Should you trust the Motley Fool? Find out here.

Summary;

- “Pump and dump” schemes involve fraudsters buying shares of a thinly traded company and flooding the market with news (to increase demand and the stock price) and then selling (dumping) the stock as the price starts to peak.

- Motley Fool is a well-known investment newsletter and stock recommendation service known for their Stock Advisor service that has drastically outperformed the market since its inception. So is the Motley Fool a pump and dump? As a paid subscriber for the last 8 years, I know they are NOT and I will tell and show you why

The internet is responsible for some of the most innovative tools investors have ever had.

Where else could you acquire instant access to all financial data for a company you are researching?

In just a few seconds, you can have…

- The annual report for a prospective investment over the last ten years;

- Their current stock quote; and

- Ten unique analyst reports to help you make a decision.

You can even watch video interviews and paper trade the stock with a verified broker to get an edge on your investing.

You can see that the internet is an amazing place for the modern investor. However, the internet has also provided a platform to fraudsters who want to steal from unsuspecting traders.

These frauds involve using misleading schemes to trick their victims into investing in products that are not what they have been advertised. One of the most popular cons that has grown in popularity with internet investing is the pump and dump scheme.

What is a “Pump and Dump?”

Out of the many ways to defraud investors, “pump and dump” schemes are very clever.

Pump and dump involves manipulating the share price of a public company rather than promoting a company that does not exist.

These scams are scary because much of the information the fake investors report contain only slivers of truth.

How does a pump and dump scheme work?

When a company has its shares listed on a stock exchange, they want to access public funds and outside investors to raise more money to grow their business and generate profits, which is why we call them “publicly traded.”.

Larger companies (e.g Apple, Amazon) are more aware about…

- Their financials being carefully audited;

- They have thousands of employees; and

- There are government representatives that get involved with their regulation.

Massive companies like that are usually safe enough to invest in for the average retail investor because there is so much data available to analyze.

But, what about small-cap stocks?

Small-cap companies may have a market capitalization of only a couple million dollars without many analysts covering their business.

It is these small companies that are most susceptible to pump and dump schemes.

In order to initiate a pump and dump scheme, there must be a shareholder or group of shareholders who bought a lot of shares of the small company around the time of its IPO.

Now, shares of a very small company may not be trading very high because they have not had time to deploy the new capital and grow the business, respectively.

Since the share price may not be very high, and these investors have many shares, they will try to pump up the stock price by utilizing misleading marketing tactics and promoting blatantly false information to attract new investment.

Once the fraudsters decide to launch a pump and dump scheme, they will usually invest some money into a fake marketing campaign that claims amazing results and “insider information” that will cause the stock to skyrocket.

The idea is to attract as many new investors as quickly as possible by creating a sense of urgency.

Their message is essentially, “if you don’t invest now, you’re going to miss the investment opportunity of a lifetime, buy-in now.”

As a result, the more investors who believe these messages and invest will push the stock price up.

Once the stock price jumps a little, other investors will see the interest in that stock and start piling in because they want a piece of the action.

Do you see a pattern?

Once the stock price reaches the desired exit point for the fraudsters, they will sell off (i.e.,”dump”) the large number of shares they had purchased at the beginning of the scam.

After they sell their shares, the scheme is finished, and then the stock will drop dramatically because the company’s fundamentals reveal the immense overvaluation caused by the false advertising.

Unfortunately, the investors who bought in and pumped up the price usually lose a lot of money, and that is how a pump and dump scheme works.

Example of Pump and Dump Scam

Let’s look at the hypothetical Power Sports Corp., which recently went public because their goal is to open offices in 5 new states, and they decided that an IPO would help them achieve that goal quickly.

Power Sports hires Shady Marketing company to help grow its advertising.

The executives at Shady Marketing recognize this amazing opportunity to make a quick profit by exaggerating the client’s business and run a pump and dump scam.

They take their advance payment from Power Sports and buy as many shares of the company with it as they can.

Next, they create this elaborate and fraudulent ad campaign that focuses on getting in on this great stock before it takes off, instead of promoting the business.

They send email blasts and use paid ads to attract as many new investors as possible, and they watch the stock price climb steadily over the next few weeks.

Before Power Sports can realize what happened, Shady Marketing has cashed out all of their shares, closed up shop, and left town.

In their wake, they leave conned investors and a severely injured Power Sports Co.

This type of scam is all too common thanks to the power of the internet.

There are many stock picking services that utilize loud marketing tactics and creative promotional material to set themselves apart and gain new subscribers for their stock-picking service.

One of the most famous and established stock picking services is the Motley Fool. Many investors are familiar with their advertisements promoting “The next big stock,” so do they qualify as a pump and dump scheme? Let’s do some digging find out.

The Motley Fool: Is it a Scam?

Before we determine whether the Motley Fool is a pump and dump or not, we need to take some time to understand what it is and how it operates.

The Motley Fool is an investment newsletter, media company, and stock recommendation service that has been around since 1993.

Their primary revenue drivers are their subscription-based newsletters that focus on various aspects of investing in the stock market.

You have probably seen their advertisements everywhere, from investment magazines to stock valuation videos on the internet.

Their marketing approach is certainly bold and in your face, because that is what serves their business model best.

Some of the more familiar commercials focus on their ability to pick the “next big stock” or the “New Netflix” or something like that to spark interest and draw in potential customers.

There are some people who don’t go any further with the Motley Fool solely because of the marketing, and that is perfectly fine.

As the name implies, the Motley Fool does not take itself too seriously because the team believes in the quality of their work, and they want to be accessible to the average, everyday investor.

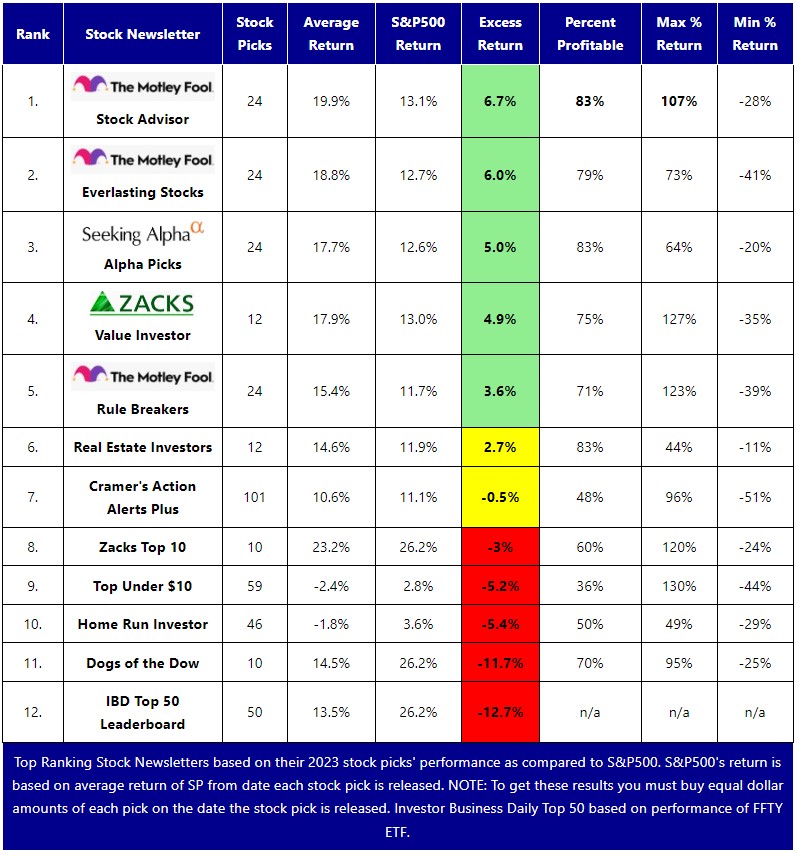

But don’t let the casual name trick you into thinking their service is a joke. They have been in business for decades, and they are consistently rated as some of the best investment services available on the market today. Here’s our analysis of the top ranked stock newsletters as of December 31, 2023:

Not only do they offer multiple investment recommendation services, but they have also grown to expand into personal finance and retirement planning advice as well.

At the end of the day, they need to sell their service to stay in business, which requires extensive advertising in an ever-competitive market, and they have found the strategy that works best for them.

How Motley Fool Started

Now that we know what the Motley Fool is, we should dive into the history of the company.

The Motley Fool was founded by brothers Tom and David Gardner in the mid-1990’s because they realized that the average retail investor did not have access to great stock recommendations with research to back up the analyst’s claims.

In the late 90s through the early 2000s, Wall Street investors were the only people with access to the most up to date financial data, and they did not have any reason to distribute it to the average investor.

This lack of quality information inspired the brothers to create a service that was both accessible and of impeccable quality, and thus the Motley Fool was born.

What began as a small business in Alexandria, VA, has evolved into a massive financial media company that has offices all over the United States, England, Germany, Australia, and more.

Now that we know what the Motley Fool is and a little bit of their story, let’s look at the services they provide.

In order to identify why some may confuse the Motley Fool with a pump and dump scheme, it is imperative that we understand how their service operates in practice.

Motley Fool Stock Advisor

The Motley Fool’s Stock Advisor, the company’s flagship service, stands out as an insightful and cohesive investment newsletter.

Established nearly as long as the company itself, it features a unique monthly selection process where founders Tom and David, along with their analyst teams, rigorously sift through hundreds of stocks to identify the top pick of the month.

This competitive endeavor combines both fundamental and technical analysis, a rare approach in investment newsletters.

This dual approach allows Motley Fool to offer a comprehensive analysis of each stock, leading to well-informed recommendations:

- Fundamental analysis delves into financial data and business models within industries, assessing competitive advantages.

- Technical analysis focuses on stock price movements and trading volume to predict future trends.

Subscribers not only receive these monthly top picks but also benefit from a starter stock list, ideal for new investors.

This list offers diverse, reputable stocks, providing a safe entry strategy into the market. Additionally, subscribers get insights into other promising stocks and access to exclusive forums for community discussions and advice exchange.

This multifaceted service ensures that subscribers are equipped with robust tools and community support to enhance their investment journey.

If you’re interested, get an exclusive offer on Stock Advisor for only $99 for the first year!

Is Motley Fool a Pump and Dump?

Now that we have a much better understanding of pump and dump schemes and the Motley Fool, it is time to discuss whether the Motley Fool does or does not qualify.

Key components of a pump and dump scheme are:

- False promises

- Overinflated marketing about the company in question

Generally, the stocks at the center of a pump and dump are small-cap companies that do not have much detail about their financials or business model.

And more often than not, the companies also recently went public, which does not give investors enough data to perform in-depth research.

As Motley Fool does (at times) have very loud advertising, the companies that they recommend usually have either:

- Market capitalizations in the billions of dollars

- Years of public financial data on record

They also do not recommend super small stocks without any financial data since they rely on that data to make their recommendations.

Whenever they send out their newsletter, they provide the research materials that they used to come up with their recommendations.

Another criteria for a pump and dump scheme is the requirement for perpetrators to own the stock prior to advertising and to dump it, as pump and dump schemes are dangerous to investors, they are heavily monitored and punished by the Securities and Exchange Commission.

The Motley Fool has very specific rules for its analysts. These rules include instances where analysts are only allowed to enter a position into a stock after they recommend it.

This rule mitigates the possibility that someone on the team will take advantage of their research.

*** UPDATE -- Saturday, July 5, 2025 -- MOTLEY FOOL STOCK ADVISOR AVERAGE RETURN OF ALL 500+ STOCK PICKS IS 1,062% VS THE S&P500'S 176% ****

The Fool investing philosophy is hold stocks for at least 5 years, invest regularly, and ride out the dips. Here is just a sample of some recent picks:

- AppLovin picked April 3, 2025 and already up 50%

- Howmet Aerospace picked January 16, 2025 is up 38%

- Transmedics (Epic) picked December 19, 2024 is up 110%

- DoorDash picked October 3, 2024 and in 2023: now up 47% & 137%

- Shopify picked June 6 is up 75%

- Chewy (Epic) picked May 14 is up 169% &

- Cava (Epic) picked in October, 2023 is up 40%

- Crowdstrike October, 2023 pick up 185%

Also, the Motley Fool just launched a July, 2025 promotion: $100 off (see the link below).

Here is their release schedule of their upcoming stock picks:

- July 3, 2025 - New Stock Recommendation

- July 10, 2025 - List of 5 Best Stocks to Buy Now List

- July 17, 2025 - New Stock Recommendation

- July 24, 2025 - List of 5 Best Stocks to Buy Now

So, if you have a few hundred dollars to invest each month and plan on staying invested for at least 5 years, we haven't found any better source of stock picks.

New Pricing: Motley Fool has slashed the price for its top stock picking service.

Use WSS100 to get $100 off HERE