Are you interested in trading cryptocurrencies like Bitcoin and Dogecoin? If the answer’s yes, then you may be on the hunt for a crypto trading platform that easily links to your bank account, and wondering which option is best for you.

Coinbase is one of the oldest and most popular crypto trading exchanges around. Coinbase is FDIC-insured (see the Security Measures section for more details) and free to use. If you’ve heard about Coinbase Pro, you might be wondering how it compares. The bottom line is that Coinbase eliminated Coinbase Pro in 2023 and has replaced it with Coinbase One.

To give you an idea of just how big Coinbase is, the company reported revenue of $6.29 billion in 2024, more than doubling its 2023 revenue.

Coinbase has had more than 100 million users since its start and has 10.8 million active monthly users as of April 2025.

In this article, we’ll compare Coinbase Pro vs Coinbase, and let you know how these options compare. We’ll include information about fees, which coins are available to trade, features, and much more.

Pro Tip:

Sign up today and get $50 of BTC for free after making your first trade on Coinbase!

Key Differences Between Coinbase and Coinbase Pro

Before you decide whether to use Coinbase’s basic platform or Coinbase Pro (now Coinbase One), let’s review the differences between Coinbase and Coinbase Pro.

User Interface and Experience

Coinbase has a nice, clean user interface that’s easy to navigate. It’s ideal for beginners who want to get their feet wet trading cryptocurrency but don’t have the experience to take full advantage of Coinbase’s Pro option.

With Simple Trade, you’ll find trading categories that include digital assets such as Currencies, DeFi, Smart Contracts, and Stablecoins. In other words, this platform is for straightforward trades that beginners can execute without any difficulty.

By contrast, Coinbase Advanced Trade, or a Coinbase One account, allows for more complex trades, including Spot Trades and Futures with advanced charts.

Coinbase One makes it easy for users to review and compare trading pairs, sort pairs based on currencies, create crypto watchlists, and check out new markets for trading.

The overall design of these two options is similar, so jumping from one to the other doesn’t require making a big leap in terms of understanding how to get around. The primary difference is in the complexity of trades allowed, which is why we recommend Coinbase for beginners and Coinbase One for more experienced traders.

Fee Structure

Coinbase uses a maker-taker fee structure. When you buy cryptocurrency and the transaction goes through immediately, you’re a taker. The basic fee is between 0.05% and 0.60% and will be disclosed at the time of the transaction. If there’s a waiting period to match your transaction, you’re considered a maker and will be charged a fee between 0.00% and 0.40%.

For Coinbase users, there will also be a spread fee, which varies from trade to trade and will be fully disclosed before you finalize your trade.

There are some volume considerations, plus different fees for stable pairs, ranging from 0.10% to 0.45%. You can find the full fee structure on their fees page.

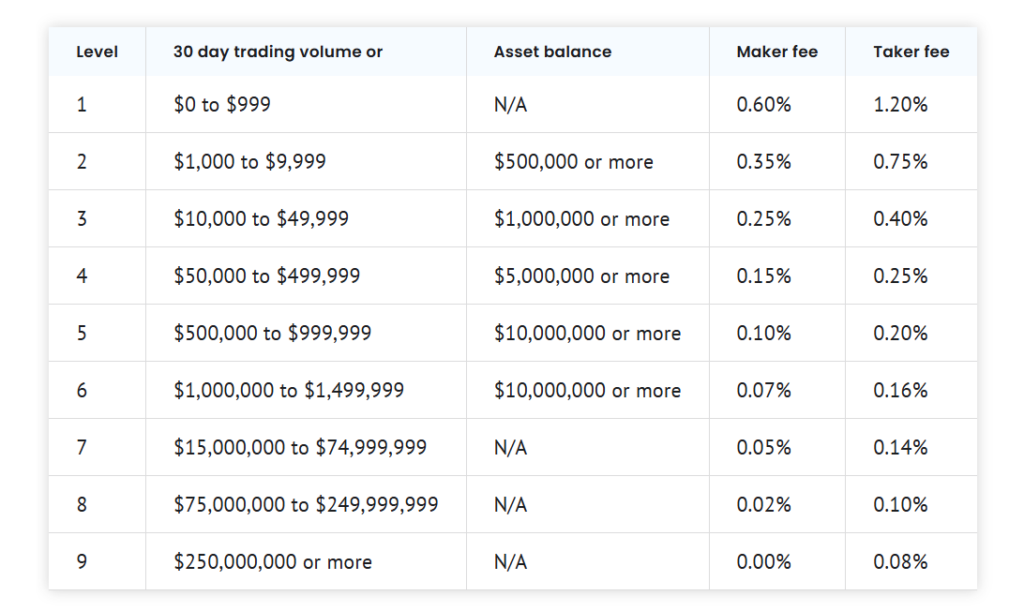

Coinbase One has lower fees for higher volume trades. There are a lot of variables. This chart shows how the rates decrease as volume increases.

As you can see, maker fees may be as low as 0.00% and taker fees may be as low as 0.08% if you use Coinbase One.

One final note: Coinbase is free, but Coinbase One comes with a monthly subscription fee of $29.99.

Pro Tip:

Sign up today and get $50 of BTC for free after making your first $50 trade on Coinbase!

Available Cryptocurrencies

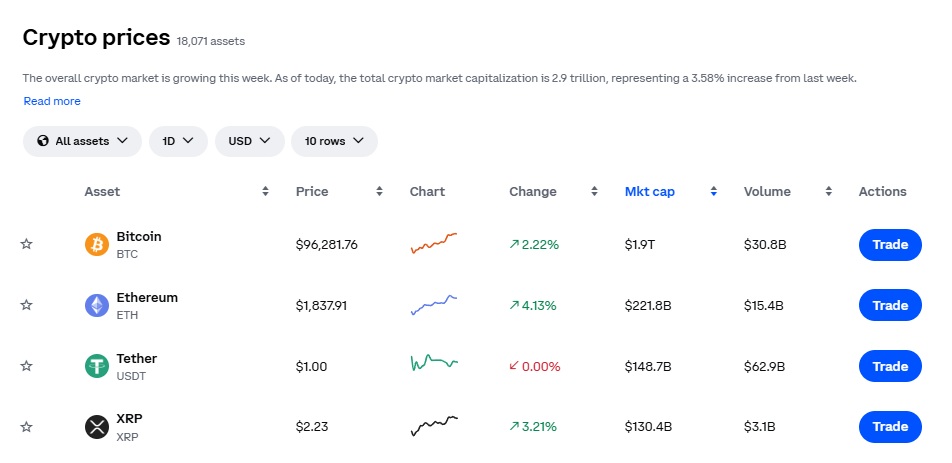

Both Coinbase and Coinbase One have a wide array of cryptocurrencies available for trading through the Coinbase exchange. Coinbase One offers more cryptocurrency options than Coinbase. Here’s how it breaks down.

Coinbase has 260+ cryptocurrencies available for trading as of December, 2024. These include major currencies such as Bitcoin and Ethereum, stablecoins such as USDT, and alt coins like Dogecoin and Cardano. Users can trade over 400 pairs, as well.

Coinbase One users have more than 500 available cryptocurrencies and 467+ trading pairs available. People who want a more substantive list of coins to buy and trade will be best served by using One.

Features

If you decide to subscribe to Coinbase one, you’ll get access to a larger selection of features and analysis tools than you would as a free Coinbase user.

- Access to 24/7 priority customer support

- Tax assistance, including pre-filled tax forms (specifically Form 8949)

- Zero-fee trading for many (but not all) trades

- Higher crypto staking rewards

- 25% back on Coinbase Advanced spot trades

- Lower maker/taker fees based on volume

- Earn 4.5% APY on USDC holdings

- Automatic entry in members-only sweepstakes for a chance to win up to 1 BTC

- Access to special deals from Coinbase partners

While you will pay a monthly fee for Coinbase One, you’ll get a lot in return. If your trading volume is high enough to justify the subscription cost, it may be worthwhile to choose Coinbase One over a free Coinbase account.

Transfer Fees

Now let’s compare Coinbase vs Coinbase Pro transfer fees. While trading fees may be lower on Coinbase One than they are on Coinbase’s basic platform, that’s not true of transfers, which are all processed in the same way. Here’s how they break down. (Note that in some situations, fees may not be disclosed up front.)

- Mining and network transaction fees. These fees are charged when you transfer cryptocurrency off of the Coinbase platform and are charged to users as part of Coinbase’s overall fee structure.

- Lightning Network processing fees. These are fees from a microprocessing network that allows for the transfer of Bitcoin without paying Bitcoin blockchain fees. Coinbase charges a fee of 0.1% per transfer.

- Withdrawal fees. Coinbase charges withdrawal fees based on the withdrawal type. ACH withdrawals to your bank account are free, and wire withdrawals are $25; fees vary for international customers.

You’ll want to double check the fees and make sure you understand what you’re being charged before you finalize any transaction. If you’re in the US, the least expensive option is the ACH transfer, which is free.

Security Measures

Both Coinbase and Coinbase One (formerly Coinbase Pro) offer extensive security measures to protect users.

- FDIC insurance is in place for all USD (US dollar) deposits up to a maximum of $250,000 per user. (Applies only to users in the United States, and to balances held at FDIC or NCUSIF-insured institutions.)

- Coinbase has also purchased crime insurance to protect users against failures in Coinbase’s security. (Their insurance won’t protect you if you use a weak password or share your information with a third party.)

- Two-factor authentication (2FA) is in place, with security key support.

- All transactions off and on the Coinbase platform have end-to-end encryption.

- The platform itself also has state-of-the-art encryption.

- Most user crypto assets are kept in cold storage.

- Multi-level withdrawal approval.

Coinbase has gone the extra mile to make sure that its users’ assets and cash deposits are protected.

Which Platform is Right for You?

Now, let’s talk about which platform, Coinbase or Coinbase One, is right for you.

The basic Coinbase wallet platform has a clean and user-friendly interface that allows for simple transactions, including buying, selling, converting, and sending cryptocurrency. There’s not much learning required. In fact, most users can jump right in, fund their accounts, and start trading as soon as their account is approved.

Coinbase One is best suited for more experienced traders looking for advanced trading features. There are more cryptocurrencies available and more trading pairs. Those who are trading at higher volumes will be well served by the Coinbase One fee structure as well.

Pro Tip:

Sign up today and get $50 of BTC for free after making your first $50 trade on Coinbase!

Conclusion

The bottom line is that the difference between Coinbase and Coinbase Pro (now known as Coinbase Advanced Trade) is a matter of preference. The key variations between the two are:

- Usability: Coinbase is easier to use, while Coinbase One is more complex.

- Available Cryptocurrencies: a normal Coinbase wallet has 260+ crypto coins available to trade while Coinbase One has more than 400, along with advanced trading tools.

- Fee Structure: Coinbase charges higher fees overall in exchange for simplicity, while Coinbase One has a tiered structure that is ideal for those with higher trading volume.

- Subscription Cost: Coinbase is free, and Coinbase One is a subscription fee that costs $29.99 per month.

Both options offer state-of-the-art security and charge the same withdrawal fees.

Ultimately, the choice comes down to your individual needs and goals. Coinbase is best for those who are just starting their cryptocurrency journey, while Coinbase One is better for professional crypto traders, looking for a sophisticated trading platform. If you are curious about how Coinbase stacks up to other Crypto platforms check out: Coinbase vs Binance

FAQs

The answer depends on your needs. Overall, we believe that Coinbase’s simple fee structure and streamlined interface make it best for beginning or casual cryptocurrency traders. Those who want access to additional coins and trading pairs and those trading at high volumes will be better served by Coinbase One.

Yes, Coinbase Pro has been discontinued and is now called Coinbase One. There are some minor differences in the features, but they’re essentially the same.

The Best Crypto Brokerages as of September 30, 2025

Ranking of Top Crypto Brokerages Based on Fees, Features, and Sign-Up Bonuses

We are experienced users of dozens of crypto platforms. We stay up to date on these platforms' service offerings, subscription fees, trade commissions, and welcome bonuses. The brokerages listed below are for crypto investors, and are ranked in order of overall value received after taking advantage of their sign-up and/or referral offers.

✅ No commission

✅ Crypto price alert

✅ Access to over 250 cryptocurrencies

✅ 24/7 customer support for verified users

✅ Institutional-grade custody services with SOC 2 compliance

✅ Crypto rewards credit card with BTC/ETH back

✅ High staking yields on 15+ assets

✅ Regulatory licenses across U.S., Canada, and Europe

• $50 in BTC after a $25 deposit & $10 trade.

• 20% fee rebate via select referral codes.

✅ Transparent spread-based pricing with no commission

✅ Recurring buys and wallet-to-wallet transfers

Fees, features, sign-up bonuses, and referral bonuses are accurate as of September 30, 2025. All information listed above is subject to change.