Income Tax

Almost every working individual has to worry about income taxes when April rolls around every year. Even though the rules surrounding income tax can be confusing, you can know exactly what to expect once you understand how it works!

What Is Income Tax?

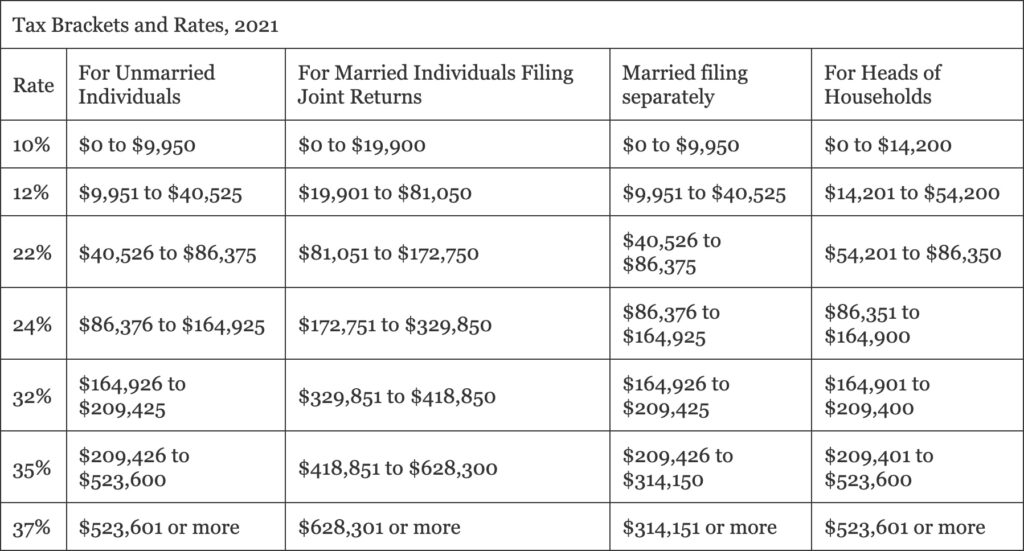

Income tax is a federal or state tax assessed according to how much money you make. In the United States, federal income taxes operate on a progressive system. This essentially means that the more money you make, the more you pay. The IRS creates the federal tax brackets every year. Here are the brackets for the year 2021:

The bracket your income falls into does not determine the total percentage you will pay in taxes. Instead, it determines your marginal tax rate. This means that the rate for any given bracket determines only what taxes you will pay on your income that falls within that bracket. For example, let’s say that an unmarried individual makes $50,000 a year. This means that his income falls into the 22% bracket. Does this mean that he will pay 22% of $50,000 in taxes? No. It means that he will pay 22% of the portion of his income inside of the 22% bracket. Since the lower end of that bracket is $40,526, then the portion of his income in this bracket would be $50,000 – $40,526, or $9474. The total amount this individual would pay can be calculated like so:

- 10% * $9,950

- 12% * ($40,525 – $9951)

- 22% * ($50,000 – $40,526)

Add these all together, and voila!

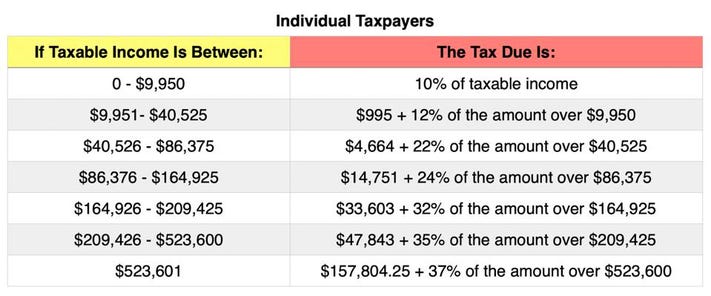

If all this seems confusing, that’s because it is. But now that you’ve learned the actual math behind federal income tax, here’s an easy table to sum it all up (for single taxpayers):

What Is My Overall Income Tax Rate?

When you take the overall payment you make and look at it as a percentage of your income, you find what is known as your effective tax rate. The effective rate is useful for knowing what percentage of your income actually went to taxes after you do all of the fancy math. For example, the individual we mentioned earlier is a single person who makes $50,000 a year. Using the above table, we know that his federal tax payment will be $4664 + 22% of the amount over $40,525. The amount over $40,525 is $9474, so his tax payment will be $4664 + (22% * $9474), which comes out to $6748.28. His effective tax rate would be $6748.28 / $50,000, or 13.50%. So, even though this individual’s marginal tax bracket was 22%, his effective tax rate was 13.50%.

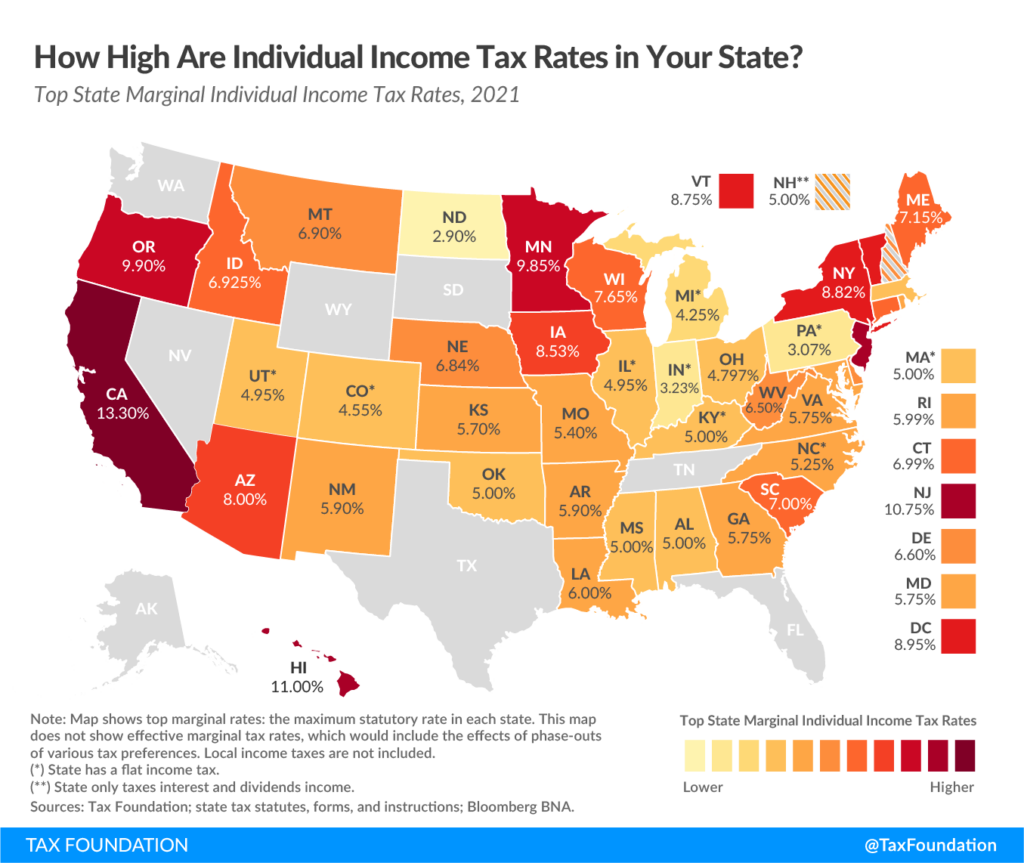

Does My State Have Income Tax?

Some states assess a state tax on their residents’ income. The form of this tax varies from state to state; some states use a progressive system just like the federal government does, some assess a flat tax, and some don’t have a state tax at all. State income tax rates tend to be much lower than those of the federal government.

Final Thoughts

Keep in mind that income tax is likely not the only type of tax you’ll have to look out for every year. Check out our article on capital gains tax!