So, you want to invest in individual stocks? However, getting started can be quite intimidating.

Investing in stocks can be risky…

…especially if you do not know what you are doing.

Investing can be difficult when trying to determine things like:

- How much money to invest

- What type of stocks to choose

- How to avoid making “rookie” mistakes

Luckily, there is a tremendously powerful tool available to ALL investors today.

What is that tool? It is the INTERNET, of course!

And the internet is full of investment websites – some are good, some are bad…

…and others are just plain U-G-L-Y.

The best thing you can do is find a *trusted* source to let you know which sites are legit.

So, if that is your goal…

…you have stumbled upon the right article.

We are here to break down the Top 9 investment website that any investor can use with ease.

These websites include news articles, educational resources, stock analysis tools, and trading platforms.

You can choose to use one, a few, or ALL of these websites!

But one thing is sure…

…these websites have the resources you need to become the best investor possible.

Top 9 Investment Sites for Any Investor

These websites will provide you with valuable information to make the best possible investing decisions.

While you’re at it, consider checking out multiple sources to cross-check information to gain more insight into the market and your potential investment.

The Motley Fool

Are you ready to start investing in the stock market?

If so, your first stop should at the Motley Fool!

The Motley Fool is a multimedia financial services company that gives users financial advice on the market, investments, and personal finance.

So, what is the mission of the Motley Fool?

To empower the casual investor to “beat the market” and outperform Wall Street analysts and financial professionals.

If you visit their website (www.fool.com)…

…you will discover countless free articles on critical financial topics, such as:

- Investing

- Stocks

- Retirement planning.

The company also boasts an active community of members that share information and opinions about their investment decisions.

Users can access a competition-based crowdsourcing feature and other paid premium services.

And if you need some help picking stocks…

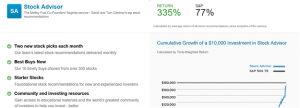

…be sure to check out the Motley Fool Stock Advisor.

For $149 per year, the Stock Advisor comes with the following:

- Two new stock recommendations each month

- “Best buy” stocks

- Foundational stocks

These recommendations can be especially helpful for new investors trying to build their portfolio.

In fact, stock picks from the founders have historically beaten the market.

Tom Gardner’s picks have earned a 149% return, and David Gardner has generated a 527% return!

Now that is not a bad return on investment.

However, there is no obligation to buy every recommendation (obviously), but these guys have an excellent track record.

Stock Advisor also has a very straightforward investing model.

Each stock recommendation explains the following:

- Current company fundamentals

- Why the stock is a good buy for the coming years

- Potential investment risks that might cause you to sell in the future

David and Tom have a goal for each investor to own at least 15 stocks.

Stock Advisor is also very intuitive, with each recommendation being categorized into the following categories:

- “Starter Stocks” – foundational companies that Tom and David believe are appropriate for any new investor

- “Best Buys” – each month Tom and David choose five stocks each that they consider “best buys.”

*** UPDATE -- Saturday, February 14, 2026 -- MOTLEY FOOL STOCK ADVISOR AVERAGE RETURN OF ALL 500+ STOCK PICKS IS 872% VS THE S&P500'S 160% ****

The Fool investing philosophy is hold stocks for at least 5 years, invest regularly, and ride out the dips. Here is just a sample of some recent picks:

- SHOP picked again June, 2024 and it is up 78%

- TSLA picked again May, 2023 and it is up 155%

- CRWD picked March, 2023 and it is up 193%

- NOW picked January, 2023 and it is up 190%

- TTD picked again Dec, 2022 and it is up 141%

- AMZN again Nov, 2022 and it is up 138%

Also, the Motley Fool just launched a special promotion: $100 off (see the link below).

Here is their release schedule of their upcoming stock picks:

- February 5 2026 - New Stock Recommendation

- February 12, 2025 - List of 5 Best Stocks to Buy Now List

- February 19, 2025 - New Stock Recommendation

- February 26, 2025 - List of 5 Best Stocks to Buy Now

So, if you have a few hundred dollars to invest each month and plan on staying invested for at least 5 years, we haven't found any better source of stock picks.

New Pricing: Motley Fool has slashed it price $100 for its top stock picking service.

CLICK HERE to get it in real-time.