If you want to know what the best stocks to buy now are….

If you want to know which stocks are likely to go up this week….

After 40 years of investing experience, I hate to burst your bubble but, I don’t think anybody really knows.

I am pretty sure that nobody has a crystal ball, not even ChatGPT, that can tell you which stocks are going to have highest return in the next few days.

I can tell you however, which stock newsletters have the most success in the short-term and long-term of picking profitable stocks. And more importantly that just picking profitable stocks, I can tell you which newsletter has the best record of BEATING THE S&P500.

When it comes to investing in the stock market, you really have 2 choices. You can put your money into mutual funds and S&P500 ETFs and hope that you can get the market’s historical 10% return over time. Or, you can manage your own stock portfolio and try to beat the S&P500.

This article is for those investors that want to beat the market consistently by buying the best stocks year after year. I can’t tell you which stocks to buy, but I can tell you where to find the best stock newsletters and what their recommendations are to help you beat the market.

While some stock market newsletters claim to have fantastic returns over the last few decades and others claim their models have been “back-tested” for 40 years or more, the important think for YOU is to know which services are performing well right now in the current market conditions.

Here is a sneak peak of some of the most popular stock newsletters’ performance of their 2023 stock picks :

As you can see from the green, indicating which ones beat the market overall, the winner is the Motley Fool Stock Advisor.

How To Find the Best Stocks

There are many stock picking subscription services that claim to beat the market and make you rich. Beware of those that offer these “get-rich-quick” schemes as the only ones getting rich are the ones selling the service.

We prefer the get-rich-slowly strategies that have proven over time to help individuals build their wealth. A 2023 study by Dave Ramsey confirmed that most millionaires build their wealth by investing consistently in the stock market year after year.

Most stock picking services occasionally beat the market, but we want to find the ones that beat it consistently. We want the ones that keep putting up the big numbers year after year, not the one’s that have a few homeruns but mostly strike out. It takes more than just scouring SEC filings to find the best stocks to buy and sell.

We’ve subscribed to a bunch of different services over the years in hopes of finding one or more that can truly deliver the kind of research, recommendations, and actionable insights (also known as “good ideas”) that can elevate an average investor into a Buffett-esque returns. And we have found a few!

- The Motley Fool Stock Advisor claims to be up 500+% since inception in 2002 vs the S&P500’s 130+%.

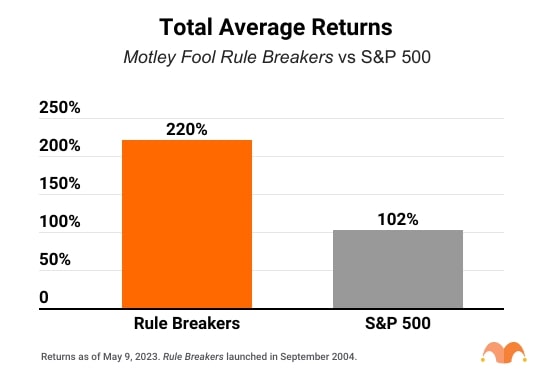

- The Motley Fool Rule Breaker claims to be up 225% vs the market’s 103% since inception in 2004.

- Seeking Alpha Premium claims their Quant Rating has yielded an average annualized return of 27% since 2010.

- Seeking Alpha Picks claims to already be up 22% vs the market’s 11% after just launching its service less than a year ago in July 2022.

Over time, we’ve come to discover that all of these services fall into one of two different categories:

- stock picking platforms that tell you what to buy/sell and when to buy/sell it, and

- stock research platforms that provide the information you need for a more informed do-it-yourself approach.

There’s some overlap, of course, but every platform leans one way or another. Stock picking platforms may include some research and analysis, for example, and stock research platforms may have their own proprietary star rating or grading system, but they usually won’t tell you what to buy or sell.

Since all of these platforms and services fall into one of two distinct camps, comparing them all against one another would be like comparing AAPLs and ORANs, so it makes more sense to split them up—after we take a second to appreciate that AAPLs and ORANs joke. Man, sometimes we really impress ourselves.

So here are the rules: We’re going to talk about a bunch of different services and platforms that we split up by category. We’ll talk about what they are, what they do, what their pro/con lists look like, and throw in any kind of performance data we can get our hands on. We aren’t going to tell you what to buy or sell, but we are going to give you a nice, firm shove in the right direction.

Best Sources of Stocks to Buy

We’re constantly evaluating the best places to get stock picks. Our list of stock pickers and stock research platforms below is reevaluated and updated monthly, so we can let you know about stellar services as soon as we do. These best stocks to buy now lists are current as of June 2023.

Let’s Hear It for Our Stock Pickers

First up is the stock picking services. These services tell you exactly which stocks to buy and sell, and when.

Motley Fool Stock Advisor

The Motley Fool is neither foolish nor particularly motley. The firm is staffed by a bunch of investors and finance professionals—hardly motley—and you wouldn’t think a bunch of fools would be able to pull off the kind of long-term performance that the talented folks at the Fool have put up over the years.

Ok, yes, the Motley Fool is named after a Shakespearean character who spoke truth to power even when that truth was deeply unpopular. And yes, they’ve dedicated themselves to providing the truth as they see it no matter how unpopular it might be. They buck trends. They value fundamental analysis and realistic thinking. They’re a bunch of smart, talented people who have put their considerable abilities to work in the service of providing investors with the best data, research, and analysis that their big old brains can muster. But none of that is funny.

What is it?

The Motley Fool Stock Advisor is the Motley Fool’s flagship product. Since 2002, they have released 2 unique stock recommendations a month and 2 lists of the Best 5 Stocks to Buy Now. So they tell you what to buy, and they also tell you when to sell it. For the last 20 years, it has been the best source of stocks to buy.

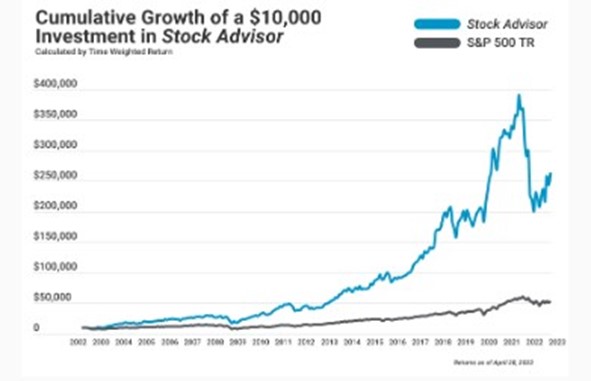

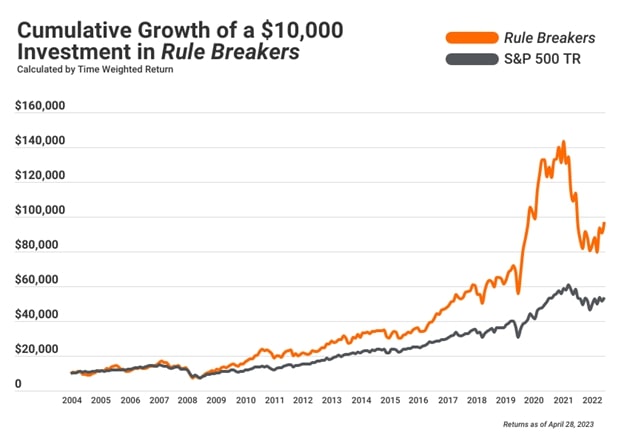

Here is a chart dated April 28, 2023 that shows the performance of their recommended stocks to buy versus the S&P500 since inception.

Not too shabby, right? Its performance speaks for itself. No other service has even come close to matching these returns.

Let’s stare at this chart for a minute. From the very beginning in 2002 their stock picks started outperforming the market as you can see from the blue line above. Their picks really spiked in 2020 and early 2021 and had a correction in late 2021 like most stocks did. But now look at the last part of the chart, from 2022 and early 2023 their picks are returning to their upward trend line.

Your first thought has got to be “are these returns really possible?” Well, we set out to validate these stated returns. We subscribed in January of 2016 and we gained full access to all of their picks going back to 2002. We then calculated the average return of all 500+ picks thru 2023, and we can now confirm the average return of all of their picks is correct!

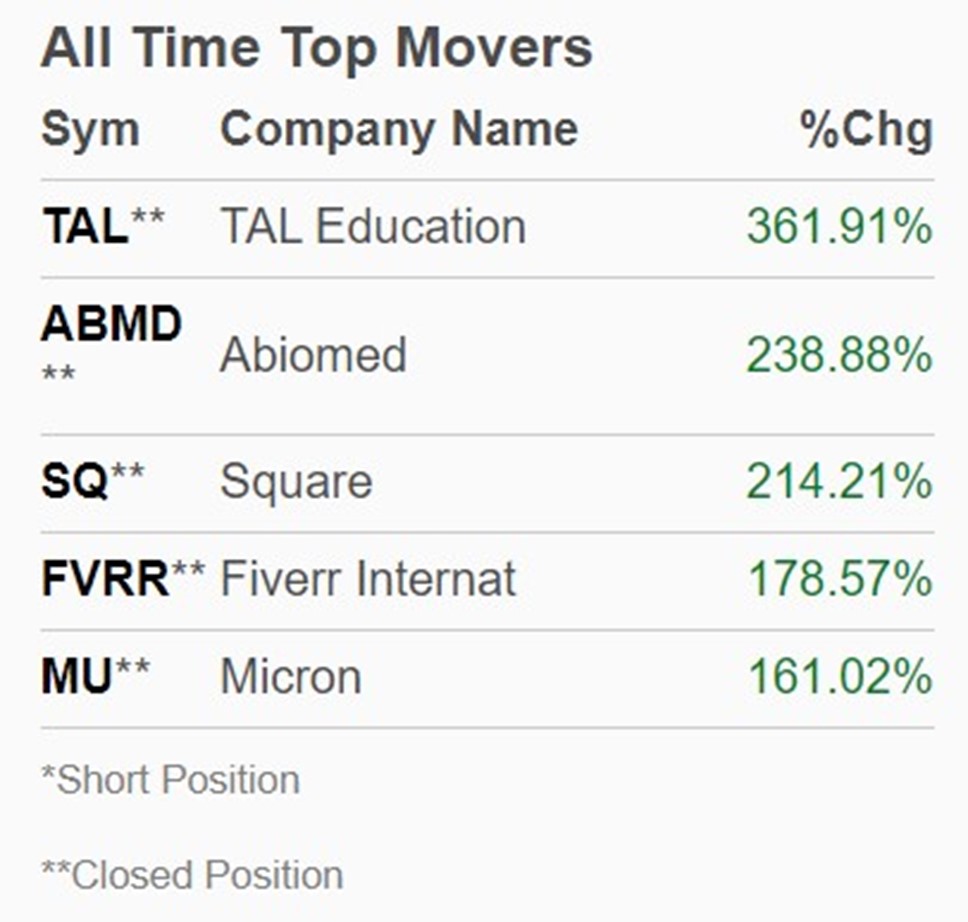

The secret to the Stock Advisor portfolio’s success is quite simple. The Motley Fool’s team has an excellent record of picking a few key stocks each year that double or triple each year.

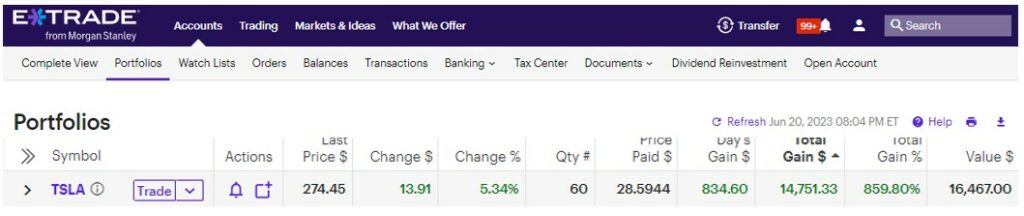

Here is a screenshot dated June 4, 2023 from our portfolio of one of their 2020 picks to prove the point:

They recommended Tesla (ticker TSLA) back on January 2, 2020 and we bought 60 shares at $28.69 (split adjusted). So that $1,700 is now worth $16,467 for a gain of 859% and a profit of $14,751 in 2.5 years.

Many of their picks simply become market leaders like AMZN, DIS, TSLA, TTD, SHOP, etc. that turn into 1,000+% returns. They use some combination of fundamentals, consumer, and economic trends to find companies before everyone else does.

When you sign up for the Stock Advisor service you get access to all past and present stock recommendations, as well as a nice smattering of research, commentary, and community features. It isn’t cheap, but the service’s history strongly suggests that all you have to do is follow their advice, wait, and cash out when the time is right.

Pros

- Started in 2002 and they have over 500,000 subscribers

- Strong historical performance (With over 500 stock picks since 2002, the average return of all 500 of their picks is 462% compared to market’s 125% as of June 3, 2023)

- They tend to pick a few stocks each year that double or triple, and they pick a few that never really move

- They make investing easy with 2 buy recommendations a month

- And they also tell you when to sell

- Very affordable at $199 per year; and they frequently offer discounts

- Not much interaction required

Cons

- With so many subscribers and friends of subscribers, their stocks really pop the few days after they release their picks so you really need to subscribe to get the alerts in real-time

- They recommend you build a portfolio of at least 25 stocks and you plan on holding the stocks for at least 5 years

- You really need to buy equal dollar amounts of all of their picks to get their super returns as you don’t know which ones will the ones that double or triple

Recent Motley Fool Stock Advisor Picks

Here are just a few of their recent picks (they won’t let me share too many):

- May 4, 2023 they re-recommended TSLA and it is already up 33% since then.

- April pick of VEEV and PAYC are up 6% and 1%

- March picks of RBLX and CRWD are down 11 and up 22%

- February picks of ACN and KNSL are up 11 and 19%

- January picks of NOW and DGX are up 1 and 50%.

Is Stock Advisor Worth it?

The Motley Fool’s Stock Advisor service is great value when you consider their track record. With over 20 years of a picks and an average return of all of their stocks of 462% vs the market’s 125%, no other service even comes close. Just scroll up and look at my January 2020 Tesla trade! Currently new subscribers can get their $199 service for the first year for just $79.

New Motley Fool Subscribers can save 60% and try 12 months of their stock picks for just $79.

Motley Fool Rule Breakers

The second service we’re looking at is the Motley Fool’s Rule Breakers. It’s their second most popular stock picking service—just behind Stock Advisor—and it’s been around for almost as long as its big brother. First established in September 2004, the Rule Breakers service ironically follows most of the rules that the Fool first set forth in Stock Advisor. The team follows the same ethos, picks two stocks each month, and is run and operated by pretty much the same folks.

The main difference between Stock Advisor and Rule Breakers is one of focus. Stock Advisor tends to pick companies that are flying under the radar but are still solid, well-established businesses. Rule Breakers, on the other hand, is primarily interested in companies that they believe have huge growth potential in emerging industries. Rule Breakers’ choices are a bit more risky on just about every level, though that risk is balanced out by the potential returns for any stock they pick that performs as predicted.

Case in point:

The numbers aren’t as great as Stock Advisor’s. Let’s just get that out of the way. But again, that’s kind of the point, isn’t it? Stock Advisor is meant to deliver slower, more even returns across all of its recommendations. Rule Breakers delivers more losses, true, but its best recommendations take off like rocket ships. A full 139 of the recommendations made in Rule Breakers have delivered 100%+ returns, and some of them have grown by a factor of almost 10,000%. That’s not too shabby.

Pros

- Solid historical performance

- Easy to use and follow

- Recommendations are well researched/reasoned

- Currently discounted by $200

Cons

- Have to hold stocks for a long time

- Riskier recommendations than Stock Advisor

Is Rule Breakers Worth It?

The Motley Fool normally charges $299 per year for Rule Breakers, which is a little steep—but right now you can get a yearlong subscription for just $99. At that price point, there’s really no reason not to subscribe. The portfolio’s put up great numbers over the years, and it shouldn’t be too hard to make more than $1.90 a week using their recommendations. So yeah, it’s worth it.

Seeking Alpha Alpha Picks

Seeking Alpha’s Alpha Picks is a stock selection service that gives you two stock recommendations a month—much like the Motley Fool’s services. The people at Seeking Alpha use a proprietary data-driven scoring system designed to find stocks that will appeal to more conservative investors, with the general idea being to find long-term plays that can deliver significant returns over time without putting the principal investment at too much risk.

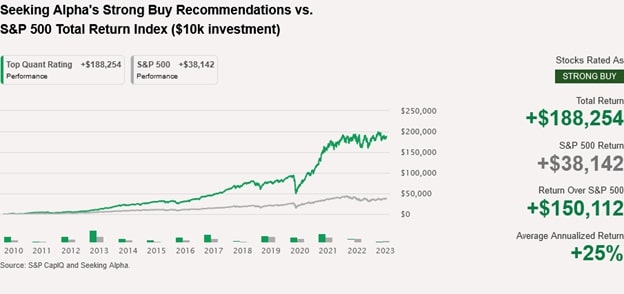

The process is guided by what they call their Quant model, which is essentially a big, complicated set of data-driven rules, algorithms, and a bunch of other complex stuff that all comes together to find the best stocks for any given investing style.

Stocks have to maintain a Strong Buy Quant rating for at least 75 days before they even qualify for Alpha Picks. They also have to maintain a market cap of over $500 million and a share price of over $10, must be traded as common stock only, and have to be the highest rated stock at the time of selection.

In other words, Alpha Picks aren’t picked all willy nilly. There’s an impressively rigorous process behind the service, and you can see how well it’s worked out for them in this graph:

The portfolio itself changes more quickly than the ones the Motley Fool maintains. They have the same “new pick every two weeks” formula, but they’re much more willing to let go of losers than the Fool. Alpha Picks checks and rechecks the Quant ratings of every stock in the portfolio at the beginning of each month. Any stocks that have dropped to Sell or Strong Sell ratings are sold off and have all the “cash” reinvested in the next portfolio rebalance (which is another whole thing), same with any accrued dividends. Stocks that are on Hold status for more than 180 days are also sold, which definitely helps reinforce the ideal of constant forward progress and price appreciation that Seeking Alpha follows.

When a stock in the Alpha Picks portfolio has more than doubled in price, it gets moved to a new category with a new set of rules. Stocks that make it to this “Good-to-Great” category sort of gain an extra life, so to speak—if their ratings fall to Sell or Strong Sell, they aren’t sold off entirely at the start of the month. Instead the portfolio only sells off the initial position and leaves the rest of it intact. If the stock gets another Sell or Strong Sell flag and doesn’t have twice the value of the initial investment, however, the initial rules take effect and the stock is sold off.

Pros

- Great for buy-and-hold investors

- Strong performance with minimal risk

- Fairly transparent quantitative rating system

Cons

- Returns aren’t quite as big as some other services

- Takes a bit more interaction than similar services

Is Alpha Picks Worth It?

Seeking Alpha is a great company with a lot of brainpower behind it. Their Alpha Picks portfolio hasn’t been around for all that long, and it hasn’t returned the kind of explosive growth that you can find elsewhere, but it’s still a solid bet. It’s definitely worth checking out, especially considering the fact that it’s only $99 for the first year right now. So go. Go now.

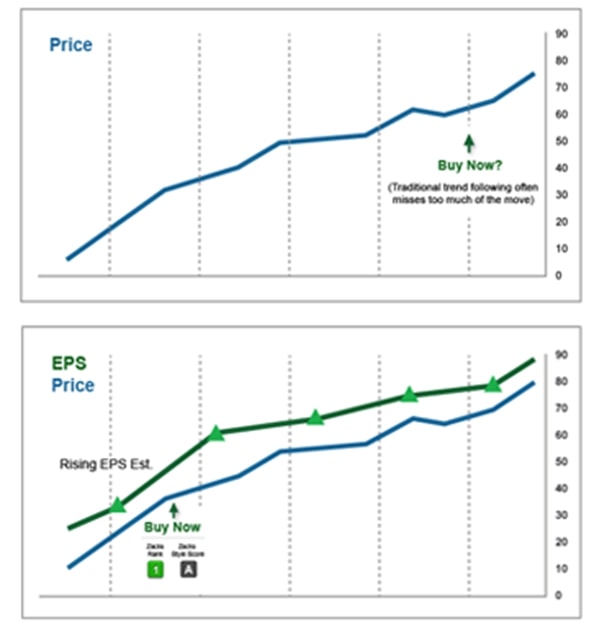

Zacks Home Run Investor

Zacks Investment Research is another firm that uses a proprietary set of algorithms and quantitative rating methods to find and recommend stocks. The firm was started by a guy with a Ph.D. in mathematics from MIT way back in 1978, and it’s been doing its thing very successfully ever since.

According to their website, Zacks Home Run Investor is another managed portfolio-style service that “targets under-the-radar companies with over-the-top potential.” It sounds similar to both the Motley Fool and Seeking Alpha, but with a bit of a twist.

Unlike those other firms/services, Home Run Investor focuses on small- and mid-cap companies, not established ones. It tends to ride trends in industries for as short or as long a time as necessary, which means its time frame for holding/selling stocks is more like 6 to 18 months as opposed to Motley Fool and Seeking Alpha’s 5+ year timeframe.

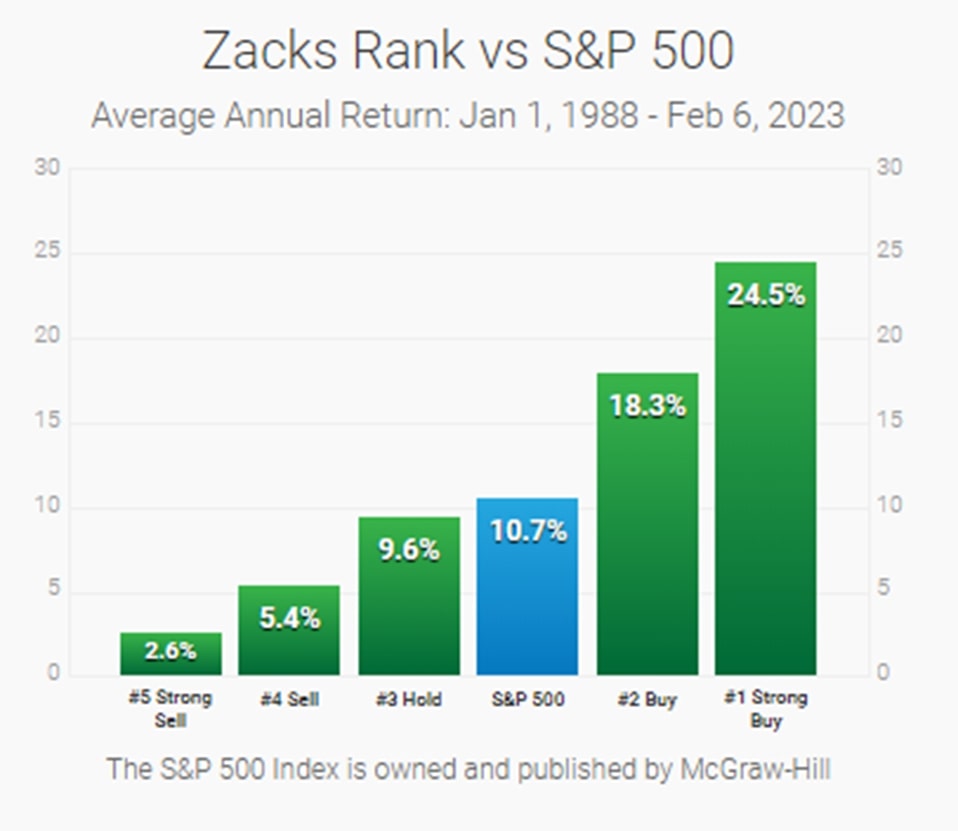

Zacks uses its original (though presumably updated and upgraded) Zacks Rank system to find the stocks, which has historically worked out well for the portfolio and for Zacks as a whole. It’s anyone’s guess as to how the Zacks Rank system works, but the proof is in the pudding:

Zacks is fairly tight-lipped about their portfolios’ performance, though we do know that to be considered a Home Run Investor stock it has to be rated with at least 50%, 100%, 200%, or more growth potential. We also know that Home Run Investor has only been around since 2011, but in that time it’s already picked more than 100 stocks that delivered double and triple-digit gains while they were held by the portfolio.

And while we don’t have the exact performance data for all of Zacks Home Run’s picks, their money back guarantee shows just how confident they are. Zacks is so confident in its ability to pick winners that it will give you a full refund on your subscription fees if they don’t manage to outperform the S&P 500 during a given stock holding period.

Pros

- Active portfolio with quick turnovers

- Proven quantitative underpinning

- Includes a bunch of research and Zacks Investor Collection

Cons

- Active portfolio with quick turnovers

- Requires a lot of interaction

- Not great for long-term investors

Is Home Run Investor Worth It?

If you subscribe to Zacks Home Run Investor right now, you can get a 50% or 35% discount on a 1-year or 6-month subscription, respectively. That evens out to $149 a year or $99 for 6 months.

Zacks hasn’t stayed in business this long by being bad at what they do. And yes, the subscriptions are a bit pricier than a lot of other services—especially at full price—but you have to remember that the portfolio is meant for much shorter holding periods than the likes of the Motley Fool’s or Seeking Alpha’s. You might need to hold the Motley Fool’s picks for 5 years or more, whereas you’d only need to pay 1 or 2 years-worth of dues to realize returns with Zacks Home Run.

So GO. Go check it out. And get rich.

Research and Destroy

Now, let’s dive into our second category: Stock research platforms that utilize their proprietary stock ranking systems to help you with your research, but don’t tell you exactly what to put in your portfolio.

Seeking Alpha Premium

Sure, they’re Seeking Alpha, but are they finding it?

Yes. Turns out they are.

Seeking Alpha Premium is the bigger, better, more expansive version of their Alpha Picks service. Signing up gets you access to a ton of premium content including analyst ratings, analyst performance stats, stock Quant ratings, stock dividend grades, and a whole lot more.

Seeking Alpha’s main bread and butter is their crowdsourced stock research and analysis. Thousands of investors and financial professionals contribute their own analysis on whatever interests them every month—way more than any one person could read. That’s great on its own, but it barely scratches the surface of what Seeking Alpha Premium has to offer.

We could take a lot of time to talk about Seeking Alpha’s wide range of features. They have a lot going on. This is a piece about stock research platforms, however, so let’s just focus on that aspect of what Seeking Alpha does.

Take a look at the graph below. Remember those Seeking Alpha Quant ratings we talked about earlier? Well, this is what it looks like when you apply their Quant rating system across the entire market and graph the performance of the ones they rate “Strong Buy.”

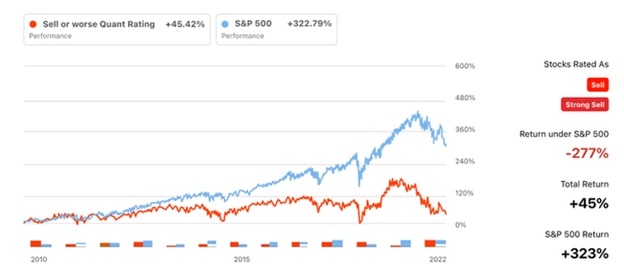

As you can see, Seeking Alpha’s Quant ratings are no joke. They know what they’re doing. If you did nothing but follow Seeking Alpha’s ratings you’d stand to make some huge gains. It works the same way in the other direction, too.

The above graph shows how all of Seeking Alpha’s Quant-rated “Sell” or worse stocks significantly underperformed the S&P 500. In other words, when Seeking Alpha says “Sell,” you’d be smart to follow their lead.

Pros

- Highly accurate Quant ratings

- Huge amount of research and analysis

- Community features

Cons

- Way more information than one person can handle

- Tough to pick which “Strong Buy” stocks to buy

Is Seeking Alpha Premium Worth It?

Seeking Alpha Premium is currently on sale for $4.95 for 1 month, then $239/year after that. It’s not cheap, but it isn’t that expensive either when you consider the amount of useful information you’ll get from the site.

If the numbers are any indication (hint: they are), then subscribing to Seeking Alpha and following its recommendations is a terrific investment. Their Quant system is as accurate as it is complicated, and it’ll point you in the right direction no matter what kind of investor you are.

Zacks Premium

Zacks is proud to tell you all about how the picks using the Zacks Ranks system have recorded average gains of 24.52% per year between 1988 and 2023. That’s an average of almost twice as much as the S&P 500.

Zacks has a bunch of stock picking services, but those are more like branches sprouting off of the big old Zacks tree. There’s a lot more gold in them hills, and you have to pay to play.

If you want to subscribe to Zacks proper, you’re going to need to pick between two tiers: Premium and Ultimate. Premium is the cheaper of the two tiers, though you shouldn’t be thrown by its relatively low price point. Make no mistake, Zacks Premium comes with more than its fair share of goodies.

First and foremost: Zacks Premium gets you access to Zacks #1 Strong Buy list, which is exactly what it sounds like. Zacks #1 Strong Buy ranked stocks have beaten the market by over 23% per year on average since 1988, as you can see below.

Premium membership also comes with equity research reports, Zacks Industry Rank (a tool that divides stocks and ranks them within 250 different industries), earnings filters, pre-built stock screeners, and more. Like we said, it’s a lot.

Pros

- Lots of research and info

- Great stock screeners

- Industry rank list for specialized investing

Cons

- Not exactly cheap

Is Zacks Premium Worth It?

Zacks Premium is worth it. Right now it’s $249 per year, but you can get a 30-day free trial to see if it’s something you really want to spend your money on. Really though, is there a better use for your money than a service that’s proven to provide profitable research and recommendations?

Get it. Get on it.

Zacks Ultimate

This is the Ultimate Zacks experience, which means it’s basically just an upgrade to Premium. You get all the Premium and basic features, plus access to the full slate of Zacks Investor Collection portfolios (essentially just managed portfolios like Zacks Home Run and so on).

Most of what you get when you subscribe to Ultimate is the ability to check out a bunch of their more esoteric and successful managed portfolios. There are portfolios for alternative energy companies, an AI-driven portfolio called Black Box Trader, some blockchain, commodity, and counter-market portfolios, plus a bunch more.

Pros

- Lots of managed portfolios with a ton of ideas and research

- Access to all of Zacks’ content

- Bragging rights(?)

Cons

- Very expensive

- Doesn’t include enough to legitimize price point

Is Zacks Ultimate Worth It?

If you have a massive portfolio already and are just looking for new ideas then sure, Zacks Ultimate might be worth it to you.

If not? No. No way. Yes, there’s a lot of good info and recommendations in there. Yes, Zacks is very good at what it does. And yes, you’ll probably make money if your portfolio is big enough to absorb the expense.

What expense? Oh, just $299 per month or $2,995 per year. Granted, they are offering a 30-day trial for $1, so it’s worth checking out at least, but come on.

Morningstar Investor

Morningstar is one of those companies that doesn’t need to advertise, because other companies do it for them. If you look through as many stock research and picking services as we have, you’ll find that most of that research comes from one place: Morningstar. That’s right. Other companies will sell access to Morningstar’s research and call it one of their very own perks.

If you subscribe to Morningstar Investor, you’ll quickly see why it’s such a big deal. They have over 150 independent analysts—all of whom are industry veterans—who are constantly cranking out deep, fundamentals-driven research and analysis on pretty much every stock you can think of.

Investor memberships give you access to all the current, past, and future research that they’ve produced, as well as a massive list of Morningstar ratings on securities, individual managers, socially and environmentally conscious investments, and pretty much anything else that’s remotely related to investing.

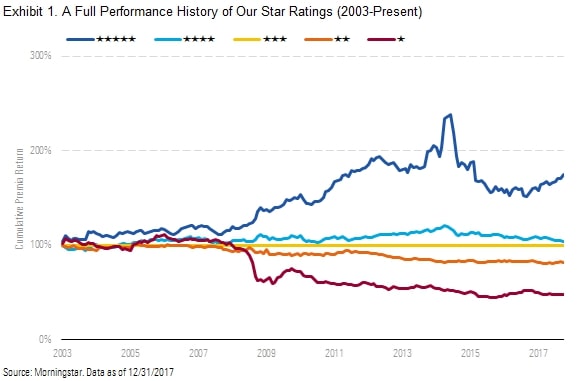

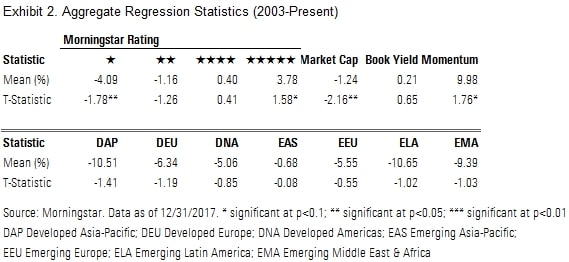

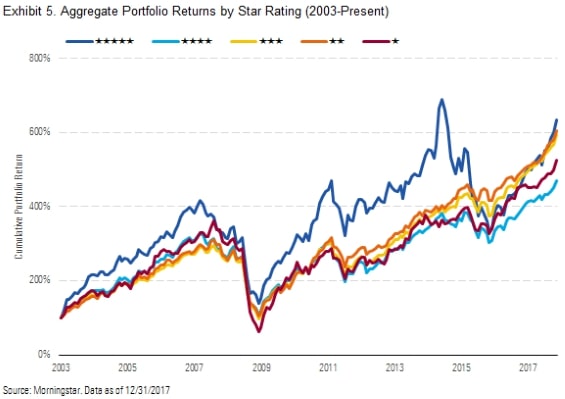

How good are these ratings?

That good.

Morningstar’s 5 star-rated companies don’t outperform the market by chance. Analysis has shown that their rating system is so good that they have statistically significant explanatory power for the future performance of stocks. Or, to put that in human words, they’re real good.

Pros

- Recognized for research and rating industry-wide

- Incredibly diligent and accurate research and recommendations

- Huge library of research and analysis to check out

Cons

- Mostly good for value investors

- Tons of information to sift through

Is Morningstar Investor Worth It?

If you’re a scholar, a value investor, a smarty-pants, etc. then Morningstar Investor is worth it. Right now, they’re offering a 7-day free trial—more than enough time to convince you—and then offer monthly and annual memberships at $34.95 and $249, respectively.

Stock Rover

Stock Rover is a stock screening and analysis platform that’s been getting a lot of attention lately. Why? Easy. Their screener functionality is unmatched across the industry, their portfolio management and analysis features are kind of insane, and—most relevant here—their Stock Rover Research Reports give you in-depth and up-to-date information on over 7,000 different stocks with just a couple of clicks.

They don’t do a whole lot of predicting or rating, so we don’t have any great performance charts for you, but that doesn’t mean you have to take our word for any of this. Their free memberships give you a remarkable amount of access to all their best features, so there’s no reason not to pop in and explore.

Pros

- Powerful screeners

- Advanced portfolio management

- Innovative interface

Cons

- You’ll need to follow the tutorials to figure it out

Is Stock Rover Worth It?

A free membership to Stock Rover is absolutely worth it, and so is subscribing to one of the higher paid tiers. Right now you can get a Stock Rover Essentials membership for just $7.99/month or $59.99 for your first year, which is kind of insane considering how much you get for the money.

Conclusion

There are tons and tons of different stock rating, research, and picking services out there. A lot of them—like the ones on this list—are well worth your time and money. So go ahead and try some free trials and maybe a cheap membership or two so you can figure out which ones are the best and the best for you in particular. And the second we hear about any services that are better, we’ll be the first to let you know.

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.