If you’re researching whether to join Round Sky as an affiliate or partner with them as a lender, you’ve likely encountered mixed signals online. Some affiliates report earning substantial weekly commissions, while others warn of payment issues and minimal earnings. This article breaks down everything you need to know about Round Sky—from trust scores and user experiences to practical due diligence steps—so you can make an informed decision.

Round Sky at a Glance (Answering Your Question Fast)

Round Sky is a US-based personal loan affiliate network founded in 2006, designed to connect affiliates, consumers, and lenders in the personal loan and debt space. The company has carved out a niche by specializing exclusively in financial leads rather than spreading across multiple verticals.

Quick Facts:

- Operating online since 2006 (nearly two decades in business)

- Processes over 100,000 US personal loan leads per day in real time

- Commissions reportedly range up to $250–$265 per lead for top-tier traffic

- Works with 50+ lenders across the United States

- Minimum payout threshold of $50 with Net-7 (weekly) payment options

Pros:

- Long track record in the personal loan affiliate program space

- High top-end payouts compared to many competing networks

- Specialized focus on loans and debts (not a generalist network)

- Proprietary tracking platform with real time tracking capabilities

- Multiple payout methods including ACH, PayPal, and wire

Cons:

- Mixed reviews with some affiliates reporting non-payment

- At least one documented scam complaint from an affiliate test

- Moderate third-party trust scores (Trustpilot ~3.2/5, ScamAdviser ~76/100)

- Strict fraud monitoring system that favors the company’s discretion

- Limited public transparency about average affiliate earnings

Is Round Sky Legit or a Scam?

Evaluating legitimacy in the personal loan space is especially important, given the CFPB’s ongoing scrutiny of loan advertising and lead generation practices. Round Sky appears to be a long-standing, likely legitimate business operating in the personal loan leads market. However, the company has accumulated some red flags and polarized reviews that potential affiliates should carefully consider before committing traffic or resources.

The Reported Scam Case:

One affiliate publicly documented a 6-month test where they claimed:

- Dashboard showed payments marked as “Paid” for May-June commissions

- PayPal records revealed the payments were actually cancelled by the sender

- Total promised commissions were approximately $15, which were never received

- The affiliate posted proof emails and rated Round Sky 1/5 across all categories

- Their warning to others: earnings were minimal and payment unreliable

What This Means:

- One or a few complaints do not prove systematic fraud

- However, payment disputes are critical signals for affiliates whose earnings depend on reliable payouts

- The complaint suggests potential issues with payment processing or dashboard accuracy

Longevity Consideration:

- Round Sky has been operating since 2006 and remains online today

- This longevity is uncommon for pure “hit-and-run” scammers

- However, a long business history alone does not guarantee fair treatment of all affiliates

Due Diligence Steps:

- Confirm all payment terms in writing before sending significant traffic

- Start with small traffic volumes to test the payment process

- Request references from current affiliates if possible

- Document all communications and promised commission rates

- Monitor your account closely and compare dashboard figures against actual payments received

Trustpilot Rating and User Sentiment

Round Sky holds an average rating of approximately 3.2 out of 5 on Trustpilot, placing it in the “Average” satisfaction category.

- Some positive reviews praise on-time payments and responsive support

- Negative reviews describe poor earnings, low conversion rates, or non-payment on smaller balances

- A 3.2 score indicates the company is neither strongly recommended nor universally condemned

- Trustpilot allows user-submitted reviews where companies can claim profiles and respond publicly

- The mix of positive and very negative reviews could indicate genuine polarization or the presence of fake reviews on either end

- Affiliates should read individual reviews rather than relying solely on the aggregate score

- Look for patterns in complaints (payment issues, support problems, conversion disputes)

ScamAdviser & Other Risk Checks

ScamAdviser assigns roundsky.com a “fair” trust score of approximately 76 out of 100, indicating a moderately reliable but not risk-free website.

Positive Signals Identified:

- Long domain age (registered since 2006, nearly two decades old)

- Valid SSL certificate (Let’s Encrypt DV SSL) for encrypted connections

- Supports standard payment methods including PayPal, Mastercard, and Visa

- Consistent online presence without major domain changes

Cautionary Signals Identified:

- Low Tranco/Alexa rank suggesting limited overall web traffic

- Registrar is NameCheap, Inc., which is commonly used by some low-trust sites (though also by many legitimate businesses)

- Mixed or extreme user reviews that could include fake positives or negatives

- WHOIS data largely hidden behind privacy protection

Important Notes:

- ScamAdviser’s last scan may be more than 30 days old

- The conclusion states the site is “likely legit but with some suspicious attributes”

- Treat this as one data point among many, not a definitive verdict

Company Background: What Is Round Sky?

Round Sky is a US-based company that has operated in the personal loans and debt niche since its founding in 2006. The business focuses exclusively on lead generation and affiliate marketing within the financial sector, positioning itself as a specialized network rather than a general-purpose affiliate platform.

Key Company Facts:

- Founded in 2006, giving it nearly two decades of industry experience

- Specializes exclusively in loans and debts, working with both online platforms and storefront lenders

- Claims to process over 100,000 real-time US personal loan leads per day

- Network includes over 50 lenders across the United States and thousands of affiliates

- Loan offers through the network reportedly extend up to approximately $50,000

- Top-tier payouts allegedly reach $250–$265 per lead for high-quality traffic

- Operates 50–60+ landing pages and promotional sites for various personal loan offers

- Primary verticals: personal loan affiliate program, payday loan affiliate program, and personal loan lead marketplace

The company differentiates itself by focusing narrowly on the finance vertical, contrasting with general digital marketing networks that spread across SEO, PPC, social media, and other channels.

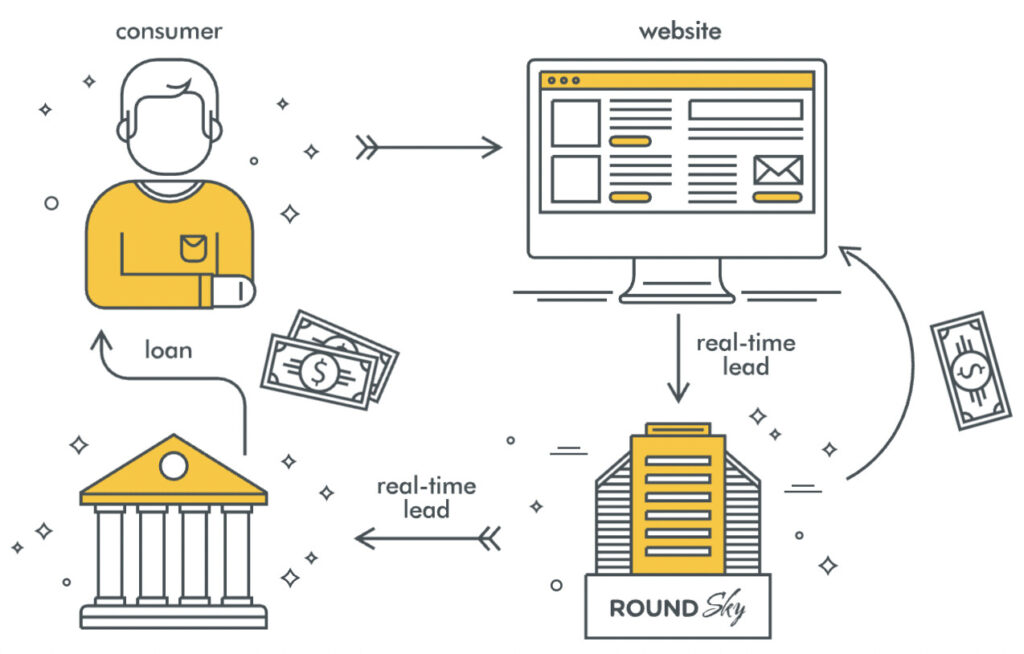

How the Round Sky Affiliate Network Works

Round Sky operates primarily as a CPA and RevShare affiliate program for personal loans. The network connects publishers (affiliates) with lenders seeking qualified borrower leads, compensating affiliates based on the actions generated through their marketing efforts.

Core Program Structure:

- Reportedly runs 5+ core affiliate offers at any given time

- Offers both CPA (cost per action/lead) and revenue share (RevShare) models

- Some offers combine both commission types for hybrid arrangements

- Referral commissions for inviting other affiliates range from 2% to 5%

- Cookie window on some offers extends to 30 days

Tracking and Platform:

- Proprietary in-house tracking platform built specifically for the network

- Real-time reporting available 24/7 for affiliates to monitor performance

- Dual-level sub-ID tracking for detailed campaign segmentation

- Support for custom pixels enabling conversion tracking in external systems

Payment Terms:

- Minimum payout threshold: $50

- Payment schedules: Net-7 (weekly) or monthly, depending on volume and agreement

- Supported payout methods: ACH direct deposit, PayPal, wire transfer, and paper check

- Availability of specific methods may depend on affiliate location and account status

Commission Structure & Payouts

Understanding how you get paid is critical before joining any affiliate program. Here’s what Round Sky offers:

- Top affiliates reportedly earn $10,000+ per week from the network

- Maximum per lead payouts allegedly reach up to $250–$265 for qualified personal loan leads

- Actual earnings for most affiliates will likely be lower, depending on traffic quality and lead approval rates

- The company claims to offer higher payouts faster than competitors in the personal loan space

Commission Models:

| Model | Description |

| CPA | Flat payout per approved lead (specified amount per action) |

| RevShare | Percentage of lender revenue generated from your leads |

| Hybrid | Combination of upfront CPA payment plus ongoing revenue share |

Payment Specifics:

- $50 minimum payout threshold before funds are released

- Net-7 (weekly) payments for qualifying affiliates

- Monthly payment cycles available depending on account terms

- ACH direct deposit is the primary payment method

- Additional 2–5% referral commissions available for sub-affiliate recruitment

Always confirm specific payment terms with your affiliate manager before committing significant traffic.

Affiliate Tools: Widgets, API & Multi-Device Offers

Round Sky provides several tools designed to help affiliates monetize their traffic effectively.

Website Widgets:

- Copy-and-paste loan application forms for easy integration

- Multiple templates and color schemes to match your website design

- Allows visitors to submit loan information without leaving your site

- Pre-built forms reduce technical implementation time

API and Integration:

- API available for real-time lead posting and custom funnel integration

- Pre-built “landers” (landing pages) optimized for both mobile and desktop

- Offers marketed as working on virtually all devices and browsers

- Helps affiliates monetize both desktop and mobile traffic streams

Tracking Features:

- Dual-level sub-ID tracking for granular campaign analysis

- Custom pixels support for integration with external tracking systems

- Real-time reporting dashboards displaying revenue, EPC (earnings per click), and projections

- Data compiled and delivered electronically through the proprietary platform

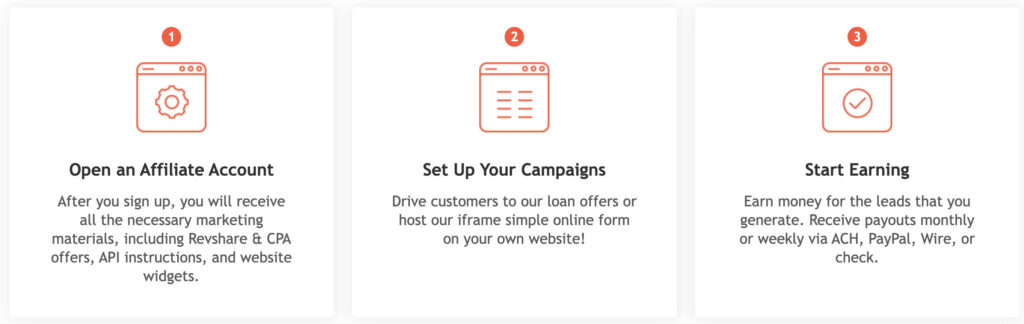

Steps to Join as an Affiliate

Getting started with Round Sky follows a relatively simple process:

- Open an affiliate account by submitting an application with details about your traffic sources and compliance capabilities

- Get approved and gain access to the network’s offers, tracking tools, and promotional materials

- Set up campaigns using your preferred methods: PPC, email marketing, social media, display ads, widgets, or API integration

- Start sending traffic to Round Sky’s forms or landers and earn commissions per qualified lead

- Open an affiliate account by submitting an application with details about your traffic sources and compliance capabilities

- Get approved and gain access to the network’s offers, tracking tools, and promotional materials

- Set up campaigns using your preferred methods: PPC, email marketing, social media, display ads, widgets, or API integration

Tips for New Affiliates:

- Some affiliates report quick onboarding, while others recommend clarifying compliance rules early

- Understand restrictions: no misleading loan promises, respect state lending laws

- Begin with low budgets and A/B test multiple landers across different devices

- Track performance closely during your first 30-60 days before scaling

- Maintain communication with your assigned affiliate manager

Round Sky for Lenders

Beyond affiliates, Round Sky also serves lenders seeking more personal loan applicants through real-time, exclusive leads delivered directly from the network’s traffic sources.

How It Works for Lenders:

- Lenders receive live, exclusive leads as consumers submit forms across Round Sky’s network

- Lead data typically includes loan amount requested, employment information, income details, and contact information

- Leads are delivered in real time rather than as aged lists, improving conversion potential

- The network works with both online lenders and physical storefront operations across the US

Getting Started as a Lender:

- Open a dedicated lender account to access the lead flow

- Adjust filters to target specific borrower profiles or geographic areas

- Test different traffic sources from Round Sky’s affiliate base

- Monitor performance metrics including approval rates, default risk, and customer lifetime value

Important Considerations:

- Lead quality and ROI can vary significantly by traffic source

- Measure approval rates, default risk, and customer complaints per lead source

- Scale spend only after establishing consistent positive metrics over time

Lead Quality & Vertical Focus

Round Sky positions itself as a specialist in US personal loans, which can offer advantages over generalist networks that spread across multiple verticals.

Quality Signals:

- Real-time leads (no outdated or recycled contact lists)

- Exclusive routing to specific lenders rather than mass-reselling the same lead to multiple buyers

- Vertical focus means offers are tailored specifically for the loan market

- Affiliates in the network specialize in finance-related traffic

Potential Concerns:

- The high-interest loan space can attract vulnerable borrowers

- Regulatory scrutiny from agencies like the CFPB affects lending advertising

- Lenders must ensure their own compliance and underwriting standards regardless of lead source

- Not all leads will meet underwriting criteria despite appearing “qualified”

Recommendation: Run a controlled test campaign analyzing approval rates, chargebacks, and customer complaints before scaling spend with any lead provider.

Reputation, Reviews & Risk Factors

Round Sky’s reputation presents a mixed picture: some long-time affiliates praise the network while others issue serious warnings about low earnings or non-payment issues.

Review Summary:

| Source | Rating/Score | Assessment |

| Trustpilot | ~3.2/5 | Average satisfaction, polarized reviews |

| ScamAdviser | ~76/100 | Likely legit but with suspicious attributes |

| Affpaying | 1/5 (single review) | Alleges payment cancellation after dashboard showed “Paid” |

Positive Testimonials Include:

- On-time weekly payments for established affiliates

- High earnings potential ($10,000+ weekly for top performers)

- Responsive affiliate managers

- Consistent offer availability and new promotional materials

Negative Complaints Include:

- Payment marked as “Paid” in dashboard but cancelled via PayPal

- Minimal earnings despite sending traffic

- Low conversion rates compared to promises

- Strict fraud monitoring that favors the company’s discretion

- Account termination risks with limited recourse

Key Takeaway: In such a polarized review environment, individual experience heavily depends on traffic quality, communication with affiliate managers, and strict adherence to program rules.

Technical & Security Considerations

Understanding the technical infrastructure helps assess reliability and security for a platform handling financial data.

Technical Facts:

- Domain registered since 2006, current age approaching two decades

- SSL certificate is DV (Domain Validated) from Let’s Encrypt

- Site speed is reported as relatively slow compared to industry benchmarks

- Hosted on shared infrastructure rather than dedicated servers

Security Notes:

- DV SSL ensures encryption but does not validate company identity as strongly as EV/OV certificates

- Shared hosting can introduce additional security and performance considerations for sensitive financial services

- WHOIS data is largely hidden behind privacy protection

- Registrar is NameCheap, Inc. based in the US

Related Domains:

- Some redirects from domains like leadhorizon.com and rnd6.com point to roundsky.com

- This could indicate brand consolidation or multiple marketing funnels

User Recommendation: Always verify you’re on the official Round Sky website before entering personal or financial details. Check the URL carefully and ensure the connection is secure (https).

Who Should Consider Round Sky (and Who Should Avoid It)?

Based on the factual review above, here’s practical guidance on whether Round Sky might be a fit for your situation. This is not financial advice—simply analysis based on available information.

May Be a Good Fit For:

- Experienced loan affiliates with established US traffic sources

- Affiliates familiar with compliance requirements in the financial space

- Those with tolerance for vertical risk and polarized reviews

- Marketers willing to start with small test traffic before scaling

- Lenders seeking incremental lead volume alongside other network providers

Should Probably Avoid or Wait:

- Beginners new to affiliate marketing or unfamiliar with loan verticals

- Affiliates uncomfortable with high-interest loan offers

- Those requiring extensive public positive reviews before joining any network

- Marketers without traffic sources specifically interested in personal loans

- Anyone unwilling to perform ongoing due diligence and payment verification

For Consumers Seeking Loans:

- Compare multiple direct lenders rather than relying on lead network marketing

- Read about high-interest loan risks before borrowing

- Understand that lead networks connect you to lenders—they don’t set loan terms

How to Do Your Own Due Diligence on Round Sky

Before joining any affiliate program or partnering with any lead provider, conduct your own research. Here’s a practical checklist:

Review Current Feedback:

- Check the Trustpilot page for Round Sky and sort reviews by “Most recent”

- Look for patterns in recent complaints or praise from the last 6–12 months

- Pay attention to how the company responds to negative reviews

Verify Technical Details:

- Re-run a ScamAdviser or similar scan to confirm current trust scores

- Verify SSL certificate status and domain registration details

- Check that the website matches official branding and contact information

Contact the Company Directly:

- Ask specific questions about payment schedule, minimums, and traffic source restrictions

- Gauge responsiveness and clarity of their replies

- Request written confirmation of commission rates and payment terms

Speak with Existing Users:

- Reach out to current affiliates or lenders if possible

- Verify claims about on-time payments and lead quality

- Be mindful that testimonials can be biased in either direction

Start Small:

- Run limited test campaigns with modest budgets

- Set clear performance targets before scaling

- Monitor closely for any discrepancies between dashboard figures and actual payments

Conclusion: Our Overall Take on Round Sky

After examining company history, trust scores, user reviews, and operational details, here’s our summary assessment of Round Sky:

- Round Sky is a specialized, long-running US personal loan affiliate network founded in 2006, offering CPA and RevShare deals, website widgets, API integration, and real-time leads for lenders

- External evaluations show mixed results: Trustpilot averages around 3.2/5, ScamAdviser assigns a trust score of approximately 76/100, and user reports range from highly positive to seriously negative including at least one documented non-payment claim

- The company appears “likely legit but with notable caveats”—it has operated for nearly two decades and maintains an active online presence, but payment disputes and strict fraud policies create real risks for affiliates

- Both affiliates and lenders should approach Round Sky as a vertical-risk partner: suitable for controlled tests with careful monitoring, not blind trust with significant upfront commitment

Final Recommendation: Your success with Round Sky—or any other network in this space—will depend heavily on your traffic quality, communication with affiliate managers, strict compliance with program rules, and thorough ongoing due diligence. Start small, verify everything, and scale only after establishing consistent positive results.

If you’re considering joining, take the time to read current reviews, confirm payment terms in writing, and test with limited resources before committing major traffic. The personal loan affiliate space offers significant earning potential, but it also carries risks that require careful management.

FAQs

Round Sky appears to be a long-running personal loan affiliate network that has operated since 2006. While longevity and active operations suggest it is not a fly-by-night scam, mixed reviews and at least one documented payment dispute mean affiliates should proceed with caution and perform their own due diligence.

There is no clear evidence that Round Sky is an outright scam. However, some affiliates report issues with low earnings or cancelled payments. These complaints do not prove systematic fraud, but they are important signals for anyone relying on consistent affiliate payouts.

Top-tier affiliates reportedly earn up to $250–$265 per approved lead, and some claim five-figure weekly earnings. Actual results vary widely based on traffic quality, compliance, lead approval rates, and communication with affiliate managers. Most affiliates should expect lower earnings, especially when starting out.

Yes. Round Sky works with 50+ lenders across the United States, delivering real-time personal loan leads generated through its affiliate network. Lenders receive live lead data rather than aged lists, though lead quality can vary by traffic source.

Round Sky advertises a $50 minimum payout threshold with Net-7 (weekly) or monthly payment schedules. Payment methods may include ACH, PayPal, wire transfer, or paper check, depending on account status and location. Affiliates should confirm payment terms in writing before scaling traffic.