Do you remember the times of Apple product events?

Well, these events still occur – they are just far less exciting.

In earlier times, everyone would tune in to see the next Steve Jobs creation.

Today, those same events are not the same (it’s not Tim Cook’s fault, either).

But many would even say that the product events are downright boring.

But what does “boring” mean for Apple?

Boring simply means that you can skip the next Apple reveal and do something better with your time.

Although, COVID-19 has everyone doing some wild things for “entertainment” these days.

And if watching the reveal of slightly better iPhone, iPad, or streaming services entertains you – then go for it.

What does the boringness mean for Apple.

Or maybe the better question is…

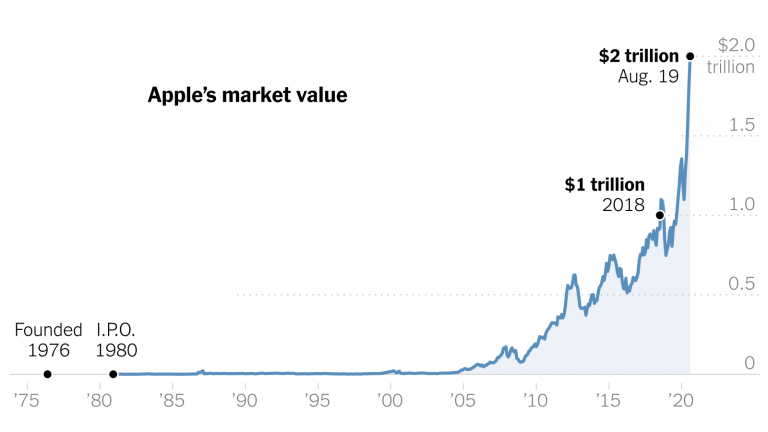

…what is next for Apple stock?

It’s hard for anyone to provide an answer with any certainty.

The company has investors eating out of the palm of its hand at this point.

Is that a good thing?

It is hard to say for sure.

Fortunately, we have got some allies on our side.

Those allies are Tom and David Gardner with the Motley Fool.

We believe the Motley Fool has an idea of what is next for Apple.

Why should you listen to the Motley Fool?

Because David Gardner recommended Apple stock back in 2008!

Did you see Apple’s success coming?

Maybe. Maybe not.

Apple seems like surefire winner today…

…but the company had not yet released the iPhone in 2008.

Once Apple released the iPhone, it was off to the races.

However, Apple is not the same company it was five years ago, much less twelve years ago.

In 2020, Apple no longer views the iPhone as its primary driver of revenue in the future.

This has some people skeptical about Apple’s long-term viability.

On the other hand, many investors think Apple is here to stay.

What do you think?

Don’t be so quick to answer.

Today, we are going to ponder whether Apple is a “buy” today.

*** UPDATE -- Friday, July 18, 2025 -- MOTLEY FOOL STOCK ADVISOR AVERAGE RETURN OF ALL 500+ STOCK PICKS IS 1,062% VS THE S&P500'S 176% ****

The Fool investing philosophy is hold stocks for at least 5 years, invest regularly, and ride out the dips. Here is just a sample of some recent picks:

- AppLovin picked April 3, 2025 and already up 50%

- Howmet Aerospace picked January 16, 2025 is up 38%

- Transmedics (Epic) picked December 19, 2024 is up 110%

- DoorDash picked October 3, 2024 and in 2023: now up 47% & 137%

- Shopify picked June 6 is up 75%

- Chewy (Epic) picked May 14 is up 169% &

- Cava (Epic) picked in October, 2023 is up 40%

- Crowdstrike October, 2023 pick up 185%

Also, the Motley Fool just launched a July, 2025 promotion: $100 off (see the link below).

Here is their release schedule of their upcoming stock picks:

- July 3, 2025 - New Stock Recommendation

- July 10, 2025 - List of 5 Best Stocks to Buy Now List

- July 17, 2025 - New Stock Recommendation

- July 24, 2025 - List of 5 Best Stocks to Buy Now

So, if you have a few hundred dollars to invest each month and plan on staying invested for at least 5 years, we haven't found any better source of stock picks.

New Pricing: Motley Fool has slashed the price for its top stock picking service.

Use WSS100 to get $100 off HERE