ALERT: Are you a U.S. citizen? If not, then you will unfortunately not be able to sign up for a Robinhood account. CLICK HERE TO LEARN ABOUT OUR #1 RECOMMENDED BROKER FOR NON-U.S. CUSTOMERS!

Millennials are now in their mid 20s to mid 30s, starting families, and looking towards the future.

However, many millennials aren’t doing much investing.

According to Business Insider, only about a third of millennials actively contribute to a retirement account.

This isn’t a surprising trend.

Many millennials reached early adulthood or entered the workforce just as the stock market came crashing down in 2008.

With that in mind, it’s easy to see why many are skittish about investing.

But the popular trend of microinvesting is changing all of that.

What Is Microinvesting?

Microinvesting is exactly the same as normal investing, just with smaller amounts of money.

Instead of opening an investment account in a broker’s office with a few thousand dollars as a minimum…

…you can open an investment account from your mobile phone and start with as little as five bucks.

While it’s still an early concept, microinvesting has definitely been a game changer.

Many apps have sprung up to lure the attention of the millennial market into investing on Wall Street.

A few of these companies have millions of users and billions of dollars in the market.

Today, we host a face-off between two of the pioneers of the microinvesting industry: Robinhood vs. Acorns.

Both seek to capture a piece of the millennial investing market, but their strategies are very different.

Each investment platform offers a different type of experience, but both platforms exist to help you reach your financial goals.

Robinhood is your traditional, individual, taxable investment account, while Acorns has been a trailblazer for micro- and robo-investing services.

So, let’s get down to business and compare these two investment platforms so that you can decide which one is a better fit for you!

Robinhood

Robinhood is a company that strives to bring investment capabilities to everyone.

The firm eliminated obstacles for users to get started.

As the company led the wave towards a democratized investing world through commission-free trading and no account minimums, they brought a new look to trading platforms.

The Story of Robinhood

Founders Vladimir Tenev and Baiju Bhatt may not be robbing the rich, but they have set out to lower the bar to investing for everyone – and they are doing just that.

After college, these two Stanford classmates moved to New York and built two finance companies, which sold stock trading software.

From this experience they learned that for large institutions, stock trades are virtually free, while the average Joe pays up to $10 a trade.

Determined to democratize access to trading in the stock market, they moved back to California to start Robinhood in 2013.

Although Robinhood was only formed in 2013, it has quickly become a force to be reckoned with in the finance industry.

There are currently 22.4 million users on Robinhood.

Major brokerages like Fidelity, Charles Schwab, and TD Ameritrade have begun copying Robinhood’s fee-free trades model to compete for investors’ dollars.

While it is still early in Robinhood’s existence, there is a good possibility they (along with their competitors) have permanently altered the investing landscape.

Robinhood: Account Minimum

There is no minimum balance requirement to open a Robinhood account, and there is no minimum balance fee.

You don’t even need the minimum dollar amount of whatever stock you choose to invest because Robinhood offers fractional shares!

For example, if you have your eye on Amazon, and it is trading at $1700 per share, you can invest in a fractional share.

Then, recurring investments allow you to set continuous investment patterns, whether it is weekly, monthly, quarterly, etc.

So, even if you can’t afford to purchase a whole share of Amazon, here you can still reap the benefits.

Additionally, fractional shares allow you to immediately reinvest your dividends, which is known as a Dividend Reinvestment Program (DRIP).

So, if your pockets aren’t that deep, you have plenty of options to choose.

However, there is a $2,000 minimum for margin trading (more on that below).

Robinhood: Investment Options

One of the beauties of Robinhood is that the world is your oyster.

If it’s a U.S. stock or an ETF on the NYSE or the Nasdaq, chances are you can buy it on Robinhood.

You can also dabble in buying options and cryptocurrency, which is a real bonus as not all microinvesting platforms offer these features.

A lot of brokerages do not provide the opportunity to trade cryptocurrencies, but Robinhood offers seven tradable cryptocurrencies and nine more you can monitor.

The one bummer we see is Robinhood’s lack of offerings in mutual funds.

Robinhood: Fees

One of the most attractive things about Robinhood is commission-free U.S. stock trades.

Yup, you heard that right.

(Of course, regulatory fees still apply. Not much you can do about that.)

There are still a few “hidden” fees for things like paper statements and wire transfers.

The most notable ones are a hefty $50 fee to trade foreign stocks and a $75 fee to transfer your account to a competing broker.

But assuming you don’t need some of these bells and whistles, Robinhood’s fee schedule is very generous.

No minimums, no account fees, no commissions.

Robinhood: User Interface

Robinhood is tailored specifically towards new investors, and it has a simple interface that all users can interact with.

From the moment you download the app, you can have your first investment in about an hour.

Robinhood’s instant bank verification enables a quick and easy setup.

Robinhood is sleek, organized, and easily accessible from both your phone and computer.

Robinhood: Types of Accounts

Robinhood only offers two kinds of investment accounts, plus a cash management account.

Both investment accounts are taxable accounts.

The basic account is free, but you can upgrade to a Gold account for $5 a month.

The Gold account comes with access to additional market analytics data as well as extended trading hours.

The Gold account also includes access to $1,000 to trade with on margin.

You may use more than that, but you will pay 2.5% interest annually on the balance above $1,000.

Users can try a Gold account free for 30 days.

Although Robinhood is known for its brokerage services, its popularity has caused them to expand to other services.

Now you can use Robinhood’s Cash Management feature, which is an account with a .30% annual interest rate.

This account comes with a Mastercard debit card and has a 75,000 fee-less ATM network.

This account is FDIC and SIPC insured, as Robinhood strives to deliver great end-to-end experiences for their customers.

Robinhood: Other Benefits/Features

Robinhood’s main unique feature is its access to options and cryptocurrency.

These offer shinier (albeit riskier) investment options for those who want to stretch outside the bread-and-butter offerings of stocks, bonds, and ETFs.

Investors can find basic information on these nontraditional assets in the articles in the Learn section of Robinhood.

Articles cover basic fundamentals, such as “What is the stock market?”, as well as more complex concepts, like “What is cryptocurrency?”

In addition to the educational articles on the website, Robinhood also offers Snacks – a 15-minute podcast or short newsletter highlighting the top 3 business news stories of the day.

These are a great way for new investors to keep tabs on what is happening in the market and why it’s important.

If you upgrade to a Gold account, Robinhood provides quite a list of additional features: Level II market analytics data, extended trading hours, larger instant deposits, and a full margin account.

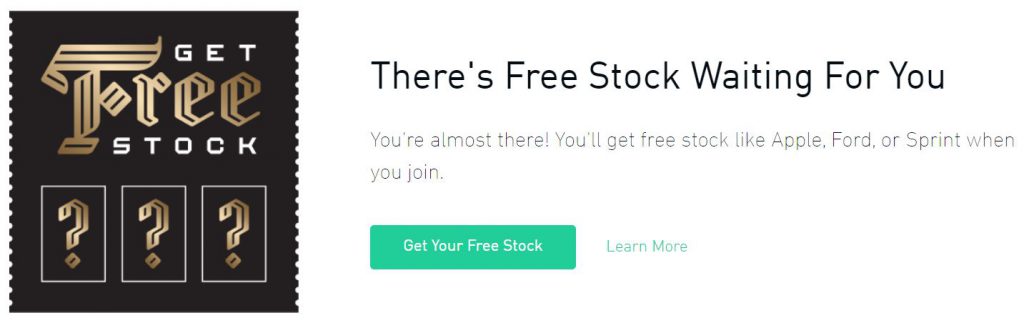

When you sign up for Robinhood today, you’ll get a FREE stock worth up to $200. PLUS, you can earn even more free stock worth up to $1500 per year when you refer friends to Robinhood!

Robinhood: Customer Service

Customer support is not Robinhood’s strongest suit.

Robinhood only offers email and an FAQ page for customer service.

There is no chatbot and no phone number.

This is a common complaint about Robinhood’s service offering.

How Do I Get up to $1,700 in FREE STOCK with Robinhood?

To open a Robinhood account, all you need is your name, address, and email. To get your free stock you will need to fund your account with at least $10 within a few days of opening so you will also need your bank account routing and account number.

As its current promotion, Robinhood will immediately give you FREE MONEY (between $5 and $200) to invest in a set list of stocks when you open a new account. You will be given your unique referral link. You will receive more free money (again valued at $5 to $200) for each person you refer. The more people you refer, the more you get up to a max of $1,500 a year. To learn more, visit Robinhood's free stock promo page below.

Why do they give away so much free stock? Because they spend their advertising dollars this way instead of buying TV, radio, print, or online ads! They WANT you to refer friends!