What are the best stock advisor websites?

Before we get into all that, let’s talk about why we need a stock advisor website in the first place.

Investing in the stock market is a rewarding, educational, and inspiring activity.

It is one of the few places where you can…

- Learn infinite information;

- Participate in a global phenomenon; and (most importantly);

- Make money.

There are plenty of factors that can impact the market’s performance that we can’t control.

Like what?

Like market conditions, global economic policy, and investor sentiment (to name a few).

Today, we are going to focus on a factor we CAN control.

One of those things that we can control includes RESEARCH.

Whether you are a beginner, intermediate, or advanced investor…

…you probably know that information is one of the most vital components of being a successful investor.

Most traders rely on a blend of different sources for their research.

Therefore, it is essential to understand the different types of information available to you as an investor.

These types of information can include:

- Investing blogs;

- Podcasts;

- TV shows; and

- Other things that center around investing in the stock market.

However, stock advisor website can be one of your most powerful resources.

Stock advisor websites are offered by companies that specialize in market research.

These companies provide up-to-date information on publicly traded companies.

However, before diving into the top stock advisor website…

…it is essential to understand what you are getting into before subscribing to different sources.

Take some time to understand the various types of investing so that you’re prepared when you decide to pull the trigger on a stock subscription service.

Discuss the difference between the two primary styles of investing, including fundamental and technical analysis.

Fundamental Research

Fundamental investing focuses on individual companies and their performance in the market.

Critical components of fundamental research include:

- Financial statement analysis;

- Earnings per share;

- Business plans; and

- Market share.

Fundamental investors, like Warren Buffett, believe that when you invest in individual companies, you should invest for the long-term based on the company’s attributes.

Growth Investing

As the name implies, growth investing is a fundamental style that focuses on a company’s rapid growth and sustainability.

Growth stocks usually have a very high price to earnings ratio because these companies are growing.

Technology companies fill most of the growth stock space because new technology tends to disrupt whatever market it enters.

Growth investors are more comfortable with higher risk because of the larger potential payout.

Value Investing

Instead of looking for the “next big thing,” value investors try to find stocks that have been overlooked by the market with immense potential.

Value investors search for winning companies by utilizing financial statement analysis.

The financial statement analysis especially involves diving into the balance sheet and income statement to determine if the company’s book value is less than the market capitalization.

Although this does not guarantee a win for the value investor, it can be one of many indicators to spend more time researching that stock.

Technical Research

Technical analysis is vastly different from fundamental analysis because it focuses solely on a company’s stock price.

When you see charts with candlestick patterns and hear about moving averages…

…you are most likely looking at technical research.

Technical traders prefer to capitalize on the movement of a stock price rather than the company’s underlying fundamentals.

The Top 2 Stock Advisor Websites

Now that we understand the different types of investing…

…let us look at some of the top websites for finding investment advice.

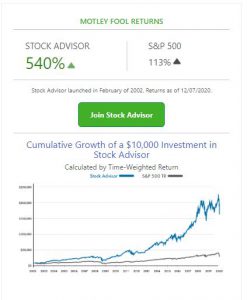

Motley Fool Stock Advisor

You have probably seen advertisements for the Motley Fool.

But do you really know the Motley Fool?

If you have ever seen an ad on the internet for an “Ultimate Buy”stock, you have seen the Motley Fool.

Motley Fool is one of the oldest and most established stock advising services around.

Also known as ‘The Fool,’ the company was founded in the late 1990s by Tom and David Gardner.

These two brothers saw a need for an accessible and reliable stock advising service for the average investor.

Their flagship subscription service is called Stock Advisor.

Stock Advisor offers a wealth of information for all levels of investors.

Stock Advisor provides a unique blend of both:

- Curated research; and

- Tools that allow investors to dig deeper.

Here is what you get with Stock Advisor

The first thing subscribers get in the monthly newsletter is a pair of stock picks research by each of the founding brothers.

Tom and David each have their own separate teams who utilize different research methodologies to identify a stock that has the potential to grow immensely over a long period.

At the end of each month, the brothers submit their stock pick.

These picks are delivered to you each month.

In addition to the stock picks, you also receive the research and data used to arrive at the stock picks.

But it does not end with just two stock picks…

…you also get the other stocks that Motley Fool analysts identified that month.

These stocks did not make the cut for “top stock,” but Motley Fool analysts believe these stocks have high growth potential.

The analysts also include their research with their picks, so readers can see how they arrived at a decision.

I love this information because it shows the though process of stock-picking professionals.

In addition to stock picks, one of the most unique benefits of the stock advisor subscription is access to their starter stock list.

The starter stock list is a compilation of established and unique stocks presented as a diversified portfolio.

This is a massive benefit to any investor because no matter what level of trader you are…

…you will struggle with your own internal biases as you search for new companies.

For example, perhaps you know a ton about the pharmaceutical industry, but nothing about retail manufacturing.

The starter stock list is a well-rounded way to learn about portfolio diversification because the companies inside it are from a multitude of industries.

Finally, subscribers get access to the library of other articles and forums.

These forums allow users to do more research and interact with the community within the Motley Fool’s network of investors.

The membership for the Motley Fool is priced at $99 for the first year, and $199 every year after that.

Motley Fool also offers its legendary 30-day money-back guarantee if for some reason you are dissatisfied.

*** UPDATE -- Monday, June 30, 2025 -- MOTLEY FOOL STOCK ADVISOR AVERAGE RETURN OF ALL 500+ STOCK PICKS IS 1,002% VS THE S&P500'S 173% ****

The Fool investing philosophy is hold stocks for at least 5 years, invest regularly, and ride out the dips. Here is just a sample of some recent picks:

- AppLovin picked April 3, 2025 and already up 50%

- Howmet Aerospace picked January 16, 2025 is up 38%

- Transmedics (Epic) picked December 19, 2024 is up 110%

- DoorDash picked October 3, 2024 and in 2023: now up 47% & 137%

- Shopify picked June 6 is up 75%

- Chewy (Epic) picked May 14 is up 169% &

- Cava (Epic) picked in October, 2023 is up 40%

- Crowdstrike October, 2023 pick up 185%

Also, the Motley Fool just launched a June, 2025 promotion: $100 off (see the link below).

Here is their release schedule of their upcoming stock picks:

- July 3, 2025 - New Stock Recommendation

- July 10, 2025 - List of 5 Best Stocks to Buy Now List

- July 17, 2025 - New Stock Recommendation

- July 24, 2025 - List of 5 Best Stocks to Buy Now

So, if you have a few hundred dollars to invest each month and plan on staying invested for at least 5 years, we haven't found any better source of stock picks.

New Pricing: Motley Fool has slashed the price for its top stock picking service.

Use WSS100 to get $100 off HERE