If you’re looking for an investing platform with a mobile app and easy-to-use features, you might be comparing Fidelity vs Robinhood and wondering which is best for you.

There are lots of things to consider. For example, which investment options and account types are available? Do Robinhood or Fidelity charge trading fees, and if so, how much are they?

Choosing the right platform requires some thinking on your part. What are your investment goals? How much are you willing to pay for a platform that suits your needs? Which investment tools are available?

We’re here to help with the answers to all these questions and more. In our Fidelity vs. Robinhood review, we’ll let you in on how both platforms work, which features are included, and how much they cost.

By the time you’ve finished reading, you’ll have everything you need to make an informed choice about which platform to use.

Overview of Fidelity and Robinhood as Online Trading Platforms

Let’s start with a high-level overview of both Fidelity and Robinhood as regulated online brokers that provide brokerage services, trading platforms, and related custody services for retail investors.

Both platforms operate under the same regulatory protections and are subject to strict oversight by U.S. financial authorities. Their brokerage accounts are protected by the Securities Investor Protection Corporation (SIPC), which safeguards customer securities up to applicable limits in case a brokerage firm fails. In addition, cash held in eligible accounts is protected through programs connected to the Federal Deposit Insurance Corporation (FDIC).

Fidelity’s brokerage operations are conducted through Fidelity Brokerage Services LLC, and clearing and custody services are provided by National Financial Services LLC, both of which are registered broker-dealers and members of FINRA and SIPC. This structure ensures that Fidelity’s retail brokerage accounts operate under strong regulatory protections applicable to large financial institutions.

Robinhood also operates as a registered broker-dealer and provides brokerage services through its trading or custody services framework. Like Fidelity, Robinhood brokerage accounts receive SIPC protection and follow the same regulatory standards designed to protect investors and their assets.

It’s important to remember that investing involves risk, and while these platforms provide regulatory protections, they do not eliminate market risk. All securities trading carries the potential for loss, and investors should evaluate their own investment objectives, experience level, and risk tolerance before choosing a platform.

Robinhood was founded in April 2013 by Baiju Bhatt and Vladimir Tenev with the mission of making securities trading more accessible through a mobile-first online trading platform. It became widely known for introducing commission-free trading and simplifying direct investment for beginner investors.

Fidelity, founded in 1946 and headquartered in Boston, is one of the largest asset managers in the world, with more than $5 trillion in assets under management. Fidelity stands out for offering a broader range of brokerage services, research tools, and account structures, making it especially appealing to advanced investors and seasoned investors who need professional-grade trading platforms.

Both Fidelity and Robinhood provide access to brokerage accounts that allow investors to trade stocks, exchange traded funds, and options contracts while benefiting from the same regulatory protections applicable across U.S. financial markets.

Robinhood vs. Fidelity Comparison: Features and Price

To help you compare Fidelity vs Robinhood more accurately, it’s important to look beyond basic trading tools and understand how account fees, account minimums, and brokerage services differ. While both platforms offer commission-free trading on many asset classes, certain account fees apply depending on how you use each platform.

Both Fidelity and Robinhood operate as online trading platforms that provide retail brokerage accounts, but their pricing structures, premium features, and account benefits are designed for different types of investors. Some accounts may involve transaction based service fees or activity assessment fees depending on trading volume and asset class. (Read: ROBINHOOD FEES)

| Fidelity Investments | Robinhood | |

| Investment types | Stocks, ETFs, Options, Mutual Funds, Cryptocurrencies (Bitcoin and Ethereum only), CDs, Bonds | Stocks, ETFs, Options, Cryptocurrencies |

| Fractional shares? | Yes | Yes |

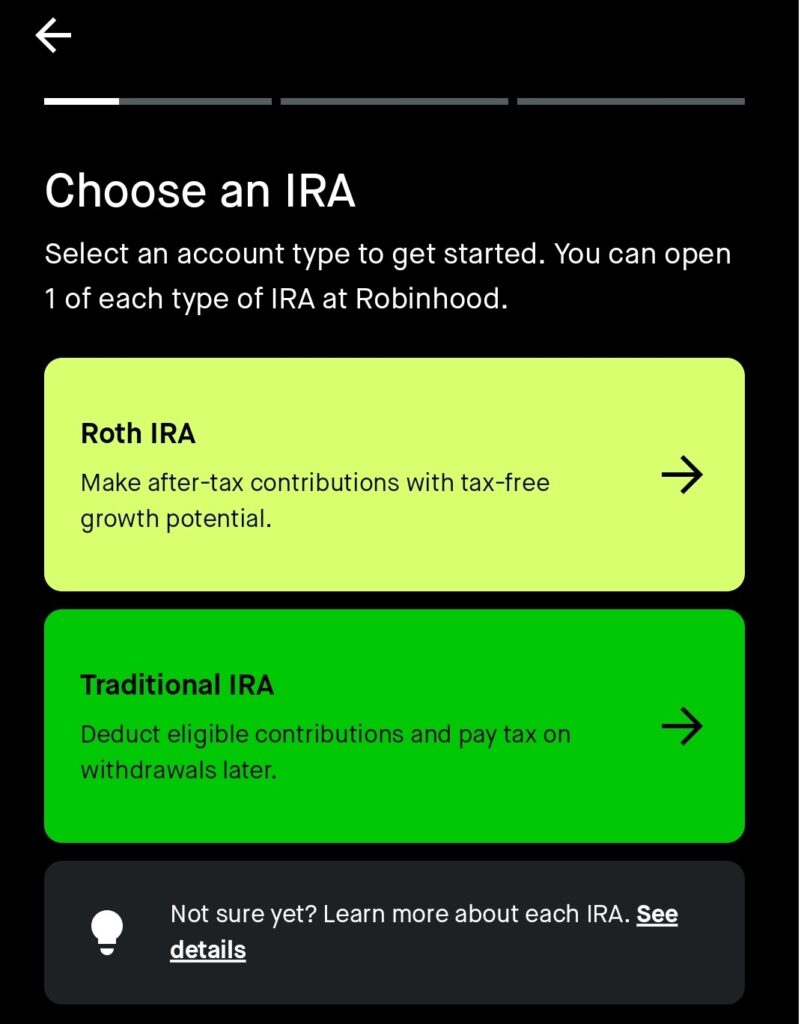

| IRA options | Traditional, Roth, SIMPLE, SEP, plus 401k | Traditional, Roth |

| IRA matching? | No | Yes; 1% with no cap; 3% for Robinhood Gold members |

| Stock & ETF commissions | $0 | $0 |

| Options commissions | $0; $0.65 per contract | $0 |

| Premium service? | No | Yes; Robinhood Gold for $5/month of $50/year |

| Free mobile app? | Yes | Yes |

| Mobile advisory? | Yes | No |

Let’s highlight a few key differences here. When comparing Fidelity vs Robinhood, one major distinction is how each platform handles retirement accounts, account fees, and premium services.

Robinhood stands out by offering IRA matching contributions, which is rare among retail brokerage accounts. Standard users receive 1% matching, while Robinhood Gold members receive 3% matching on IRA contributions. This feature makes Robinhood attractive for investors focused on long-term retirement growth without employer-sponsored plans.

Robinhood Gold is a premium subscription designed for investors who want access to margin trading benefits, higher APY on uninvested cash, and advanced account features. However, unlike Fidelity, Robinhood Gold is a paid service, which means account fees apply through a monthly or annual subscription.

Fidelity, on the other hand, does not charge for premium subscriptions like Robinhood Gold. Instead, Fidelity offers zero account fees and zero account minimums on most of its retail brokerage accounts. This makes Fidelity appealing to investors who want professional tools without paying recurring membership costs.

Fidelity also provides a cash management account that includes a cash sweep program. This program automatically moves uninvested cash into interest-bearing options, helping investors earn passive returns while maintaining liquidity.

Robinhood offers competitive interest on uninvested cash as well, but it is tied more closely to its Gold subscription benefits.

When comparing account fees, it’s important to note:

- Fidelity generally avoids inactivity fees

- Robinhood does not charge inactivity fees but applies subscription fees for premium services

- Some transaction based service fees or activity assessment fees may apply depending on asset type and market conditions

These differences can significantly affect the overall cost of using each platform over time.

Unlike Fidelity, Robinhood offers a premium subscription called Robinhood Gold. This service is designed for active traders who want enhanced account features and expanded trading capabilities.

- 3% matching for IRA contributions (must remain a Robinhood Gold member for at least a year to retain matching funds)

- No interest on the first $1,000 you borrow for margin trading

- 4.5% APY on uninvested cash in your account

- Priority customer support

- Access to professional-grade market data tools

Robinhood vs. Fidelity: Investment Options and Account Types

One of the most important things to consider as you weigh your options is the investment choices and account types that are available on both platforms.

Variety of Investment Options

When comparing Fidelity vs Robinhood, one of the biggest differences is the range of asset class options available through each brokerage platform. Fidelity offers a much broader set of investment options, making it more suitable for investors who want diversification across multiple asset classes and long-term investment strategies.

Fidelity allows direct investment in:

- Stocks and equity trades

- Exchange traded funds (ETFs)

- Mutual funds

- Fixed income investments such as bonds and CDs

- Options trading and options contracts

- Cryptocurrency exposure through Fidelity Digital Assets and Fidelity Crypto offerings

- Managed accounts and professionally guided portfolios

This wide range of such assets is attractive for investors who want access to traditional securities trading, fixed income, and alternative investment products in one place.

Robinhood offers a more streamlined set of investment options focused on simplicity:

- Stocks

- ETFs

- Options

- Cryptocurrency trading

While Robinhood’s selection is narrower, it still covers the most popular asset classes for everyday investors who want fast access to equity trades and digital assets through an easy-to-use online trading platform.

Robinhood particularly stands out in crypto accessibility, operating as a virtual currency business that allows users to trade a wider selection of cryptocurrencies directly from their brokerage accounts.

This difference makes Fidelity better for diversification-focused investors, while Robinhood is ideal for users who prefer a simplified investing experience, check out our new guide covering it: IS ROBINHOOD GOOD FOR CRYPTO?

Pro Tip:

Sign up with Robinhood today and refer friends to earn FREE SHARES worth up to $1500 a year!

Comparing Account Types

Both Fidelity and Robinhood offer several types of investment accounts designed for different investing needs. These include retail brokerage accounts, retirement accounts, and specialized account structures.

Fidelity supports a wide range of account types, including:

- Retail brokerage accounts

- Individual taxable accounts

- Retirement accounts such as Traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs

- Custodial accounts for minors

- Managed accounts for investors who want professional portfolio oversight

- Cash management accounts that integrate banking-style features

These account structures allow Fidelity to serve investors who want hands-on trading, passive investing, or professionally managed investment strategies.

Robinhood offers a simpler lineup of such accounts, including:

- Standard brokerage accounts

- Traditional and Roth IRA accounts

- Margin accounts for margin trading

- Robinhood accounts designed for mobile-first investors

Robinhood focuses on accessibility and simplicity, making it appealing for beginner investors who want quick access to securities trading without complex account structures.

When comparing account minimums, Fidelity and Robinhood both maintain zero account minimums for most investment accounts, allowing investors to get started without large upfront deposits.

Choosing between these platforms often comes down to whether you want a simplified account setup (Robinhood) or a more flexible brokerage structure with advanced investment strategies and account management options (Fidelity).

Who Should Choose Robinhood and Fidelity?

The decision about which investment accounts to use is largely based on your personal preferences.

Robinhood is likely the best choice for younger, mobile-first investors who prefer a streamlined platform. It’s not the right place for investors who want to dig deep into the numbers or small time active traders. Instead, it’s ideal for those who want access to market news and prices at their fingertips and are comfortable making their own investment decisions. It’s also a good pick for anybody who wants to take advantage of IRA matching contributions and free Robinhood stocks.

Fidelity has a more in-depth trading platform that includes a robo advisory. Investors get access to stock screeners and can engage in certain types of riskier trading, including short selling and OTC penny stock trading for serious investors. Fidelity also offers mutual fund trading.

We would say that on the whole, Robinhood is best suited for beginner retail traders and those who want a streamlined and easy-to-use interface with the possibility of margin account savings. Fidelity may be better suited to more experienced investors.

Pro Tip:

Sign up with Robinhood today and refer friends to earn FREE SHARES worth up to $1500 a year!

Robinhood vs. Fidelity: User Experience

You should consider the user experience for any trading platform. Here’s our take.

Both Fidelity and Robinhood provide strong customer service, but Fidelity stands out by offering access to live representatives and financial advisor support. This can be especially valuable for investors who want professional investment advice alongside their online trading experience.

How Easy Are Fidelity and Robinhood to Use?

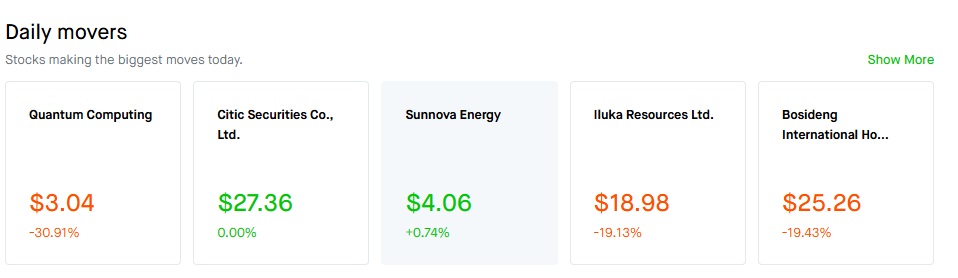

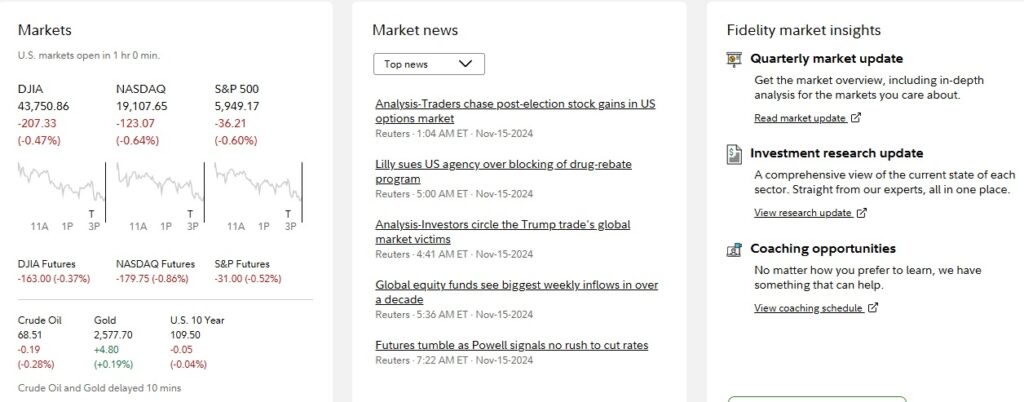

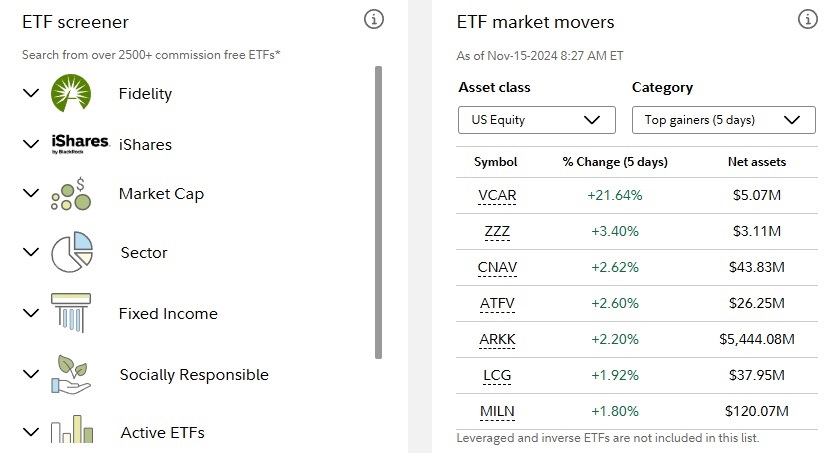

Given that Robinhood started as a mobile app, you might expect them to have the edge in usability, and they do. That said, it’s not a huge advantage. Fidelity has done a good job with its mobile app.

We give Fidelity a slight advantage for its desktop model and online platform. It has a lot more features to help investors learn about stocks, ETFs, and so on. That said, beginners may prefer Robinhood’s simple interface.

Our final observation is that customer service isn’t as easy to access on Robinhood as it should be. Users are required to send a message through the app and wait for someone to get back to them. By contrast, Fidelity’s customer service is available 24/7.

Ideal for Different Users

Ultimately, our take is that Fidelity is ideal for advanced investors who want access to Fidelity’s rich array of research tools. With multiple charting options and in-depth analysis, Fidelity is designed to give investors the information they need to make smart investment decisions.

Robinhood is geared toward new investors who want a quick and easy way to get started. Its simplicity and clean interface make it possible to jump right into investing and learn as you go.

Fidelity also stands out for offering advanced tools such as technical indicators, Level II market data, and access to a financial advisor through managed accounts and advisory services. These features appeal to advanced investors who want deeper market insight and professional guidance.

Robinhood focuses more on accessibility and simplicity, supported by basic educational resources and a streamlined mobile interface. Its approach works well for beginner investors who prefer learning through direct experience rather than in-depth analysis.

Is Robinhood Better Than Fidelity?

When comparing Fidelity vs Robinhood, it’s important to remember that investing involves risk. All forms of securities trading carry the potential for loss, and some asset classes involve significant risk depending on market volatility, leverage, and trading strategy.

Choosing between these platforms should start with clearly defined investment objectives. Your experience level, investment strategy, and risk tolerance should guide whether you prefer a simplified platform like Robinhood or a more comprehensive brokerage like Fidelity.

Investors with a high risk tolerance who are interested in active trading, options contracts, or advanced market participation may find Fidelity more suitable. Those who prefer basic stock trading and a straightforward investment experience may feel more comfortable starting with Robinhood.

While Robinhood doesn’t offer as many investment options or features as Fidelity, we feel that its simplified approach is useful for people who may not have much knowledge about investing. You can buy fractional shares, which makes it easy to diversify your holdings.

Most of all, we like Robinhood’s democratic approach to investing. Anybody can join, anybody can invest, and overcoming the initial hurdles to investing is often the first step in a lifetime of saving (and earning) money.

Pro Tip:

Sign up with Robinhood today and refer friends to earn FREE SHARES worth up to $1500 a year!

Final Verdict: Which is Best for You?

Our final verdict is that we think Robinhood offers benefits for most investors, particularly those who are just starting out. People who want to access advanced features can do it for just $50 per year with Robinhood Gold: a very affordable price when compared to some other options that are available.

Now that Robinhood offers Traditional and Roth IRAs, it is one of the best choices for those who want to kickstart their retirement savings through trading platforms. Upgrading to Robinhood Gold can help you earn 3% in matching contributions.

That said, if you want to invest in mutual funds or bonds, then you should go with Fidelity. They offer more diversity in terms of investments and they also have a robo advisor, which is something that appeals to a lot of young investors who want some advice on what to buy without having to pay for a financial advisor.

If you’re a beginner, we strongly suggest getting started with Robinhood. If you are curious about how Robinhood crypto offerings compare to mainstream companies such as Coinbase, check out our new review: ROBINHOOD VS COINBASE!

FAQs

Yes. Robinhood offers both Roth IRAs and Traditional IRAs, with 1% matching funds for regular members and 3% matching funds for Robinhood Gold subscribers.

Yes, Fidelity offers commission-free trading. They do charge a fee of $0.65 per option contract.

Robinhood has a simple interface that’s ideal for beginning investors. It’s easy to dive in and start investing right away.

Top U.S. Brokers Promotions for 2026

★ ★ ★ ★ ★

✅ Now 23 million users

✅ Cash mgt account and credit card

Free stock up to $200 with new account, plus up to $1,500 more in free stock from referrals; US residents only!

Get Free Stock

★ ★ ★ ★ ★

✅ Access to U.S. and Hong Kong markets

✅ Educational tools

Deposit $500 get $30 in NVDA stock; Deposit $2,000 get $100 in NVDA stock; Deposit $10,000 get $200 in NVDA stock; Deposit $50,000 get $400 in NVDA stock.

Get Free Shares

★ ★ ★ ★ ☆

✅ Trade U.S. stocks, ETFs, and crypto

✅ Trades with themed portfolios

★ ★ ★ ★ ☆

✅ Great charts and screeners

✅ Commission-free options trading

$10 and a 30-day complimentary subscription to Webull premium; $200-$30,0000 Tiered Sign up bonus

Learn more

★ ★ ★ ★ ☆

✅ IBKR Lite & Pro tiers for all

✅ SmartRouting™ and deep analytics