The concept of survival of the fittest is appropriate in the discussion of financial publications today. The rise of digital media has rendered the traditional paper and print model nearly useless. However, those that have survived have done so because they possess the superior insight, analytics and reporting that make them an asset to any reader. In this article we’ll look at 10 top business magazines that stand above the rest and should be in the weekly rotation of anyone wishing to stay ahead of the market.

Holiday Tag Sale – Up to 88% OFF – Save on Magazines and Gift Subscriptions

Top 10 Financial Magazines of All Time:

Entrepreneur (@Entrepreneur) *on sale now

Entrepreneur magazine is the premier source for everything small business. Get the latest small business information in out latest issue of Entrepreneur Magazine. I love reading it for their insightful business advice. I really feel like it’s taken my business to the next level.

Sale: $11.97 ($1.20/issue) Cover Price: $59.88

BUY IT NOW

The Economist (@TheEconomist)

The Economist enjoys the best reputation of any publication on this list. They offer a wider analysis of the economy by examining not only US policy but the broader forces at work across the globe. Any reader will quickly learn just how interconnected the geopolitical fabric of the economy really is. The high quality of writing may require some time to absorb and understand but the insight is unparalleled.

Kiplinger’s (@Kiplinger) *on sale now

Kiplinger’s is a close competitor to Money magazine. They similarly offer financial tips and advice that is widely applicable across various demographics. Reader’s looking for concise, actionable content should start here. The publication has long embraced the list format to deliver information on topics like preventing identity theft to optimizing your 529 plan asset allocation. Sale: $11.97 ($1.20/issue) Cover Price: $59.88

BUY IT NOW

Barron’s (@Barronsonline)

Barron’s offers a deeper dive into the fundamentals of publicly traded companies. The acumen offered by the writers empowers readers to make good decisions when investing in either fixed income of equities. Much of the terminology comes from the world of CFAs and CFPs who lend credence to measurements like alpha, beta and the yield curve. Regularly reading Barron’s will, in short time, make one conversant in the fundamental aspects of analyst terminology.

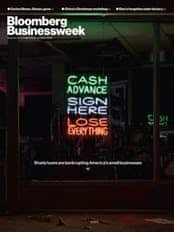

Bloomberg Businessweek (@Business) *on sale now

Bloomberg sits at the intersection of politics and business. The authors draw provocative connections between the machinations of politicians and the economic results. This magazine is for the politically minded who want to make informed investing and financial decisions. In keeping with the origins of the company the publication relies on a robust array of market analytics to gauge immediate and long-term movements.

Sale: $75.00 ($1.36/issue) Cover Price: $249.50

BUY IT NOW

Consumer Reports (@ConsumerReports)

Many don’t see Consumer Reports as one of the best financial magazines, however, they’re prudent evaluation of the fees assessed on investment products will serve anyone well. The reviews provided are in-depth and share the detail that can only be gleaned from actual experience. The magazine’s recent article on the cost of college and burden of loan repayment resonated with much of the millennial generation.

Inc. (@Inc) *on sale now

Readers of Inc have their finger on the pulse of emerging technology, business and ideas in the finance world. Many of the personality profiles reveal the nascent shifts in the marketplace that are sure to drive valuations in publically traded companies. The publication covers a wide range of topics. This is a great choice for those who want to be at the edge of revolutionary business practices and tech start up disrupters.

Readers of Inc have their finger on the pulse of emerging technology, business and ideas in the finance world. Many of the personality profiles reveal the nascent shifts in the marketplace that are sure to drive valuations in publically traded companies. The publication covers a wide range of topics. This is a great choice for those who want to be at the edge of revolutionary business practices and tech start up disrupters.

Sale: $11.99 ($1.20/issue) Cover Price: $59.88

BUY IT NOW

Fortune (@FortuneMagzine)

Fortune keeps a tight focus on the biggest of the big companies. The articles take cues from their list of ‘Fortune 500’ companies to understand broader movements in the US economy. Readers enjoy the connections between government policy makers and how their decisions influence the business climate. The current event news stories are among the best reporting.

U.S. News & World Report (@usnews)

This is a great resource for breezy pieces covering personal finance, the economy and even personal interest stories. The magazine is known for their popular ranking guides that distill the most important facts about everything from companies to business schools. Use this magazine to get down to the numbers when considering a mutual fund, new car or education.

Investor’s Business Daily (@IBDinvestors)

Those interested in understanding the daily market fluctuations need this top investment magazine. The publication provides detail on both index movements as well as buy/sell ratings for individual securities. This is truly the investor’s magazine. The writers use quarterly data to assess the projected earnings of major market movers.

Some Honorable mentions:

Money (@Money)

The advice is procedural and driven by analytics so that any reader can make an informed decision. Money magazine is for all income levels as they regularly provide on-point advice from choosing between a Roth IRA and traditional IRA or what home renovation offers the best return.

Fast Company (@FastCompany) *on sale now

Fast Company is a monthly American business magazine published in print and online that focuses on technology, business, and design. They are known as the hip guide to the business revolution, featuring the latest business news and trends, cutting-edge entrepreneurs and the very fastest growing companies.

Sale: $11.99 ($1.20/issue) Cover Price: $49.90

BUY IT NOW

Motley Fool (@TheMotleyFool)

Helping the world invest – better. You may already know about the Motley Fool. They are one of the largest multimedia financial services companies. They provide financial advice and daily stock picks since 1993. Read our article on the Motley Fool.

*** UPDATE -- Tuesday, July 8, 2025 -- MOTLEY FOOL STOCK ADVISOR AVERAGE RETURN OF ALL 500+ STOCK PICKS IS 872% VS THE S&P500'S 160% ****

The Fool investing philosophy is hold stocks for at least 5 years, invest regularly, and ride out the dips. Here is just a sample of some recent picks:

- SHOP picked again June, 2024 and it is up 78%

- TSLA picked again May, 2023 and it is up 155%

- CRWD picked March, 2023 and it is up 193%

- NOW picked January, 2023 and it is up 190%

- TTD picked again Dec, 2022 and it is up 141%

- AMZN again Nov, 2022 and it is up 138%

Also, the Motley Fool just launched a special promotion: $100 off (see the link below).

Here is their release schedule of their upcoming stock picks:

- July 3, 2025 - New Stock Recommendation

- July 10, 2025 - List of 5 Best Stocks to Buy Now List

- July 17, 2025 - New Stock Recommendation

- July 24, 2025 - List of 5 Best Stocks to Buy Now

So, if you have a few hundred dollars to invest each month and plan on staying invested for at least 5 years, we haven't found any better source of stock picks.

New Pricing: Motley Fool has slashed it price $100 for its top stock picking service.

CLICK HERE to get it in real-time.