When it comes to investing, everyone wants to get an edge, and “10 bagger” stocks can help you accomplish this coveted edge.

And if you are anything like other reasonable investors…making money is a primary objective when trading stocks.

However, picking winning stocks and generating sustainable income from your portfolio is much easier said than done.

You need to be a smart as you can when it comes to investing your hard-earned money.

Both new and experienced investors alike are always looking for an edge in their trading.

But, before we get into 10 bagger stocks…

…let’s start with a few basic tips.

Building a Portfolio

Regardless of how long you have been investing, you probably heard the term portfolio quite a bit.

If you are going to try and make money in the stock market, you should be familiar with two things:

- What a portfolio is; and

- How you should a portfolio.

Once you have the basics of portfolio management under your belt, searching for high-performance stocks will feel more natural.

In doing so, you WILL be able to spot potential winners much easier.

Diversification

Diversification is probably the most crucial concept to understand when you are building a portfolio.

For example, let’s look at two hypothetical portfolios – both have ten different stocks in them.

Portfolio A

This portfolio is comprised of exclusively automotive stocks (like GM and Ford).

While ten stocks may provide intrinsic diversification (meaning there are ten different companies), the portfolio is very heavily weighted towards the automotive industry.

If anything were to happen to that industry as a whole, most of this portfolio would suffer.

Why is that?

Because this portfolio relies on similar supply chains and manufacturing processes.

You simply cannot properly diversify if all of your stocks are in the same industry!

Portfolio B

This portfolio contains:

- Three automotive stocks;

- Three technology stocks;

- Two financial services stocks; and

- Two telecommunication stocks.

Right off the bat, you can see how diversifying your portfolio like this one provides exposure to many markets and decreases risk.

Consider a circumstance where one sector experiences turbulence…

…there are three other sectors that operate independently and can carry those losses.

Risk Management

This leads us into the other most crucial portfolio management factor…

…controlling how much risk is in your portfolio.

Although risk is a very subjective term, it revolves around your potential to lose a large amount of your investment.

As we discussed above, diversifying your portfolio is a great way to reduce risk in your portfolio.

Another way to mitigate risk in your portfolio is by balancing:

- Growth stocks;

- Value stocks; and

- Income-generating stocks.

For example, a portfolio comprised entirely of growth stocks will be very volatile because of the nature of high-growth companies.

Conversely, dividend-only portfolios generate stable income, but their share price doesn’t appreciate nearly as fast as it grows the company would.

By balancing a portfolio this way, you have the potential to enjoy steady returns with a solid base.

10 Bagger Stocks

Now that we have given some tips on setting up your portfolio, you may be ready for a nap.

Right?

Well, this is not the time for a nap!

Now, we will get into those “grand slam” stocks that defy all expectations and return over 1,000%.

We call these stocks “10 baggers” because these stocks return tenfold your original investment.

You cannot expect every company to be a 10 bagger, but these companies certainly do exist.

So, how do you find them?

In all reality, you need to find the perfect storm.

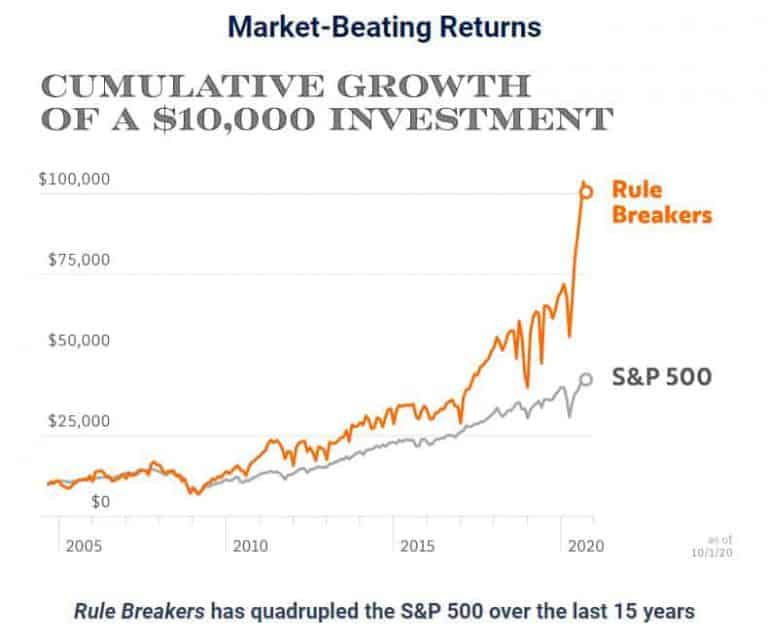

*** UPDATE -- Wednesday, February 25, 2026 -- MOTLEY FOOL STOCK ADVISOR AVERAGE RETURN OF ALL 500+ STOCK PICKS IS 967+% VS THE S&P500'S 197% ****

The Fool investing philosophy is hold stocks for at least 5 years, invest regularly, and ride out the dips. Here is just a sample of some recent picks:

- Aritzia picked Nov 6, 2025 and already up 42%

- Rocket Lab picked August 7, 2025 and already up 92%

- AppLovin picked April 3, 2025 and already up 70%

- ASML picked March 20, 2025 and already up 75%

- Howmet Aerospace picked January 16, 2025 is up 78%

- Transmedics (Epic) picked December 19, 2024 is up 88%

- DoorDash picked October 3, 2024 is now up 52%

- Unity Software picked Sept 5 is up 161%

- Shopify picked June 6 is up 118%

- Chewy (Epic) picked May 14 is up 169%

Also, the Motley Fool just launched a February promotion: $100 off (see the link below).

Here is their release schedule of their upcoming stock picks:

- February 5 2026 - New Stock Recommendation

- February 12, 2025 - List of 5 Best Stocks to Buy Now List

- February 19, 2025 - New Stock Recommendation

- February 26, 2025 - List of 5 Best Stocks to Buy Now

So, if you have a few hundred dollars to invest each month and plan on staying invested for at least 5 years, we haven't found any better source of stock picks.

New Pricing: Motley Fool has slashed the price for its top stock picking service.

Use WSS100 to get $100 off HERE