Bond valuation is a technique for determining the fair price of a bond. The theoretical fair value is the present value of the stream of cash flows it’s expected to generate.

Now that you have a basic understanding of what bond ratings are, we’ll look at bond valuation and how you can use it to select your investments.

What is a Bond Valuation?

Bond valuation is a technique for determining the fair price of a bond. The theoretical fair value is the present value of the stream of cash flows expected. Bond valuation includes calculating the present value of the bond’s cash flow (future interest payments), and the bond’s par value (value upon maturity)

A bond’s par value and cash flow are fixed, so investors need simply to look to bond valuation to determine whether an investment in a particular bond would be worthwhile. It’s only one of the factors investors consider in determining whether to invest in a particular bond, though. Other important considerations are: the issuing company’s creditworthiness, the bond’s price appreciation potential, prevailing market interest rates, etc.

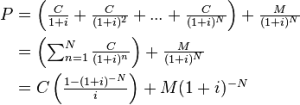

Bond Valuation Formula

Firstly, the present value of the bond’s future cash flows should be determined. The present value is the amount that would have to be invested today in order to generate said future cash flow. It’s dependent on both the timing of the cash flow and the interest rate. To figure out the value, the present value of each individual cash flow must be found. Then, you’ll simply add the cash flows together.

(Image source: Wikipedia)

- F = face values

- iF = contractual interest rate

- C = F * iF = coupon payment (periodic interest payment)

- N = number of payments

- i = market interest rate, or required yield, or observed / appropriate yield to maturity

- M = value at maturity, usually equals face value

- P = market price of bond

Bond Valuation Calculators

There are many tools available online to help you calculate a bond’s valuation, without having to do that crazy math computation on your own! Here are some popular ones:

There’s a lot to learn about bond valuation. It’s important to be able to understand the fair price of a bond before investing in it. Selecting an investment that is well suited for you can be a stressful experience. We’ve got you covered. Our Investing in Different Markets coursehttps://www.wallstreetsurvivor.com/starter-guides/what-are-bonds-how-they-work/ will teach you all about bonds.

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.