Discover the truth about Motley Fool.

Summary;

- Motley Fool is an established investment research company known for its Stock Advisor service, offering stock picks, in-depth analysis, and recommendations through a subscription-based monthly newsletter.

- Motley Fool’s reputation, history, physical presence in multiple countries, and transparent practices contribute to its credibility—reinforcing that Motley Fool is a legitimate service.

- I have been a paid subscriber since 2016 and I share my results below.

Many investors, both beginners and experienced, rely on research to inform and enhance their investment decisions.

One of the most popular and well-known research sites is the Motley Fool. They are best know for the Stock Advisor newsletter that provides 2 stock picks a month for a fee of $199 per year. Here is one of the Motley Fool Stock Advisor recent ads promoting their impressive performance:

When you see results like that, you can’t help but be skeptical. So I subscribed to their Stock Advisor service in 2016 and have been a loyal subscriber ever since. I even started buying about $1,500 of each of their stock picks, and I will share some of my results below.

Based on my own experience of buying their picks, I know for a fact that they are not a scam! My results with their picks prove it. How did they achieve these tremendous average returns and how are they able to beat the market by so much? This graphic gives you an idea. They really do seem to pick a few stocks each year that double or triple. And over the 20+ years of this service they have picked many stocks with over 5,000% returns…

And here are a few of their all-time best stock picks as of June 29, 2025. Just take a look at some of these returns. They picked Nvidia back in 2005 and that stock is now up over 90,000%. They also picked Netflix early and it is now up 70,000%:

When I read all of the negative press out there about the Motley Fool, I just laugh and think–those people must be subscribing to different service, or not following the Fool’s own rules.

Number 1, the Motley Fool says you should plan on holding their stocks for at least 5 years and have at least 25 stocks in your portfolio. Is is absolutely true that ALL of their picks are not profitable. Some do go down. But from my experience for the last 8 years is that they tend to pick a few stocks each year that double or triple. So I have learned to buy about $1,000 of each and every one of their picks (that’s $2,000 a month I am adding to my portfolio) and I sell all of their stocks when they say to.

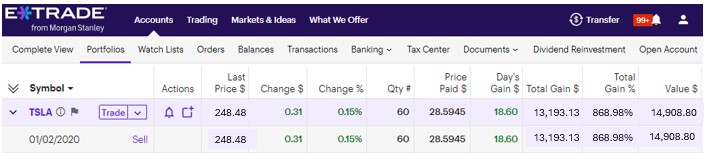

To prove it, here is a look at their best stock for me in the last few years that is up 868% as of December 31, 2023 since it was picked in January of 2020.

Number 2, for those of the naysayers out their on the web that say they bombard you with emails, i have one word for you: UNSUBSCRIBE! Of course they will try to upsell you to their other services, but just unsubscribe.

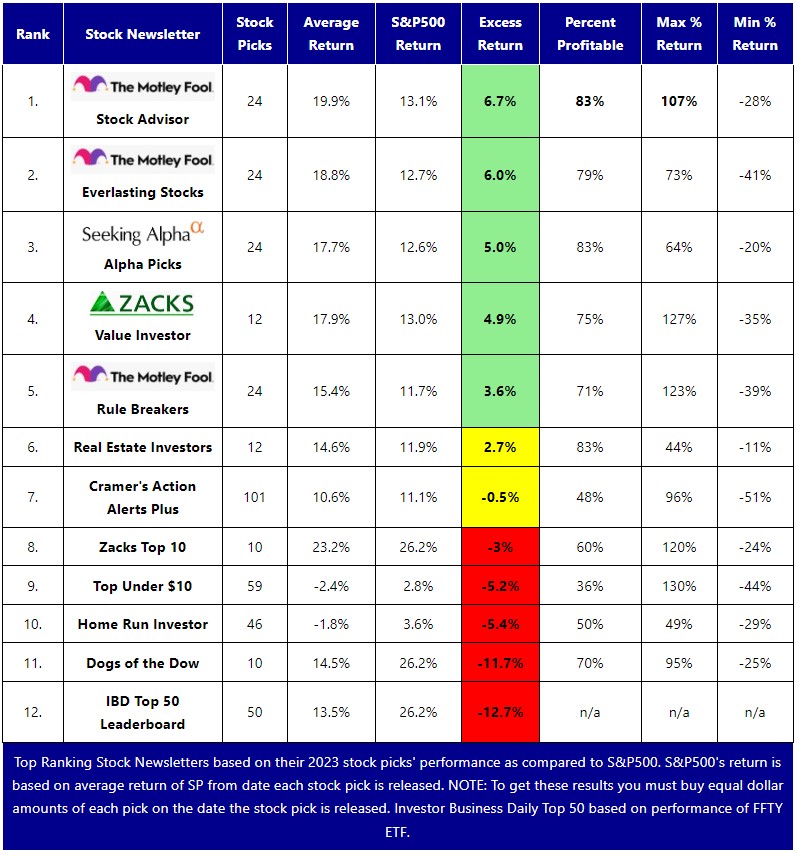

Number 3, they were the best performing low-priced newsletter of 2023:

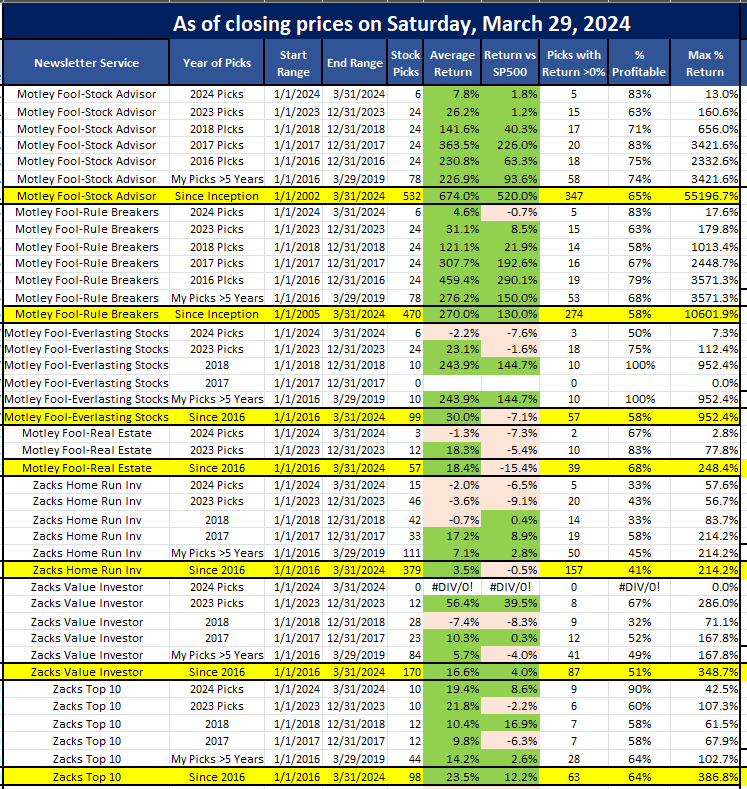

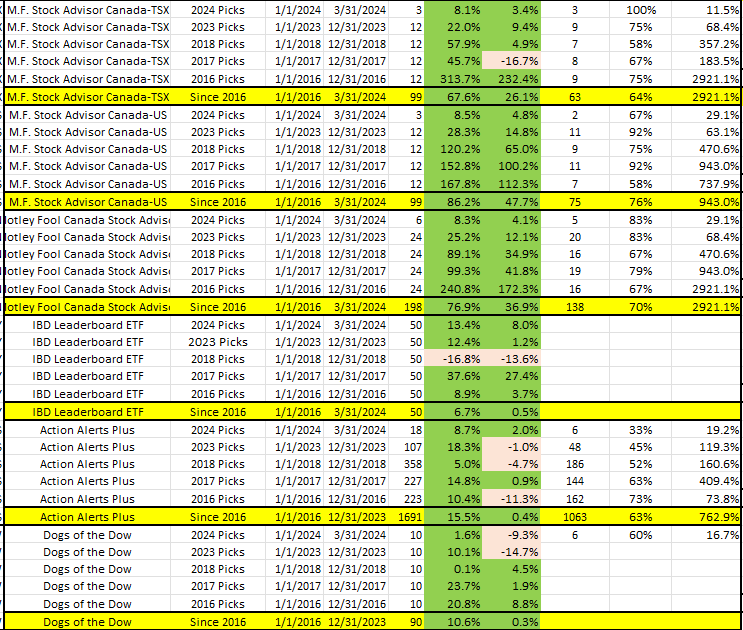

And take a look at this analysis of the most popular newsletters as of March 31, 2024. Look how the 2 Motley Fool services of Stock Advisor and Rule Breakers are beating the competition almost every year.

Their lighthearted designs, loud marketing, and clever sales tactics can sometimes beg the question, “Is the Motley Fool a scam?”

When it comes to investing your hard-earned money…

…performing due diligence on your investment research is paramount.

So, let’s take a deep-dive into who the Motley Fool is, and what makes them a reputable source of investment information.

What is the Motley Fool?

Quite simply, the Motley Fool is an investment research and analysis company that offers free and paid information for investors.

They are most well-known for their Stock Advisor service, which is a subscription-based monthly newsletter.

The newsletter offers stock picks, in-depth company analysis, recommendations to buy stocks, and much more.

Every month, the two founders each submit a stock pick that they and their teams have spent the prior month researching.

And here are a few of their all-time best stock picks as of June 29, 2025. Just take a look at some of these returns. They picked Nvidia back in 2005 and that stock is now up over 90,000%. They also picked Netflix early and it is now up 70,000%:

This includes fundamental and technical analysis.

The picks also include market research for the sector that the company is in, and they provide a strong case for why they believe that stock is better than its competitors.

For more information on Motley Fool, take a look at our deep dive into the entire platform with the Motley Fool Review.

How to Recognize a Scam

Technology is a blessing and a curse.

The internet allows investors to access more data and research than any other time in history.

Unfortunately, the internet also opens the door to scams and false salespeople.

Thankfully, the government-sponsored, investor.gov, offers a few red-flags for investors to watch out for fraudulent investments.

Here are three of the top red flags, and how the Motley Fool is differentiated from them.

1. “Risk-free” investment opportunities

When anyone promises “risk-free” investments…

…you should run the other way!

All investment has the potential for loss, and The Motley Fool does not say otherwise.

On the contrary, the company is well aware of the risk, which is why they spend so much time and resources on conducting a thorough analysis of the stocks they recommend.

2. Payment with Cards, Gift Cards, or Overseas Transfers!

This is the classic foreign prince asking for help scam.

The way this works is someone will email you asking for financial help.

They may promise to pay you if you can transfer their money to a foreign account.

They have convincing stories, and once you send money somewhere, you never hear from them again.

The Motley Fool sells a service.

They will never ask you to send money to a third-party personal bank account.

3. Promises of great wealth and guaranteed returns

The Fool is very proud of their work, and they share their top-performing stock picks to validate their services.

However, they do not promise that you will achieve great wealth and guaranteed returns.

Some critics of The Fool who have not conducted any research think sharing a stock pick that returned 233% is guaranteeing those results for every investor.

This is not the case!

These are some of the biggest indicators that you are involved in a potential scam.

None of these apply to the Motley Fool’s business plan or the way that they market their service.

Review for yourself whether Motley Fool offers anything that may be too suspicious for your investing game. Our deep dive into the entire platform with the Motley Fool Review.

Is Motley Fool a Scam?

The Motley Fool has a vital distinction from trendy investment newsletters as well as other established publications.

What is it that makes Motley Fool’s services so unique with in the finance landscape?

It’s reputation.

To the novice, investing is a daunting endeavor.

And it should be…because YOUR money is literally at stake.

So, what do most people do when they embark on a new venture where capital is at risk?

Smart people seek counsel.

The Motley Fool has a strong reputation for providing vetted research, detailed analysis, and consistent performance to both its paid and free members.

They care about their customers as well.

Paid members have access to a wide array of customer service specialists to assist them with any questions or clarification on stock picks and analysis.

Personally, I’m a big fan of Motley Fool’s Stock Advisor, since it has consistently helped my portfolio by beating the S&P500, year over year.

If you need more information on how Motley Fool’s Stock Advisor has equipped me with a winning portfolio, read our review on it’s entire offering with our Stock Advisor review.

The Motley Fool History

Founded in 1994 by David and Tom Gardner, The Motley Fool has grown into an international company, committed to aiding retail investors with top-tier stock market research. With a mission to empower “Main Street” with tools akin to Wall Street, they’ve expanded globally, offering numerous services and newsletters.

Their longevity counters typical scam traits of brief existence and “non-existent” operations. The Fool boasts physical offices worldwide, staffed with real analysts, all while enhancing their credibility with two front facing founders. Unlike fraudulent entities using PO boxes and vague contacts, their substantial presence and Glassdoor awards for workplace excellence further affirm their legitimacy.

Why Motley Fool is NOT a Gimmick

Motley Fool adopts a long-term, diligent approach to investment decisions. They make sure to steer clear of common financial scams promising instant results from “easy” stock trading.

Contrary to schemes that offer unrealistic gains, The Fool values transparency and a proven track record, which can even be shown by the founders on their website:

We believe in treating every dollar as an investment in the future you want to create.

We believe that investing in great businesses, for the long term, is the most effective path to wealth.

We believe in the power of a community to learn and grow together.

We believe in keeping score and being transparent in our investment performance.

We strive to fulfill our purpose by truly serving every Fool, from our employees to our members to our community.

David and Tom Gardner

This ethos is a far cry from any get-rich-quick gimmick. Even though Motley Fool is not an investment manager, they are a top provider of stock picks and recommendations, offering a subscription service that focuses on long term value over any false promises of instant riches.

*** UPDATE -- Friday, July 18, 2025 -- MOTLEY FOOL STOCK ADVISOR AVERAGE RETURN OF ALL 500+ STOCK PICKS IS 1,062% VS THE S&P500'S 176% ****

The Fool investing philosophy is hold stocks for at least 5 years, invest regularly, and ride out the dips. Here is just a sample of some recent picks:

- AppLovin picked April 3, 2025 and already up 50%

- Howmet Aerospace picked January 16, 2025 is up 38%

- Transmedics (Epic) picked December 19, 2024 is up 110%

- DoorDash picked October 3, 2024 and in 2023: now up 47% & 137%

- Shopify picked June 6 is up 75%

- Chewy (Epic) picked May 14 is up 169% &

- Cava (Epic) picked in October, 2023 is up 40%

- Crowdstrike October, 2023 pick up 185%

Also, the Motley Fool just launched a July, 2025 promotion: $100 off (see the link below).

Here is their release schedule of their upcoming stock picks:

- July 3, 2025 - New Stock Recommendation

- July 10, 2025 - List of 5 Best Stocks to Buy Now List

- July 17, 2025 - New Stock Recommendation

- July 24, 2025 - List of 5 Best Stocks to Buy Now

So, if you have a few hundred dollars to invest each month and plan on staying invested for at least 5 years, we haven't found any better source of stock picks.

New Pricing: Motley Fool has slashed the price for its top stock picking service.

Use WSS100 to get $100 off HERE

Motley Fool Guarantee

Thanks to the Motley Fool’s longevity and transparent practices, they have made a name for themselves where it counts; their wallet.

They offer a 30-day money-back guarantee with their paid Stock Advisor service.

You can try it out, invest in their recommendations, learn how they analyze the market, and see how they operate.

At the end of the day, you can cancel with no risk if the service is not the right fit for you.

This guarantee is one of the most important and tangible reasons why the Motley Fool is not a scam.

You may love their services, or you may not, but their history and practices are those of a real business.

In conclusion…Motley Fool is NOT a scam!

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.