It’s time for the Blooom review!

If you are new to the workforce, retirement is likely a distant thought.

But did you know…

…creating strong habits now can significantly impact how and when you retire?

This is why employer-sponsored retirement plans are critical but often overlooked.

The road to retirement is a long, unpredictable one.

So, how can you ensure that your retirement goes smoothly?

We recommend 3 steps:

- Managing Portfolio Performance

- Squashing the Fees

- Making the Best Decisions

To manage your portfolio performance, you need to maintain the proper asset allocation.

In order to squash the fees, you need to determine the lowest-cost portfolio option in each fund category within each plan.

To make the best decisions, you must make the right decisions concerning your 401(k), IRA, and beyond.

Does this sound overwhelming?

Of course it does!

Fortunately, there are services out there to help you be successful.

Today, we are here to talk about Blooom (aka “blooom” with a lowercase ‘b’).

These guys are helping thousands of people get on track for retirement.

And they would like to help you, too.

Blooom Review: Overview

Founded in 2013, Blooom is a registered investment advisory and robo-advisor based in Leawood, Kansas.

The company specialized solely in retirement accounts.

So, what makes Blooom so unique?

This company is the first (and basically the only) robo-advisor that can manage employer-sponsored retirement plans.

In fact, that is how it’s been from day one.

Blooom is all about employer-sponsored plans, particularly the ole 401(k).

Do not fret if you do not have a 401(k)…

…because the company expanded its offerings to include management of IRA accounts, too.

As of this writing, Blooom manages over $3 billion in assets.

Furthermore, the company estimates that it’s saved users over $1 billion in lifetime investment fees.

This robo-advisor covers employer-sponsored plans, which is a surprisingly rare find in today’s market.

Blooom Review: Features

401(k) Management

Blooom sticks out by providing a much-needed niche strategy for managing employer-sponsored retirement plans.

Given that 401(k)s are the preferred retirement savings vehicle for many investors, this company is filling a significant void.

On the flip side, most robo-advisors deal exclusively in individual retirement and taxable brokerage accounts.

Blooom offers IRA account management, too.

However, the IRA account must be held at Vanguard, Charles Schwab, or Fidelity.

For employer-sponsored plans, it doesn’t matter where you work or where your account is held…

…Blooom will manage your 401(k)!

No account minimum

We love no account minimum because it allows newcomers to get started right away.

Blooom requires no account minimum.

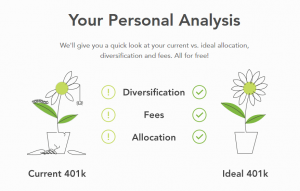

Free Account Analysis

You can sign-up for Blooom, and they will analyze your 401(k) for free.

The process is quite simple.

Here are the steps:

- You will begin by creating a username and password.

- Then, you will share a few details about yourself (standard info).

- Finally, you will securely link your 401(k) to the platform.

Once complete, Blooom will show you how your fees and asset allocation compare with its recommendations and suggest ways to improve.

You can change your recommended asset allocation for more or less risk, depending on your preference.

Once this is set, Blooom will share its recommendations for your 401(k) and compare it with your current investments.

If that’s all you need, you can incorporate Blooom’s recommendations and fine-tune your asset allocations without signing up for Blooom’s paid accounts.

Investment Expense Audit

Is your employer-sponsored plan costing you too much money?

Can you even answer that question right now?

If not, you will want to look into that.

Blooom will work with the investments in your account and classify each one into an asset class.

From there, the company will select the investment in each bucket with the lowest expense ratio.

Note that there are instances where there is only one fund in each category (and thus, no way to lower expenses), this method can help lower overall costs and maintain your desired asset allocation.

Financial advisors

You can access financial advisors through e-mail and live online chat support.

These advisors include registered investment advisors who can answer your financial planning questions.

These advisors can be a massive benefit because they cover topics that fall out of the scope of traditional 401(k) management.

The topics include debt repayment, budgeting, and preparing for major life events.

Cost

Blooom would like you to see the value in outsourcing the management of your 401(k).

So much so, that the company offers one annual flat fee for users.

The flat fee totals $120 annually (unless you pay upfront, which gives you a $12 discount).

This way, you know exactly what you are paying.

Furthermore, the charge is made directly to your bank account, rather than skimmed from your 401(k) balance.

The downside to this fee structure is that it could be a significant percentage of your savings if you do not have much to invest.

For example, at $120 per year, the management fee would be the equivalent of 2.4% on an account balance of $5,000.

Blooom Review: Improvements

Limited Due Diligence

We have concerns about the level of risk assessment done by Blooom.

The simplicity of linking your 401(k) and getting recommendations is effortless.

However, the company could do a better job assessing risk tolerance to provide better recommendations.

One thing to note is that Blooom assumes your goal is retirement (which is reasonable given that the company specializes in retirement plans).

No phone support

Customer service can be vital for these finance apps.

While phone support is not essential to me, it could be for some.

Limited IRA Plan Options

If you want Blooom to be your go-to IRA manger, you will need to use Fidelity, Charles Schwab, or Vanguard.

Again, not a deal-breaker, but certainly worth noting.

Sign-up for Blooom

The sign-up process is simple, and everything takes place online.

Simply start by linking Blooom to your retirement plan, which can be an IRA account or an employer-sponsored plan.

Next, you’ll answer a few simple questions.

From there, you will create your Blooom account and provide your preferred e-mail address and password.

Once complete, you will log into your retirement account, where Blooom will provide your fee-free account analysis and make investment recommendations.

You will need to put a credit card on file with the company.

Finally, if you sign-up for an account, the fees will be charged outside of your account balance (as mentioned previously).

Final Thoughts

Sadly, this concludes our Blooom review.

Blooom is a solid product, but is it right for you?

Here is who stands to benefit the most from this service:

- Investors who participate in their employer-sponsored plan.

- Investors who have IRAs through Vanguard, Charles Schwab, or Fidelity.

- Any investor who would like a free 401(k) portfolio analysis.

Blooom is one of the few robo-advisors that focuses on retirement plans, such as 401(k) and individual retirement accounts.

The company provides a much-needed service to employer-sponsored retirement plans.

Since few robo-advisors have addressed this need, that makes Blooom worth checking out.

Before you sign-up, consider whether the fee is manageable compared to the amount that you currently invest.

This niche was previously overlooked by nearly all other robo-advisors.

As a reminder, here are the plans that Blooom manages:

- Retirement plans, including 401(k), 403(b), 457 and 401(a).

- Traditional and Roth IRAs, it only manages those from Fidelity, Charles Schwab, and Vanguard.

So, what are you waiting for?

Get your retirement on track TODAY!

Do you already use Blooom? Do you use another service?

Let us know with a comment below!

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.