We’re diving headfirst into the best finance games for students – the ultimate way to transform money management from a chore into an engaging challenge. This post is your all-access pass to the top games that teach financial literacy for every age level. Get ready to discover how levelling up your financial smarts can be seriously fun and incredibly rewarding.

Key Takeaways

- Gamifying financial literacy isn’t just a gimmick. Levels, rewards, and instant feedback transform dry concepts into engaging challenges, motivating students to conquer essential money management skills.

- One size doesn’t fit all. Age-appropriate finance games arm younger students with basic money smarts, while dedicated platforms like PersonalFinanceLab for K-12 and StockTrak for higher education offer sophisticated simulations to tackle real-world financial hurdles head-on.

- Heavy hitters like Visa’s Practical Money Skills and brainy platforms like Khan Academy offer a one-two punch of solid resources and hands-on gameplay, complementing the deep, curriculum-integrated experiences provided by educational software leaders.

How to Gamify Financial Literacy?

Gamifying financial literacy is like giving traditional financial education a much-needed adrenaline shot. It transforms learning into an interactive arena where students actually want to participate. Clear goals and objectives aren’t just targets; they’re quests – like hitting a savings milestone or acing a tough financial decision. Want to crank up the excitement? Toss in points, badges, and leaderboards. Suddenly, learning isn’t just about knowledge; it’s about bragging rights and outsmarting the competition (and yourself!).

Levels and progression aren’t just steps; they’re a climb. Each new challenge unlocked, each new tool mastered, delivers a hit of accomplishment that keeps students hungry for more. Instant feedback? That’s the game showing you the immediate ripple effect of your financial choices – learn fast, adapt faster. And the best part? Risk-free experimentation. This is your financial sandbox. Make mistakes, learn from them, and emerge wiser without any real-world wallet wounds.

Virtual currencies and rewards aren’t just pixels; they’re high-fives for smart financial habits, making the art of managing money an engaging quest on the path to understanding investing.

How do you teach financial literacy in a fun way?

Let’s be real: “fun” and “financial literacy” haven’t always been best buds. But gamification is changing the game, making it the cool new method to wire financial skills and concepts into young minds. Sprinkling in elements like:

- Levels that challenge and reward

- Rewards that feel like real wins

- Tutorials that guide, not dictate

…suddenly, learning feels less like a lecture and more like an adventure. Games create a safe environment where students can get their hands dirty managing finances, making decisions, and seeing outcomes without the sting of real-world consequences.

Different ages, different arenas. For the younger crowd, games are about cracking the code of basic money concepts – recognizing coins, understanding their worth. For teens, it’s about stepping into relatable financial dilemmas with games like ‘Would You Rather?’, forcing decision-making and cranking up engagement. This isn’t just about making finance “fun”; it’s about making it stick. It’s laying the groundwork for financial freedom, empowering smart financial decision-making, and building a rock-solid understanding of personal finance.

Popular Finance Games for High School Students

High school marks a crucial stage where understanding how to manage money can significantly influence a student’s future path. Financial literacy games serve as valuable tools, providing an engaging way to practice and learn about:

- Effectively handling their finances

- Creating and sticking to a budget

- Establishing an essential emergency fund

These capabilities are more than just lessons; they’re foundational skills for their adult lives. Through interactive calculators that simplify complex calculations and real-life simulations that immerse them in decision-making scenarios, these games help financial concepts become clear and relatable. While many free games provide excellent introductions, educational institutions seeking thorough, curriculum-integrated solutions will discover exceptional depth in platforms specifically developed for structured learning environments.

Practical Money Skills

Visa’s Practical Money Skills program is a comprehensive financial literacy education resource designed to empower individuals with essential money management knowledge. The program offers a vast library of free educational resources, including:

- Articles

- Calculators

- Lesson plans

- Interactive games tailored for various age groups.

Educators can seamlessly integrate these resources into the classroom, making financial education accessible and engaging for students. Popular games like “Financial Football” and “The Payoff” are part of this initiative, using engaging themes and simulations to teach personal finance.

Financial Football

Financial Football, developed by Visa as part of their Practical Money Skills initiative, blends financial literacy with the excitement of American football (or soccer). This interactive game makes learning about money management fun and engaging. Players advance down the field and score touchdowns by answering financial questions correctly, making it a fast-paced, 3D experience that appeals to students and adults alike. The competitive element motivates players to learn and perform better, reinforcing smart financial decisions in an enjoyable way.

Incorporating Financial Football into classroom curricula can effectively teach essential financial principles such as saving, spending, budgeting, and credit management. The game covers key topics and provides instant feedback, allowing students to see the impact of their financial choices in real time. This interactive approach makes financial education accessible and engaging, helping students develop valuable money management skills.

The Payoff

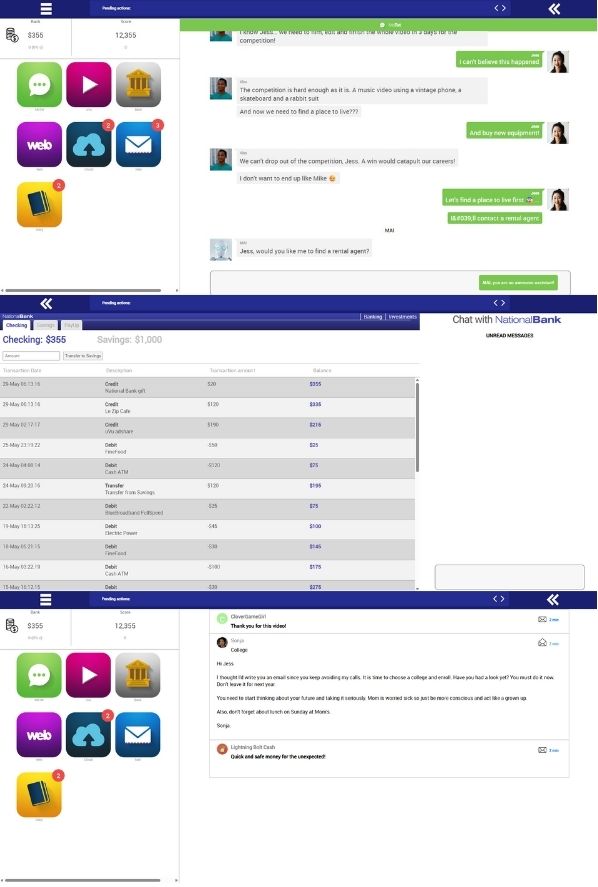

The Payoff, another engaging game from Visa’s Practical Money Skills program, immerses players in a relatable storyline where they act as aspiring video bloggers preparing for a competition. The game interface mimics a mobile phone, allowing players to interact with chat, banking apps, emails, and fake websites, making the experience feel authentic and familiar. This immersive simulation teaches students fundamental financial concepts through decision-making scenarios, emphasizing the importance of saving, how to pay bills, and the consequences of financial choices.

Visa provides extensive classroom resources to support educators, including:

- A teacher’s guide

- Detailed lesson plans

- Student handouts

- Assessments

- A glossary of financial terms

These resources make it easy for teachers to integrate The Payoff into their curricula, providing a structured and engaging way for students to practice managing money and making smart financial decisions for their wealth benefit.

NextGen Personal Finance Arcade Games

Next Gen Personal Finance (NGPF) offers an acclaimed collection of free, web-based interactive games designed to provide quick engagement and focused learning on specific personal finance concepts. These “bite-sized” games, typically lasting 10-25 minutes, are accompanied by robust curriculum resources, making them highly valuable for educators.

Popular titles that offer unique, experiential learning opportunities include:

- “Payback”

- “SPENT”

- “Money Magic”

- “The Uber Game”

These games help teach students develop essential math skills in a fun and interactive way.

Time for Payback

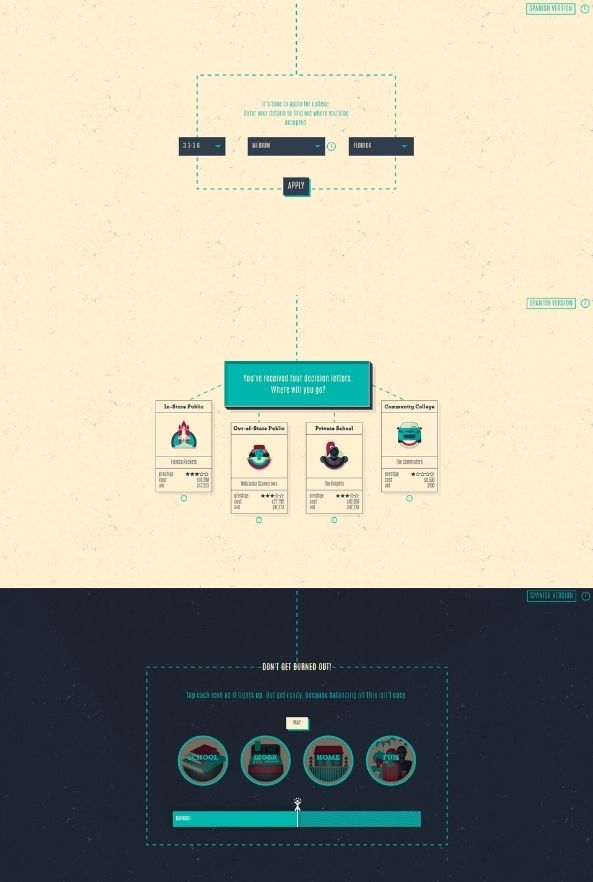

Payback focuses on the critical decision of paying for college, making it highly relevant to high school students. The game allows students to:

- Pick their careers and majors, showing the impact on job prospects and student loan debt

- Make choices about student loans, part-time jobs, and living expenses

- Experience the consequences of these choices on their overall debt, focus, attention, and happiness

This consequence-driven learning empowers students to navigate complex financial decisions related to higher education.

The objective of graduating without excessive debt is a practical and understandable goal for students. Payback’s simulation helps students understand the implications of student debt, make realistic decisions about college financing, and experience the consequences of these choices. This game is an excellent tool for teaching financial literacy and preparing students for the financial realities of college life.

Money Magic

Money Magic features an engaging narrative with a character named Enzo, a magician aiming to get to Las Vegas to perform. The visually appealing graphics and story-driven gameplay make the budgeting process fun for students. Players help Enzo manage a budget, make spending decisions, and reach a savings goal, teaching fundamental concepts of earning, saving, and spending wisely in a practical scenario.

The game emphasizes the concept of opportunity cost and making tradeoffs when managing limited financial resources. Students learn to manage money wisely by making spending decisions and seeing the immediate impact on their pretend budget and progress towards their saving money goal, understanding how spending affects their financial goals.

Money Magic is ideal for middle school or early high school students who are new to budgeting concepts.

SPENT

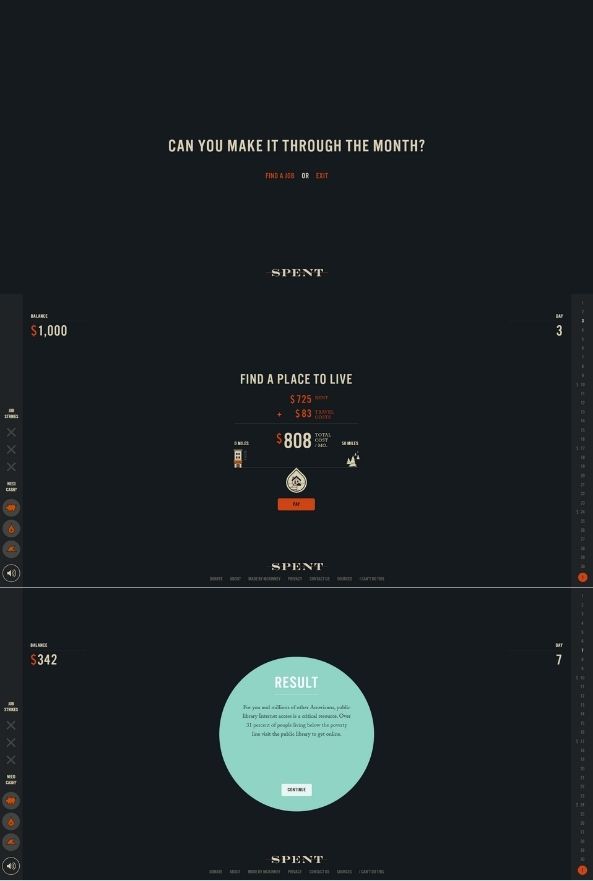

SPENT offers a powerful and empathetic experience by simulating the difficult reality of living paycheck-to-paycheck with a very limited budget. Players must make tough choices about which essential expenses to pay and which to sacrifice, illustrating the harsh financial realities faced by many. This eye-opening game raises awareness about financial hardship and the stress of managing insufficient income.

The game presents realistic scenarios that require players to juggle responsibilities and limited funds, making it a concise but impactful learning experience. With a short playtime of approximately 10 minutes, SPENT is easily accessible and delivers a strong message about poverty and financial hardship. It is an effective tool for fostering social awareness alongside financial literacy.

The Uber Game

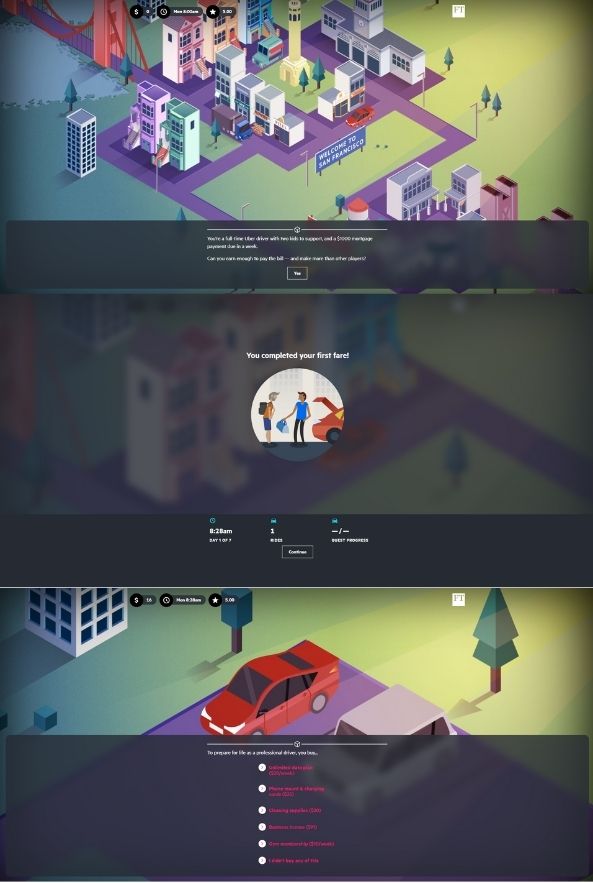

The Uber Game explores the realities of working in the gig economy, a timely and relevant topic for students considering future career paths. Players act as an Uber driver needing to earn a specific amount within a tight deadline, managing financial responsibilities such as mortgage payments and support for children. This realistic pressure simulation helps students understand the pros and cons of gig work and the financial decisions involved.

Developed from actual news reporting and featuring insights gathered from multiple Uber drivers, The Uber Game promotes critical evaluation of gig work as a potential career. Linking the effort of taking on gig jobs to meeting essential financial obligations helps students connect work to financial goals and reflect on their career options.

This experiential learning approach makes the game an effective tool for teaching financial literacy.

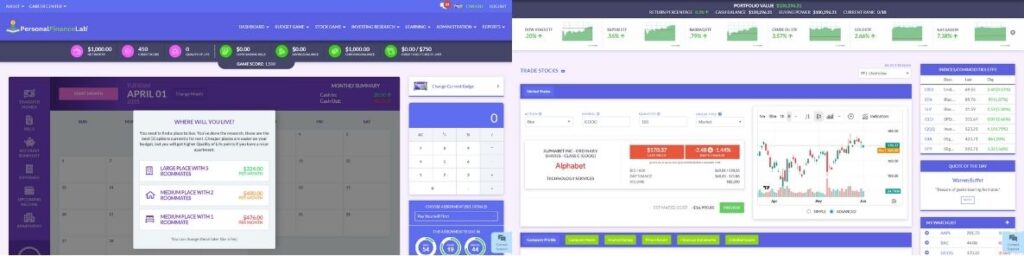

PersonalFinanceLab

A Comprehensive Solution for K-12 Students

PersonalFinanceLab offers a holistic, curriculum-integrated approach to financial literacy for K-12 students. The platform combines a realistic, long-term Budget Game with a dynamic Stock Market Game, providing immersive dual simulations that cover real bills, credit score impacts, and quality of life. Students manage their own virtual finances, making impactful decisions that help them develop financial habits and confidence.

PersonalFinanceLab offers the following features:

- Over 300 standards-aligned lessons, videos, and activities tightly woven with simulations, ensuring deep curriculum integration and practical skill connection.

- Extensive customization and control for teachers over game parameters and assignments, allowing them to fit any classroom.

- Tools for tracking student progress, participation, and comprehension in financial literacy activities, making it a robust resource for educators.

PersonalFinanceLab’s value proposition goes beyond just games; it’s a complete financial literacy platform designed for deep, sustained learning and skill development. With live chat support and personalized services for teachers, the platform enhances the teaching experience and ensures students are well-prepared for real-world financial challenges.

Fun and Interactive Financial Literacy Games for Younger Students

Getting younger students hooked on financial literacy early is like planting a money tree that will bear fruit for life. The right games make learning about money an adventure, not a chore, helping them absorb basic financial concepts while they’re having a blast. These games are engineered to captivate kids and stealthily teach them essential skills.

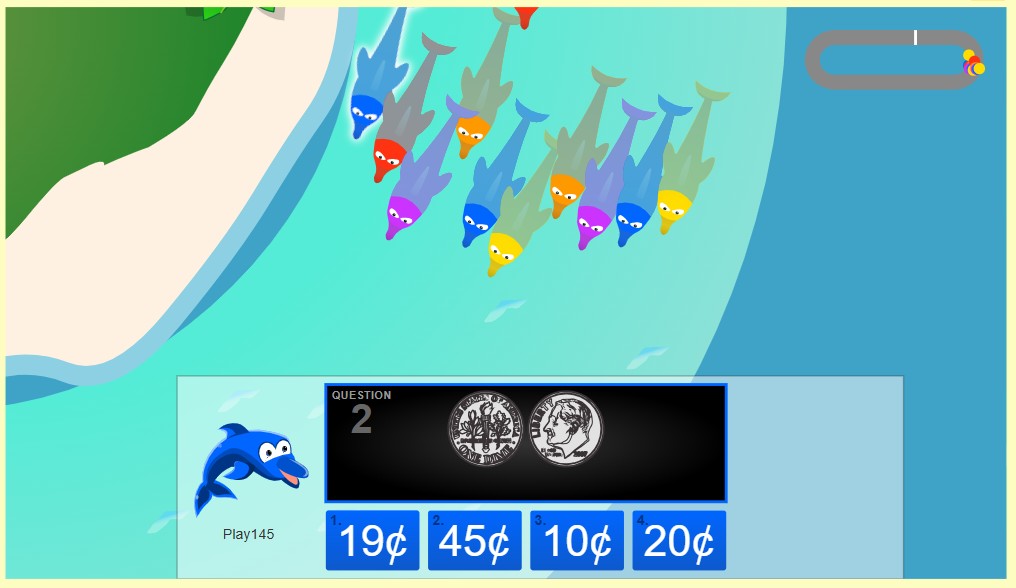

Dolphin Dash

Dolphin Dash throws down the gauntlet, letting players race against classmates in a fun, interactive splash towards money mastery. Built for the Pre-K to 6th-grade crew, this game sharpens counting, money management, and even multiplication skills through addictive gameplay. Players have to rapidly add coin values to propel their dolphin to victory, turbo-charging their mental math.

As an online multiplayer showdown, Dolphin Dash connects students globally, all while they’re leveling up their money-counting prowess. To jump in, teachers or parents need to register for an educator account, keeping the learning environment supervised, safe, and fun.

Hit the Road

Hit the Road channels that classic “Oregon Trail” vibe into an epic cross-country financial adventure. This isn’t a passive slideshow; students are in the driver’s seat, actively managing a budget, making tough spending calls, and bracing for those inevitable unexpected costs. They learn by doing, mastering key financial skills like:

• Budgeting like a boss

• Saving strategically

• Spending responsibly

• Understanding debt (and how to avoid its pitfalls)

Created and hosted by MyCreditUnion.gov, Hit the Road is a free, trustworthy educational tool. This learn-by-doing road trip helps students feel the pressure of real-world financial choices and make smarter decisions.

Peter Pig’s Money Counter

Peter Pig’s Money Counter is tailor-made for the 5-8-year-old crowd, hitting that sweet spot where learning and play collide. Every element – the concepts, visuals, interactions – is perfectly tuned to their developmental stage.

Brought to you by Visa as part of their Practical Money Skills powerhouse, Peter Pig’s Money Counter even sprinkles in fun facts about U.S. currency, sparking curiosity beyond just the numbers. With clear goals and a motivating reward system (who doesn’t want to dress up Peter in cool gear?), it helps build a positive, can-do attitude towards money right from the start.

Advanced Financial Literacy Games for Older Students

Advanced financial literacy games play a crucial role in preparing older students for complex financial challenges. By engaging with these complex game scenarios, students develop essential skills for real-world financial management. These advanced games provide a safe space for students to practice making financial decisions and understand their consequences without real-world risks. This hands-on experience equips them with the knowledge and confidence needed to navigate financial challenges in adulthood, setting the stage for financial freedom.

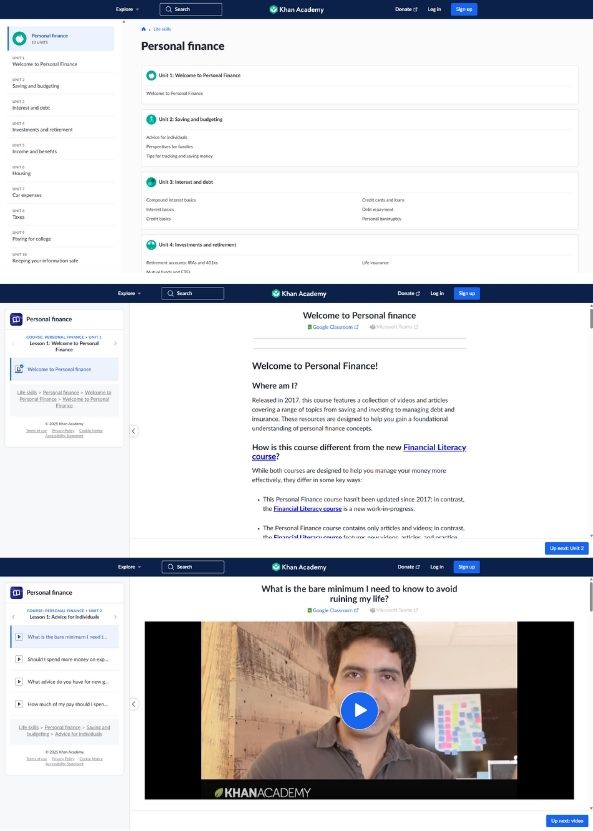

Khan Academy (Personal Finance Course)

Khan Academy’s comprehensive personal finance course is an excellent resource for high school and college students. The course offers free video lessons and practice exercises on a wide array of personal finance topics, including:

- Saving and budgeting

- Interest and debt

- Investments and retirement

- Income and benefits

- Housing

- Car expenses

- Taxes

- Paying for college This free and accessible format ensures that high-quality educational content is available to everyone.

Known for breaking down complex topics into understandable components, Khan Academy provides clear explanations and comprehensive coverage of foundational personal finance areas relevant to college students. The self-paced learning approach allows students to learn at their own speed and revisit topics as needed, making it a valuable supplement or prerequisite for more advanced finance courses.

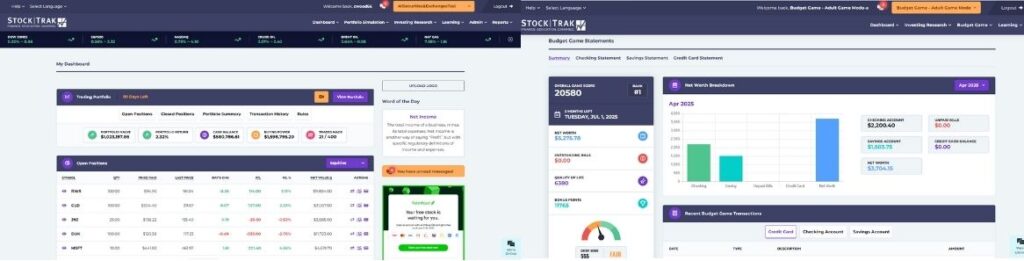

StockTrak

For college-level finance, personal finance, and investment courses, StockTrak provides an industry-leading platform for sophisticated, real-world simulation.

This isn’t just a game; it’s a professional-grade simulation ecosystem meticulously engineered to mirror the complexity and dynamism of real-world global finance. The Virtual Investing & Portfolio Management simulation is a powerhouse, offering real-time bid/ask prices for U.S. markets and a comprehensive array of tradable asset classes including Stocks, ETFs, Bonds, Mutual Funds, Options, Futures, Futures Options, Forex, Spot Commodities, and Cryptocurrencies. Students don’t just trade. They learn to navigate the markets with tools and metrics used by seasoned professionals.

What elevates StockTrak for educators is its robust suite of classroom management and customization tools, proving it’s “much more than just a stock market game.” Professors can customize the simulations to precisely match class objectives, create detailed Assignments that guide students through financial literacy topics, and benefit from Self-grading Assignments that automatically track student activity, pop quizzes, and performance. Detailed Admin Reporting Tools provide instructors with clear oversight and actionable insights.

StockTrak extends beyond the trading floor with its immersive Personal Finance Simulation. Here, students step into the realities of adult financial life: they get a job, live on their own, and face managing monthly bills. As they “roll the dice” to move through 12 virtual months, they establish budgets, receive paychecks, and crucially, confront random, unexpected life events and weekend activities designed to challenge their financial plans.

Summary

In summary, finance games offer a fun and interactive way to teach students essential money management skills. From younger children to college students, these games provide hands-on experience in managing money, budgeting, and making smart financial decisions. Programs like Visa’s Practical Money Skills and NGPF’s arcade games, along with advanced simulations like StockTrak and PersonalFinanceLab, ensure comprehensive financial education for students of all ages.

By gamifying financial literacy, we can make learning about money engaging and accessible, setting the foundation for financial freedom and informed financial decision-making. Embracing these innovative teaching methods will prepare students for the financial challenges of adulthood, empowering them to achieve financial success and stability.