Oh man, I have waaay too much time on my hands…

…said no one ever.

Your time is valuable, and there is always someone (or something) competing for your time.

Your finances and investments are no exception.

As an investor, you have many things requiring your attention and time on a daily basis.

And whether you are an investment professional or trade on your own…

…you need to give your investments the time and attention they deserve.

But when you consider the time it takes to…

- Identify investment opportunities;

- Research investment opportunities; and

- Buy and sell investments

You wind up spending the entire day on your so-called “passive” income stream.

Add in the time it takes to monitor your portfolio’s performance…

…and there is not enough time in the day!

Accordingly, you are left with 3 options:

- Spend all of your free time on investments

- Quit investing altogether

- Get help and work smarter

The fact is, every investor needs help, including the professionals.

Financial professionals use a wide range of powerful tools to make managing a seemingly overwhelming number of assets significantly more manageable.

But, if you are like us, you want to avoid flat-out paying thousands of dollars for someone to manage your money.

You invest in the stock market to make money, not throw it away!

For this reason, we are here to present a unique and powerful resource that we think all investors should at least try.

What is it, you ask? You will need to read on to find out!

Morningstar Overview

If you missed the it in the header above…

…the resource is called Morningstar, and their mission is to empower investor success.

This company can save what is most valuable to you, which is your time, money, and most importantly, your SANITY (assuming you still have it).

And if saving time and money is not compelling enough for you to read on, we will go ahead and assume you are insane.

Morningstar is an investment advisor that relies on a large team of in-house investment experts.

The company began with an idea by a 27-year-old stock analyst.

That guy is Joe Mansueto, who thought it was unfair that people did not have access to the same information as financial professionals.

So, what did Joe do?

He hired a few people and set up shop in his apartment…

…to deliver top-notch investment research to everyone.

Initially, the firm reviewed mutual funds exclusively but more recently has branched out to include stocks.

Today, MorningStar has 5,230 employees in 27 countries and covers 621,370 investments.

And the company has become one of the biggest names in investment research.

Morningstar is best-know for its rating system, rating funds from one- to five stars.

These ratings have become well-respected in the investment community over the years.

The mission of MorningStar is to empower investor success.

The company has empowered investors all over the world and continues to help individuals achieve financial security.

So, how does Morningstar help individuals achieve financial security?

The company does this in the following way:

Identify new investment ideas

Investment ideas include finding undervalued stocks and portfolio anchors. The most popular stock screeners enable you to see Morningstar’s best research.

Evaluate investment ideas

You can invest confidently by reviewing Morningstar ratings and valuations from a team of 150+ experts.

Monitor your investments

You receive a comprehensive overview highlighting strengths and weaknesses and where to put your money in your next investment.

Morningstar Features and Tools

Stock Research

As we said, Morningstar now offers stock research tools.

You can use Morningstar to access comprehensive rating lists that are updated daily by Morningstar analysts.

These lists include picks of the top stocks and bonds.

Morningstar uses a proprietary mathematical formula based on a fund’s past performance to determine how it ranks within a category.

And the best part about Morningstar rankings is that they are not based on personal opinion.

Instead, the ratings are based on the performance of an asset in relation to comparable assets in the same category.

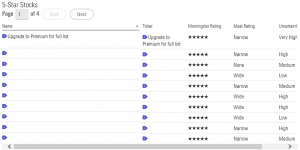

The most valuable lists for stock traders are:

- 5-Star Stocks

- Wide-Moat + Undervalued

These lists provide stocks that Morningstar analysts believe are undervalued relative to their fair market value (FMV) price.

Additionally, they are an excellent starting point for research that will save you TONS of time.

But how is this possible?

Instead of sifting through thousands of stocks, you get the top picks delivered to you.

From there, you can use Morningstar analyst recommendations as a starting point to further your own research.

Here is how 5-Star Stocks stocks are chosen (via Morningstar.com):

- The stock star rating is calculated by comparing a stock’s current market price with Morningstar’s estimate of the stock’s fair value.

- The further the market price is below the fair value, the higher the star rating. A 5-star rating means the stock is trading meaningfully below fair value.

- Our rating system also factors in an uncertainty adjustment (known as the Fair Value Uncertainty rating). As the Uncertainty rating goes up, so does the discount we require for a company to earn a 5-star rating, given the lower confidence in the precision of our fair value estimate.

Here is how Wide Moat + Undervalued stocks are chosen (via Morningstar.com):

- They are trading at a discount to Morningstar analysts’ estimates of their fair value (in other words, 4- or 5- star stocks).

- They have “wide” economic moat ratings. Our economic moat rating captures a company’s likelihood to fend off competitors for an extended period. Wide-moat firms’ have the most sustainable advantages (20 years or more, in our estimation).

- They have a Fair Value Uncertainty rating of Medium or lower. We are more confident in our fair value estimates for companies with these ratings.

In addition to stocks, ETFs, and mutual funds, Morningstar offers rating lists for four types of bonds: high-yield bonds, foreign bond funds, bond index funds, and core bond funds.

You can also use the Premium Stock Screener to identify the best stock for you.

The state-of-the-art stock screener allows you to perform your analysis of over 400 data points.

You can use pre-set stock analyst screens, with categories like:

- Morningstar Stock Ratings

- Today’s Rating Changes

- Highest Rated Stocks

- Low Uncertainty

- Large Fair Value Discounts

- Terrific 10-Year Records

- And more!

Managed Fund Research

While stocks are great, where Morningstar stands out is in offering rating lists for ETFs and mutual funds.

The fund-pick lists are based on similar metrics as the stock-pick lists.

Accordingly, Morningstar can be your one-stop-shop for mutual fund and ETF research.

The Find a Fund Analyst Report allows you to view informed opinions from the experts.

These opinions cover things like strategies, portfolio, and performance of over 2,000 funds and nearly 400 ETFs.

The reports include:

- All Fund Analyst Reports

- All ETF Analyst Reports

- Fund Medalists

- Fund Medalists by Category

- ETF Medalists

You can also use the Managed Fund Research to find Similar Funds.

Similar Funds offer solid substitutes for funds that are closed to new investors.

Additionally, you can determine if a prospective fund is too similar to one that you already own.

Managed fund research also offers the Premium Fund Scanner to users.

This tool can create custom screen parameters for nearly any measurable factor relating to mutual funds.

You can even add conditionals to narrow down what gets filtered out of your screen.

Additionally, the results display is totally customizable so you can find exactly what you are seeking.

You can add close to 100 individual columns to the results table to sort data based on criteria that matters to you.

The ETF Valuation Quickrank gives you fair value estimates for a variety of ETFs.

These estimates are based on Morningstar valuations of the underlying holdings.

Lastly, the fund analyst screens include:

- Portfolio Anchors

- Hidden Gems

- Lower-Risk Foreign Funds

- Aftertax Stars

- Small & Beautiful

- And more!

With all of these features, you can see why Morningstar is second-to-none in mutual funds.

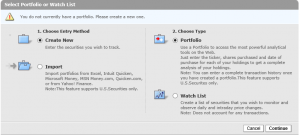

Portfolio Management

Morningstar can make managing your portfolio significantly easier.

The Portfolio Monitor gives you a clear idea of your investments, including personalized reports.

You can get monthly statements and on-demand statements, as necessary.

The Portfolio Monitor also allows you to create lists of securities you can monitor and observe daily for price changes.

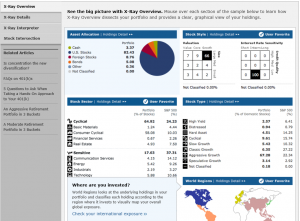

Additionally, the Portfolio X-Ray tool gives your portfolio a comprehensive analysis.

Morningstar takes mutual funds and reviews the quarterly SEC reporting of their individual stock ownership.

This type of analysis can uncover areas in your mutual fund that are heavily weighted in categories unknown to you.

This weighting can increase your investment risk and decrease overall returns.

The X-Ray tool also goes into great detail with your portfolio, including:

- Asset allocation

- Sector weighting

- Stock style and type

- International exposure

Lastly, the Stock X-Ray tool analyzes how well your holdings and expenses are meeting your financial goals.

You can use the X-Ray Interpreter to get a fair portfolio assessment and suggestions to improve your diversification.

The Portfolio Management section comes with so many features, let us make this easy:

Stock Intersection

See how much of a stock you really own, individually and through mutual funds.

Asset Allocator

Decide the best asset allocation for your financial situation.

Trend Analyzer

Understand the tax and cost of replacing a security in your portfolio.

Cost Analyzer

Find the most cost-effective options for you.

With these features, keeping your portfolio on track will be much, much easier.

Morningstar Membership and Pricing

Morningstar offers two types of membership packages:

- Basic

- Premium

The basic membership is completely free. To sign-up, simply visit the website and register.

This membership includes financial data access, access to articles, access to forums, and the ability to connect your account to Morningstar research.

You can also see the star ratings and information on mutual funds and stocks through the Basic membership option.

The premium membership offers everything included above, and the following features:

- The wide moat screener

- The goal medalist screener

- Access to analyst ratings and support

- Improved portfolio management

- Premium newsletter

And for a limited time, you can try premium with a free 14-day trial.

You can access your free trial by registering on the website.

Sign-up takes less than 5 minutes.

If you decide Morningstar Premium works for you, there are several pricing options:

- 1-year for $199 (save 45% annually)

- 2- years for $349 (save 52% annually)

- 3-years for $449 (save 58% annually)

- Monthly for $29.95

We recommend taking advantage of the 14-day free trial, then choosing the best pricing plan for your situation.

Do you think Morningstar can help you make a better investment decision?

If so, premium membership fees could be worth significantly more than you end up paying.

If you find Morningstar is not the right fit, simply cancel prior to your 14-day trial period.

Premium Articles

Morningstar provides tons of new articles written by analysts each day.

Most of the articles are available to Basic and Premium members, but occasionally the company will post Premium-only content.

The Premium-only articles typically revolve around stock picks (e.g., Five Best Buys in XYZ Industry).

Morningstar Customer Service

To manage your account, simply contact Morningstar at +1 (866) 229-9449 (or +1 (312) 384-3838 if you are a non-US caller).

You can contact Customer Care Agents at the following times:

- Monday and Tuesday: 9AM EST to 8PM EST

- Wednesday through Friday: 9AM EST to 6PM EST

You can call this number for account questions and to cancel your account.

California residents and international subscribers have the option to e-mail cancellation@morningstar.com to cancel.

You can e-mail Morningstar with feedback and questions by completing a secure form here.

If that is not enough, there is a FAQ page on the website that covers common questions like:

- How do I cancel my Premium Membership?

- How safe is my information Morningstar.com?

- Is it safe to submit my credit card over the Internet using Morningstar.com?

Sign-up for Morningstar

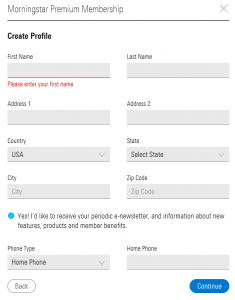

The sign-up process is a breeze.

Remember that signing up for your 14-day free trial takes less than 5 minutes!

Simply enter your e-mail, password, and occupation.

From there, you need to enter some minor personal information.

And (full disclosure) the company will take your credit card information in the event you exceed your free trial period.

What We Love about Morningstar

Expert analyst ratings

Morningstar offers reliable ratings for stocks, mutual funds, bonds, and ETFs.

These ratings allow you to review hundreds of assets in a very short time.

Comprehensive research and tracking tools

Morningstar is the only place you need to visit when it comes to research tools.

You can use Morningstar to make the most informed decision when you invest.

So, whether you are buying stocks, bonds, mutual funds, or ETFs, there is a tool for you.

In addition to choosing investments, you can track your investments with ease.

Free and Premium account options

With a free account, you get access to nearly everything you need as a beginner investor.

You can use the free account until you need more advanced tools offered with the Premium account.

What We Don’t Love about Morningstar

Difficult to manipulate data

It would be nice a feature to be able to export data from the platform more efficiently.

Can improve on stock, bond, and ETF tools

The company specializes in mutual funds, but has room for improvement in other asset categories.

Is Morningstar Right for You?

Morningstar is an excellent choice for beginner to advance fundamental investors.

The service is like getting an investment advisor at a fraction of the cost.

If you use the Morningstar tools wisely, you should easily recoup the annual cost of the service.

The primary criticism of Morningstar is that the company is strong in mutual funds and is lacking in other areas, like stocks and bonds.

This critique makes sense given that the company began specializing in mutual funds.

Ideally, we will see Morningstar continue to improve upon its offerings to match or exceed the competition.

The tools that the company does offer for stocks, bonds, and ETFs are useful – but like everything in life, there is room for improvement.

Morningstar has something that can benefit almost anyone.

The real decision to make is which account you need.

Will it be Basic or Premium?

And you can make that decision risk-free with your FREE 14-DAY TRIAL.

What do you have to lose? Nothing!

How do you save time and money managing your investments? Let us know with a comment below.

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.