Investors, like all people, are driven by psychological forces. Behavioral finance is a field of study that attempts to explain why humans makes investing Why do investors make the decisions that they do? This course will explain why.

Irrationality

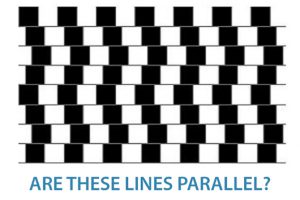

Take a look at this picture:

Well…are they?

At first glance, they look crooked. But it turns out, all of these lines are exactly parallel with each other.

Don’t believe us?

Check it out for yourself. Take a ruler and move it up and down the lines. You’ll notice that your ruler doesn’t change angles from line to line.

This is an illusion. It is our mind playing tricks on us.

It turns out that our mind is constantly playing tricks on us – making decisions on our behalf, before we have the facts straight.

In this case, our mind tells us these lines are crooked, when they are in fact parallel. The same goes for our investment decisions. There are “illusions” in the way we consume information, and we make irrational decisions based on emotions rather than facts.

Economics operates on the assumption that all people are rational beings.

They assume we know all of the information available and we examine it completely before making an emotionless decision.

Unfortunately, the world doesn’t work like that. People are, by nature, irrational. Especially while investing, we tend to let our subconscious influence our decisions.

Countless studies have shown that the key to successful investing is the “buy and hold” strategy (long‑term investing). Often however, when a stock price begins to fall, investors panic and sell their shares. This behaviour is known as “buy high and sell low” and is an easy way to lose money in the stock market.

“Buy high and sell low” seems ridiculous because, right now, you are thinking of it in a rational state of mind. In the moment, however, with your hard earned cash on the line, your mind doesn’t examine any extraneous circumstances and panics (for example, if the entire market is slumping, it is not a good reason to sell your stock). This panic convinces you to sell at a loss.

As a way of counteracting our natural tendency to act irrationally, scientists have developed the field of neuroeconomics – a mix of behavioural economics and psychology. This field of study seeks to explain human decision making. The idea is that, if you understand why you’re acting irrationally, you’ll be able to self-correct.

Neuroeconomics

What do neuroeconomists study exactly?

Neuroeconomics is the study of how our brains react to economic situations.

As with most things in life, our brain looks for the shortest, simplest answer to the problems and questions we face. When making investment decisions, our brain knows that there is a lot of information available and so, it uses shortcuts called “mental models” to filter through the information. Our brain creates models to process only the information it considers to be true and significant.

For example, if you’re asked if it’s wiser to put your money into a savings account or to invest with Apple, you might have the following thought processes:

- On the news last night, you heard that Apple has a new product being introduced next month;

- You know that Apple’s stock price has risen dramatically over the past 10 years;

- You remember that your savings accounts do not pay a lot of interest.

These pieces of information lead you to conclude that it would be wiser to invest in Apple whether or not that is actually true. Your mental model fails to consider all possible facts, only sifting through the pieces of information that were readily available.

These mental shortcuts create broad-sweeping assumptions about our financial world. Things like:

- Everyone should have a TFSA

- Mutual funds are the only way to diversify

- The rich get richer and the poor get poorer

These assumptions are our mind’s way of dismissing details and creating a simple, bite‑sized explanation of a financial issue.

How can investors avoid these mental models? Unfortunately, there is no easy fix. Our brain needs these shortcuts in order to not become hopelessly overwhelmed with all of the possible options that we have. The best compromise would be for a person to use these mental models to make a decision and then research that choice extensively to make sure that it is well-founded before acting upon it.

This means that, in the previous example, after deciding to buy Apple over parking your money in a savings account, you would need to determine if all three of the assumptions you made were in fact true, as well as weigh in the possible risks associated with both options, before going ahead with your stock purchase.

Availability and Confirmation Bias

To complicate matters further, our brains have biases that they will use to try and get you to think that your initial reaction – to buy Apple stock let’s say – is the correct one. They’re pretty powerful and are working hard against us in our attempt to think rationally. Let’s take a look at two very common biases:

Availability Bias

The availability bias is sort of your brain’s way of justifying laziness. This bias occurs when your brain uses the information that it has handy and weighs it more heavily than information that it has to seek out.

If you hear of a friend who made $10,000 in the stock market, you will use this information to justify investing your life savings, regardless of the fact that he made his money by investing during the recession and that similar conditions do not exist today.

Similarly, when you hear that the stock market is falling, you are more likely to sell your shares than you are to research the company and see whether it would be wise for you to sell at this moment or if you are simply panicking.

Confirmation Bias

Confirmation bias is closely linked to availability bias. The simplest way of explaining it is that, once you’ve begun looking for new information, you will retain information that supports the position that you want and ignore contrary views. In other words, you will seek out and trust information that confirms your view rather than information that opposes it.

While at a fancy restaurant, you overhear a stock tip and rush home to research it. Because you subconsciously already think that it is a good buy, you spend hours combing through data about the company and cherry-pick the information that favours you buying the stock while pushing aside any evidence which might suggest that you not buy the stock.

The solution to this preconceived notion is to recognize that these biases exist and to research, research, research with as much impartiality as you can. If you begin to see red flags in your research, do not ignore them simply because they don’t support your conclusion – if anything, weigh them more heavily!

Anchoring Bias

Another way that our brain insists on making us act irrationally is via the anchoring bias.

Anchoring bias is the idea that the first piece of information you hear will influence your opinion in the future.

Take the situation described in the previous section – while researching the company, you find that they are precariously close to bankruptcy. A rational investor would run in the opposite direction but unfortunately, your anchoring bias is telling you that you overheard this tip from someone that you perceive to be credible (a rich man in a fancy restaurant). Because the first thing that you heard about this company was positive, you entertain the idea of buying the stock a little bit longer than you would have otherwise done had you not overheard the stock tip.

Another example would be the strange notion that you should never sell a stock for less than you paid for it. While this is not an ideal scenario, if you buy at a $100 price and, at an $80 price you learn that the company has lost a major client, it is definitely in your best interest to sell because the price has nowhere to go but down. Anchoring bias tries to convince you that the value of the stock is $100 because that is what you paid at first – regardless of what its actual value currently is.

The way to combat this bias is, like all biases, to recognize it and try to force your brain to think in the completely opposite direction as much as possible. Simply learning about these biases helps with that, so keep reading!

Two part quiz:

Social Proof and Mental Accounting

Social Proof Bias

How else is your brain trying to sabotage your quest for financial success? Simply put, peer pressure!

Social proof is abundant in the world of personal finance. The jar or envelope system (where money is divided and placed into different jars or envelopes to help with budgeting) is seen as the “right” way to budget since it is endorsed by popular personal finance gurus. This system, however, may not be right for everyone but, seeing as our irrational brains look for the simplest solutions, we still use these budgeting systems.

What’s wrong with these budgeting systems? They are a form of mental-accounting, which in and of itself is an irrational exercise.

Mental Accounting Bias

By mentally dividing your money, you are setting aside a bit of money each month for clothes, a vacation, retirement etc. and also paying off your debt. While you are freely spending your clothing allowance, you are accruing interest on your debt. Rationally, the benefits of paying down debt greatly outweigh the advantages of mental accounting money into categories where it is “supposed” to be spent.

A less popular way for people to manage their money is to “pay yourself first and spend the rest”. With this system, people save or invest a certain amount of money and then live off of the rest. By keeping your money in one big pool in a single account, you don’t get into the habit of “this money needs to be spent on entertainment”, like you might with the jar or envelope system. By refusing to do mental accounting, you are going against the irrational things that your brain is trying to do to keep up with peer pressure!

Effects of Irrational Behavior

So, why does it matter if we’re irrational? Well, in short, because of our innate irrationality, our outlook towards finances can take a strange turn. Here are some of the ways that irrational behavior can affect investing decisions:

- The endowment effect: We demand a higher price for something than we are willing to pay someone else for that same thing. If I own a share, I will value it at $100, but would only be willing to buy that same share that someone else owns at $95.

- Over-trading: Investors can get too emotional and not think rationally when the markets get heated up. A result of this is that they begin trading which can result in “buy high, sell low”. This can also cost the investor quite a bit in trading frenzy fees.

- Do-nothing: Investors can become overwhelmed with the options and information available. This can sometimes lead to the decision to invest nothing or leave their investments sitting in under-performing or risky vehicles.

- Mean regression bias: Investors may be acting irrationally if they believe too heavily in mean regression. Mean regression is the theory that all shares have an average price. The belief is that daily fluctuations are temporary and the price will ultimately return to the average. However, the price fluctuations could be caused by other factors that the investor is not examining – like internal problems or macroeconomic effects.

How to Limit Irrational Behavior

Irrationality in investing is very difficult to avoid altogether, but it is possible to manage. Luckily, you are already ahead of the curve, because simply learning about these biases and tendencies is the first step!

Here are some more ways to limit the effects of irrational behavior on your investment decisions:

- Be aware: Maintain a constant awareness that irrationality exists and identify the possible biases that could affect you

- Take your time: Understand that you are inevitably going to jump to conclusions. That isn’t to say that your gut instincts are worthless, but they’re definitely not the be all end all of answers. Allow time for rationality to kick in and make decisions based on the facts.

- Be emotionless: Having emotions is usually healthy, but not when it comes to investing your money. Take a step back and reflect on your decision-making as unbiased as possible.

- Be informed: Research, research and more research. The only way to move away from irrational behaviour is to start thinking rationally, and in order to start thinking rationally you need to have the facts!

All of these steps that bring you closer to becoming a rational investor can only come from time and experience. So get out there and practice! A great way to train yourself is to use the practice portfolios available here on Wall Street Survivor. Try to invest as if you are investing with real money, because once you make the switch to actual money, that’s when the real emotions and irrationalities kick in. You can also consider going to a professional such as a financial advisor, as it is their job to detach the emotions and biases tied to investing.