Managing your money shouldn’t feel like a security gamble. Yet every time you connect a financial app to your bank account, that question lingers: is this actually safe?

Rocket Money has become one of the most popular personal finance tools in the United States, promising to help you cancel subscriptions, negotiate bills, and track your spending habits. But with millions of users trusting it with their financial information, the stakes are high.

This guide breaks down exactly what “safe” means when it comes to Rocket Money—covering everything from encryption standards to privacy practices, real user experiences, and the risks that don’t show up on a security page.

Quick Answer: Is Rocket Money Safe to Use?

For most users, Rocket Money is generally safe to use, but it’s not risk-free. The app employs industry-standard security measures comparable to major banking institutions, though concerns around privacy practices and third-party data sharing remain valid for some users.

Rocket Money uses bank-level AES-256 encryption for secure online data storage and data transmission. When you connect your bank account, the app doesn’t actually store your login credentials—instead, it relies on Plaid, a third-party service that generates an encrypted token to facilitate read-only access to your transaction data.

If you use Rocket Money’s smart savings account feature, your funds are held at FDIC-insured partner banks. As of 2025, this means deposits are protected up to $250,000 per depositor, per institution—the standard federal limit that applies to traditional banks.

That said, no money app can guarantee 100% security. Data breaches happen even to the most protected companies, and account misuse is always possible with any online financial service. When asking “is rocket money safe,” you’re really asking two separate questions:

- Data and bank-account security: How well does Rocket Money protect your financial data from hackers and unauthorized access?

- Financial risk from features: Could the bill negotiation service fees, automatic savings transfers, or hands-off money management lead to unexpected costs?

Who Rocket Money is likely safe enough for: Typical U.S. consumers already comfortable connecting bank accounts to apps like Venmo, PayPal, or other budgeting tools. If you’ve used Plaid-based services before without issue, Rocket Money follows the same security model.

Who should think twice: Very privacy-sensitive users uncomfortable with any third-party seeing their banking data, or those unfamiliar with how financial aggregators work. If you’d rather track spending manually than share transaction data, this may not be the right fit.

What Is Rocket Money and How Does It Work?

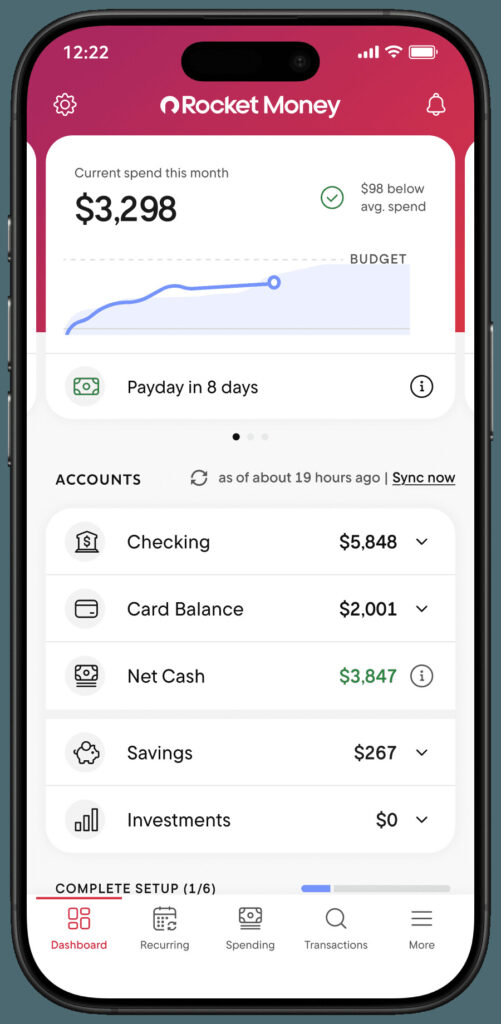

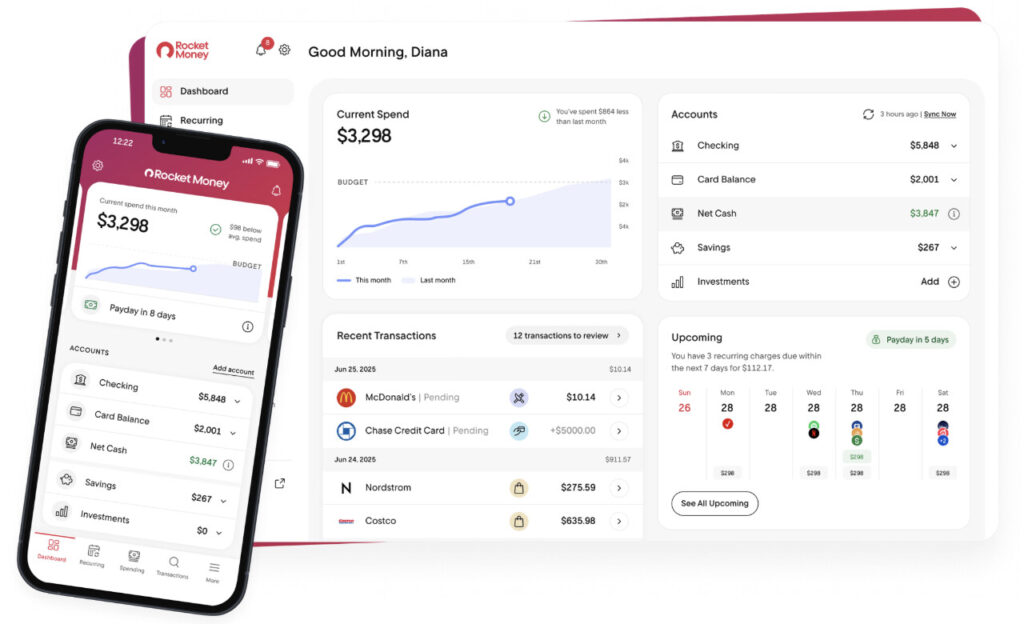

Rocket Money is a U.S. personal finance app designed to consolidate your money management in one place. Its core focus is budgeting, subscription tracking, and bill negotiation—tools aimed at helping users save money without spending hours on spreadsheets.

The app has an interesting history. It started as Truebill, founded in 2015, before being acquired by Rocket Companies in late 2021. The rebranding to Rocket Money came in 2022, making it part of the broader Rocket ecosystem that includes Rocket Mortgage and other financial services. This corporate backing from a publicly traded company adds a layer of regulatory scrutiny you won’t find with smaller startups.

Here’s how Rocket Money works in practice: you connect your checking, savings, credit card, and sometimes investment accounts via Plaid. Once linked, the app automatically syncs your transactions and begins categorizing your spending.

Core features include:

- Budgeting tools that let you create unlimited budgets and track spending categories

- Subscription detection and one-tap cancellation for unwanted subscriptions

- A financial goals tool for automatic savings transfers

- Credit score tracking

- Bill negotiation to lower recurring expenses

- Net worth tracking across all your financial accounts

The app is available on iOS, Android, and via a web dashboard. Sign-in uses email and password, and you can enable biometric authentication (Face ID or fingerprint) depending on your device.

For Rocket Money to function, you must grant read-only access to your transactions through your financial institutions. This is central to both the app’s convenience and the safety concerns we’ll address throughout this article.

To learn more about the platform, read our Rocket Money Review.

Rocket Money Security: How Your Data and Accounts Are Protected

Rocket Money’s security model follows the same playbook as other top U.S. finance apps like Monarch Money, YNAB, and the former Mint. If you’ve trusted any of these platforms, Rocket Money operates on similar principles.

As of 2025, Rocket Money publicly states it uses AES-256 encryption—the same standard used by banks and government agencies—for data both in transit (when moving between your device and their servers via HTTPS/TLS) and at rest (when stored on their systems).

These security practices are documented on Rocket Money’s official security and privacy pages. Since policies can change, it’s worth confirming current details directly on their site before signing up. They also provide contact options like security@rocketmoney.com for inquiries, which suggests a level of transparency not all apps offer.

The app’s ownership structure matters here too. Rocket Companies is a publicly traded financial-services group subject to U.S. regulations and audits. This raises the bar for security and compliance expectations compared to a small, privately-held startup that answers to no one but its investors.

What Rocket Money can and cannot do with your accounts:

Rocket Money can see your transaction data, account balances, and spending patterns. However, it does not have permission to move money out of your linked bank accounts without explicit user action. The only exception is if you specifically set up Financial Goals transfers, which require your authorization.

Passwords are never stored in plain text. They’re encrypted and hashed following common industry standards, meaning even Rocket Money employees can’t see them in a readable format.

Key protections at a glance:

- AES-256 encryption for data storage and transmission

- Segregated access tokens (Plaid handles credentials, not Rocket Money)

- Read-only permissions for bank connections

- Internal access controls limiting employee data visibility

- Hosting on Amazon Web Services (AWS), which serves high-security clients including the Department of Defense, NASA, and the Financial Industry Regulatory Authority

See how Rocket Money has helped members save over $2.5 billion—and decide if it’s right for you.

How Bank Connections Work: Plaid and Read-Only Access

One of the most common concerns about Rocket Money centers on bank connections. Here’s the important distinction: Rocket Money does not directly handle your bank username and password. Instead, it uses Plaid, a third-party financial data aggregator.

Plaid is a widely used service that connects apps to over 12,000 U.S. financial institutions. You’ve likely encountered it before if you’ve used Venmo, Chime, Robinhood, or dozens of other financial apps. It’s become the industry standard for secure account linking.

Here’s how the connection flow works:

- When you add a bank account in Rocket Money, you’re redirected to a Plaid authentication window

- You enter your bank credentials directly into Plaid’s interface—not Rocket Money’s

- Your bank authenticates the login

- Plaid generates encrypted tokens

- Rocket Money receives only the access token and your transaction data, never your actual login credentials

This connection is designed to be read-only. Rocket Money can pull transaction histories, account names, and balances, but it cannot initiate withdrawals or transfers directly from your external accounts. The only money movement happens through features you explicitly enable, like automatic savings transfers.

You retain full control over these connections. To revoke access:

- Disconnect the institution inside the Rocket Money app

- For maximum control, also remove the connection in your bank’s own security or “connected third-party apps” page

A note for privacy-sensitive readers: If you’re uncomfortable with any third-party seeing your banking data—even through a read-only connection—you may prefer a manual-entry budgeting app that doesn’t use Plaid or similar aggregators at all. Apps like YNAB offer manual tracking modes that don’t require bank linking.

Is Your Money Itself Safe? FDIC Insurance, Savings, and the Rocket Visa Card

There’s an important distinction between “data safety” (protecting your information from hackers) and “deposit safety” (protecting the actual cash you might hold through Rocket Money’s features).

When you use Rocket Money’s Financial Goals or smart savings account feature, your funds aren’t sitting on Rocket Money’s servers. Instead, they’re placed at one or more FDIC-insured U.S. partner banks. As of 2025, this means deposits are typically insured up to $250,000 per depositor, per institution—the same protection you’d get at a traditional bank.

Rocket Money itself is not a bank. It partners with regulated financial institutions to hold customer funds. This is similar to how apps like Cash App or Chime operate—they provide the interface while actual banking services happen behind the scenes at chartered banks.

What FDIC insurance does and doesn’t cover:

| Covered by FDIC | Not Covered by FDIC |

| Bank failure (your deposits protected) | Investment losses |

| Insolvency of the partner bank | Fraud on your external accounts |

| Up to $250,000 per depositor, per institution | High service fees from Rocket Money |

| Savings held in partner bank accounts | Disputes over bill negotiation charges |

Regarding the Rocket Visa Signature Card (launched in 2023): if you link this card to Rocket Money, your card activity will appear in the app for tracking purposes. However, card safety—fraud monitoring, zero-liability policies, and purchase protection—is governed by the issuing bank and Visa’s own protections, not by Rocket Money directly.

Quick deposit safety recap:

- FDIC insurance applies to funds in Rocket Money’s savings features

- Coverage limit: $250,000 per depositor, per institution (standard federal limit)

- You can check which specific partner bank currently holds your funds in the app’s settings or help documentation

Privacy: What Rocket Money Can See and How It Uses Your Data

To deliver budgeting insights and spending categories, Rocket Money must analyze detailed transaction data from your linked accounts. Understanding exactly what they can see—and what they do with it—is crucial for informed consent.

Types of information typically visible to Rocket Money:

- Account balances across all linked financial accounts

- Transaction dates, amounts, and merchant names

- Recurring payment patterns (identifying subscriptions)

- Spending patterns across top spending categories

- Investment accounts balances (if linked)

Rocket Money uses this data to categorize spending, identify unwanted subscriptions, suggest budgets based on your spending habits, and surface potential bill negotiation opportunities. This is the core value proposition—automated spending insights that would take hours to compile manually.

Here’s where it gets more complicated: as part of Rocket Companies, Rocket Money may share some data within the corporate family. This could include Rocket Mortgage or other Rocket brands, subject to their privacy policy. If you’re considering the app, read that policy carefully before linking all your financial information.

Anonymized or aggregated data may be used for analytics and product improvement—a common practice across the tech industry. However, personally identifiable financial details are governed by privacy commitments and applicable laws like the Fair Credit Reporting Act.

A note on targeted offers: Users may receive product suggestions based on their financial profile—things like mortgage refinancing options, credit products, or savings tools. Some users find this helpful; others find it intrusive. It’s not inherently unsafe from a security standpoint, but it’s worth knowing that your data informs these recommendations.

The December 2022 complaint filed by the Electronic Privacy Information Center (EPIC) with the Consumer Financial Protection Bureau raised concerns about Rocket Money’s data practices, including allegations of using “dark patterns” in marketing and sharing data with third parties. While no enforcement action has been publicly announced, privacy-conscious users should factor this into their decision.

Risks and Drawbacks: Where “Safe” Gets Complicated

While Rocket Money’s technical security measures are generally solid, “safe” encompasses more than just encryption. Understanding other kinds of risk is essential before you link your bank account.

Bill negotiation fees can add up

The bill negotiation tool is one of Rocket Money’s premium features, and it comes with costs that catch some users off guard. Rocket Money typically charges roughly 30-60% of the first year’s savings when they successfully negotiate a lower rate on your bills.

Here’s what that looks like in practice:

| Annual Savings Achieved | Rocket Money’s Fee (at 40%) |

| $100 | $40 |

| $300 | $120 |

| $500 | $200 |

This isn’t a security risk, but it’s a financial risk if you don’t read the fee disclosures carefully. Some users report surprise charges or confusion about exactly when the bill negotiation service activates. Take screenshots before authorizing any negotiations, and review the terms of any premium membership you’re considering.

The “hands-off” danger

Over-relying on automatic tools can make people less engaged with their actual budget. When you set everything to autopilot—automatic savings transfers, automatic subscription tracking, unlimited budgets that you never review—you might miss important changes in your financial health. This is a behavioral risk, not a cybersecurity risk, but it’s real.

Data-sharing with a large financial group

For users who prefer strict data minimization, sharing transaction data with a company connected to Rocket Mortgage and other financial services may feel like a privacy drawback. Even if the data stays within the corporate family, it’s still more exposure than a standalone, privacy-focused app would require.

No platform is immune to attacks

As of early 2025, there are no widely reported major data breaches involving Rocket Money. That’s a positive signal. However, any online platform can be targeted by attackers, and past security is no guarantee of future safety. Users should assume non-zero risk and act accordingly—strong passwords, two-factor authentication, and regular account monitoring.

Join more than 10 million users using Rocket Money to take control of subscriptions, bills, and savings.

User Reviews, Reputation, and Real-World Experience

App store ratings provide a practical, ground-level view of how safe and reliable the app feels for actual users. While not a substitute for security audits, millions of reviews offer insights that technical documentation doesn’t capture.

Rocket Money typically holds ratings in the low-to-mid 4-star range. The Apple App Store rating hovers around 4.3-4.6 stars, with similar or slightly lower scores on Google Play. These are solid ratings for a finance app, though not exceptional.

What positive reviews highlight:

- Clean, intuitive interface

- Easy subscription tracking and the ability to cancel subscriptions quickly

- Helpful bill reminders and spending insights

- Consolidated view of net worth across accounts

- Actual money saved through the bill negotiation tool

Common complaints include:

- Confusion about bill negotiation fees (users expecting free service)

- Difficulty canceling the premium version subscription

- Occasional syncing glitches with specific banks

- Concerns over upselling and marketing emails

- Account syncing issues after bank security updates

High ratings don’t prove perfect security, but a multi-year track record with millions of users and no widely reported catastrophic breach is a positive signal. The app has been around since 2015 (as Truebill), giving it more runway than newer competitors.

A practical tip: Before linking your financial accounts, read recent 1-star and 2-star reviews specifically. These surface worst-case experiences and help you understand what could go wrong. Pay attention to patterns—if the same complaint appears repeatedly, it’s more likely to affect you.

How Rocket Money Compares to Other Budgeting Apps on Safety

Rocket Money’s security posture is broadly similar to other modern budgeting apps that use Plaid or similar aggregators. If you’re concerned about Rocket Money specifically, switching to a competitor may not actually address your underlying concerns.

Comparison of popular budgeting apps:

| App | Uses Plaid/Aggregator | Encryption | Read-Only Access | Manual Entry Option |

| Rocket Money | Yes (Plaid) | AES-256 | Yes | Limited |

| Monarch Money | Yes | AES-256 | Yes | Limited |

| YNAB | Optional | AES-256 | Yes | Full manual mode |

| Empower | Yes | AES-256 | Yes | Limited |

| Copilot | Yes (Plaid) | AES-256 | Yes | Limited |

Most competitors also require bank linking, so choosing a different app doesn’t necessarily avoid Plaid or third-party aggregators. The technology stack is remarkably similar across the industry.

Where apps actually differ:

- Business model: Some apps monetize through subscriptions only; others (like Rocket Money) also earn from bill negotiation fees and potential cross-selling within their corporate family

- Data-sharing practices: How aggressively does the company market additional financial products based on your data?

- Manual options: YNAB stands out for offering a complete manual tracking mode that doesn’t require any bank connections

If your primary concern is avoiding third-party access to your bank account entirely, pure envelope-budgeting apps with manual entry are your best option. The trade-off is significantly more effort—you’ll need to enter every transaction yourself.

Bottom line: The key differences between Rocket Money and competitors are less about encryption strength (which is standardized across the industry) and more about business model, data-sharing practices, and how aggressively each company markets additional products. Choose an app that matches both your comfort with data-sharing and your preferred budgeting style.

Practical Safety Tips When Using Rocket Money (Or Any Money App)

This section provides a practical checklist you can implement immediately—whether you’re already using Rocket Money or just considering it.

Enable all available security features:

- Use a strong, unique password (at least 12 characters, mix of letters, numbers, symbols)

- Enable biometric login (Face ID or fingerprint) if your device supports it

- Set up device-level screen locks—if someone accesses your unlocked phone, they access your financial data

Secure your email first:

Two-factor authentication on the email account associated with Rocket Money is arguably more important than the app’s own security. If attackers compromise your email, they can reset passwords for almost everything. Enable 2FA on your email and your banks directly.

Manage connected apps regularly:

- Review your bank’s “connected apps” or “authorized third-party access” settings every few months

- Revoke Rocket Money and Plaid connections if you stop using the app

- Don’t just delete the app—actually disconnect the integration

Stay informed about changes:

- Check Rocket Money’s security and privacy pages annually for updates

- Adjust settings like marketing email preferences when possible

- Review the terms of the free version versus premium features before upgrading

Monitor your accounts proactively:

- Check bank and credit card transactions weekly for unusual activity

- Set up alerts for large transactions or international charges

- Report suspicious activity directly to your bank, not to Rocket Money alone

If you’re testing the app:

Consider starting with just one account connection—perhaps a checking account with limited funds—before linking all your financial accounts. This lets you evaluate how does rocket money work in practice without maximum exposure.

See all your subscriptions in one place—and stop unnecessary payments in minutes.

Who Rocket Money Is (and Isn’t) a Good Fit For

“Safe enough” is subjective. It depends on your personal risk tolerance, tech comfort level, and what you’re trying to accomplish with a budgeting app.

Rocket Money is a good fit if you:

- Want automatic subscription tracking and alerts for recurring charges

- Are already comfortable connecting bank accounts to apps like Venmo, PayPal, or Cash App

- Understand and accept the bill negotiation fee trade-off (paying a percentage of savings)

- Value consolidated views of your net worth and spending patterns

- Prefer automation over manual tracking

- Are considering the seven day free trial to test premium features before committing

You should be cautious or look elsewhere if you:

- Are averse to any third-party seeing your banking data

- Feel overwhelmed by marketing from financial companies (Rocket Money may cross-promote other Rocket products)

- Prefer manual, spreadsheet-style control over your budget

- Have concerns about inflated savings estimates or aggressive upselling

- Want complete privacy regarding your financial information

The DIY alternative: Users who only want a clear budget and are very privacy-sensitive can recreate most of Rocket Money’s value through manual-entry apps or spreadsheets. You’ll lose the automation and subscription detection, but you’ll keep your transaction data entirely private. Tools like YNAB offer a middle ground with optional bank linking.

Ultimately, the decision should be based on your personal comfort with sharing sensitive financial data—not just on app ratings, friend recommendations, or marketing claims about how much does rocket money cost to use.

Bottom Line: Is Rocket Money Safe Enough for You?

Rocket Money employs industry-standard security measures that put it on par with other major finance apps. AES-256 encryption, Plaid-based account linking, FDIC-insured partner banks for savings accounts, and ownership by a publicly traded company subject to regulatory oversight all contribute to a solid security foundation. Millions of users have trusted the app since its Truebill days, and there’s no widely reported history of major breaches.

That said, “is rocket money safe” isn’t a simple yes-or-no question. While technical safeguards are strong, legitimate concerns remain around privacy practices, business model transparency (particularly bill negotiation fees and potential upselling), and the inherent risks of sharing your financial data with any third party. The 2022 EPIC complaint highlights that even legitimate apps can face scrutiny over how they handle user data and market their services.

Before you decide:

- Read Rocket Money’s current privacy and security pages—policies can change

- Check recent user reviews, paying special attention to negative experiences

- If testing the app, start with minimal account connections before linking everything

- Understand that Rocket Money offers both a free plan and premium membership options with different feature sets

The balanced take: Rocket Money is a reasonable, modern option for most people already comfortable with online banking connections. Its key features—subscription management, basic budgeting, bill negotiation, and spending insights—deliver real value for users willing to share their transaction data. However, ultra-cautious users who prioritize privacy above convenience may prefer manual tracking tools or apps that don’t require bank linking at all.

Your financial health deserves tools that work for you. Whether that’s Rocket Money, Monarch Money, a spreadsheet, or pen and paper—the best budgeting app is the one you’ll actually use consistently, with a level of data-sharing you’re genuinely comfortable with.

FAQs

For most users, yes. Rocket Money uses read-only connections through Plaid, meaning it can view transactions and balances but cannot move money without your permission. It also uses bank-level AES-256 encryption to protect data.

No. When you connect an account, your login credentials are entered directly into Plaid’s secure interface. Rocket Money receives an encrypted access token, not your username or password.

Rocket Money itself is not a bank, but funds held in its savings or Financial Goals features are placed at FDIC-insured partner banks. As of 2025, deposits are typically insured up to $250,000 per depositor, per institution.

Not without your explicit approval. Linked accounts are read-only by default. Money transfers only occur if you enable features like automatic savings or Financial Goals.

As of early 2025, there are no widely reported major data breaches involving Rocket Money. However, no online financial service can guarantee zero risk.

Top U.S. Brokers of 2025

★ ★ ★ ★ ★

✅ Now 23 million users

✅ Cash mgt account and credit card

Free stock up to $200 with new account, plus up to $1,500 more in free stock from referrals

Get Free Stock

★ ★ ★ ★ ★

✅ Access to U.S. and Hong Kong markets

✅ Educational tools

Deposit $100, get $20 in NVDA stock; Deposit $2,000, get $50 in NVDA stock; Deposit $10,000, get $300 in NVDA stock; Deposit $50,000, get $1,000 in NVDA stock

Get Free Shares

★ ★ ★ ★ ☆

✅ IBKR Lite & Pro tiers for all

✅ SmartRouting™ and deep analytics