If you live in Canada and are deciding between Qtrade and Questrade, you’re not alone. Many Canadian investors compare Qtrade vs Questrade when choosing an online brokerage that balances cost, usability, and investment flexibility.

Both platforms provide competitive online brokerage services, robust tools, and a variety of account options for beginners and experienced investors alike. As a Canadian online brokerage, each platform operates under strict regulatory oversight and competes with many other online brokerages in the market.

In this head-to-head comparison, we’ll break down everything from fees and registered accounts to mobile apps, research tools, and investment options. Whether you’re building your first investment portfolio or you’re an active trader focused on cost efficiency and advanced tools, this guide will help you decide which platform aligns with your goals.

So, which platform is right for you? Keep reading to find out.

Both platforms are regulated by the Canadian Investment Regulatory Organization (formerly the Investment Industry Regulatory Organization of Canada) and are members of the Canadian Investor Protection Fund, which protects client assets up to applicable limits for Canadian investors using online discount brokerages.

Qtrade Direct Investing: A Canadian Online Brokerage

Is Qtrade legit? Here’s what you should know.

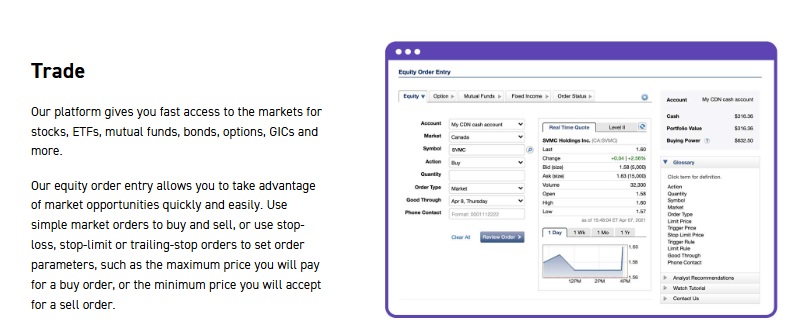

Qtrade Direct Investing is a self directed investing platform that gives Canadians access to a wide range of investment accounts, including TFSAs, RRSPs, FHSAs, margin accounts, and cash accounts.

For Canadian investors exploring direct investing, Qtrade Direct Investing combines research tools, portfolio analytics tools, and account flexibility to support both beginner and experienced investor needs.

The Qtrade platform is operated by Credential Qtrade Securities Inc, a subsidiary supported by Aviso Wealth, which is closely connected to Canada’s credit union network. This structure enhances long-term platform stability and reinforces Qtrade security.

Qtrade is especially appealing to beginner and intermediate investors. It offers curated education, goal-planning tools, and proprietary insights such as portfolio scoring. These features help users understand diversification, risk, and asset allocation while building confidence over time.

Questrade: A Low-Fee Powerhouse for Active Investors

Questrade is one of the most popular online trading platforms in Canada, particularly among cost-conscious and experienced investors. With more than $50 billion in assets under administration, it remains a top choice for Canadians seeking flexibility and lower trading costs.

A Questrade account gives users access to stocks, ETFs, mutual funds, options, and more from a single dashboard. The platform supports self directed investing, offering advanced charting, market insights, and customization for investors who want full control.

Questrade is well known for competitive Questrade fees, including commission-free stock and ETF trades. It also reimburses transfer fees (up to $150 per account), making it easier to move assets from another brokerage.

You’ll often see “Qtrade and Questrade” listed side by side when comparing Canada’s best platforms—and for good reason.

Open an account with Qtrade to receive a month of free trading…

or use our exclusive Questrade offer code: Get50bonus, to receive a $50 cash back bonus when you open a self directed investment account!

Investment Account Types and Flexibility

Both Qtrade and Questrade offer a wide range of account types to support different investing goals.

Available registered accounts include:

- TFSA

- RRSP

- FHSA accounts

- RRIF / LIF

- RESP

Qtrade also supports USD accounts, including USD registered accounts, helping Canadian investors reduce foreign exchange costs when trading U.S. securities.

Questrade matches these offerings and adds corporate and investment club accounts, appealing to advanced users and small businesses.

The account opening process is designed to be simple, allowing users to get started with minimal paperwork.

Here’s a side-by-side comparison.

| Qtrade | Questrade | |

|---|---|---|

| TFSA | Y | Y |

| RRSP | Y | Y |

| Cash | Y | Y |

| Margin | Y | Y |

| FHSA | Y | Y |

| LIRA/LRSP | Y | Y |

| RESP | Y | Y |

| RRIF | Y | Y |

| LIF | Y | Y |

| Corporate accounts | N | Y |

Pricing and Fee Structure

Transparent pricing is one of the most important aspects when comparing online brokerage services in Canada.

Both Qtrade and Questrade aim to deliver competitive value, but their fee models differ in approach and flexibility.

Qtrade Fees:

- $8.75 flat commission per stock, equity, or ETF trade, with some exceptions as noted below. There’s a discounted rate of $6.95 available to investors who meet minimum thresholds in assets or activity.

- Commission-free trading on over 100 curated ETFs

- Account fees vary depending on your balance and activity level.

- A quarterly administration fee applies to low-balance, inactive accounts unless users meet minimum trade or deposit requirements.

Questrade Fees:

- Stock, ETF, and option trades are now commission free.

- No annual fees for self-directed accounts.

- Up to $150 in transfer fees reimbursed when moving funds from another brokerage.

- Options trading includes a base fee plus a per-contract rate of $0.99, ideal for experienced or high-frequency traders.

Both brokers offer clear, upfront pricing, but Questrade provides more flexibility for active traders, while Qtrade’s fixed-fee model and curated ETF list may appeal to long-term investors.

Both platforms charge regulatory fees as imposed by the SEC (for United States securities) and certain exchanges. Check out the Qtrade and Questrade websites to see their full fee schedules.

Ready for a bonus? Receive $100 when you fund an eligible Qtrade account, or use our exclusive Questrade offer code: Get50bonus, to get your first $10,000 managed free with Questrade!

ETF Investing: Access and Cost Efficiency

ETF investing is a strong point for both platforms.

Qtrade offers over 100 curated commission free ETFs, ideal for long-term and passive investors. These funds emphasize diversification and low cost.

Want to learn more about Qtrade? Read our full Qtrade review!

Questrade allows users to trade any ETF commission-free, giving more flexibility for ETF trading strategies.

Beyond ETFs, both platforms support additional investment options, including index funds, international equities, and limited exposure to precious metals, depending on account eligibility.

Research Tools and Educational Resources

For investors who rely on analytics and market data, both Qtrade and Questrade offer advanced solutions.

Qtrade integrates Morningstar ratings, portfolio score tools, and market commentary. It’s especially strong in helping beginners understand investment fundamentals, thanks to clear educational resources and intuitive navigation.

Questrade provides more customizable charting options and integrates tools like the Intraday Trader, Mutual Fund Centre, and watchlist alerts. For those with experience, Questrade’s suite is more robust for technical analysis and asset screening.

Both platforms also support practice accounts, allowing users to test strategies before committing real capital.

It’s worth noting here that Questrade users have the option to subscribe to one of two market data packages. The real-time streaming subscription offers up-to-the-minute Level I data for $9.95 per month, while the advanced streaming subscription adds Level II data to the mix for $44.95 per month.

Experienced investors and even beginners who love research might benefit from subscribing to one of these plans.

Open an account with Qtrade to receive a month of free trading…

or use our exclusive Questrade offer code: Get50bonus, to receive a $50 cash back bonus when you open a self directed investment account!

Mobile Experience and Trading on the Go

Both Qtrade and Questrade offer mobile apps that give investors full control over their portfolios from anywhere.

Qtrade’s mobile app emphasizes simplicity and reliability, offering real-time market data, biometric login, and seamless trade execution.

It’s built for users who prefer a no-fuss experience without sacrificing core functionality.

Questrade’s app caters to power users by layering in more advanced capabilities. Traders can analyze real-time quotes, execute bracket orders, and review past trades.

The interface is slightly more complex, but well-suited for active users who want deeper visibility into performance metrics and analytics.

Customer Support and Account Protection

Service quality and platform security often influence long-term satisfaction with a brokerage.

It makes sense, right?

Getting the help you need when you need it is a must, and so is the peace of mind that comes with knowing your money is safe.

Qtrade and Questrade both understand the importance of reliable support and state-of-the-art protection, though they differ slightly in their approaches.

Qtrade is known for offering attentive, human support during trading hours. Its help channels include phone support from 8:30 AM to 8 PM ET, and email, but there isn’t a live chat option.

Most users report prompt and thorough responses. The platform has earned praise for its clear communication, especially with beginner investors navigating account setup or trade execution.

Questrade also provides support through multiple channels, including extended weekday hours. You can get phone support during business hours, plus email and live chat.

Its customer service team is backed by a detailed online help center filled with how-to guides, FAQs, and platform walkthroughs. Though wait times can occasionally vary, especially during high-traffic periods, most users find their concerns resolved quickly and professionally.

On the security front, both brokerages are regulated by the Canadian Investment Regulatory Organization (CIRO) and are members of the Canadian Investor Protection Fund (CIPF), providing insurance for up to $1 million per client in the event of insolvency.

Both Qtrade and Questrade use end-to-end encryption and require two-factor authentication (2FA) to protect users.

Qtrade adds additional user protection with its Investor Internet Security Guarantee, which provides 100% reimbursement of lost funds due to unauthorized brokerage account activity. Keep in mind they won’t reimburse you if you compromise your own account by giving out your password or loaning someone your phone.

These features ensure that users feel supported and protected no matter their level of experience or investment goals.

Final Verdict: Qtrade vs Questrade

In a direct Questrade vs Qtrade comparison, the better choice depends on your experience and priorities.

Qtrade is ideal for beginners and long-term investors who value guidance, education, and structured portfolios.

Questrade appeals to experienced investors and active traders who want lower fees, advanced analytics, and broader customization.

Both platforms are strong Canadian online brokers, and choosing between them comes down to how hands-on you want to be and how much flexibility you need.

FAQs

Questrade costs are lower than Qtrade’s because it offers commission-free stock and ETF trades on all North American securities.

Qtrade is often preferred by beginners thanks to its clean platform and strong educational resources. Some may also prefer its straightforward pricing model, even though it’s more expensive than Questrade.

Yes, both platforms support trading on U.S. exchanges and offer USD account options to help minimize foreign exchange fees.

Yes. Qtrade offers over 100 curated commission-free ETFs, while Questrade allows you to buy any ETF commission-free.

Both brokerages are regulated by CIRO and are members of the CIPF, providing insurance up to $1 million per client in the event of firm insolvency.

The Best Canadian Brokerages as of February 1, 2026

Ranking of Top Canadian Stock Brokerages Based on Fees, Features, and Sign-Up Bonuses

We are experienced users of dozens of Canadian stock trading platforms. We stay up to date on these platforms' service offerings, subscription fees, trade commissions, and welcome bonuses. The brokerages listed below are for Canada-based investors, and are ranked in order of overall value received after taking advantage of their sign-up and/or referral offers.

✅ Dual-currency accounts without conversion fees

✅ Advanced trading with multi-leg options support

✅ Tiered interest on idle cash balances over $10,000 CAD

✅ Supports portfolio margin and direct market routing

✅ Access to Canadian Markets

✅ RRSP and TFSA Accounts

Deposit $100, get $20 in NVDA stock; Deposit $2,000, get $50 in NVDA stock; Deposit $10,000, get $300 in NVDA stock; Deposit $50,000, get $1,000 in NVDA stock

Learn more✅ In-kind transfers & dividend reinvestment plans for CA stocks

✅ RESP and FHSA accounts with self-directed tools

✅ 24/5 U.S. market access with fractional share support

✅ No FX fees on U.S. trades if subscribed to USD feature

Fees, features, sign-up bonuses, and referral bonuses are accurate as of June 30, 2025. All information listed above is subject to change.