Reading through the financial news looking for investing ideas can be overwhelming for the new investor. Investing Ideas come in all forms from pot stocks to cryptocurrencies to bizarre ETFs to stocks that most of us have never heard of.

So how can a new investor filter through all the noise and find the best investing ideas?

We created WallStreetSurvivor to help you do exactly that! We filter through all the noise and share with you our findings. And, we provide you a free virtual brokerage account with a $100,000 for you to practice and test various trading tips and strategies. Click on the REGISTER button in the upper right if you want to sign up for our free virtual trading account.

If you want to learn more about how to find the Best Investing Ideas, then keep reading…

How To Invest in Stocks

Investing in stocks is easier than you think.

The first thing you need to do to invest in stocks is open a brokerage account, if you don’t already have one. The brokerage industry is real competitive right now so you are lucky. Many brokers are offering great deals like “commission free trading ” and “up to $300 bonus cash.”

How Do I Get up to $1,700 in FREE STOCK with Robinhood?

To open a Robinhood account, all you need is your name, address, and email. To get your free stock you will need to fund your account with at least $10 within a few days of opening so you will also need your bank account routing and account number.

As its current promotion, Robinhood will immediately give you FREE MONEY (between $5 and $200) to invest in a set list of stocks when you open a new account. You will be given your unique referral link. You will receive more free money (again valued at $5 to $200) for each person you refer. The more people you refer, the more you get up to a max of $1,500 a year. To learn more, visit Robinhood's free stock promo page below.

Why do they give away so much free stock? Because they spend their advertising dollars this way instead of buying TV, radio, print, or online ads! They WANT you to refer friends!

So click here to see the latest offers, review the different features, and find a stock brokerage that is right for you. Keep in mind that it might take a few days to get your account open and funded, so go ahead and fill out the application now so you can get approved and start the funding process. If you already have a brokerage account, then consider switching and taking advantage of these great commission free trading deals.

How to Find the Best Investing Ideas

To invest in stocks, the second thing you need to do is put together a list of stocks that you want to invest in. This is the harder part of stock investing. While some suggest that you only invest in what you know, it’s actually not that simple. You should also understand if the company is profitable, and most importantly, what the future looks like for that company.

[emx_motley_fool_form]With over 15,000 stocks available to invest in, finding the best investing ideas may appear to be an overwhelming task. But at WallStreetSurvivor we have done all the work for you to help you get started successfully and profitably. Here at WallStreetSurvivor we subscribe to over a two dozen stock advisory services and we actually paper trade their all of their stock ideas.

The Best Source for Stock Ideas is…

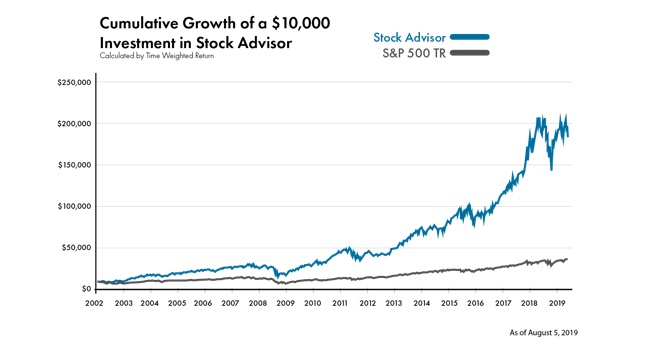

Over the last year 5 years, from 2016-2021, the best stock picking service was the Motley Fool’s Stock Advisor which is up 360% compared to the SPY’s 85%. They have a great track record of picking lots of stocks that double and triple each year. And they even have picked a few that have gone up 500% to 1000% in a 3 years years. Their best stock ideas over the last few years were SHOP which is up 941%, MTCH which is up 553%, PAYC up 299%, and MA up 176%. (updated percentages as of December 1, 2019)

You can get access to all of their picks for just $19. There service is a no-brainer for someone that wants to get the best stock ideas and beat the market. To subscribe to the Fool service, CLICK HERE to get access to all of their recent stocks picks, plus their latest list of Top 10 Stocks to Buy Now.

Of their 24 stock picks for 2016, 18 of those stocks are up. The average return of all 24 stock picks, including the few losers, is an amazing 127% which is 67% BETTER than the market. In fact, 16 of these picks are up over 50% with the best stock picks being SHOP, up 941%, and MTCH up 553%. Of their 24 picks for 2017, 20 of them are up. The average return of all 24, including the losers, is 61% which is 26% BETTER than the market. In fact, 13 are up over 50% with their best picks TTD up 313% and PAYC up 299%. Of the 24 Fool picks for 2018, 19 are up with an average return of 55% which is 38% BETTER than the market (SP500).

CLICK HERE to learn more about the Motley Fool’s Stock Advisor!

The Motley Fool service follows a blend of Growth and Value Investing Strategies. Their investing ideas are for those who want to invest for the long term. So there is not much to do other than to read the emails you get from them. They will even tell you when to sell if they think a stock has lost its value.

Some other styles of investing ideas include:

Swing Trading

A swing trading position is held longer than a day trading position, but shorter than a buy and hold investment strategy that can be held for months or years. Typically, a tradeable asset would be held for days at a time in order to profit from price changes or ‘swings.’ Profits can be attained by either buying an asset or by short selling.

Learn more about Swing Trading

Value Investing

A value investor believes that the market overreacts to both good and bad news. He/she would look for stocks that they believe the market has undervalued; thereby profiting by buying when the price is deflated.

Learn more about Value Investing

Growth Investing

Growth investors invest in companies that show above-average growth. Growth investing focuses on capital appreciation. Growth investing kind of contrasts with value investing.

Learn more about Growth Investing

Great chess players don’t sit at a board and just…play.

Masters of the game have a very concrete plan of how they intend to play. They decision-making that can adapt to whatever their opponents throw at them. Investing is no different: you need a plan to guide your investment decisions!

Deciding What To Invest In

Deciding what investing ideas to research and/or buy is a constant challenge for even the most experienced investor. Nobody really knows that the stock market will do tomorrow. However, an analysis of the last 20 years, 50 years and even 100 years shows that among stocks, bonds, gold, real estate, and bank money markets, without a doubt, the best place to invest has been the stock market. So if you are trying to decide what to invest in, if you have a time horizon of more than a few years, the best place to invest is the stock market.

If you know you are ready and willing to invest in the stock market, let’s get started. If you don’t have a brokerage account, or even if you do, learn how you can get $1,700 in free stock when you open a Robinhood account.

Now that you have a good brokerage account, it’s time to decide what to invest in. The best place to start is with some Exchange Traded Funds, or ETFs. ETFs are a way to buy a basket of stocks in a single transaction. One of the most popular ETFs is one that matches the S&P500 Index. It has a ticker symbol of SPY. This is popular because a lot of people have the attitude of “if you can’t beat’em, then join them.” In other words, instead of trying to pick stocks that will outperform the stock market, just invest in stocks that match the market. The SPY is the probably the safest place to start when you are trying to decide what to invest in for the first time.

When you are ready to start picking individual stocks, we suggest you subscribe to one of the top performing stock newsletters. The one that has performed best over the last decade has been the Motley Fool’s Stock Advisor which is up 360% compared to the SPY’s 85%. This service is just $19 a month or $99 a year and is well worth it as you get up to a dozen picks each month. We suggest signing up for their service, and reading their stock analysis. Even if you don’t buy all of their picks, it is a GREAT way to learn about researching stocks and what to look for when you are trying to decide what to invest in.

Here is some more advice:

Research ETFs

ETFs have become hugely popular over the recent years as a way for novice investors to begin investing. In addition to index ETFs that match the SP500 or the DOW Jones Industrial Average, there are ETFs specific to industries, countries, metals, oils, currencies, etc.

Choose Sectors

Select your stocks based on specific criteria (sector, industry etc.) Use a screener to further sort companies by dividend yield, market cap and other super useful metrics.

Stay Informed

Keep up-to-date. Read stock analysis articles. Read financial news releases. Stay critical.

Know Different Types of Investments

Bonds

Bonds, or fixed-income securities, are debt investments in which an investor loans money to an entity, with interest. The borrower borrows the funds for either a fixed or variable period of time.

Mutual Funds

Mutual funds are operated by money managers and should match the investor’s objective. They are made up of a bunch of funds collected from many investors and the purpose is to invest in securities like stocks, bonds, etc.

Small-Cap Stocks

Small-cap investors are the risk takers. These small companies have huge potential for growth. However – because they are often under-recognized, more research is necessary. This requires the investor to have more time available to properly crunch numbers.

Large-Cap Stocks

Large-cap investors are more conservative – these guys like to play it safe. With their steady dividend payouts, these big-cap blue chip companies are as stable as they come

Penny Stocks

Penny stocks are super high risk because of their lack of liquidity. Beginners are often lured in to these stocks because of their crazy low share price. This allows investors to hold thousands of shares for a relatively small amount of invested capital. With a scale like that, the gain of just a few cents per share can translate into major returns.

How To Buy Stock

Here are the necessary steps to buy stock:

- Learn the basics

- Figure out your investment goals

- Determine your risk tolerance

- Find your investing style & strategy

- Learn the costs

- Find a broker/adviser

- Pick your investments

- Keep your emotions separate

- Review and adjust your portfolio

But remember, you don’t make money until you sell. For more on when to sell stocks, click here!

Finding Good Stocks To Buy

Within each stock sector, the ultimate goal is to find the stocks that are showing the greatest price appreciation. In the same way that one would pay attention to sectors, multiple timeframes should also be examined to make sure the stock in question is moving well over time. There are two main things to keep an eye on when selecting stocks:

Liquidity

It isn’t smart to invest in a stock that has very little volume. What if quick liquidation is required? Selling it at a fair price will be extremely difficult if not impossible. Unless you are a seasoned trader, invest in stocks that trade at least a couple hundred thousand shares per day. Save yourself the headache.

Price

Trade in stocks that are at least $5. Don’t shy away from a stock just because of its high price. Don’t buy a stock just because of its low price.

Investment Ideas

Want to invest like The Greats? Take a look at the strategies these big guys used to earn their names:

Warren Buffet

Warren Buffet is considered a value investor. Essentially, he selects stocks that are priced at a significant discount to what he believes is their intrinsic value. When Buffett buys stocks, he buys them for keeps. This requires a lot of discipline: it’s hard to resist buying or selling when the market seems perfectly ripe to act.

Buffet views the stock market as temperamental. He doesn’t panic when stocks plummet, or celebrate when they skyrocket. Instead, the Oracle of Omaha maintains the “keep calm and carry on” mantra, only buying stocks he intends to hold indefinitely, if not forever.

Peter Lynch

Lynch is also a value investor who stresses fundamental analysis . Lynch’s bottom-up approach involves focusing on an individual company, rather than the entire industry or the market as a whole. The idea here is that what really matters is the quality and growth potential of a specific company, regardless of whether the industry is under-performing or even in a tailspin.

Here are 3 additional Lynch stresses when looking at a company from the bottom up:

- Good research pays off

- Shut out market noise

- Invest for the long term

Philip Fisher

Philip Fisher was a growth investor. He consistently invested in well-managed, high-quality growth companies. He would hold on to these for the long term. His famous “fifteen points to look for in a common stock” were divided up into two categories: management’s qualities and the characteristics of the business itself.

When Fisher found an investment he liked, he wasn’t afraid to take an outsized position of the stock within his portfolio. In fact, Fisher sometimes downplayed the value of diversification. He often found himself scouring the tech sector because the pace of change there creates an environment that is ripe for disruptive innovations.

Next stock pick released July 17th.

Get Up to $1,700 in FREE Stock

When you open a Robinhood Brokerage Account

Robinhood was the first brokerage site to NOT charge commissions when they opened in 2013. In June, 2025 they reached 23,000,000 accounts and to celebrate they are offering up to $1,700 in free stock when you open a new account.

Here's the details: You must click on a special promo link to open your new Robinhood account. Then when you fund your account with at least $10, you will receive one stock valued between $5 and $200. Then, you will get a link to share with your friends. Every time one of your friends opens an account, up to 5 a year, you will receive another free stock valued between $5 and $200. See details on this Robinhood free stock offer.

Open your Robinhood account and claim your first free stock NOW

(before it's too late)

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.