S. and Hong Kong markets

✅ Learning tools built in60 free stocks with $5k deposit; or 25 free stocks with $2k deposit

Moomoo Review

3.

Interactive Brokers

$0

✅ Access 150+ global stock exchanges

✅ IBKR Lite & Pro tiers for different experience levels

✅ SmartRouting™ and deep analytics for executionRefer a Friend and Get $200

Interactive Brokers Review

4.

M1 Finance

✅ Automated investing “Pies” with fractional shares

✅ Integrated banking & low-interest borrowing

✅ No trading fees with scheduled trades$75-$500 Tiered Sign-up bonus

M1 Finance Review

5.

Webull

$0

✅ Extended-hours trading premarket and after-hours

✅ Built-in technical charts, screeners, and indicators

✅ Commission-free options trading$10 and a 30-day complimentary subscription to Webull premium;

$200-$30,0000 Tiered Sign up bonusWebull Review

6.

Public

$0

✅ Fractional shares of U.S. stocks and ETFs

✅ No payment for order flow (PFOF) model

✅ “Alpha” tool with earnings calls and sentiment data$100-$10,000 Tiered Cash Account Transfer Bonus

Public Review

7.

Composer

$32 a month

✅ Invest in fully automated stock strategies

✅ Build custom strategies with our no-code builder

✅ IRAs$49 per successful referral with no limit on the number of referrals

Composer Review

8.

Stash

✅ Stock-Back® debit card rewards in fractional shares

✅ Auto-invest and budgeting tools for beginners

✅ Curated theme portfolios for retail investors$5 when you invest $5

Stash Review

9.

Acorns

✅ Automated investing portfolios

✅ ESG curated portfolios

✅ Retirement Accounts

✅ Acorns Early Invest for Kids' AccountsGet a $20 bonus when you start saving & investing

Acorns Review

10.

Etoro

$0

✅ CopyTrading™ feature to follow top traders

✅ Trade U.S. stocks, ETFs, and crypto in one app

✅ Commission-free trades with themed portfolios$10 Crypto Sign-Up Bonus

Etoro Review

11.

Robinhood Gold

$5

✅ 4% APY on cash

✅ 3% IRA match

✅ Level II data; Morningstar

✅ No interest on first $1,000 of margin Save with Annual Fee

Robinhood Gold Review

12.

Cash App

$0

✅ U.S. stocks and bitcoin; $1 minimum

✅ Peer-to-peer payments

✅ Beginner-friendly financial ecosystemUp to $200 in free overdraft coverage and earn 4% on cash

Cash App Review

Fees, features, sign-up bonuses, and referral bonuses are accurate as of May 31, 2025. All information listed above is subject to change.