Keeping your finances on track takes effort.

This effort can be overwhelming for those with other responsibilities.

I think all of us fall into the category of people with “other responsibilities.”

Therefore, all our finances can become overwhelming at one point or another.

However, even IF you check your financial accounts regularly…

…it remains EASY to overlook subscriptions, recurring expenses, and other financial “leaks.”

So, let me ask you a few questions…

- Do you have trouble saving money?

- Are you having trouble maintaining your financial health?

- Do you cringe at the thought of reviewing your spending?

Did you know that nearly 50% of Americans spend as much or more than they are currently earning?

This is an unsettling, but true statistic.

Accordingly, we have gathered you here today to GET YOU BACK ON TRACK.

How do you get back on track?

By reading on…

Now, if you have a pulse, you are likely familiar with one of a few financial apps.

These apps include Mint, Personal Capital (now known as Empower), and Acorns.

Financial apps have revolutionized the way we manage and save money.

However, none of these apps (albeit great in their own right) prioritize saving you money.

Fortunately, these are not the only apps at our disposal.

There are two apps that will go to bat for you and keep your hard-earned cash where it belongs.

Where does your cash belong?

IN. YOUR. POCKET.

The companies keeping cash in your pocket are Trim and Truebill.

Today, we will be comparing Truebill vs. Trim to determine which is best.

It is time to let the best money-saver win!

Trim vs. Truebill – Overview

Trim Overview

Trim is excellent for managing your finances and saving you money.

The company automates savings, cancels unwanted subscriptions, and negotiates lower bills.

Many users enjoy the all-in-one feature that Trim offers.

You can think of Trim as your personal assistant.

The app works in the background and finds ways to save you money.

Could you stand to save a few dollars?

If this sounds like you, Trim can fill that void.

That’s right – Trim will fill your void with cold, hard cash.

Trim users saved over $1,000,000 last month alone.

You can get your results in less than a minute.

Truebill Overview

Truebill is another fin-tech app that many financially-savvy folks hold in high regard.

You can lower your bills, manage subscriptions, and unlock savings you never imagined possible.

To put it simply…

…Truebill makes saving money e-a-s-y!

Truebill has saved users over $14 million since its inception in 2015.

The company analyzes your financial patterns, recurring bills, and generates personal financial reports.

If you WANT to manage your money but do not have TIME, Truebill can make you whole.

What is that?

You did not know a piece of you was missing?

I am here to tell you that you are missing something.

That “something” is a fat stack of money.

Trim vs. Truebill – Common Features

Trim Features

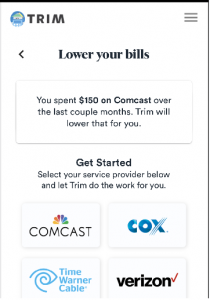

Trim Bill Negotiation

Do you have internet, cable, or a cell phone?

Of course, you do.

How else would you be reading this article?

So, let me answer for you: YES!

Great!

Trim can save you money by renegotiation these bills.

The company saves users, on average, between $5 and $50 per month.

Trim utilizes chatbots online or real-life humans to call on your behalf.

Additionally, Trim is continuously monitoring your bills to save you money.

You do not have time to check internet service provider rates…

…but Trim does this for a living.

Trim covers everything from price increases to limited-time offers.

You will not miss out on savings while using Trim.

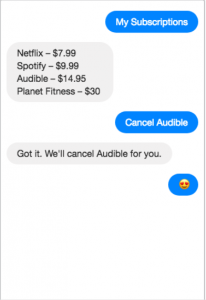

Trim Subscription Management

Remember that Amazon Audible account you signed up for last year?

Of course, you don’t!

Fortunately, Trim discovers your long-forgotten subscriptions…

…and cancels them on your behalf.

The company beings by reviewing your finances.

From there, they identify ALL your subscriptions and memberships.

After that, Trim will give you a list…

…and you may be surprised at what you find!

This list includes everything from:

- Gym memberships;

- Media subscriptions; and

- Who knows what else (hey, what you do in your free time in none of our business).

Forgetting about past subscriptions happens to even the most financially savvy folks.

But these “small” expenses can add up significantly over time.

Trim will send you the list of your subscriptions and ask which ones you want to cancel.

From there, simply reply “Cancel [insert subscription],” and Trim will cancel it for you.

Easy as one, two, three.

Trim Simple Savings

Trim offers an automated savings account to all users.

You can choose a set amount of weekly transfers from your checking into savings.

The best part?

Trim provides an annual 1.5% annual rate on your balance.

So, you can save money and earn money without lifting a finger.

The savings account is administered by Evolve Bank.

Your funds are FDIC insured up to $250,000.

Trim Alerts

You can use Trim to set-up text message alerts.

For example, you can prompt a low balance alert, late fee alert, and other alerts.

These notifications are excellent for keeping your finances on track (even after you have forgotten).

The alerts are a small but helpful feature.

Truebill Features

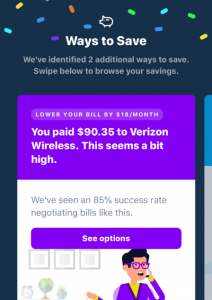

Truebill Bill Negotiation

You can use Truebill to lower your bills.

The company will negotiate with your various services providers.

Just like Trim, the most common renegotiations come from the following services:

- Cable

- Internet

- Cell Phone

These service providers include AT&T, Comcast, Verizon, Spring, Audible, and more!

Keep in mind, Truebill never downgrades or removes your services.

Instead, the company lowers your bill by:

- Negotiating a better rate; or

- Getting a one-time credit applied to your account.

Truebill saves its customers 20% on existing telecom plans through negotiation, on average.

Once the negotiation process is complete…

…you will receive an e-mail you letting you know your savings!

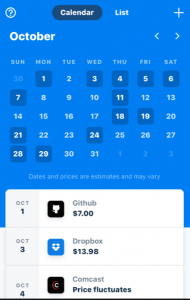

Truebill Subscription Management

Truebill saves you money by flagging recurring charges in your bank statements.

Simply connect your checking and credit card accounts to the app.

Through the financial encrypting services, “Plaid,” simply enter your account information in the Truebill app.

Once your account information is input, Truebill reviews all your data and flags the following:

- Recurring bills

- Changes to bills

- Opportunities to lower bills

From there, you can select any Subscription to see details and cancel, as necessary.

Additionally, Truebill offers a premium service.

With Truebill Premium, you can have the company cancel your unused services for you.

Simply select “Cancel Service,” and you are good to go!

Truebill Smart Savings

Smart Savings is an easy, smart way to save money for your financial goals.

Your goals can be big or small.

Simply choose the amount you want to transfer and the frequency of transfers.

Your “Smart Savings” account is entirely up to you.

The Smart Savings accounts with Truebill are FDIC insured U.S. bank accounts.

For security purposes, money deposited into the account must be withdrawn to the checking account in which it came.

Trim vs. Truebill – Unique Features

As you can see, Truebill and Trim provide similar services.

Many compare the two to see which service is best for their individual needs.

To recap, both apps provide:

- Bill negotiation to lower bills

- Subscription identifying and canceling

- Savings accounts

However, each app has its own set of unique features.

This section will lay these features out.

Trim Unique Features

Trim Debt Payoff Calculator

Need help managing your debt?

Trim offers this handy tool to help you become debt-free.

The debt payoff calculator helps you:

- Total all your debt;

- Calculate interest; and

- Find a repayment plan to meet your goals.

Once your plan is set, Trim will set you up with a financial coach to help you

The financial coach can help with:

- Negotiating lower interest rates;

- Optimizing your debt payoff strategy; and

- Build a personalized budget and spending plan.

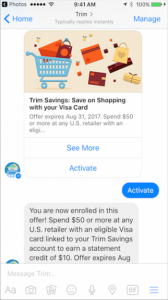

Trim Coupon Search (currently on-hold)

You can register your Visa card (it only works with Visa…for now) that you use for daily purchases.

Trim will not use your Vis information outside of the Trim Savings feature.

From there, Trim will find coupons and add them to your purchases automatically.

And did I mention that this service is free? No?

Okay, it is FREE.

You can even earn $40 cashback coupons toward “everyday purchases.”

Here are the offers:

- Groceries: Earn $1 on any purchase over $5— redeem a total of 10 times for $10.

- Dining: Earn $1 on any purchase over $5 – redeem a total of 10 times for $10.

- Movies: Earn $10 on any purchase over $20 – a one-time offer.

- Shopping: Earn $10 on any purchase over $50 – a one-time offer.

While not hundreds of dollars in cashback, the $40 sure beats nothing!

And you are making these purchases regardless, so why not get something back?

Trim Amazon Price Patrol (currently on-hold)

You can also use Trim to save money on Amazon.

And who doesn’t use Amazon?

Here is how Trim saves you money on Amazon purchases:

If you make a purchase on Amazon, and that item drops in price…

…Trim can get you a refund on the price difference.

The only work on your part is linking your Amazon account to Trim.

Trim files the paperwork and sends you a check when the process is complete.

As a frequent Amazon user, I found this to be a very cool feature.

Truebill Unique Features

Truebill Outage Monitoring

Let’s say your cable or internet provider has an outage in your area.

When this happens, Truebill will request a credit to your account.

You may be thinking…

…my cable provider has outages ALL THE TIME.

If this is the case, Truebill saves its users $96 on average.

Like Bill Negotiation, Truebill keeps 40% of the outage savings.

With Truebill on your side, you will be wishing for outages!

Truebill Save on Electricity

The Electric Save feature is available in select areas.

These areas are where electricity is “deregulated.”

If you are in one of these areas, Truebill will partner with Arcadia Power to find you the lowest cost electric possible.

Some users report up to 30% savings on their electricity bill.

Truebill Spending and Budgeting

To track your spending, go over to the “Spending” tab.

Here you will see monthly reports of…

- Your overall financial health

- Where your money is going

- How your spending is changing over time

You can also view a full list of transactions and review transactions across all accounts.

Additionally, you can start budgeting by selecting the “Start Budget” box on the Dashboard.

The budgeting tools let you keep track of your spending by category.

Trim vs. Truebill – Fees

Trim Fees

Signing up for Trim is entirely free.

Trim’s free services include:

- Finding and canceling subscriptions;

- Personal finance dashboard; and

- Spend alerts and reminders.

For bill negotiation, the company charges 30% of your yearly savings.

This fee structure means $300 yearly savings equates to an immediate $90 charge.

If the company fails to negotiate savings, you do not owe anything.

For debt payoff, Trim charges $10 per month.

However, there is a 90-day refund window if you are not satisfied with the service.

Truebill Fees

Like Trim, Truebill is totally free to download.

Truebill’s free services include:

- Finding and canceling subscriptions;

- Spending and budgeting tools; and

- Spend alerts and reminders.

For bill negotiation, the company charges 40% of your yearly savings.

This fee structure means $300 yearly savings equates to an immediate $120 charge.

If the company fails to negotiate savings, you do not owe anything.

Truebill Premium is $35.99 annually or $4.99 per month.

The best option for you is likely the monthly option.

You can pay the $4.99, cancel your unwanted bills, and then cancel the Premium service.

If you want to lower your bills, Truebill charges 40% of the annual savings in the first year.

This fee is charged as soon as the bill renegotiation is complete.

As mentioned, if Truebill cannot renegotiate lower bills, you pay nothing.

Overall, the fees are reasonable and can save you significant time and money.

Trim vs. Truebill – Security

Trim Security

Trim employs the banking industry-standard 256-bit SSL encryption.

Additionally, Trim never sees your login information.

Trim uses a system called “Plaid” to remit the information to your bank.

Once complete, the bank sends your transactions in a read-only format.

Truebill Security

Truebill works by connecting to your financial accounts.

With that said, safety is likely one of your concerns.

The company uses bank-level, 256-bit encryption, and has read-level access to your information.

Additionally, Plaid is used to connect to over 15,000 financial institutions across the U.S securely.

Therefore, you do not need to worry about your accounts getting charged.

Truebill will not sell your data to third parties without your consent.

Trim vs. Truebill – Customer Service

Trim Customer Service

You can contact Trim at help@asktrim.com if you require support.

You can also access the FAQ section for answers to questions like:

- How does bill negotiation work?

- Is Trim free?

- How do I sign up for Trim?

Truebill Customer Service

Truebill offers plenty of advice and answers straight from the team.

You can get answers to questions like:

- Why is my account not linking?

- How do I cancel a bill negotiation?

- How can I cancel Truebill Premium?

You can also Chat in App with the Truebill support team.

Alternatively, you can utilize the Webform here.

Trim vs. Truebill – Which is better?

Trim and Truebill offer many different services to save you money.

Additionally, many of these services are 100% free.

In terms of services, both apps offer very similar benefits.

Truebill gets a slight advantage, in my opinion.

The app has a better interface and is better about finding “true” subscriptions.

By “true subscriptions” I mean, separating expenses like Netflix and recurring savings deposits.

Truebill also offers more comprehensive financial management tools.

Trim is the newer app and has a bit of catching up to do.

However, since both apps are free…

…why not try both?

You may even find that Trim is better than Truebill.

In which case, come back and let us know why.

Regardless of the “winner,” you are bound to improve your financial health.

What are you waiting for?

Sign-up today!