ALERT: Are you a U.S. citizen? If not, then you will unfortunately not be able to sign up for a Robinhood account. CLICK HERE TO LEARN ABOUT OUR #1 RECOMMENDED BROKER FOR NON-U.S. CUSTOMERS!

Do you invest in the stock market with a brokerage account? If not, do you want to invest in the stock market?

If your answer was ‘Yes’ to either of those questions…

…you’ve come to the right place!

And we’re here to educate you on companies that are making investors’ lives much, much easier.

There are FREE, cutting-edge apps that have erased the most common excuses for not investing in the stock market.

These technological advances have taken high-commission costs and reduced them to literally nothing.

For the average investor, there has never been a better time to be in the market with the help of these apps.

As you can imagine, there are many investing apps to choose from.

Some heavenly. Some hellish. And – for the purposes of this analogy – some in purgatory.

So, we decided to save you a whole bunch of time by comparing the very best.

Today we have Robinhood and Webull going head-to-head in our epic investment app showdown.

Here you will learn…

- Where these companies shine

- Where these companies can improve

And after about 5 minutes of reading, you will know which app is the best for saving money and making money.

So, let the games begin: Here’s our review!

In this Webull vs Robinhood comparison, we analyze trading tools, fees, commissions, asset availability, security, and user experience to help you decide which trading app is better for your investing style. Whether you are a beginner investor or an active trader, understanding the differences between Webull and Robinhood can help you choose the right brokerage platform.

Both Webull and Robinhood are popular stock market apps and full-featured stock trading platforms that function as powerful online brokerage platforms for modern investors. Each app allows users to open an online brokerage account, trade stocks, ETFs, and options, and access commission free trading through a mobile trading app experience. While both operate as online brokers, their tools and features differ depending on whether you are beginner investors just getting started or active traders looking for advanced functionality.

This investment app comparison focuses on helping users choose the right brokerage platform based on experience level, assets offered, and available advanced trading tools.

Platform Security, Regulation, and Brokerage Services

Both Robinhood and Webull employ security measures to protect users.

Both Webull and Robinhood operate under strict oversight from the Financial Industry Regulatory Authority (FINRA) and the SEC, reinforcing trust and transparency across their brokerage services. While neither platform provides access to personal financial advisors, they compensate by offering educational tools, real-time financial news, and responsive customer assistance. For users who prefer direct help, phone support is available, making it easier to resolve account-related or transaction-specific concerns.

Is Robinhood legit?

Robinhood is a licensed broker-dealer which is regulated by the SEC and a member of FINRA. User deposits are insured by the SIPC up to $500,000 including $250,000 in protection for cash deposits.

All data stored on Robinhood is protected with 256-bit encryption.

These security features are important to see because you need to know that your personal information and money will be secure.

But note that this type of insurance does not cover loss in market value (so make wise decisions!)

Now… is Webull safe?

Like Robinhood, Webull is regulated by the SEC, a FINRA member, and insured by the SIPC.

Another similarity is that Webull uses state-of-the-art encryption to protect users’ information and assets.

To learn more about Webull, check out our in-depth review.

Pro tip: If you are thinking about signing up for Webull, do it now. For a limited time only, Webull is giving away two free stocks for signing up and making a deposit. (up to $300).

Trading Platform Tools and Advanced Trading Features

Both Webull and Robinhood offer powerful trading platform experiences through their mobile app and web-based interfaces. These platforms are designed to support everyone from beginner investors and everyday investors to intermediate investors and experienced investors who rely on advanced tools, research tools, and professional research features.

Trading Platform Tools Comparison for Active and Beginner Investors

Robinhood’s interface is user-friendly and includes essential trading platform tools for everyday investors.

- Instant deposits

- Trade stocks, ETFs, and cryptocurrency

- Intuitive interface

- 24/5 trading

- 4.25% APY on uninvested holdings

- Robinhood IRA with 1% matching (3% for Gold members)

- Educational resources

- Free stock when you refer friends

Webull offers more advanced trading tools and features than Robinhood, including:

- Commission-free trading

- Up-to-date market news and prices

- Extended trading hours

- Trade stocks, ETFs, options, bonds, futures, and engage in crypto trading where supported

- Educational resources

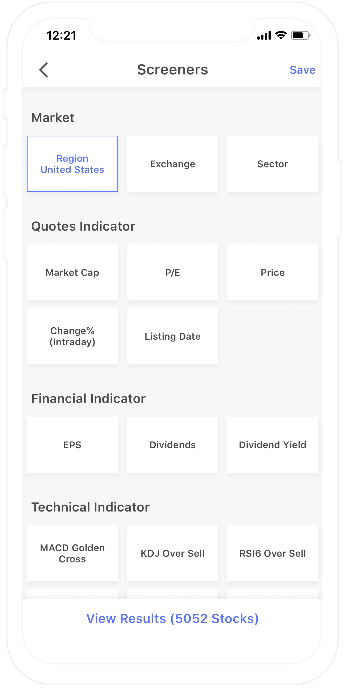

- Stock screeners and analysis

- Free stocks

Either of these apps may be right for you, but Robinhood is more suited to beginners while Webull offers more advanced features.

Technical Analysis, Market Data, and Advanced Charts

Technical analysis is not a requirement for investors, but if you’re interested in deeper market insights, Robinhood doesn’t offer much in the way of advanced charting tools or professional-grade analysis. They do have:

- Articles about the stock market and investing

- Basic stock screeners

- Price alerts

- Basic charting with limited advanced charting tools

Robinhood isn’t the place to go for in-depth research and analysis. By contrast, Webull offers a lot more for experienced users who want professional-grade professional charting tools and analysis.

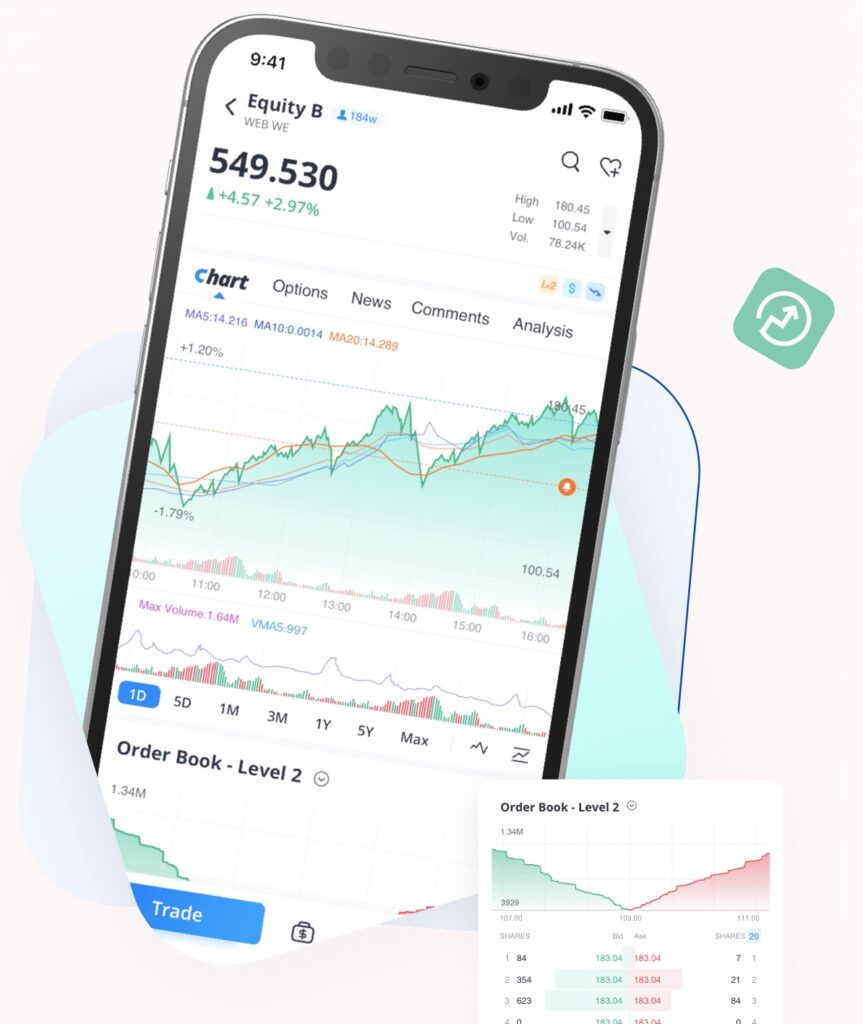

Webull provides advanced technical indicators, real-time market data, and professional-grade advanced charts that appeal to experienced traders and active traders.

- Historical data

- Links to relevant and up-to-date news

- Real time market data

- Advanced charting options, including bar, candlestick, and line charts

- Money flow index

- Bollinger bands

- MACD

- RSI

- Custom alerts

You can also access pre- and post-market trading hours starting at 4:00 a.m. and ending at 8:00 p.m.

And, this trading platform offers a trading simulator (paper trading) to help beginner investors and active traders practice new strategies

Unique Features: Simulated Trading, Fractional Shares, and Desktop Platform

There are a few unique features on each of these platforms.

Webull’s simulated trading (paper trading) feature allows both new investors and experienced traders to practice strategies without risking real money. Both Webull and Robinhood also allow users to trade fractional shares, making investing more accessible. Webull further stands out with a powerful desktop platform designed for advanced investors.

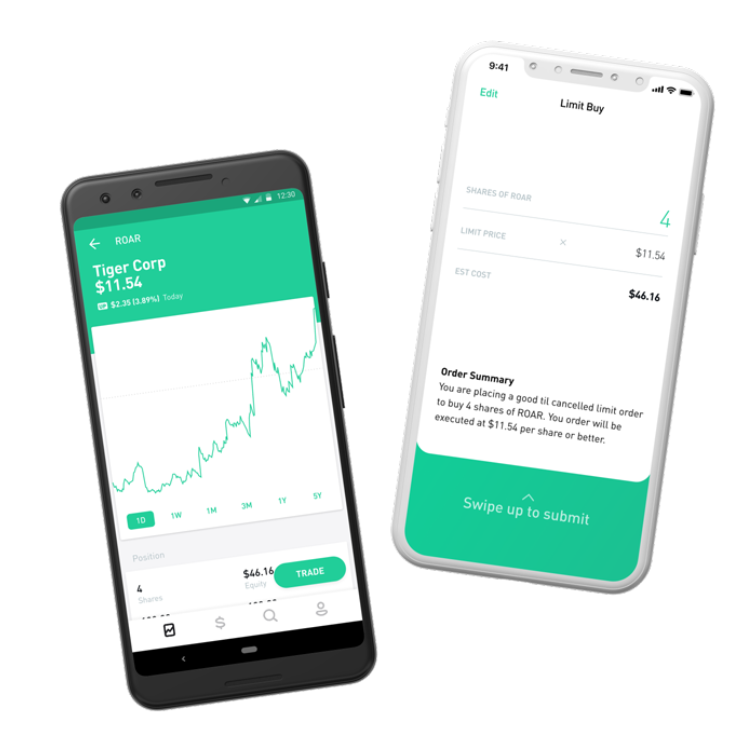

For example, Robinhood has a well-reviewed and simple user interface that removes many of the barriers to investing.

It also offers IRA matching funds, which is great if you’re not working for someone that offers employer matching.

Webull stands out for its outstanding educational content. It has affordable prices for options and advanced options features that you won’t find on Robinhood.

User Experience, Trading Experience, and Platform Accessibility

Both the user experience and accessibility are important on any digital investment platform. Both Webull and Robinhood are beginner-friendly trading platforms.

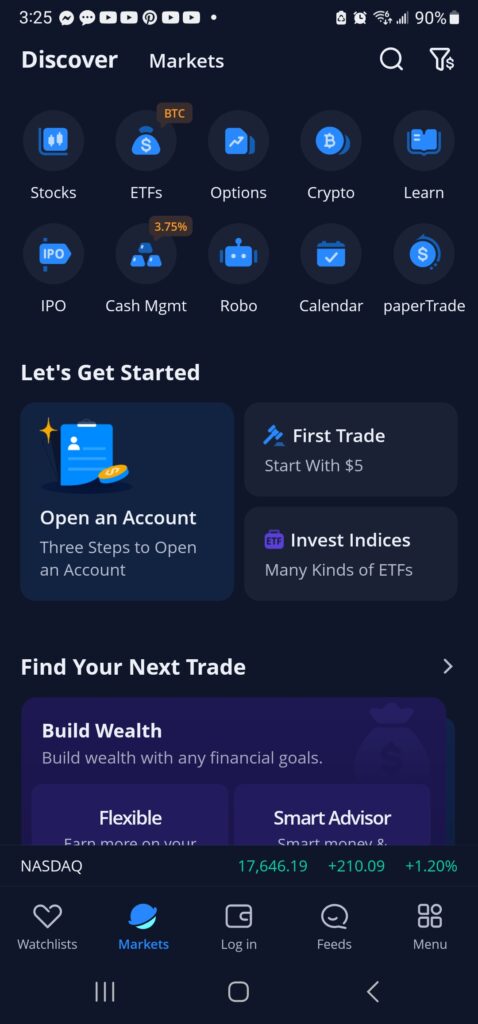

Robinhood really revolutionized the user experience with its mission of democratizing investments.

That mission is clear when you look at Robinhood’s clean and easy-to-understand user interface.

There are only a few menu options, making it easy for new users and even people who aren’t familiar with investing to find what they need.

Whether you want to buy your first stock, create a watchlist, learn about investing, or get support, it’s easy to do on the Robinhood app.

We should also note that the Robinhood website is just as clean and easy to use.

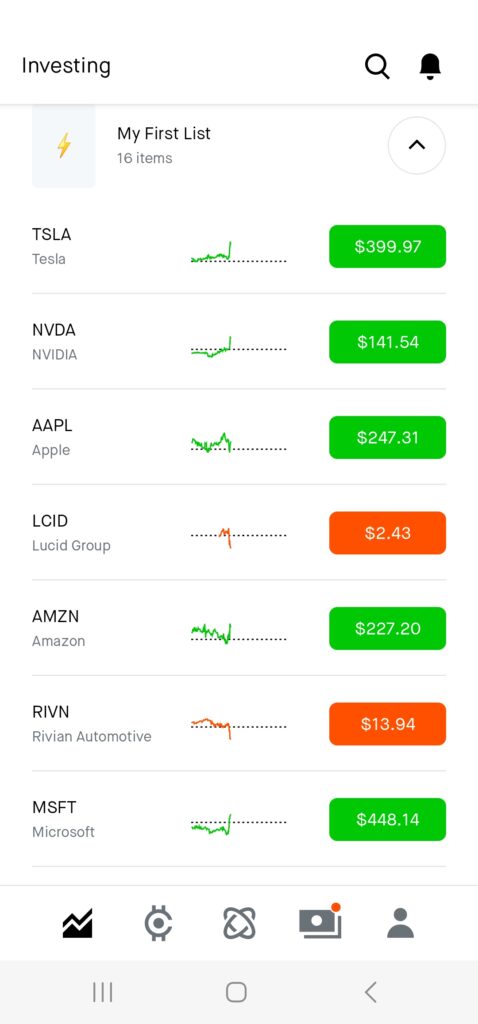

Webull is a strong competitor to Robinhood and has a similar mission. Its app is designed to be user friendly.

We really like the way the menu is organized here, with easy-to-understand icons.

They have some options that Robinhood doesn’t, such as paper trading and IPOs.

The menu choices at the bottom are nice as well. Even from the first time you log on, you can see where to go to create a watchlist, get market updates, and see your news feed.

In short, both Webull and Robinhood have excellent, user-friendly interfaces that makes their apps accessible and extremely easy to use.

Trading Fees, Regulatory and Exchange Fees, and Tradable Assets Comparison

By now, you’re probably wondering how much each trading platform charges and what assets you can trade through each brokerage platform.

When comparing Webull and Robinhood, it’s important to understand not just commission free trading, but also how regulatory and exchange fees apply, along with any broker charges that may affect your total trading cost. Both platforms operate as online brokers, and while they advertise free trading, certain mandatory fees still exist.

These regulatory fees are charged by the SEC and FINRA and apply across all brokerage services. In addition, some exchange fees apply depending on the asset being traded, including option contract fees, futures trading fees, and crypto-related transaction costs.

Commission Structure and Zero Commissions Model

Let’s start with commissions.

Both platforms offer commission free trading using a zero-commission pricing model, meaning investors can trade stocks, ETFs, and options without paying traditional brokerage commissions. This free trading model is one of the biggest reasons Webull and Robinhood are so popular among everyday investors and beginner investors alike.

However, commission free does not mean fee-free.

Even though the platforms offer commission free stock and ETF trading, regulatory fees, exchange fees, and small brokerage charges still apply. These are standard across most online brokerage platforms and are unavoidable when executing trades.

This is where understanding brokerage accounts, account types, and fee disclosures becomes extremely important.

Regulatory Fees, Hidden Fees, and Broker Charges

Speaking of fees…

There’s no such thing as completely free trading, even on a commission free trading platform. While both Robinhood and Webull advertise free trading, investors still pay regulatory fees, regulatory and exchange fees, and small broker charges that are passed through directly from market regulators.

These include:

- SEC regulatory fees

- FINRA regulatory fees

- Exchange fees apply depending on the trading venue

- Option contract fees

- Futures trading fees

- Margin interest for margin accounts

If you use margin accounts, you will also pay margin interest, which varies depending on your portfolio size and account balance. Margin investing can increase buying power, but it also increases risk and borrowing costs.

Additionally, if you trade during pre market or after-hours sessions, pricing spreads and liquidity conditions can also impact execution quality, even if commissions remain free.

Some fees may also apply to:

- Wire transfers

- Account transfers

- Futures trading contracts

- Cryptocurrency trading

So while both platforms are excellent for low-cost investing, it’s critical to understand how these smaller fees impact your investing journey.

| Webull | Robinhood | |

| Trading commission | 0% | 0% |

| SEC regulatory fee | $0.0000278 * Total $ Trade Amount (Min $0.01) | $0.0000278 * Total $ Trade Amount (Min $0.01) |

| FINRA regulatory fee | $0.000166 per share (equity sells) and $0.00279 per contract (options sells). This fee is rounded to the nearest penny and no greater than $8.30. | $0.000166 per share (equity sells) and $0.00279 per contract (options sells). This fee is rounded to the nearest penny and no greater than $8.30. |

| Options regulatory fee | $0.02815 * No. of Contracts | $0.04 per options contract (buys and sells) |

| Index options | $0.55 per contract; additional fees may apply for some trades | $0.50 per contract for non-Gold members; $0.35 per contract for Gold members |

| Margin trading | 4.74% to 8.74% depending on portfolio size | 4.70% to 5.75% depending on portfolio size |

| Futures | $0.13 to $1.25 per contract, depending on futures type | N/A |

| Wire transfer withdrawal | $25 domestic, $45 international | $25 |

| ACAT transfer (stock transfer) | $75 | $100 |

As you can see, both brokerage platforms have very similar regulatory fee structures. The difference usually comes down to how each platform handles option contract fees, margin interest, and futures trading costs.

If you plan to hold uninvested cash, both platforms offer interest-earning programs, though rates and eligibility vary. This can be an important factor for investors who want their unused funds to remain productive while waiting for trading opportunities.

If all you plan to do is trade stocks and ETFs, they’re the same.

Pro Tip:

Get a free stock when you sign up with Robinhood or Get 20 free fractional shares when you deposit $500 or more with Webull today!

Tradable Assets, Options Trading, and IRA Accounts

Finally, let’s look at which assets you can trade on each investment platform and online brokerage platform.

| Webull | Robinhood | |

| Stocks | Yes | Yes |

| ETFs | Yes | Yes |

| Options/Index Options | Yes | Yes |

| Futures | Yes | Yes |

| Cryptocurrency | Yes, through their partnership with Bakkt Crypto Solutions | Yes |

| OTC | Yes | No |

| IRA/Retirement | No | Yes |

As you can see in this chart, both trading platforms are similar in terms of available assets for most brokerage accounts. One key difference is that crypto trading is built directly into Robinhood, while Webull offers crypto trading through a partner platform.

Robinhood supports IRA accounts for long-term investors, while Webull focuses more on advanced options trading and broader tradable assets.

This isn’t an asset class, but we should note that both online brokerage platforms support day trading for qualified brokerage accounts. Make sure you understand the day trading limitations before you start.

Customer Service Evaluation

Customer service availability and quality should always be considered when choosing an investment app. So, let’s make a customer service comparison.

Let’s start with Webull.

Webull offers both in-app and website support.

On their website, you can access their help center to find articles and answers to frequently asked questions. You can also send them an email.

In-app support includes email and there’s also a phone number you can call.

We wish they offered live chat, and it’s possible they’ll add it in the future.

What about Robinhood’s customer support?

Robinhood has an in-app support center. They also have 24/7 customer support that you can access from the app or from their website.

The support center has tons of useful articles about everything from how to link your bank account to the specifics of trading every asset that Robinhood offers.

Ideal User Profile

By now, you’re probably wondering who the best users for Webull are.

Webull offers more assets for trading and more complex trades than many other online brokers on the market. For that reason, we’d say that intermediate or experienced users, as well as those in search of more assets to trade, may prefer Webull to Robinhood.

We still think that Webull is beginner-friendly, but this trading platform is especially powerful for active traders.

Who is Robinhood ideal for?

Robinhood really is the ideal stock trading app and investment platform for beginner investors.

It’s easy to figure out. Once your account is verified, you can make your first trade within a few minutes.

Robinhood is also the better choice for anyone who wants an IRA and to take advantage of matching contributions for long-term investing.

Overall, we’d suggest Robinhood for beginners and Webull for more advanced traders who want a broader selection of assets to choose from.

Pros and Cons Summary

To give you the easiest comparison possible, here’s our summary of the benefits and drawbacks of Webull as well as the advantages of Robinhood and its limitations.

Pro Tip:

Get a free stock when you sign up with Robinhood or Get 20 free fractional shares when you deposit $500 or more with Webull today!

What We Love About Each Platform

Let’s start with the good stuff. Here are the benefits of Webull.

- Webull offers a broader array of assets than Robinhood

- The resource library is excellent and makes it easy to learn about every aspect of trading

- Users get access to advanced trading tools

- Stock and ETF trades are commission-free

- Paper trading is available to help new investors learn

And here are the advantages of choosing Robinhood

- There’s no minimum account balance

- Robinhood Gold subscribers get lower fees and additional features

- You can trade cryptocurrency right on the platform

- IRA matching

- 24/7 chat support

What We Don’t Love About Each Platform

Here are some Webull and Robinhood limitations you should know about, starting with Webull.

- You need a separate app to trade cryptocurrency

- No retirement funds or IRA matching

- No live-chat support

- No bonds or mutual funds

Robinhood’s disadvantages are as follows.

- There’s little in the way of third-party research

- Analytical tools are extremely limited

- Trade types are limited when compared to Webull

- No bonds or mutual funds

- No paper trading

Overall, we think that these two services are pretty evenly matched. It depends on what you want.

Pro Tip:

Get a free stock when you sign up with Robinhood or Get 20 free fractional shares when you deposit $500 or more with Webull today!

Final Verdict

Final review, Webull vs Robinhood…

Both apps are excellent at what they offer!

Did you find this conclusion helpful? No?

Okay, okay. I get it. This isn’t kindergarten, where everyone is “special” in their own way. And this sure as hell isn’t soccer where things end in a 1-1 tie.

So, which investment app should you choose?

Don’t stress yourself out.

All you need to know your personal situation and what you are looking for in an investment app.

Maybe this will make your decision a bit easier…

- Do you want to trade cryptocurrency and other assets in the same place? Forget about Webull.

- Do you want tools for advanced traders? Forget about Robinhood.

- Do you want to invest in mutual funds through your brokerage account? Forget both.

- Do you have the memory of a goldfish? Read below for a refresher!

Robinhood is excellent because of its simplicity, making it a top stock trading app and investment platform for beginner investors. commission-free trades on many assets, and no account minimums.

If you are a newer trader, we recommend that you sign-up for Robinhood.

Webull is excellent because of its advanced trading tools, making it a powerful trading platform for active traders, commission-free trades on stocks and ETFs, and no account minimums.

For intermediate and advanced traders, we recommend that you sign-up for Webull.

If you prefer to dig deep into investment information, we say that Webull has a slight advantage because of fundamental and technical analysis tools.

But again, the best app depends entirely on your personal needs.

And since Robinhood and Webull offer commission-free trades and no account minimums, there is no harm in trying BOTH to see which works best for you.

There is absolutely no risk or obligation on your part.

Let us know if you are Team Robinhood or Team Webull with a comment below!

FAQs

Yes, stock and ETF trades use a commission free trading model on both trading platforms. Still, there are regulatory fees and may be other fees, so be careful to review the fee disclosure before finalizing a trade.

We think Robinhood has the edge when it comes to suitability for beginners. It has a super-sleek interface, more accessible and immediate support, and fewer trade options.

There is no minimum deposit requirement to open a brokerage account on either online brokerage platform. You can set up your account without making a deposit, and add funds as you choose.

Robinhood users can trade cryptocurrencies using the Robinhood app. Webull only offers crypt trading through a partner, so you’ll need to use a separate all (Webull Pay) for crypto trading.

The answer really depends on what you want. If you’re looking for an all-in-one app where you can trade stocks, ETFs, and crypto, then Robinhood is the better choice. If you want access to a wider array of assets and more complex trades, then Webull has the edge.

Top U.S. Brokers Promotions for 2026

★ ★ ★ ★ ★

✅ Now 23 million users

✅ Cash mgt account and credit card

Free stock up to $200 with new account, plus up to $1,500 more in free stock from referrals; US residents only!

Get Free Stock

★ ★ ★ ★ ★

✅ Access to U.S. and Hong Kong markets

✅ Educational tools

Deposit $500 get $30 in NVDA stock; Deposit $2,000 get $100 in NVDA stock; Deposit $10,000 get $200 in NVDA stock; Deposit $50,000 get $400 in NVDA stock.

Get Free Shares

★ ★ ★ ★ ☆

✅ Trade U.S. stocks, ETFs, and crypto

✅ Trades with themed portfolios

★ ★ ★ ★ ☆

✅ Great charts and screeners

✅ Commission-free options trading

$10 and a 30-day complimentary subscription to Webull premium; $200-$30,0000 Tiered Sign up bonus

Learn more

★ ★ ★ ★ ☆

✅ IBKR Lite & Pro tiers for all

✅ SmartRouting™ and deep analytics