A quick browse through the Apple or Google Play store will make it clear there are tons of mobile investment apps available. Some are well-established and some may not have the same name recognition.

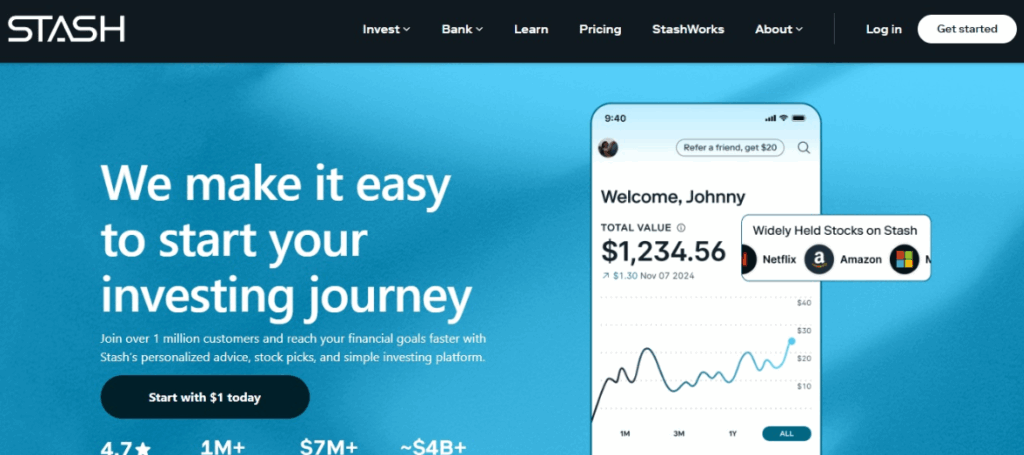

If you’ve seen the Stash app, you know it’s got more than 10 million downloads in the Google Play store alone.

But is Stash a good smart portfolio investment app for automated investing?

In this Stash review, we’ll go through everything you need to know: the company’s history, the app’s features and ratings, how Stash keeps your money safe, and how it’s regulated.

Keep reading to get the full scoop on Stash!

What Is Stash?

Stash is an investment platform and app that focuses on micro-investing with stocks and etfs.

Stash was founded in 2015 by Brandon Krieg and Ed Robinson. Both men had careers on Wall Street.

What they realized, and what drove them to create Stash, is that the odds were stacked against everyday Americans who couldn’t afford to invest huge amounts of money necessary to meet their financial goals.

The result was Stash, which allows anybody to create an account and start building wealth, even if they’ve got only a few dollars to invest.

The Stash Mission

Stash’s mission is based on four core values that describe the company’s purpose and help employees maintain their focus on what’s most important.

- Prioritize People: Stash fosters a diverse and inclusive culture where everyone can grow together.

- Obsess over the Customer: Keep focused on the user experience and what customers need in order to build wealth.

- Take Ownership: Stash team members are encouraged to create and innovate, and always to take ownership of their work.

- Create Solutions: Team members challenge the status quo and use their creative energy to solve problems.

Everything about the Stash mindset helps drive the company’s success and explains why so many people have chosen Stash as their digital investment app.

Pro Tip:

Get a smart money portfolio with a $5 deposit with Stash, and get a bonus $5 free of charge.

Is Stash Safe to Use?

Stash is a registered advisor with the SEC, and all Stash users’ investments are held by Apex Clearing Corporation, a broker-dealer registered with the SEC and a member of FINRA. Apex Clearing is also a member of the SIPC, so all investment accounts are protected up to $500,000.

Cash deposits are held through the Apex FDIC-Insured Sweep Program, which means that your money is insured up to $250,000.

In terms of website and Stash app security, Stash employs 256-bit bank-level encryption, Transport Layer Security, 2FA and biometric recognition, and other state-of-the-art security features to protect members’ investments and personal data.

Stash Statistics

Here are a few Stash statistics to help you understand the company before beginning to start investing with Stash.

- Stash has over 1.5 million active subscribers

- The company has approximately $4 billion in assets under management (AUM)

- Overall, they’ve helped more than 6 million people build their wealth through micro-investing

- Stash was named to the Forbes Fintech 50 in 2022 and has won many other awards

As you can see, people have flocked to Stash for a reason!

Pro Tip:

Start your investing overhaul with Stash today for just $5, and receive a bonus $5 free!

What Features Does Stash Have?

Stash offers a solid selection of investment and portfolio management tools and retirement accounts.

Stash offers a suite of investing tools designed to simplify the investment process for beginners. Whether you’re looking to own stocks directly or prefer a hands-off approach with a Stash managed portfolio, the platform caters to various investment styles.

With Stash, you can open a taxable investment account, providing flexibility beyond retirement-specific options. Additionally, their banking services integrate seamlessly, allowing users to manage finances and investments in one place.

It’s essential to remember that investing involves risk, and while Stash provides resources and guidance, returns are not guaranteed. Always assess your financial goals and risk tolerance before making investment decisions.

Smart Portfolio

Smart Portfolio is Stash’s automated investing option. It’s a tool that will automatically build a diversified investment portfolio based on your input, including your financial goals, risk tolerance, and other factors (a great way to begin your investment journey).

Your portfolio gets rebalanced periodically to make sure that you’re not over-invested in any one stock or sector. All rebalancing incorporates your chosen investment strategy. For example, are you a more conservative investor, looking just to save money, or comfortable with taking some risks?

Self-Directed Investing

For users who prefer to build their own portfolio, Stash has a self-directed option. In other words, you don’t need to use the robo-advisor unless you want to.

With self-directed investing, you can trade individual stocks and ETFs. You can’t buy bonds on Stash, but you can get access to the bond market by adding bond ETFs to your portfolio.

Another important note: there’s no cryptocurrency investing with Stash. That may be a significant downside for investors who want to diversify by investing in crypto.

You can buy full shares or fractional shares, something that makes investing accessible to anybody.

When you’re searching for assets to add to your portfolio, you can:

- Filter assets by risk, category, or industry

- Focus on socially responsible investments

- Take advantage of recurring investments and stock round-up to build your portfolio

- Reinvest dividends into your portfolio

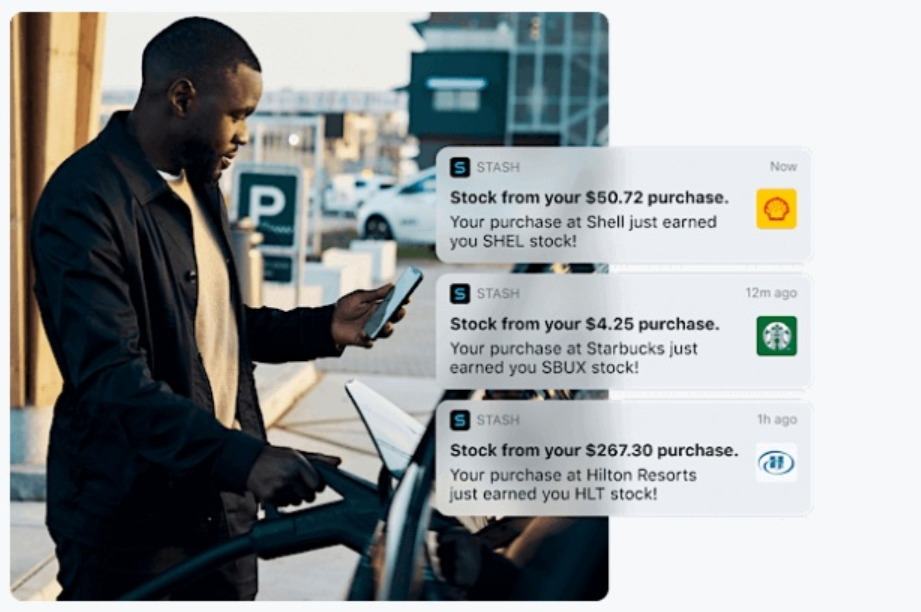

Stock-Back Card

The Stock-Back Card is something you can get with any subscription to Stash.

Every time you use it, you’ll earn between 1% and 3% back, money that can be automatically invested to help you build wealth.

It can be added to your digital wallet for secure spending, and you can withdraw cash at thousands of fee-free ATMs.

Retirement Accounts

Stash doesn’t offer a ton of retirement options, but it does offer two of the best and most popular: traditional and Roth IRAs.

You’ll be happy to know that Stash IRAs don’t charge add-on commission fees, and you can access auto-invest features or get advice from a registered investment advisor (RIA).

Stash’s retirement savings plans are limited compared with most competitors. Although traditional and Roth IRAs are two of the best retirement plan options, Stash doesn’t offer small-business retirement plans or custodial IRAs.

Stash Pricing and Plans

For those thinking about smart money management, Stash uses a subscription model. There’s no free plan, but subscription costs are affordable for most people, something that’s in keeping with the company’s mission to make investing accessible to anybody at any income level.

Stash Growth

The cost of Stash Growth, which is the basic subscription plan, is just $3 per month. In return for your money, you’ll get:

- Advice for beginner investors and general financial advice

- Access to Personal, Smart, and Retirement portfolios

- Ability to invest in stocks and ETFs

- Earn 1% with your Stock-Back® Card

- Get paid up to 2 days early

- $1K life insurance from Avibra

Life insurance is a nice benefit and something very few other investment platforms offer.

Stash+

Stash+ is the higher-priced plan but it still comes in at just $9 each month. You’ll get everything that’s included in Stash Growth, plus:

- Stash+ Market Insights

- Kids’ portfolios

- Earn up to 3% in stock on purchases with your Stock-Back card

- $10K in life insurance from Avibra

While this plan is priced a little higher, it gives you access to a few features to help you grow your wealth more quickly with automated investing (a great first step on your investing journey).

Pro Tip:

Take the first step toward financial freedom with a $5 deposit with Stash, and get a bonus $5.

Who Can Benefit the Most from Using Stash?

By this point in our Stash review, you might be wondering who can benefit from using Stash. Here’s our take.

Stash is ideal for beginning investors who want to build a portfolio quickly, and who may not have a ton of money to invest starting out.

Users can create and build a portfolio quickly by buying fractional shares, taking advantage of stock-rounding and dividend reinvestment features, and by using the Stash Stock-Back Card.

More experienced investors, including those who want advanced investment analysis and tracking features and those who want to be able to invest in a wide range of assets (bonds, mutual funds, options, futures, and crypto) may want to go elsewhere, the smart portfolio system may not give you enough control.

Pros and Cons of Stash

Here’s our overview of the pros and cons of using Stash.

| Pros | Cons |

|---|---|

| Choice of DIY or automated investing | No automated ESG or specialized portfolios |

| Stock round-up and dividend reinvestment | Limited assets (stocks and ETFs only) |

| Earn rewards with Stock-Back card | Lack of advanced analysis tools |

| Traditional or Roth IRA | No custodial or small business IRAs |

| Automated portfolio rebalancing | Educational resources aren’t as comprehensive as they could be |

| Affordable subscription options | No tax harvesting or tax guidance |

Our Final Verdict: Is Stash Right for You?

Our final verdict is that Stash is a solid choice for beginning or hands-off investors who want simple-to-use tools to build a portfolio and add to it through automated investing. Stash makes smart investing easy.

We particularly like the automated stock round-up and dividend reinvestment options, both of which can help investors grow their investments without any work.

More advanced investors and those who want an all-in-one investment app that allows them to buy stocks, bonds, ETFs, mutual funds, and crypto, while gaining investing tips, will likely do better with a different platform.

One of the biggest and most similar competitors to Stash’s easy, simplistic approach to investing is Acorns. Check out our comparison of the two in our Acorns vs Stash review!

FAQs

You can begin investing with as little as $5 in your account.

No, Stash doesn’t encourage day trading, so there are two trading windows in the morning and two in the afternoon. As a result, stock or ETF prices may change slightly from the time you place an order to the time the transaction is complete.

If you choose to engage in automated investing with a Smart Portfolio, it will be automatically rebalanced once per quarter, or every three months.

Yes, Stash Invest accounts are taxable brokerage accounts. You’re legally required to report capital gains and other earnings to the IRS and pay taxes accordingly.

Absolutely. It’s SEC-regulated and offers SIPC and FDIC coverage for invested and stored funds.

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks as of December 27, 2025

We are paid subscribers to dozens of stock and option newsletters. We actively track every recommendation from all of these services, calculate performance, and share our results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Return vs S&P500" which is their return above that of the S&P500. So, based on December 27, 2025 prices:

Best Stock Newsletters Last 3 Years' Performance

| Rank | Stock Newsletter | Picks Return | Return vs S&P500 | Picks w Profit | Max % Return | Current Promotion |

|---|---|---|---|---|---|---|

| 1. |  Alpha Picks | 82% | 56% | 76% | 1,583% | VALENTINE'S SALE: SAVE $75 NOW |

| Summary: 2 picks per month based on Seeking Alpha's Quant Rating; consistently beating the market every year since launch; tells you when to sell and they have sold almost half. See complete details in our full Alpha Picks review. Or get their Premium service to get their QUANT RATINGS on your stocks to better manage your current portfolio--read our Is Seeking Alpha Worth It? article to learn more about their Quant Ratings. | ||||||

| 2. |  Zacks Value Investor | 60% | 40% | 54% | 692% | February Promotion: $1, then $495/yr |

| Summary: 10 stock picks per year on January 1st based on Zacks' Quant Rating; Retail Price is $495/yr and includes 6 different services including those below. Read our Zacks Review. | ||||||

| 3. |  Moby.co | 50% | 16% | 74% | 2,569% | February Promotion: Next pick free! |

| Summary: 60-150 stock picks per year, segmented by industry; consistently beating the market every year; retail price is $199/yr. Read our full Moby Review. | ||||||

| 4. |  Zacks Top 10 | 36% | 15% | 71% | 170% | February Promotion: $1, then $495/yr |

| Summary: 10 stock picks per year on January 1st based on Zacks' Quant Rating; Retail Price is $495/yr and includes 6 different services. Read our Zacks Review. | ||||||

| 5. |  TipRanks SmartInvestor | 20% | 9% | 62% | 464% | Current Promotion: Save $180 |

| Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. | ||||||

| 6. |  Action Alerts Plus | 27% | 5% | 66% | 208% | Current Promotion: None |

| Summary: 100-150 trades per year, lots of buying and selling and short-term trades. Read our Jim Cramer Review. | ||||||

| 7. |  Zacks Home Run Investor | 5% | -0.4% | 45% | 241% | February Promotion: $1, then $495/yr |

| Summary: 40-50 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. | ||||||

| 8. | Dogs of the Dow Strategy | 16% | -1.8% | 43% | 44% | Current Promotion: None |

| Summary: Buy the 10 highest yielding dividends stocks in the Dow Jones Industrial Average on January 1st and sell on Dec 31st each year. | ||||||

| 9. | IBD Leaderboard ETF | 11.4% | -1.8% | n/a | n/a | February Promotion: NONE |

| Summary: Maintains top 50 stocks to invest in based on IBD algorithm; Retail Price is $495/yr. Read our Investors Business Daily Review. | ||||||

| 10. |  Stock Advisor | 34% | -3.9% | 75% | 289% | February Promotion: Get $100 Off |

| Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr. Read our Motley Fool Review. | ||||||

| 11. |  Zacks Under $10 | -0.2% | -4% | -4.3 | 263% | February Promotion: $1, then $495/yr |

| Summary: 40-50 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. | ||||||

| 12. |  Rule Breakers | 34% | -5.1% | 69% | 320% | Current Promotion: Save $200 |

| Summary: Rule Breakers is included with the Fool's Epic Service. Get 5 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. | ||||||

| Top Ranking Stock Newsletters based on their last 3 years of stock picks covering 2025, 2024, and 2023 performance as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF. Performance as of December 27, 2025. | ||||||