Purchasing stocks and other securities normally requires a broker who can execute your trade.

If you are an active trader, you likely realize the importance of having a good stockbroker.

If you are a new trader, you may be wondering…

…do I really need this middleman (i.e., a stockbroker) to charge me fees?

Well, the short answer is a resounding ‘YES.’

However, with the rise of various financial websites, it is possible to cut the broker out of the equation.

And while you “can” bypass a broker to purchase securities, doing so is definitely not easy.

And while you may HATE the idea of using a middleman to purchase stocks…

…if you choose not to use one, your options will be severely limited.

So, while a broker is not 100% necessary to buy and sell…

…a broker is needed for you to get the most out of your financial transactions.

Now that we have established that a stockbroker is more than middleman/thief let’s take a look at what a stockbroker actually does.

What is a stockbroker?

After all of that talk, you may be wondering…

…what does a stockbroker do?

And why do I need one?

A stockbroker is a person or institution licensed to executes buy and sell orders given by investors.

Stockbrokers can buy and sell stocks and other securities via the market exchanges.

In short, stockbrokers connect the buyers and sellers of stocks and make the trades happen.

However, this service comes at a cost – such as a flat fee or a commission, which is a percentage of the sale or purchase price.

In the past, the only way that individuals could invest directly in stocks was to hire a broker to place trader on their behalf.

This process was once a clunky, costly transaction done over landline telephones (remember those?).

But now, that same transactions can take place online in…

…a matter of seconds and for a fraction of what full-service brokers used to charge!

Gotta love technology, right?

That’s right – the growth of discount brokers on the Internet has made it possible for anyone to invest.

Most investors use online brokerage accounts to place their trades.

With that said, you should know the BEST online brokers to trade with.

Some online stock brokers differentiate themselves in the following ways:

- Excellent customer service

- Inexpensive stock trades

- Powerful trading tools

- And more!

Which differentiator is best?

That answer will depend on your investing goals, educational needs, and learning style.

Choosing an online brokerage that suits your needs can be the difference between…

…making money or an uphill battle leading to frustration, disappointment, and surrender.

We certainly do not recommend the latter for you.

That is why we plan to search, test, and review the online brokers, and recommend only the best ones.

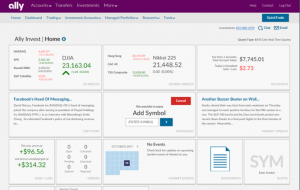

Ally Invest Overview

Today, we are here to review all of the things that you need to look for in your ideal brokerage so that you can make a well-informed decision.

These factors include everything from whether the platform trades securities you are interested in, down to the customer service provided.

With this review, you will have everything that you need to begin evaluating your options…

…and setting yourself up for SUCCESS!

So, what do you say?

Are you ready to hear about Ally Invest, one of the top online brokerages on the market today?

Ally Invest (formerly TradeKing) is a discount online brokerage firm owned by Ally Financial.

The company operated as an independent, online broker for over 10 years before being acquired by Ally Financial in April 2016 for a whopping $275 million.

Ally Invest maintains much of what was right about TradeKing while putting its spin on the new entity.

Customers of Ally Bank can manage their bank accounts and investment accounts in one place. Many people are big fans of the universal account experience and have made Ally their exclusive bank.

Ally Invest currently serves over 250,000 customer accounts with $4.7 billion in assets under management.

The company offers both self-directed investing and managed accounts.

Ally Invest Self-Directed Investing

Self-Directed Overview

If you are looking to invest on your own, this is the section for you.

There is a lot of information to cover, so we will keep it short and to the point.

You can choose between the following types of accounts:

- Individual and joint taxable accounts

- Traditional, Roth, and rollover IRAs

- Custodial and Coverdell accounts

- Certain business accounts

You choose between the following types of investments:

- Stocks

- Bonds

- Options

- Mutual Funds

- Exchange traded funds

- FOREX and futures

There is no minimum initial investment for the Self-Directed Investment account.

See below in the trading fees section for additional information on costs.

Trading Tools

When it comes to trading tools, Ally Invest stands out by having one of the most comprehensive offerings.

Ally Invest has maintained and improved upon most of what TradeKing offered in the past.

Some of our favorite trading tools include:

Streaming Charts

Ally Invest gives you six chart types, with over 90 chart studies and drawing tools. These tools will assist you in analyzing the performance of:

- Stocks;

- ETFs;

- And indices.

Streaming charts also allow you to customize settings and utilize interactive charts for prices and studies.

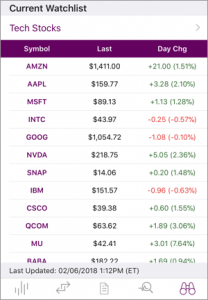

Watchlists

With Watchlists, you can follow groups of securities and track their market data.

Research and Market Data

This tool allows you to get quotes, charts, high/low prices, dividend dates, news, historical quotes, and peer performance comparisons.

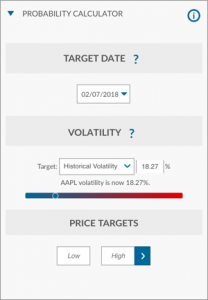

Probability Calculator

You can use implied volatility to help determine the likelihood of hitting your targets before you pull the trigger on an investment.

The following tools are specific to Options trading:

Profit/Loss Graph

The P/L graph helps you understand an options trade’s profit and loss potential. You can review outcomes based on changes in volatility and time.

Options Chains

With this tool, you can easily place trades, including elaborate multi-leg spreads.

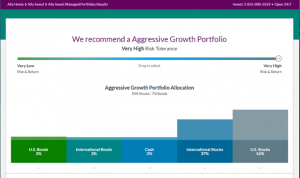

Ally Invest Managed Portfolios

As it turns out, you are not a ‘do-it-yourself-er’ and would prefer someone else to manage your investments.

We completely understand.

So, as an alternative to self-directed investing…

…you can have a part, or all, of your portfolio professionally managed by Ally.

![]()

Ally Invest Managed Portfolios works similarly to a robo-advisor.

As such, the investment management methodology is based on modern portfolio theory (MPT).

With this option, all aspects of investment management are covered for you.

You start by completing a questionnaire used to determine your:

- Risk tolerance

- Investment goals

- Time horizon, etc.

From there, your portfolio is created by using several diversified, low-cost index funds (ETFs).

Ally Invest will handle everything from this point forward…

…all you need to do is fund your account.

For Managed Portfolios, there is a required initial investment of $2,500.

Additionally, the annual management fee will cost 0.30% per year.

The 0.30% charge reasonable, considering a $10,000 portfolio can be managed for just $30 per year!

You can choose between the following types of accounts:

- Individual and joint taxable accounts

- Traditional, Roth, and rollover IRAs

- Custodial accounts

On top of that, Ally Invest gives you five different portfolio options:

- Conservative

- Moderate

- Moderate Growth

- Growth

- Aggressive Growth

Ally Invest will make a portfolio recommendation based on your risk tolerance (determined from the questionnaire). Thus, you can ultimately choose which portfolio is best for you.

You have the flexibility to change from ‘Conservative’ to ‘Aggressive Growth’ if you so choose.

The more aggressive that you are, the higher the allocation of stocks you will have. The more conservative, the higher distribution goes to bonds and cash.

For example, the ‘Aggressive Growth’ portfolio contains:

- 93% stocks

- 5% bonds

- 2% cash

So, if you are more of a “hands-off” investors, the Managed Portfolio is where it is at!

Ally Invest Forex & Futures

Some of you may have never head of Forex, but did you know…

…Forex is one of the most traded markets in the world?

And if you are interested, Ally Invest offers a Forex platform for you to use.

With Ally Invest, you can trade over 50 currency pairs, which includes gold and silver.

These trade can be made in real-time, and the company offers comprehensive research and analysis to give you the advantage you are looking for.

You can open an account with $250 (but a $2,500 is recommended). $2,500 is advised to take full advantage of the account.

Forex and Futures Tools

You can access these tools with a Forex and futures account (these are not available with a self-directed account alone).

Forex and Futures Demo Account. You can test the waters with a free $50,000 practice account. You will gain full access to the trading platform and tools for up to 30 days. This demo account will give you the opportunity to test your trading skills before using your real money.

ForexTrader Web. ForexTrader Web is the trading platform available for Windows and Mac. You can view real-time positions, account information, and a fully integrated charting tool. This feature also comes with a variety of single and contingent order types, including:

- If/then;

- If/then OCO;

- And Trailing Stops.

Forex Premium Charting. This feature includes a set of professional grade tools that help you identify and decode Forex patterns and trends.

Ally Invest Commissions & Fees

One great thing about Ally Invest is that there is no minimum initial investment associated with its accounts. Additionally, there is no annual fee, inactivity fees, or IRA fees.

This section is off to a great start, eh?

The trading fees are as follows:

- Stocks and ETFs: $4.95 per trade

- Mutual funds: $9.95 per trade on no-load funds only

- Options: $4.95 per trade plus $0.65 per contract

- Bonds: $1 per bond, subject to a $10 minimum and $250 maximum

- United States Treasures: No fee

If you trade often, Ally Invest offers…

…preferred pricing for high-frequency traders!

How can you become a high-frequency trader?

Simply make at least 30 trades per quarter or have an account balance of $100,000 or higher.

The stock trade fee drops from $4.95 to $3.95 and options commissions go to $3.95 + $0.50 per contract.

Lastly, there are no commissions for Forex trades.

Ally Invest Customer Service

You can contact Ally Invest in several different ways:

Live Chat. Go to the ‘Contact Us’ page on the website to Live Chat.

Phone Call. Give them a call at 1-855-880-2559 or 1-818-459-4591 for non-US callers.

Email Support. Shoot them an e-mail at support@invest.ally.com.

Mail. You can also send check, forms, and letters to:

Ally Invest

P.O. Box 49050

Charlotte, NC 28277-3432

Overall, Ally Invest is very accessible and available for any customer questions, comments, and concerns.

Who is Ally Invest Best For?

Ally Invest is great for all types of investors. However, here is who we think can benefit the most:

- Investors with a basic understanding of markets and security types looking for a simple brokerage account

- Active or high-volume traders who can benefit from lower commission fees

- Advanced traders looking to trade Forex or futures

If you fit this mold, Ally Invest is an excellent low-cost alternative to other brokerages like E-Trade and TD Ameritrade.

Ally Invest can benefit other types of investors, but the several mentioned above stand to benefit the most.

Beginner investors that seek guidance in the form of professional help, educational materials, etc., for making investment decisions could find a better alternative.

Sign-up for Ally Invest

Applying online for an Ally Invest Self-Directed Trading or Managed Portfolio account is simple.

Self-Directed Trading

Go to the Self-Directed Trading page and select Start Trading to go to the application. Enter your personal information and choose the account type and funding options you prefer. You’ll receive an email once your application is approved.

Managed Portfolios

Go to the Managed Portfolios page and select Create My Plan to get a personalized portfolio recommendation. Once you have your customized plan, select “Open an Account” to apply. Enter your personal information and choose the account type and funding options you prefer. You’ll receive an email once your application is approved.

What We Love about Ally Invest

Commissions

Few online brokers can compete with Ally Invests rock-bottom commission pricing of $4.95 per trade of stocks and exchange-traded funds.

And do not forget, active investors, qualify for a discounted rate of $3.95 per trade by making 30 or more trade per quarter or having a balance of $100,000 or more.

Account minimum

The $0 minimum account balance means there is no barrier to getting started. This benefit is significant for stock-focused investors looking to fund an IRA.

Trading platform

Since the platform is web-based, it is easy to use anywhere, anytime. No download required!

Ally Invests trading platform gives you the following benefits:

- Quick trading capabilities

- Real-time streaming quotes and data

- Customizable dashboard

- Access to all of the broker’s tools

You can also trade via a mobile device with the mobile app (for iOS and Android) or through the web-based platform.

Investing and research tools

Ally Invest offers above-and-beyond investing and research tools, especially for a low-cost broker.

All of the tools are free and include things like:

- Streaming charts

- Watchlists

- Research and market data

- Profitability calculator

- And more!

Its options trading tools are also powerful and include an options pricing calculator that compares current bid/ask prices to forecast theoretical values.

Customer Service

Ally Invest customer service representatives are available 24 hours a day, 7 days per week.

What We Don’t Love about Ally Invest

Mutual funds

Ally Invest offers plenty of mutual funds (over 8,000!), but they all come with transaction fees.

The commission for a no-load fund is $9.95. This fee is not unreasonable, but other discount brokerages offer thousands of funds with no transaction fees attached.

Physical locations

If you are an investor that will require more of an in-person touch – you will not find it here because Ally Invest has no physical presence.

The company does, however, offer 24/7 online and phone customer support.

No “tester” account option

We always like to see an option to test out a product before using it “live.”

Ally Invest does not currently offer this option for Self-Direct or Managed Portfolio accounts (but we would love to see it).

Is Ally Invest Right For You?

TradeKing was once one of the top online brokerages around. Ally Invest has taken that company and improved upon it immensely.

For that reason, Ally Invest is one of our favorite low-cost online brokerages.

The company boasts a robust trading platform that includes FREE research, data, and analysis tools.

As an investor, you have two options:

- Self-Directed

- Manage Portfolio

These options make Ally Invest great for all types of investors and many different investment goals.

The advanced investors can get started with a self-directed account and new investors can open a managed portfolio and ease their way into self-directed investing.

Remember, you can open a self-directed account with no minimum initial deposit.

Additionally, the platform offers 24/7 customer service to help you on your journey.

You can continue to look around for better online brokerages…

…but you will be hard-pressed to come up with a better overall investment platform.

If you are looking for more information, feel free to visit the Ally Invest website for more details.

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.