If you’ve ever felt frustrated by slow-loading finance websites cluttered with ads and pop-ups, you’re not alone. StockAnalysis.com has quietly built a reputation as one of the cleanest, fastest platforms for researching stocks and ETFs—and in this review, I’ll break down whether it lives up to the hype in 2026.

SPECIAL OFFER: For the second time in company history, StockAnalysis.com is running a 20% discount on all annual Stock Analysis plans. That means you can get Pro for $5.27/month, or Ultimate for $13.27/month!

The Bottom Line: Is StockAnalysis.com Worth Using in 2026?

After extensive testing in early 2026, I can confidently say that StockAnalysis.com delivers on its promise of being a “Yahoo Finance but better” experience for regular investors. Since its 2019 launch, the platform has grown to attract millions of monthly visits, and it’s easy to see why. The site pulls financial data from reputable providers like S&P Global and Nasdaq Data Link, which means the numbers you’re seeing are accurate and updated within minutes of earnings releases.

StockAnalysis.com is best suited for data-driven investors, swing traders, and ETF investors who already know how to interpret financial statements and valuation metrics. If you’re comfortable analyzing stocks on your own and just need fast access to reliable numbers, this platform will feel like a breath of fresh air. However, if you’re an absolute beginner wanting hand-holding explanations or step-by-step investment guidance, you may find the experience overwhelming—the site delivers data, not education.

The free version is surprisingly powerful for basic stock research, offering access to screeners, watchlists, and basic financial statements across 130,000+ global stocks and funds. The Pro plan (around $79/year) unlocks deeper historical data, ad-free browsing, and data exports, while the Unlimited plan (around $199/year) is designed for heavy users who need unlimited downloads and integration workflows. User sentiment across app stores and review platforms hovers around 4.7–4.9 stars, with most reviews praising the speed and data quality.

At a glance:

- Pros: Fast page loads, clean interface, comprehensive U.S. and global coverage, excellent stock screener with 290+ filters, strong value for money

- Cons: Limited interpretive guidance, charts less sophisticated than dedicated technical analysis tools, no API access, portfolio analytics are basic

- Best for: Experienced DIY investors, dividend and ETF researchers, traders who want quick data access

- Skip if: You need educational content, community discussion, or advanced backtesting

Want deeper financial data without the clutter? Try StockAnalysis Pro and unlock 10–40 years of financial history, advanced screeners, and ad-free research

What StockAnalysis.com Is (and Isn’t)

StockAnalysis.com is a stock and ETF research website and app founded in 2019 by Kris Gunnars, who also runs his own investment firm. The platform is operated by a small team blending finance expertise and software development, which explains its focus on data integrity and fast digital delivery. Unlike newsletter-style services that push stock picks and opinion pieces, StockAnalysis.com takes a minimalist approach—think of it as a “Bloomberg-lite” experience designed specifically for retail investors.

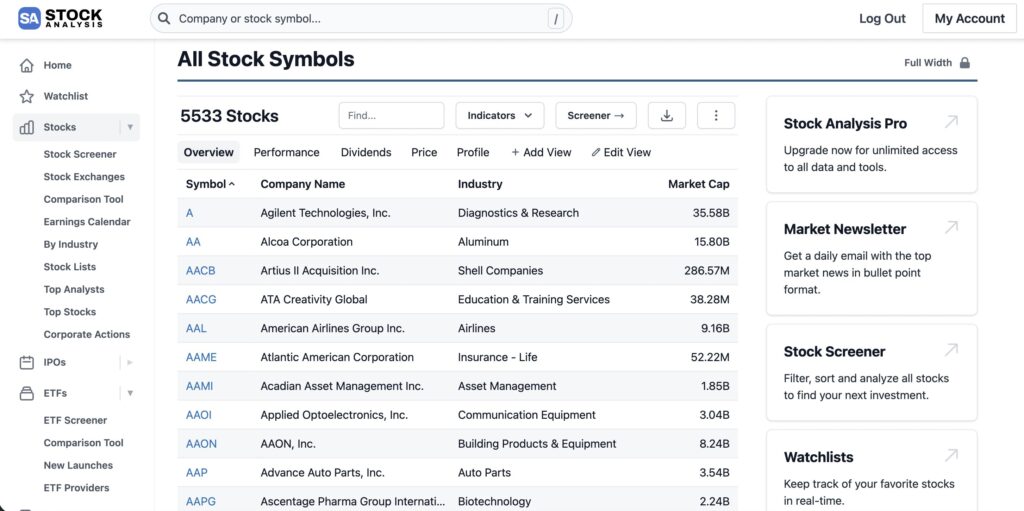

The core concept is straightforward: pages load quickly and present fundamentals, stock prices, and research tools for over 130,000 stocks and mutual funds across U.S. and global markets. You won’t find long-form opinion articles or social feeds here. Instead, you get clean access to the numbers that matter.

What it is:

- A data-focused platform offering financial statements, valuation ratios, dividend history, insider activity, analyst ratings, price targets, IPO data, and customizable screeners

- Coverage spans U.S. equities, ETFs, and an expanding list of international markets

- Available via web browser and mobile app (iOS/iPadOS/macOS, with Android users accessing via mobile web)

- Design philosophy emphasizes fast pages load times and minimal visual clutter

What it is not:

- No long-form editorial content or community discussion features

- No AI chat assistant or social trading integration

- No public API for programmatic access (due to data licensing restrictions)

- Not a replacement for dedicated technical analysis platforms if you need advanced charting

The platform is built for investors who want to get in, grab accurate data, and make investment decisions without wading through noise.

My Hands-On Experience Using StockAnalysis.com

I tested StockAnalysis.com extensively in January 2026 across both desktop (Chrome on Windows) and the iOS app on an iPhone running iOS 17. My goal was to simulate real research workflows—scanning for trending stocks, reviewing detailed financials, and building watchlists—to see how the platform holds up under practical use.

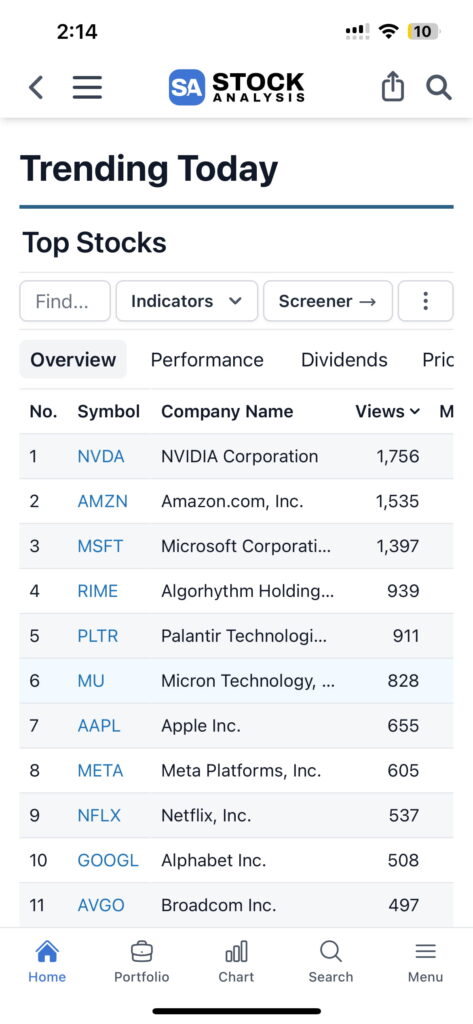

The homepage greets you with a global search bar front and center, flanked by sections highlighting market movers and trending stocks. Quick links to the stock screener, watchlist page, IPO calendar, and ETF tools are readily accessible without scrolling. The layout is intuitive enough that new investors can navigate immediately, while experienced traders will appreciate not having to hunt for features.

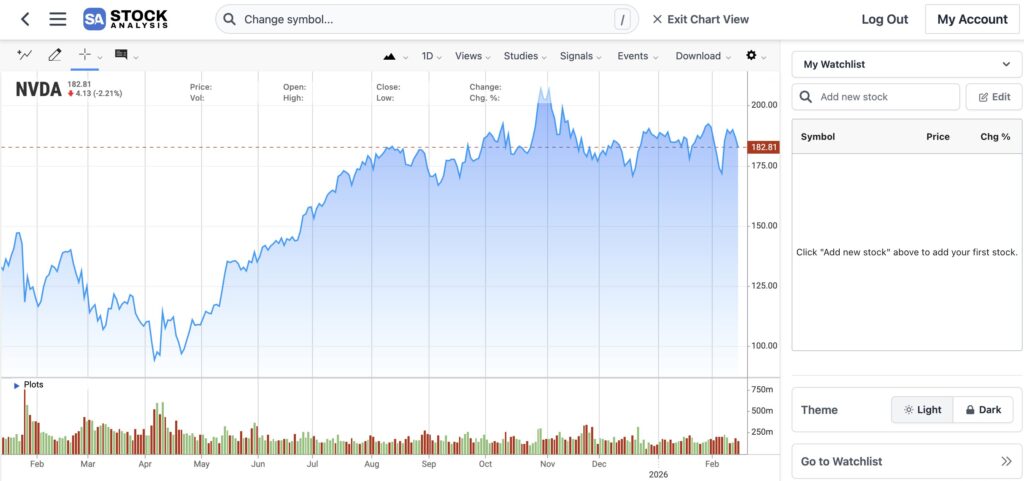

Opening a popular ticker like NVDA or AAPL brings you to an overview tab displaying the price chart, key ratios (P/E, EV/EBITDA, dividend yield), market cap, 52-week range, and a quick valuation snapshot. What impressed me most was speed—pages load in under a second on a typical home connection, and switching between tabs (Overview, Financials, Dividends, Statistics, Profile) happens almost instantaneously.

For U.S. stocks, the Financials section is particularly deep. You can view quarterly and annual income statements, balance sheets, and cash flow statements going back 10–40 years on Pro, depending on the company. The ability to toggle between raw values and per-share metrics is a nice touch for investors comparing companies of different sizes. Pro and Unlimited tiers also unlock CSV and Excel exports, which I found essential when building spreadsheet models.

I tested the stock screener by filtering for all U.S. large-cap dividend stocks with yield above 3% and payout ratio below 70%. The screener returned results in seconds, and I could save the filter for future use. With around 290+ filters spanning fundamentals, price metrics, dividends, sector, and country, the screener rivals tools that cost significantly more.

The mobile experience mirrored the desktop quality. Charts, customizable watchlists, and price alerts remained responsive throughout testing. Dark mode worked smoothly for evening research sessions, and the app never crashed or lagged during my week of use.

Key Features and Tools Explained

This section serves as a feature tour of StockAnalysis.com for 2026 users. I’ll break down each major tool and explain how it fits into a typical research workflow.

Stock & ETF Dashboards

Every ticker page—whether it’s MSFT, SPY, or QQQ—opens to a comprehensive dashboard. You’ll see the current price with real time prices during market hours (including pre-market and after-hours quotes for U.S. exchanges), a customizable price chart, valuation metrics, analyst price targets, and peer comparisons. Chart timeframes range from 1-day to max (full historical data), with basic technical indicators like moving averages, RSI, and volume overlays available. That said, if you need advanced charting tools like Fibonacci retracements or VWAP, you’ll want to supplement with a dedicated technical data platform.

Financials Section

This is where StockAnalysis.com truly shines for fundamental analysis. The Financials tab presents income statements, balance sheets, and cash flow data in both quarterly and annual views. For established U.S. companies, Pro subscribers can access 40+ years of financial history—a depth that’s rare outside of expensive terminals like Capital IQ. You can switch between absolute values and per-share metrics with a single click, and the layout makes it easy to spot trends in revenue growth, margins, or debt levels. This is the kind of detailed financials that serious investors need for researching stocks.

Stock & ETF Screeners

The screener is arguably the platform’s most powerful feature. With approximately 290+ filters, you can slice and dice the market based on virtually any criteria. Example filters include:

- Value: P/E ratio, P/B ratio, EV/EBITDA, PEG ratio

- Growth: Revenue growth rate, EPS growth, projected earnings

- Dividends: Current yield, dividend growth streak, payout ratio

- ETFs: Expense ratio, assets under management, underlying index tracked

I ran multiple sources of screens during my testing, from hunting for undervalued small-caps to identifying high-yield REITs, and the screener handled each request quickly. You can save custom screens and modify columns to display exactly the metrics you care about.

Watchlists & Portfolio Tracking

Adding tickers to your watchlist is a one-click affair—just hit the plus icon on any stock page. The watchlist page updates in real time without requiring a full page reload, showing day change, total change, and basic performance metrics. You can create multiple lists (I set up separate ones for “Growth Ideas,” “Dividend Core,” and “Watch Later”) to organize your research. Portfolio tracking is available but remains basic—you won’t find deep performance attribution, risk analytics, or tax lot tracking here.

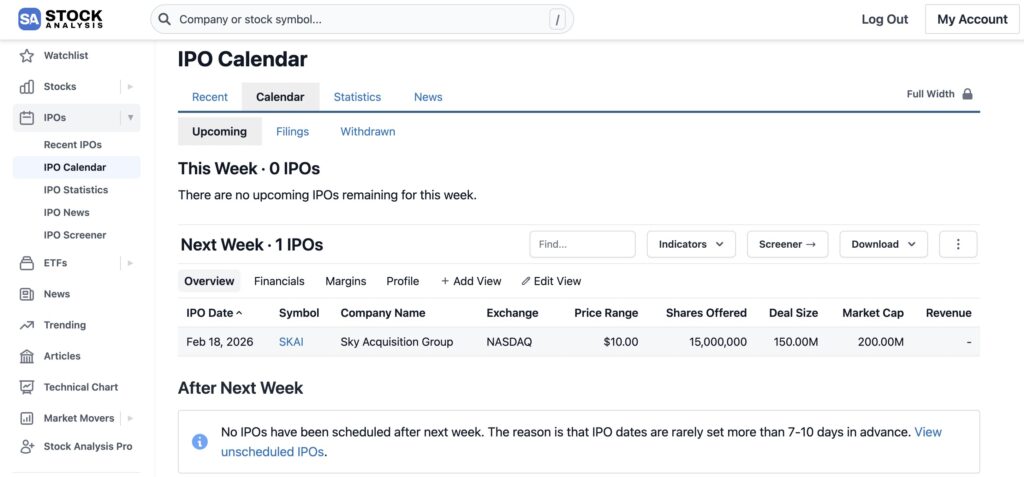

IPO Calendar & News

The IPO calendar displays upcoming and recent public offerings with dates, ticker symbols, exchange listings, and offering sizes. It’s a great tool for staying aware of new market entrants, though don’t expect deep editorial analysis on each IPO. The news section aggregates headlines relevant to your watchlist and market movers, keeping you informed without overwhelming you with social media noise.

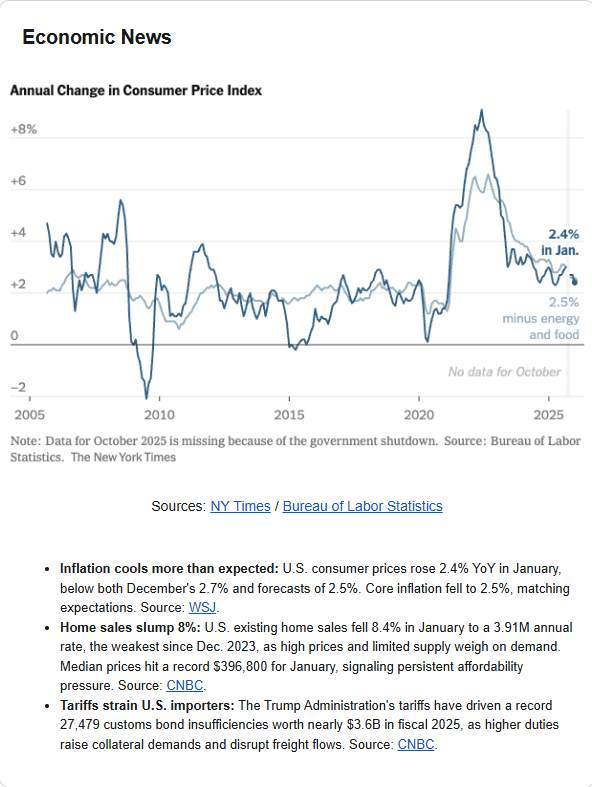

Morning Newsletter & Email Alerts

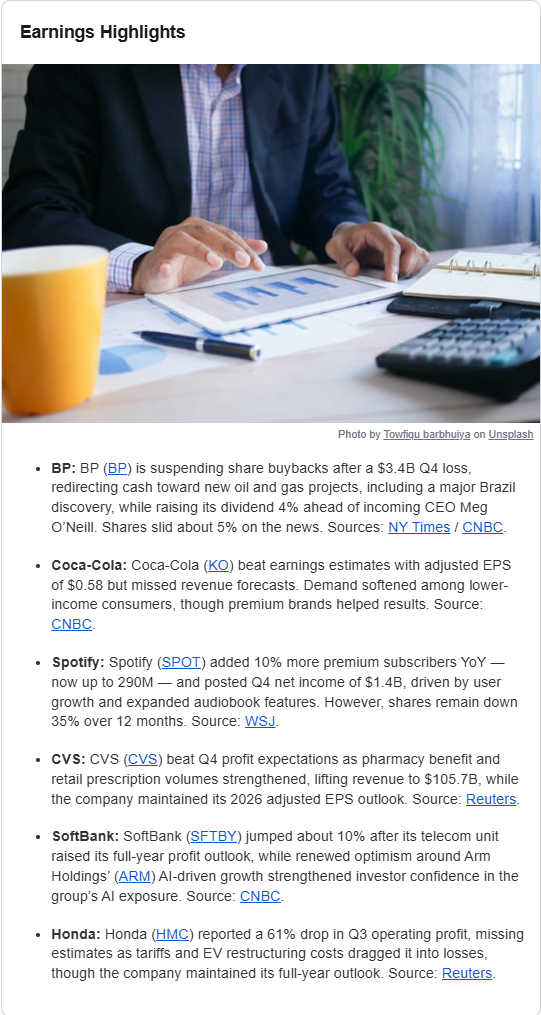

StockAnalysis.com also offers a free weekday morning newsletter delivered before U.S. markets open. After reviewing several issues, I’d describe it as a data-first briefing rather than an opinion-heavy market recap.

Each edition typically includes:

- Key economic events for the day (CPI, inflation data, Fed-related releases)

- Recent earnings reports with revenue, EPS, and year-over-year comparisons

- Upcoming earnings to watch

- Weekly IPO calendar updates

- Major market movers and headline summaries

- Pre-market index performance (S&P 500, Nasdaq, Dow)

What stands out is the format. Instead of paragraphs of commentary, you get structured, scannable data. For example, earnings are broken down clearly:

- Revenue (with YoY change)

- Whether the company beat or missed estimates

- EPS performance and surprise amounts

If you’re the type of investor who prefers raw numbers over opinions, this is a strong fit. It feels more like a Bloomberg-style snapshot than a newsletter trying to push stock picks.

There’s minimal editorial spin. You won’t find bold predictions or emotional takes — just concise summaries and links back to full financials inside the platform.

For active traders, dividend investors, and earnings-focused investors, this makes it easy to:

- Identify overnight movers

- Track companies reporting after the close

- Spot macro catalysts before the opening bell

It’s not meant to replace in-depth analysis or a premium research newsletter. But as a daily market orientation tool, it’s genuinely useful.

If you already use the screener and financial dashboards, the newsletter pairs well with your workflow — it highlights what’s moving, and you can immediately jump into deeper research.

Power-User Features

For those on paid plans, several conveniences unlock. Dark mode makes evening research sessions easier on the eyes. Custom columns in the screener let you display exactly the metrics you need. Data exports to Google Sheets or CSV format enable integration with your own spreadsheets and models. Unlimited plan subscribers get unlimited downloads, which is essential for professional bloggers, small RIAs, or anyone building data-intensive workflows.

If you’re serious about fundamental analysis, the Pro plan unlocks 40+ years of financial history, 200+ screener filters, and downloadable Excel/CSV exports.

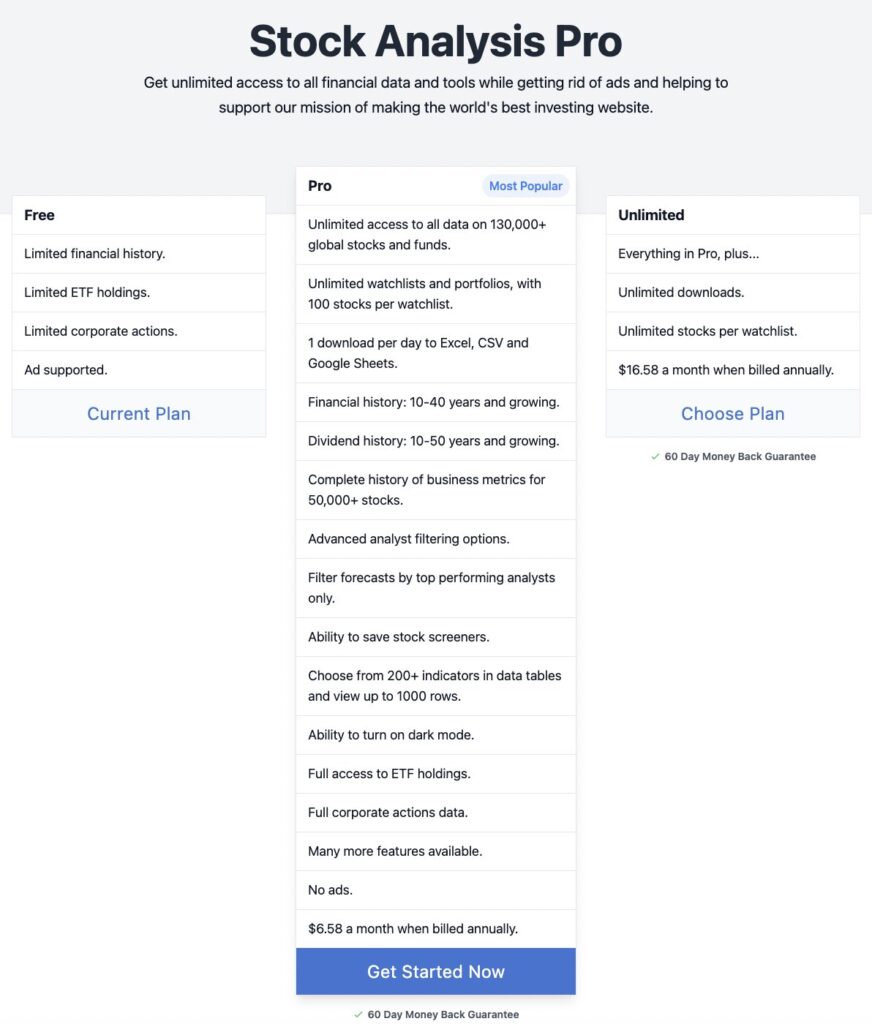

Pricing, Plans, and Value for Money

StockAnalysis.com operates on a freemium model with three main tiers: Free, Pro, and Unlimited. Unlike some platforms that gate basic features behind paywalls, the free version here is genuinely useful for everyday stock research.

2026 Pricing Breakdown:

- Free: $0, ad-supported. Access to all tickers, basic financial statements, screeners (with some filter limitations), watchlists, and portfolio tracking. No credit card required.

- Pro: $5.27/month, billed annually. Removes ads, unlocks 10–40 years of historical data, expands screener filters, enables data exports, and provides near real time prices for most U.S. exchanges.

- Unlimited: $13.27/month, billed annually. Designed for heavy users who need unlimited CSV/Excel downloads, making it ideal for quants, financial bloggers, and small funds that don’t want to pay for expensive terminals.

What Stays the Same Across Tiers:

All users get access to the full universe of 130,000+ stocks and funds, basic financials including income statements, balance sheets, and cash flow data, watchlists, and the core screener functionality. The free version is more than adequate for casual investors checking on a handful of positions.

What You Unlock with Pro:

The jump to Pro makes sense if you frequently analyze historical data for trend analysis. Having 40 years of financial history for major companies is invaluable for understanding long-term business performance. The removal of ads and faster data refreshes also improve the experience significantly. Exports become available, which is essential if you build your own spreadsheet models.

What You Get with Unlimited:

The Unlimited plan is primarily about volume. If you’re running frequent screens, downloading historical data sets regularly, or feeding information into external tools, the unlimited downloads justify the higher price. For most individual investors, Pro will be sufficient.

One standout feature is the 60-day money-back guarantee on paid plans. This is substantially more generous than the 7–30 day windows typical of finance tools in 2026, giving you ample time to evaluate whether the paid version fits your workflow.

Is It Good Value?

Compared to alternatives costing $150–$300+ per year (like Seeking Alpha Premium at $239/year or Stock Rover’s premium tiers), StockAnalysis.com offers strong value if your research style leans heavily on raw fundamentals and screener-driven discovery. You’re not paying for editorial content or community features—just clean, fast access to accurate information.

For less than $6 per month (billed annually), StockAnalysis Pro gives you unlimited access to data on 130,000+ global stocks — without ads.

Strengths, Limitations, and Who It’s Best For

After spending considerable time with StockAnalysis.com, here’s my synthesis of what works, what doesn’t, and who should consider signing up.

Strengths:

- Very fast page loads and responsive UI on both web and app—this is consistently the fastest finance research site I’ve used

- Comprehensive coverage spanning U.S. stocks, ETFs, and expanding global markets with over 130,000 securities

- Clear, well-organized financial statements and metrics that make fundamental analysis straightforward

- Excellent stock screener with 290+ filters and customization options rivaling paid-only tools

- Value-for-money pricing with a generous 60-day refund window on paid plans

- Data sourced from reputable providers like S&P Global, ensuring accurate data you can trust

- Great for tracking meme stocks and market movers with real-time updates

Limitations:

- Little or no built-in explanation of what the data means—if you don’t know what a metric indicates, the platform won’t teach you

- Charts are less sophisticated than specialist technical analysis tools; lacks interpretation for advanced setups

- Portfolio analytics are basic with no deep performance attribution, risk analysis, or tax reporting

- No native API for automated trading algorithms or programmatic data access

- The small team means feature development may be slower than larger competitors

Best For:

- Experienced investors who already know how to interpret fundamentals and don’t need hand-holding

- DIY traders who want to quickly scan for opportunities using screeners

- Long-term dividend and ETF investors needing reliable dividend and expense ratio data

- Anyone frustrated with cluttered platforms like Yahoo Finance or other sites overloaded with ads

- New investors who are comfortable learning on their own and just need access to reliable data

May Need Something Else:

- Absolute beginners requiring step-by-step educational content and guided learning

- Investors who rely heavily on advanced technical indicators, backtesting, or automated trading

- Those seeking community discussion, copy-trading features, or social investment feeds

- Users who need API access for quantitative strategies or algorithmic trade execution

The bottom line is that StockAnalysis.com works best as a fast, primary data source. Many users will find it valuable to combine it with other tools—perhaps a newsletter for stock picks or a charting platform for technical setups—but as a research foundation, it’s hard to beat at this price point.

Still unsure? You can try StockAnalysis Pro completely risk-free with a 60-day money-back guarantee — no questions asked. Test the full platform and decide if it fits your investing style.

FAQs

Yes, the free version is genuinely functional and not just a teaser. You can access screeners, basic financial statements, watchlists, portfolio tracking, and real time prices without paying anything. No credit card is required to test the free tools—you can simply create an account and start researching stocks immediately.

The platform has operated since 2019 and is backed by Vefir ehf., a company based in Iceland. Data comes from reputable sources including S&P Global and Nasdaq Data Link, which are industry-standard providers used by institutional investors. User ratings across app stores and review sites average around 4.8/5 stars, and the site maintains transparent data methodology pages explaining where information comes from. There’s no indication of any trade execution or money handling—it’s purely a research tool.

The platform uses automated quality checks and sources from established data providers, making it one of the more reliable free options available. That said, occasional small discrepancies can occur across all data vendors. For critical numbers—especially before making large investment decisions—I recommend double-checking against primary company filings (10-K, 10-Q) or the SEC’s EDGAR database.

Consider Pro if you frequently use screeners, need access to historical data going back decades, or want to export data to Google Sheets or Excel for custom analysis. The Unlimited plan makes sense for professional bloggers who publish data-heavy content, small RIA firms managing client research, or active traders running frequent screens who need unlimited downloads. If you’re a casual investor checking a few positions weekly, the free version will likely meet your needs.

Compared to article-heavy platforms like Seeking Alpha, StockAnalysis.com is faster, cleaner, and more focused on raw data rather than contributor opinions and stock ratings. Seeking Alpha offers more interpretive content and community discussion, while StockAnalysis.com excels at pure data access. Stock Rover offers more sophisticated portfolio analytics and charting for a higher price point. Neither is objectively “better”—it depends on whether you prioritize speed and data (StockAnalysis.com) or analysis and community (competitors).

If you’ve made it this far, you’re clearly serious about finding the right tools for your research workflow. StockAnalysis.com won’t make investment decisions for you—and it won’t pretend to. What it will do is give you fast, reliable access to the financial and technical data you need to make those decisions yourself.

Start with the free version to test the screener and financial statements on stocks you already follow. If you find yourself wanting deeper historical data or ad-free browsing, the Pro plan is a reasonable upgrade at $79/year. Either way, you’ll have a great tool that respects your time and delivers accurate information without the clutter.

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks as of December 27, 2025

We are paid subscribers to dozens of stock and option newsletters. We actively track every recommendation from all of these services, calculate performance, and share our results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Return vs S&P500" which is their return above that of the S&P500. So, based on December 27, 2025 prices:

Best Stock Newsletters Last 3 Years' Performance

| Rank | Stock Newsletter | Picks Return | Return vs S&P500 | Picks w Profit | Max % Return | Current Promotion |

|---|---|---|---|---|---|---|

| 1. |  Alpha Picks | 82% | 56% | 76% | 1,583% | February SALE: SAVE $50 NOW |

| Summary: 2 picks per month based on Seeking Alpha's Quant Rating; consistently beating the market every year since launch; tells you when to sell and they have sold almost half. See complete details in our full Alpha Picks review. Or get their Premium service to get their QUANT RATINGS on your stocks to better manage your current portfolio--read our Is Seeking Alpha Worth It? article to learn more about their Quant Ratings. | ||||||

| 2. |  Zacks Value Investor | 60% | 40% | 54% | 692% | February Promotion: $1, then $495/yr |

| Summary: 10 stock picks per year on January 1st based on Zacks' Quant Rating; Retail Price is $495/yr and includes 6 different services including those below. Read our Zacks Review. | ||||||

| 3. |  Moby.co | 50% | 16% | 74% | 2,569% | February Promotion: Next pick free! |

| Summary: 60-150 stock picks per year, segmented by industry; consistently beating the market every year; retail price is $199/yr. Read our full Moby Review. | ||||||

| 4. |  Zacks Top 10 | 36% | 15% | 71% | 170% | February Promotion: $1, then $495/yr |

| Summary: 10 stock picks per year on January 1st based on Zacks' Quant Rating; Retail Price is $495/yr and includes 6 different services. Read our Zacks Review. | ||||||

| 5. |  TipRanks SmartInvestor | 20% | 9% | 62% | 464% | Current Promotion: Save $180 |

| Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. | ||||||

| 6. |  Action Alerts Plus | 27% | 5% | 66% | 208% | Current Promotion: None |

| Summary: 100-150 trades per year, lots of buying and selling and short-term trades. Read our Jim Cramer Review. | ||||||

| 7. |  Zacks Home Run Investor | 5% | -0.4% | 45% | 241% | February Promotion: $1, then $495/yr |

| Summary: 40-50 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. | ||||||

| 8. | Dogs of the Dow Strategy | 16% | -1.8% | 43% | 44% | Current Promotion: None |

| Summary: Buy the 10 highest yielding dividends stocks in the Dow Jones Industrial Average on January 1st and sell on Dec 31st each year. | ||||||

| 9. | IBD Leaderboard ETF | 11.4% | -1.8% | n/a | n/a | February Promotion: NONE |

| Summary: Maintains top 50 stocks to invest in based on IBD algorithm; Retail Price is $495/yr. Read our Investors Business Daily Review. | ||||||

| 10. |  Stock Advisor | 34% | -3.9% | 75% | 289% | February Promotion: Get $100 Off |

| Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr. Read our Motley Fool Review. | ||||||

| 11. |  Zacks Under $10 | -0.2% | -4% | -4.3 | 263% | February Promotion: $1, then $495/yr |

| Summary: 40-50 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. | ||||||

| 12. |  Rule Breakers | 34% | -5.1% | 69% | 320% | Current Promotion: Save $200 |

| Summary: Rule Breakers is included with the Fool's Epic Service. Get 5 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. | ||||||

| Top Ranking Stock Newsletters based on their last 3 years of stock picks covering 2025, 2024, and 2023 performance as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF. Performance as of December 27, 2025. | ||||||