When it comes to investing, everyone is trying to get an edge, whether they admit it or not.

The stock market is both the greatest wealth-generating tool in the world, and it is a potential black hole where you can lose an obscene amount of money in an instant.

In order to get ahead, many investors rely on stock picking services to help them achieve an edge and through the thousands of stocks that are listed on the exchanges.

Would you like to get ahead?

Well, you have come to the right place!

Stock picking services take much of the leg work out of investing by compiling and analyzing large sets of stock data and recommending the best stocks to buy based on a defined set of criteria.

This includes quarterly earnings, leadership, market share, and more, which all contribute to the research conducted by stock picking companies.

One of the benefits of using a stock picking service is that there are often services that cater to certain markets such as penny stocks or growth stocks.

At its core, the stock market is very simple.

It is an open marketplace where publicly traded companies offer pieces of their business to potential investors and speculators.

When companies list their shares on an exchange, they are attempting to raise funds from the public with which they will spend to grow their business and hopefully increase their share price and deliver value for their investors.

Investors come in all shapes, sizes, and forms.

An investor can be an 18-year-old who opens a brokerage trading account for the first time, or an investor can be a hedge fund with billions of dollars at its disposal and everything in between.

Now, what separates the hedge fund from the teenager (besides the amount of capital at its disposal)?

Their investment strategy, of course.

Our investment strategy dictates how we invest the money that we have at our disposal.

Over the decades, two over-arching investing strategies have shaped the perspective of most investors – passive and active investing.

So, let’s take a look at how both passive and active investors can gain a lot from stock picking services.

Passive Investors

Passive investors are not oblivious to their investments.

Rather they believe that the market will generate the most stable returns over the long run because there are so many variables that affect the outcome of a company’s financial performance.

The biggest factor dictating how a stock will perform may have nothing to do with the company itself.

For example, if a manufacturing company relies on a single supplier for their raw materials, and that supplier goes under or cannot deliver, then the manufacturer will suffer.

The manufacturer has no control over the supplier, but the supplier still has tremendous influence over its success.

Passive investors will invest in an index or a mutual fund to mitigate risks like this by spreading their investment over many shares of many companies.

An index like the S&P 500 is a gold standard for passive investment because it represents the 500 largest companies in the American economy.

In short, passive investors are betting on the long-term stability of the market — these investors do not jump in and out of their investments.

Active Investors

Active investment occurs when an investor or portfolio manager makes an intentional decision about what stocks they are going to buy or sell versus alternative options.

Active investors practice this investment style because they believe that they have a better chance of achieving superior returns instead of what the market will generate.

The term “beating the market” is attributed to active investors because they believe that over the long-term, they will earn a higher rate of return than if they just left it in the market.

Active investors need to conduct in-depth research about the companies they choose to invest in because their portfolios are typically focused on a small group of stocks.

On the other hand, passive investors are more likely to invest in pieces of hundreds or thousands of stocks.

Regardless of your investment style, you will want to ensure that you are wisely investing your money.

Therefore, whether you are active or passive, you could use the help of a stock picking company.

The Best Stock Picking Companies

Now that we have reviewed the two major investing strategies let’s dive into the best stock picking services available.

Morningstar

Morningstar is one of the most well-known investment research companies out there.

The company also delivers an immense amount of value with their stock pick recommendations in their premium service.

Founded in 1984, Morningstar’s purpose has been to provide the best investment research on Wall Street and make it accessible to the average retail investor.

The membership for Morningstar Premium starts at $199 per year and offers a plethora of stock picking resources for subscribers.

Morningstar offers stock screening, which helps sort through potential investment ideas.

However, Morningstar research shines with the way that they offer their picks by assigning a value of gold, silver, or bronze to their top stocks.

The top picks dashboard is optimized to show the company names, historical returns, and what they are currently rating the stock.

Gold stocks are the best of the best according to their criteria.

Gold stocks have excellent fundamentals, and they usually have some form of ‘X’ Factor that sets them apart.

Silver stocks have great fundamentals and are on a positive trajectory.

Finally, Bronze stocks have strong fundamentals but are waiting for their next breakout moment.

Other features in the Morningstar Premium service include ETF picks, analysis for mutual funds, and recommendations for high-yield stocks that seek to deliver strong quarterly dividends.

For $199, Morningstar has plenty of tools to offer traders, and an excellent reputation behind it.

Motley Fool Stock Advisor

If you have ever looked into a stock picking service, then you have undoubtedly come across the Motley Fool over the course of your research.

In fact, most of their advertisements center around the theme of picking the next big stock, and they have an immense team of analysts in offices all over the world.

Since they are so big, you may be curious about how they operate and how you can benefit from their service.

The Motley Fool was founded in the mid-1990s by brothers Tom and David Gardner, and their mission was to offer the best stock analysis service that was accessible to the average investor.

We believe they have accomplished this goal.

Their flagship service is the Motley Fool Stock Advisor subscription, which costs between $99-$199 annually, depending on promotions.

So, what makes Stock Advisor so special?

Not only does Stock Advisor provide actionable stock picks, but a subscription includes a comprehensive introduction to investing in the stock market as a whole.

Every month, Tom and David work with their teams to identify what they consider to be the next big stock.

Their analysis uses different approaches like fundamental analysis, technical analysis, and more.

At the end of their research, they each submit their stock to the next monthly newsletter (two picks per month), along with all of the supporting research behind it.

So, you just get two stock picks per month?

Not even close.

Along with their top stock picks, you get…

- A list of other top performing stocks with supporting research that provides some great trade ideas;

- You get access to members’ only forums to discuss your findings with other investors; and

- They also give you their starter stock list.

Whether you are a brand new investor or a seasoned trader, the starter stock list is a huge asset.

The list is made of a diverse group of stocks in many different industries.

This list is very helpful because it creates a sample portfolio that is intentionally diversified.

Why does this matter?

Many investors have difficulty building diversification into their portfolios due to unconscious bias or because they invest too heavily in the same group of stocks.

If you own 10 different bank stocks, you may think you have a diverse portfolio, but in reality, if the entire financial services industry drops, your entire portfolio will drop with it.

Thankfully, the starter stock list helps investors pick the right stocks and keep their portfolio diverse.

Motley Fool Rule Breakers

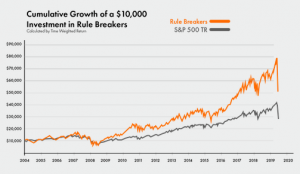

Rule Breakers is the aggressive growth stock picking service from the Motley Fool.

Priced at $99 per year, there is a lot of potential value in its recommendations.

However, it is important to understand the distinct differences between the two subscriptions.

The Rule Breakers service is spearheaded by founder David Gardner, and they focus on analyzing companies that are poised to have a monumental breakout in the near to medium future.

Before you choose Rule Breakers, make sure you understand your investment goals.

Growth stocks get their name by focusing on products and services that can launch into an exponential increase in value and share price.

Famous growth stocks you may know are Netflix and Tesla, for example.

Rule Breakers has a long track record of performing well and choosing great companies.

However, a new investor should understand that the picks recommended by Rule Breakers are going to be more volatile than the picks recommended by Stock Advisor.

Volatility can be a great thing because it shows that there is a significant amount of speculation in a particular stock.

But, you should avoid losing your cool if some of the prices regularly fluctuate 10% or more.

For the investor with a firm understanding of portfolio management, or wants more exposure to growth stocks, Rule Breakers can be a GREAT addition to your stock picking research.

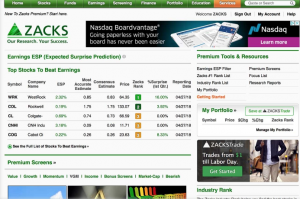

Zacks

Zacks is another renowned investment research service company packed with features for its subscribers.

At the core of their stock-picking services is their graded rating system that assigns a rank with 1 being the absolute best.

One of the methods to rank a stock is its Expected Surprise Prediction (ESP). The ESP rating is a weighted prediction of how much a stock will beat its consensus quarterly earnings prediction. The higher the ESP, the higher Zacks anticipates the stock’s performance to be.

Investors who like fundamental analysis in their stock-picking strategies may enjoy the Zacks approach, and they have access to the tools at three different membership levels.

Basic

The Basic membership from Zacks is very informative and primarily offers news and observation tools.

Subscribers receive a daily email with a handful of #1 rated stocks, a stock of the day, and access to rankings for mutual funds.

For investors who want a quick reference, the basic membership is more than enough, but if you want to take advantage of some of Zacks’ more powerful tools, you will need to upgrade the premium membership.

Premium

The Premium membership from Zacks is $249 per year and offers a host of interactive portfolio tools, along with additional research sources.

One of the most useful portfolio tools is the ability to link your portfolio to the Zacks platform and compare your holdings to their Zacks ratings.

This, in and of itself, can be an excellent gauge to understand how they perform their research and help you understand your trades better.

For stock picking, premium members receive access to all of Zacks research reports and rankings, so you can find all of their top-rated stocks and screen them to see if they fit your portfolio.

Ultimate

Zacks offers ann Ultimate membership for $2,995 per year, which is targeted towards high net worth individuals and professional traders.

What makes this membership so powerful?

Not only do members receive all research and exclusive recommendations, but they also receive access to all of the Zacks strategy training.

The main benefit of this is the combination of both getting the best stock picks, but also how to buy and sell, how much to allocate for each, and much more.

As you can see, Zacks has great resources for every level of investor, so if you are interested in their style, start with the free account and work up from there.

*** UPDATE -- Saturday, July 5, 2025 -- MOTLEY FOOL STOCK ADVISOR AVERAGE RETURN OF ALL 500+ STOCK PICKS IS 1,062% VS THE S&P500'S 176% ****

The Fool investing philosophy is hold stocks for at least 5 years, invest regularly, and ride out the dips. Here is just a sample of some recent picks:

- AppLovin picked April 3, 2025 and already up 50%

- Howmet Aerospace picked January 16, 2025 is up 38%

- Transmedics (Epic) picked December 19, 2024 is up 110%

- DoorDash picked October 3, 2024 and in 2023: now up 47% & 137%

- Shopify picked June 6 is up 75%

- Chewy (Epic) picked May 14 is up 169% &

- Cava (Epic) picked in October, 2023 is up 40%

- Crowdstrike October, 2023 pick up 185%

Also, the Motley Fool just launched a July, 2025 promotion: $100 off (see the link below).

Here is their release schedule of their upcoming stock picks:

- July 3, 2025 - New Stock Recommendation

- July 10, 2025 - List of 5 Best Stocks to Buy Now List

- July 17, 2025 - New Stock Recommendation

- July 24, 2025 - List of 5 Best Stocks to Buy Now

So, if you have a few hundred dollars to invest each month and plan on staying invested for at least 5 years, we haven't found any better source of stock picks.

New Pricing: Motley Fool has slashed the price for its top stock picking service.

Use WSS100 to get $100 off HERE