Looking for a Canadian online broker that combines low fees, flexible account options, and advanced trading tools? This Questrade review breaks down everything Canadian investors need to know before choosing Questrade as their go-to online brokerage.

Questrade has positioned itself as a strong alternative to traditional banks and legacy brokerages by focusing on cost transparency, powerful platforms, and investor control. In this Questrade review, we’ll cover account types, trading platforms, fees (including ECN fees), tools, safety, customer service, and who Questrade is best suited for.

Is Questrade a Legit and Safe Online Brokerage for Canadian Investors?

A common question in any Questrade review is whether the platform is legitimate and secure.

Questrade has been operating for over a decade, having launched in 1999. It is a registered investment dealer regulated by the Canadian Investment Regulatory Organization (CIRO) and protected by the Canadian Investor Protection Fund (CIPF). This protection helps safeguard client assets (up to applicable limits) in the unlikely event of insolvency.

From a security standpoint, Questrade uses strong encryption, two-factor authentication, and monitoring systems. While no platform can eliminate all risk, Questrade is widely considered Questrade safe for Canadian residents and Canadian citizens who want a secure online broker.

Account Types at Questrade

Questrade offers a wide variety of account types, making it suitable for many investing styles:

- TFSA (Tax-Free Savings Account): Grow investments without paying capital gains taxes on interest, gains, or withdrawals.

- RRSP (Registered Retirement Savings Plan): Defer taxes while saving for retirement.

- RESP (Registered Education Savings Plan): Save for a child’s post-secondary education; withdrawals are taxed at the beneficiary’s tax bracket.

- Cash Account: A standard self-directed trading account.

- Margin Account: Allows for leveraged trading and short selling.

- Corporate and Investment Accounts: Tailored for businesses and incorporated entities.

- LIRA, RIF, and Other Registered Plans: Designed for locked-in and retirement income purposes.

This flexibility makes Questrade popular among Canadian DIY investors, passive investors, and active traders alike.

Opening a Questrade account is fully online and designed to be simple for Canadian residents. Funding can be done through a linked bank or chequing account, allowing users to start investing quickly.

With Our Exclusive Bonus Code: GET50BONUS, Get up to $10,000 managed free!

Click Here to Get Started with Questrade!

Questrade Trading Platforms & Tools

One of the biggest strengths highlighted in any detailed Questrade review is the platform lineup.

Questrade Platform Overview

Questrade offers multiple trading platforms:

- A web based platform for casual and long-term investors

- Questrade Edge, a powerful desktop platform

- Mobile apps for iOS and Android

The Questrade platform supports stocks and ETFs, options trading, mutual funds, and international equities.

Questrade Edge

Questrade Edge is designed for active traders and day traders who need speed and precision. It supports:

- Advanced charting

- Bracket orders

- Custom layouts

- Fast order execution

Questrade Edge offers a professional trading experience that competes with tools from Interactive Brokers and other platforms aimed at advanced users.

Beyond domestic trading, Questrade Global allows investors to access international equities across multiple markets. Questrade trading supports stocks and ETFs, exchange traded funds, and international exposure, making the Questrade platform suitable for investors who want to diversify beyond Canadian stocks.

Trading Fees, ECN Fees & Cost Breakdown

Fees are where Questrade really stands out in this Questrade review.

Questrade Fees Explained

- Commission-free trading on stocks and ETFs

- Options trading starting at $0.99 per contract

- Mutual funds available for a flat fee

- No annual account fees for self-directed accounts

However, investors should understand trading fees, account fees, and ECN fees. ECN fees apply to certain trades depending on order routing and liquidity removal, and these can add up for very active traders.

Questrade also reimburses transfer fees (up to $150), which is helpful for investors moving money from other brokers. Overall, Questrade remains a low-fees Canadian online brokerage compared to many Canadian brokers, especially RBC Direct Investing and other big-bank platforms.

With Our Exclusive Bonus Code: GET50BONUS, Get a $50 back bonus when you set up a self directed trading account!

Click Here to Get Started with Questrade!

Market Data & Advanced Tools

For traders who want deeper insights, Questrade offers optional data subscriptions, including a real time streaming package with Level I and Level II quotes.

Additional tools include:

- Integrated research tools

- News feed and market updates

- Advanced analytics for day trading and swing trading

These advanced tools make Questrade appealing not just for basic trading needs, but also for experienced users managing more complex strategies.

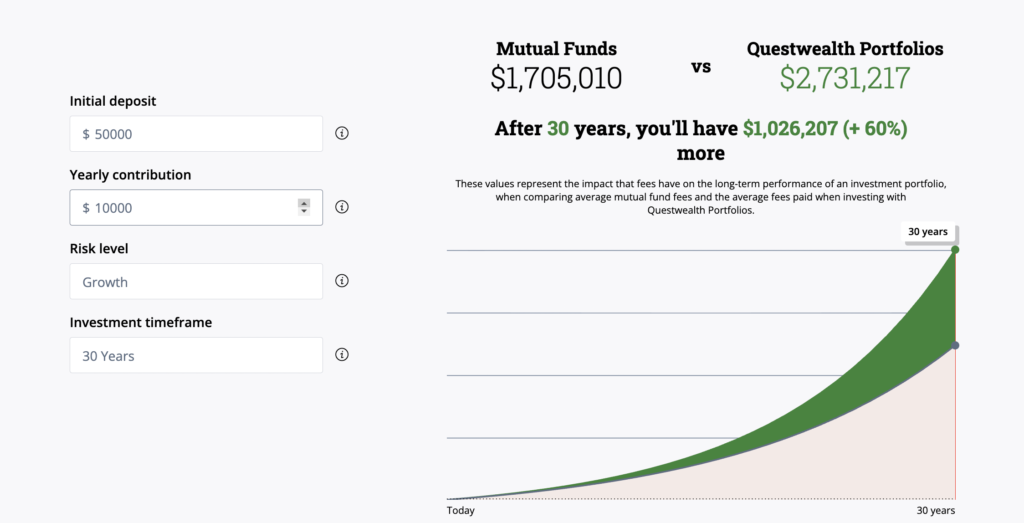

Questwealth Portfolios: Passive Investing Option

For investors who prefer automation, Questwealth Portfolios offers professionally managed portfolios built with ETFs.

Questwealth Portfolios are:

- Low-cost

- Automatically rebalanced

- Designed for long-term growth

This makes Questrade attractive to passive investors who want hands-off investing while still benefiting from Questrade’s platform.

Who Is Questrade Best For?

Based on this Questrade review, the platform works best for:

- Canadian investors who want low fees

- DIY investors who prefer control

- Active traders and day traders

- Long-term investors focused on their financial future

Questrade may be less ideal for investors who want in-person branch support or those uncomfortable managing investments online.Want to know how Questrade compares to competitor Qtrade? Check out our Questrade vs Qtrade review today!

Customer Service & Reputation

Questrade offers phone, chat, and email support. Most reviews describe solid customer service, though wait times can vary during high-volume periods.

While negative reviews do exist (as with any broker), the vast majority of user feedback highlights Questrade’s pricing, platform flexibility, and reliability.

Questrade vs Other Canadian Online Brokers

Compared to other brokers, Questrade competes strongly on pricing and platform depth. It’s often chosen over traditional banks and is frequently compared to Interactive Brokers for active trading.

Among Canadian brokers, Questrade has become a go-to brokerage for investors who value cost efficiency and independence.

With Our Exclusive Bonus Code: GET50BONUS, Get up to $10,000 managed free!

Click Here to Get Started with Questrade!

Final Verdict: Is Questrade Worth It?

So, is Questrade good?

Based on this in-depth Questrade review, the answer is yes for most Canadian investors. Questrade offers low fees, flexible account options, powerful trading platforms, and tools suitable for both beginners and experienced traders.

If you’re ready to start investing, want access to global markets, and prefer a modern Canadian online brokerage over traditional banks, Questrade is a solid option worth serious consideration.

FAQs

Questrade offers commission-free stock, ETF and options purchases. However, options have a base fee, as do mutual funds. They offer full fee transparency, and the platform is still one of the lowest-cost options for Canadian investors.

Yes, Questrade offers a robust online options trading experience with customizable strategies and risk management tools. You can trade single-leg or multi-leg options strategies, with pricing starting at $0.99 plus $1 per contract.

Questrade is a regulated Canadian online brokerage firm overseen by the Canadian Investment Regulatory Organization (CIRO) and protected by the Canadian Investor Protection Fund (CIPF).

Yes, Questrade accepts transfer requests and will reimburse transfer fees up to $150 from your existing brokerage. This makes switching easy and cost-effective.

Questwealth Portfolios are pre-built portfolio solutions managed by Questrade Wealth Management Inc. They offer low-fee, automated investing for Canadians who want a hands-off approach.

Absolutely. The Active Trader Plan offers discounted contract rates, advanced market intelligence, and streaming data tools tailored for active traders and intraday traders.

Yes, Questrade’s mobile apps are available for iOS and Android and include many of the same features as the desktop and web platform, allowing you to trade from anywhere.

The Best Canadian Brokerages as of June 30, 2025

Ranking of Top Canadian Stock Brokerages Based on Fees, Features, and Sign-Up Bonuses

We are experienced users of dozens of Canadian stock trading platforms. We stay up to date on these platforms' service offerings, subscription fees, trade commissions, and welcome bonuses. The brokerages listed below are for Canada-based investors, and are ranked in order of overall value received after taking advantage of their sign-up and/or referral offers.

✅ Dual-currency accounts without conversion fees

✅ Advanced trading with multi-leg options support

✅ Tiered interest on idle cash balances over $10,000 CAD

✅ Supports portfolio margin and direct market routing

✅ Access to Canadian Markets

✅ RRSP and TFSA Accounts

Deposit $100, get $20 in NVDA stock; Deposit $2,000, get $50 in NVDA stock; Deposit $10,000, get $300 in NVDA stock; Deposit $50,000, get $1,000 in NVDA stock

Learn more✅ In-kind transfers & dividend reinvestment plans for CA stocks

✅ RESP and FHSA accounts with self-directed tools

✅ 24/5 U.S. market access with fractional share support

✅ No FX fees on U.S. trades if subscribed to USD feature

Fees, features, sign-up bonuses, and referral bonuses are accurate as of June 30, 2025. All information listed above is subject to change.